Serverless Architecture Market Report Scope & Overview:

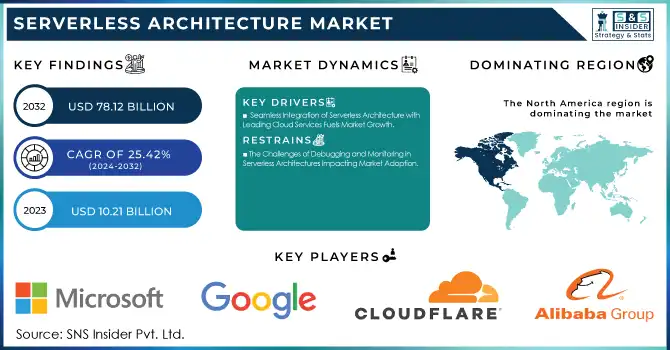

The Serverless Architecture Market was valued at USD 10.21 billion in 2023 and is expected to reach USD 78.12 billion by 2032, growing at a CAGR of 25.42% from 2024-2032.

To Get More Information on Serverless Architecture Market - Request Sample Report

The Serverless Architecture Market has experienced rapid expansion as companies pursue scalable, budget-friendly options to fulfill their IT requirements. In 2024, expenditures on IT services are anticipated to hit USD 1.6 trillion, indicating substantial investments in cloud technologies. This expansion is primarily fueled by the removal of conventional server management, enabling companies to concentrate on coding as cloud providers manage the infrastructure. In August 2024, Coherence introduced serverless deployment choices for AWS and GCP, allowing developers to deploy applications straight onto AWS Lambda and GCP Cloud Run. As the use of cloud technology grows, companies are attracted to the adaptability of serverless architectures, which provide automatic scaling and lower operational costs. As a result, companies in various industries acknowledge the importance of serverless solutions to optimize processes and promote innovation, accelerating additional market growth.

The increasing need for serverless architecture is driven by its built-in benefits, especially cost-effectiveness and scalability, which assist organizations in managing resources more efficiently. Serverless models provide businesses the capability to operate applications without the concern of provisioning or managing servers, leading to enhanced agility and quicker deployment periods. In June 2024, OpenMetal investigated the combination of serverless computing with OpenStack, assessing the application of Cloud Hypervisor, Unikernel, and Firecracker technologies, thus progressing this strategy. This effectiveness is vital for sectors such as e-commerce, fintech, and healthcare, where rapid innovation and minimal operational expenses are essential. As an increasing number of organizations enhance their IT infrastructure, the need for serverless solutions is on the rise.

Looking toward the future, the Serverless Architecture Market is set for additional expansion, as new technologies present fresh possibilities for innovation. In September 2024, Kong introduced Konnect Serverless Gateways, a completely managed API management solution, enhancing serverless functionalities even further. The ongoing development of serverless solutions is anticipated to lead to enhancements in performance, security, and the overall experience for developers, increasing their attractiveness to companies looking for optimized cloud settings. Moreover, incorporating advanced technologies like AI and machine learning into serverless frameworks will facilitate smarter and more autonomous operations. As edge computing and IoT gain more attention, serverless architectures will penetrate new markets, maintaining their importance and offering significant growth prospects in the years ahead.

Serverless Architecture Market Dynamics

Drivers

-

Seamless Integration of Serverless Architecture with Leading Cloud Services Fuels Market Growth

The combination of serverless architecture with leading cloud platforms like AWS Lambda, Azure Functions, and Google Cloud Functions is crucial for boosting its adoption. These platforms provide smooth integration with various cloud services, allowing developers to easily add functionalities such as storage, databases, and messaging systems to their serverless applications. By utilizing current cloud ecosystems, companies can simplify their development workflows, lessen integration difficulties, and quickly launch applications in various settings. The simplicity of use, combined with access to a range of managed services, enables organizations to concentrate on innovation while delegating infrastructure management to cloud providers. As an increasing number of companies acknowledge the benefits of these unified solutions, the need for serverless architecture steadily grows, solidifying its role as an essential technology for contemporary application development.

-

The Rise of Microservices and Its Synergy with Serverless Architecture in Modern Application Development

The increasing popularity of microservices architecture plays a key role in the growth of serverless computing in the industry. Serverless platforms are especially advantageous for microservices, facilitating the creation of modular, event-driven applications that are both scalable and adaptable. Every microservice can be deployed, maintained, and scaled independently, which fits seamlessly with serverless models that allocate resources dynamically according to demand. This integration enables organizations to decompose intricate applications into smaller, easier-to-handle parts, enhancing agility and streamlining deployment procedures. Additionally, serverless computing improves the overall effectiveness of microservices by minimizing the overhead associated with managing infrastructure. With an increasing number of companies adopting microservices to enhance application performance, serverless architecture emerges as a logical and efficient selection, promoting smooth integration, quicker deployments, and simpler scalability.

