Sales Training Software Market Report Scope & Overview:

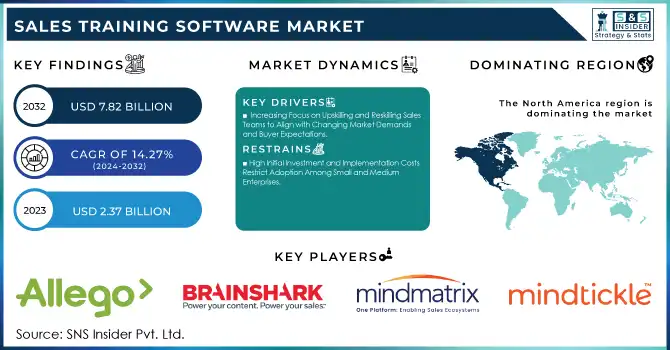

The Sales Training Software Market Size was valued at USD 2.37 Billion in 2023 and is expected to reach USD 7.82 Billion by 2032 and grow at a CAGR of 14.27% over the forecast period 2024-2032.

Get more information on Sales Training Software Market - Request Free Sample Report

The sales training software market has experienced remarkable growth in recent years and continues to expand at a significant pace. It can be attributed to the growing needs of businesses to improve the competencies of sales teams, adapt to advanced technological solutions, and stay competitive within an ever-changing business environment. The market covers a wide array of industries across the spectrum: retail, finance, healthcare, technology, and manufacturing, further emphasizing its relevance and applicability.

Furthermore, organizations are now focusing more on upskilling and reskilling the workforce in line with shifting market demands and technology. The sales training software equips the employees with new skills and exposure to the current trends in sales to ensure the businesses stay responsive and competitive. E-learning would take around 38% to 58% less time than the traditional methods and thus is cost-effective for any business that seeks to improve its sales teams' skill sets. In the United States, companies spend about USD 70 billion every year on training programs, and sales training is among the highest return on investment. For every dollar spent on training, companies can expect up to USD 4.53 in return, which makes it a good financial investment to put money into sales training software.

Sales Training Software Market Dynamics

Key Drivers:

-

Increasing Focus on Upskilling and Reskilling Sales Teams to Align with Changing Market Demands and Buyer Expectations

The sales training software market is experiencing rapid growth because of the growing need for organizations to upskill and reskill their sales teams. With the evolving buyer expectations and market dynamics, sales professionals must adjust to new tools, methodologies, and customer-centric strategies. Sales training software allows organizations to offer customized and efficient training solutions that keep sales teams ahead of the curve. Businesses can effectively address skill gaps by leveraging features such as AI-driven analytics, role-playing simulations, and real-time feedback.

Additionally, reskilling programs ensure employees are up-to-date with the latest sales techniques to stay ahead of the competition. This emphasis on continuous learning is what has made sales training software essential for businesses in multiple industries, propelling market growth.

-

Adoption of Artificial Intelligence and Machine Learning Technologies Enhances Personalization and Efficiency in Sales Training Programs

The integration of AI and ML technologies into sales training software. AI-powered platforms allow for real-time feedback, personalized learning experiences, and predictive analytics to identify skill gaps. The ML algorithm helps tailor training content based on individual performance for targeted and effective learning. Third, AI and ML technologies streamline administrative activities that are undertaken in the system, such as producing progress reports and scheduling sessions. This way, the trainer can concentrate more on quality content. It empowers organizations to deliver superior training experiences, enhance the productivity of sales teams, and derive measurable results. Technological advancement is among the factors propelling the sales training software market.

Restrain:

-

High Initial Investment and Implementation Costs Restrict Adoption Among Small and Medium Enterprises

The market for sales training software does, however, suffer from one major restraint-high initial investment and implementation costs. Small and medium enterprises (SMEs) face a big problem in assigning considerable budgets for software deployment, customization, and onboarding employees.

Moreover, the fact that these technologies require constant updating and integration with other systems further increases the expenses. Most of the SMEs are reluctant to adopt these due to uncertainty related to ROI as well as complexities in implementation. Smaller firms also do not have designated IT support which makes it hard to solve the technical issues promptly. Although cloud-based solutions and flexible pricing models have improved accessibility, the cost barrier remains a deterrent to widespread adoption among SMEs, limiting the overall market growth potential.