Restraints

-

The Challenges of Debugging and Monitoring in Serverless Architectures Impacting Market Adoption

Debugging and overseeing serverless applications pose major difficulties because of their stateless and distributed characteristics. In a serverless setting, functions operate autonomously and scale automatically, complicating the tracking of request flows and pinpointing the source of problems. Conventional debugging tools might not be entirely suitable, necessitating customized solutions designed for serverless architectures. Additionally, tracking the performance of these applications can be intricate, as they are distributed across various services and trigger numerous events, potentially causing visibility gaps and slow issue resolution. Consequently, businesses must allocate resources towards sophisticated tools and skills to proficiently track the performance of serverless applications and guarantee seamless functionality. These intricacies may discourage certain businesses from completely adopting serverless solutions, particularly those with strict operational needs.

-

The Challenge of Cost Management in Serverless Architectures and Its Impact on Market Growth

While serverless architecture provides substantial cost savings in various situations, it may lead to unpredictable expenses, especially during usage surges or when functions are called repeatedly. In contrast to conventional models with set pricing, serverless operates on a pay-per-use basis, where expenses fluctuate depending on the volume of requests and the length of function execution. Consequently, organizations might encounter difficulties in managing budgets and controlling costs, particularly when workloads vary or surpass expectations. In the absence of strong monitoring and cost optimization tools, companies might find it difficult to predict and control expenses accurately, resulting in possible financial shocks. This uncertainty may discourage certain organizations from completely embracing serverless solutions, particularly those with strict budget limitations or particular financial planning requirements.

Serverless Architecture Market Segment Analysis

By Vertical

In 2023, the IT and Telecom segment dominated the Serverless Architecture Market with the highest revenue share of approximately 26%. This can be attributed to the sector's growing need for scalable and cost-effective solutions to manage vast amounts of data, support rapid application development, and optimize resource allocation. Serverless architecture enables IT and telecom companies to handle fluctuating workloads efficiently, minimize infrastructure overhead, and accelerate time-to-market for new services, making it a preferred choice for this industry.

The Healthcare segment is projected to grow at the fastest CAGR of about 29.07% from 2024 to 2032. The increasing demand for cloud-based healthcare solutions, coupled with the need for scalable and flexible infrastructure to manage sensitive patient data, is driving this growth. Serverless architecture provides the agility and cost savings necessary for healthcare organizations to deploy applications quickly, enhance data security, and maintain regulatory compliance, positioning it as a key enabler in the transformation of healthcare IT systems.

By Deployment

In 2023, the Public Cloud segment led the Serverless Architecture Market with the highest revenue share of approximately 58%. This dominance is primarily driven by the widespread adoption of public cloud services across various industries, offering flexibility, scalability, and reduced infrastructure management costs. Public cloud providers, such as AWS, Microsoft Azure, and Google Cloud, offer robust serverless platforms that seamlessly integrate with other cloud-based services, making them the go-to choice for businesses seeking efficient, cost-effective solutions.

The Hybrid Cloud segment is expected to grow at the fastest CAGR of about 27.67% from 2024 to 2032. This growth is fueled by organizations seeking the best of both worlds—combining the scalability and cost benefits of the public cloud with the security and control offered by private cloud infrastructures. Hybrid cloud solutions allow businesses to optimize workloads, maintain compliance, and ensure greater flexibility, driving their rapid adoption and fueling the segment's impressive growth trajectory in the coming years.

By Services

In 2023, the Automation & Integration segment led the Serverless Architecture Market with the highest revenue share of approximately 25%. This dominance stems from the growing demand for automated processes and seamless integration of diverse services across cloud platforms. Serverless architecture offers significant advantages in automating routine tasks, managing workflows, and reducing the complexity of integrating various systems, making it a crucial enabler for businesses looking to enhance operational efficiency and speed up time-to-market.

The Security segment is expected to grow at the fastest CAGR of about 29.49% from 2024 to 2032. As organizations increasingly move to serverless environments, the need for robust security measures to protect sensitive data and ensure compliance becomes paramount. Serverless architectures, with their distributed nature and reliance on third-party services, require specialized security solutions to address potential vulnerabilities. This growing focus on securing cloud-based infrastructures is driving the rapid expansion of the security segment in the serverless architecture market.

Regional Analysis

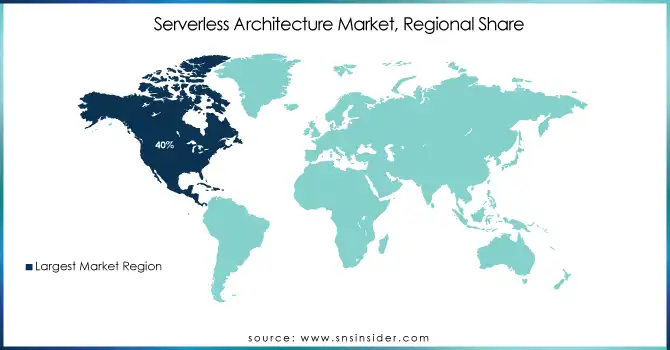

In 2023, North America dominated the Serverless Architecture Market with the highest revenue share of approximately 40%. This leadership is driven by the region’s strong technological infrastructure, early adoption of cloud services, and the presence of major cloud service providers like AWS, Microsoft Azure, and Google Cloud. The demand for scalable, flexible, and cost-efficient solutions in industries such as IT, finance, and telecommunications further propelled the region's dominance, making North America a hub for serverless innovation and deployment.