Sales Training Software Market Segments Analysis

By Enterprise Size

The large enterprise segment commanded the majority of the sales training software market revenue in 2023, accounting for 63.00%. This dominance stems from the robust adoption of advanced technologies by large corporations seeking scalable, comprehensive training solutions to upskill their extensive workforces. Major players such as Salesforce, SAP, and Cornerstone OnDemand have launched enhanced platforms that integrate AI-driven personalization, analytics, and immersive learning tools to cater to diverse training needs. For instance, Salesforce introduced its AI-powered learning paths within the Sales Cloud to accelerate onboarding and sales competency development.

The small and medium enterprise (SME) segment is experiencing the fastest growth in the sales training software market, with a projected CAGR of 15.61% during the forecast period. SMEs are increasingly leveraging affordable, cloud-based training solutions to enhance sales team performance while managing limited resources. Companies like Zoho and HubSpot have introduced cost-effective, user-friendly platforms tailored for SMEs, emphasizing CRM integration, gamification, and mobile accessibility. For example, In Sept.2023, HubSpot recently unveiled a feature-rich learning module targeting SMBs to simplify sales strategies.

By End-Use

The Retail sector emerged as the largest revenue contributor to the sales training software market in 2023, holding a 22.00% share. This dominance is driven by the retail industry's emphasis on enhancing customer experience and driving sales conversions through skilled workforce development. Retail giants such as Walmart and Amazon have invested in advanced sales training solutions that incorporate AI-driven analytics, real-time feedback, and microlearning modules to empower front-line employees with product knowledge and sales strategies.

The IT & telecom sector is projected to achieve the fastest growth in the sales training software market, with a CAGR of 17.01% during the forecast period 2024-2032. The rapid evolution of technology, coupled with the need for technical expertise in selling complex IT solutions, drives the adoption of cutting-edge training tools. Companies like Microsoft and Cisco are spearheading innovation by introducing platforms with AI-based skill assessments, role-playing simulations, and scenario-based learning.

Regional Analysis

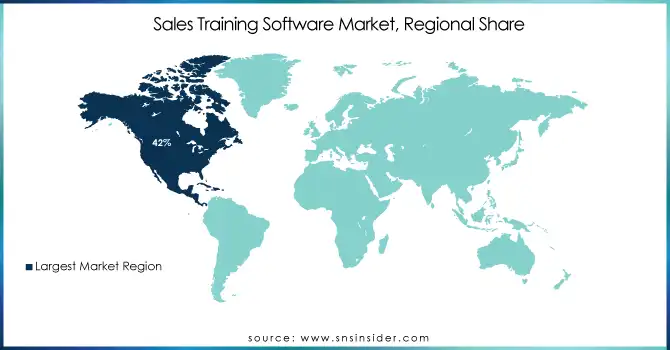

In 2023, North America emerged as the dominant region in the sales training software market, holding an estimated market share of around 42%. Such leadership emerges from the high presence of leading software providers, including Salesforce, HubSpot, and Cornerstone OnDemand, as well as high technological adoption across various industries in the region. Companies in North America are increasingly using AI, machine learning, and VR-based training solutions to enhance productivity among their sales teams.

Additionally, the region's mature digital infrastructure and the importance of continuous skill development for staying competitive in such a highly dynamic market. Investment in customizable and scalable training tools is on the rise, reflecting the strength of growth in North America.

The Asia Pacific region is the fastest-growing in the sales training software market in 2023, with an estimated CAGR of 16.8% during the forecast period. The growth can be attributed to rapid digital transformation and the boom of SMEs across countries in India, China, and Southeast Asia. Organizations in the region are opting for cloud-based, cost-effective training solutions to support scalable workforce development. For example, Zoho and Fresh Works have introduced localized training platforms tailored to diverse linguistic and cultural requirements. High growth rates in Asia Pacific e-commerce, IT services, and tech start-ups heighten the need for agile training solutions. Mobile connectivity and higher smartphone penetration boost the adoption of mobile-first learning platforms as the regional growth is set to continue unabated.

Need any customization research on Sales Training Software Market - Enquiry Now

Key Players

Some of the major players in the Sales Training Software Market are:

-

Allego (Allego Sales Learning Platform, Allego Sales Coaching)

-

Brainshark, Inc.. (Brainshark Sales Enablement, Brainshark Video Coaching)

-

Mindmatrix Inc. (Mindmatrix Sales Enablement, Mindmatrix Partner Relationship Management)

-

Mindtickle Inc. (Mindtickle Sales Readiness, Mindtickle Onboarding)

-

Qstream, Inc. (Qstream Sales Coaching, Qstream Sales Training)

-

Salesforce, Inc. (Salesforce Sales Cloud, Salesforce Trailhead)

-

SalesHood Inc. (SalesHood Sales Enablement, SalesHood Content Sharing)

-

SAP SE (SAP SuccessFactors, SAP Sales Cloud)

-

Showpad (Showpad Sales Enablement, Showpad Content Management)

-

Zoho Corporation Pvt. Ltd. (Zoho CRM, Zoho SalesInbox)

-

Microsoft (Microsoft Dynamics 365 Sales, Microsoft Viva Learning)

-

Skillsoft (Skillsoft Sales Training, Skillsoft Leadership Development)

-

Trainual (Trainual Onboarding, Trainual Sales Training)

-

DocuSign (DocuSign Agreement Cloud, DocuSign CLM)

-

Oracle (Oracle Sales Cloud, Oracle Learning Management)

-

PandaDoc (PandaDoc Document Automation, PandaDoc Proposal Management)

-

Korn Ferry (Korn Ferry Sales Effectiveness, Korn Ferry Leadership Development)

-

Sandler Training (Sandler Sales Training, Sandler Coaching and Mentoring)

-

Huthwaite International (Huthwaite SPIN Selling, Huthwaite Sales Training Programs)

-

Harvard Business Publishing (Harvard Business Review Sales Training, Harvard Business Publishing Leadership Development)

Recent Developments:

-

In March 2024, Mindmatrix Inc., a leader in next-generation Partner Relationship Management (PRM), partner marketing, and sales ecosystem solutions, unveiled major improvements to its PRM platform, Bridge. These enhancements represent a significant leap forward in helping businesses effectively manage their channel partnerships and sales ecosystems.

-

In April 2023, Mindtickle Inc. secured $50 million in Series C funding. This investment will be used to enhance Mindtickle’s sales training software platform and support the expansion of its sales and marketing teams.

-

In April 2023, Zoho announced a partnership with HubSpot, a leading CRM platform. This collaboration enables Zoho SalesIQ users to seamlessly integrate their sales training software with HubSpot, providing sales teams with improved tracking of their progress and performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.37 Billion |

| Market Size by 2032 | US$ 7.82 Billion |

| CAGR | CAGR of 14.27 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premise, Cloud) • By Enterprise Size (Large, Small & Medium) • By Training Delivery Mode (E-Learning Platforms, Virtual Instructor-Led Training, Blended Learning) • By End-Use (BFSI, Automotive, Retail, Healthcare, IT & Telecom, Discrete Manufacturing, Government, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allego, Brainshark, Inc., Mindmatrix Inc., Mindtickle Inc., Qstream, Inc., Salesforce, Inc., SalesHood Inc., SAP SE, Showpad, Zoho Corporation Pvt. Ltd., Microsoft, Skillsoft, Trainual, DocuSign, Oracle, PandaDoc, Korn Ferry, Sandler Training, Huthwaite International, Harvard Business Publishing. |

| Key Drivers | • Increasing Focus on Upskilling and Reskilling Sales Teams to Align with Changing Market Demands and Buyer Expectations • Adoption of Artificial Intelligence and Machine Learning Technologies Enhances Personalization and Efficiency in Sales Training Programs |

| Restraints | • High Initial Investment and Implementation Costs Restrict Adoption Among Small and Medium Enterprises |