The Asia Pacific region is expected to grow at the fastest CAGR of about 28.41% from 2024 to 2032. This rapid growth can be attributed to the increasing digital transformation initiatives across countries like China, India, and Japan. As businesses in the region embrace cloud computing to improve scalability and reduce costs, serverless architecture is emerging as an ideal solution to meet these evolving needs. The growing number of tech startups and expanding enterprise sectors in Asia Pacific are expected to drive the adoption of serverless models at an accelerated pace in the coming years.

Do You Need any Customization Research on Serverless Architecture Market - Enquire Now

Key Players

-

Alibaba Group (Alibaba Cloud Function Compute, Alibaba Cloud API Gateway)

-

Cloudflare, Inc. (Cloudflare Workers, Cloudflare Pages)

-

Google (Google Cloud Functions, Google Cloud Run)

-

IBM Corporation (IBM Cloud Functions, IBM Cloud Foundry)

-

Microsoft (Azure Functions, Azure Logic Apps)

-

NTT DATA Group Corporation (NTT Smart Data Platform, NTT Cloud Functions)

-

Oracle (Oracle Functions, Oracle API Gateway)

-

TIBCO Software (Cloud Software Group, Inc.) (TIBCO Cloud Integration, TIBCO Cloud Mashery)

-

Amazon Web Services (AWS Lambda, Amazon API Gateway)

-

Rackspace Inc (Rackspace Serverless, Rackspace Cloud)

-

Salesforce.com, Inc. (Salesforce Functions, Salesforce Heroku)

-

Platform9 Systems, Inc. (Platform9 Serverless Kubernetes, Platform9 Cloud Managed Kubernetes)

-

OpenStack Foundation (OpenStack Functions, OpenStack Heat)

-

PubNub, Inc. (PubNub Functions, PubNub Real-time Messaging)

-

Spotinst Ltd. (Spotinst Functions, Spotinst Kubernetes)

-

5 Networks, Inc. (5G Serverless, 5G Edge Functions)

-

DigitalOcean, Inc. (DigitalOcean Functions, DigitalOcean App Platform)

-

Kong Inc. (Kong Gateway, Kong Enterprise)

-

Back4App (Back4App Functions, Back4App Serverless)

-

Netlify, Inc. (Netlify Functions, Netlify Edge Functions)

-

Vercel Inc. (Vercel Functions, Vercel Edge Functions)

-

Cisco Systems, Inc. (Cisco Cloud Functions, Cisco API Management)

-

VMware, Inc. (VMware Tanzu Application Service, VMware Cloud Functions)

Recent Developments:

-

In January 2024, Alibaba Cloud introduced a serverless solution that reduces inference costs by up to 50%, enabling cost-efficient access to generative AI services. The company also integrated its vector engine into various products, enhancing AI performance and information retrieval.

-

In November 2024, Fauna and Cloudflare partnered to streamline serverless development, enabling faster and more scalable solutions. This collaboration leverages Fauna's serverless database with Cloudflare's edge network, offering quick deployments, enhanced global reach, and simplified management for developers.

-

In October 2024, IBM introduced Quantum Serverless, a toolset that enhances quantum and classical resource management for long-running workloads. This approach allows dynamic allocation of CPUs, GPUs, and QPUs, overcoming traditional system limitations and ensuring persistence of tasks, improving the scalability and efficiency of quantum computing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.21 Billion |

| Market Size by 2032 | USD 78.21 Billion |

| CAGR | CAGR of 25.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Automation & Integration, API Management, Monitoring, Security, Support and Maintenance, Training and Consulting, Others) • By Deployment (Public Cloud, Private Cloud, Hybrid Cloud) • By Organization Size (Large Enterprise, SME) • By Vertical (IT and Telecom, Healthcare, Retail and E-commerce, Banking, Financial Services, and Insurance (BFSI), Government, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alibaba.com, Cloudflare, Inc., Google, IBM, Microsoft, NTT DATA Group Corporation, Oracle, TIBCO Software (Cloud Software Group, Inc.), Amazon, Rackspace Technology, Inc., Salesforce.com, Inc., Platform9 Systems, Inc., OpenStack Foundation, PubNub, Inc., Spotinst Ltd., 5 Networks, Inc., DigitalOcean, Inc., Kong Inc., Back4App, Netlify, Inc., Vercel Inc., Cisco Systems, Inc., VMware, Inc. |

| Key Drivers | • Seamless Integration of Serverless Architecture with Leading Cloud Services Fuels Market Growth • The Rise of Microservices and Its Synergy with Serverless Architecture in Modern Application Development |

| RESTRAINTS | • The Challenges of Debugging and Monitoring in Serverless Architectures Impacting Market Adoption • The Challenge of Cost Management in Serverless Architectures and Its Impact on Market Growth |