Cloud Advertising Market Report Analysis & Growth Overview:

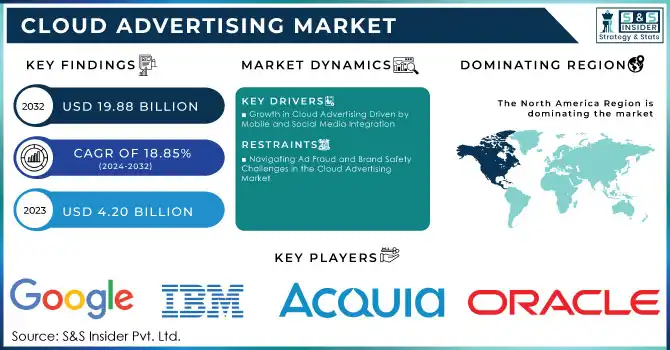

The Cloud Advertising Market Size was valued at USD 4.20 billion in 2023 and is expected to reach USD 19.88 billion by 2032 with a growing CAGR of 18.85% over the forecast period 2024-2032.

Get more information on Cloud Advertising Market - Request Free Sample Report

The cloud advertising market is experiencing strong growth driven by the increasing demand for digital marketing solutions. As consumer engagement with digital media continues to surge, businesses are turning to cloud advertising to reach their target audiences effectively and efficiently. Platforms like social media, websites, and mobile applications are becoming core elements of marketing strategies, and cloud advertising provides significant advantages such as scalability, real-time campaign management, and seamless cross-platform integration. With cloud-based solutions, businesses can manage and optimize campaigns across multiple channels from a single platform, boosting productivity and simplifying the complex task of ad targeting, measurement, and attribution. As organizations shift towards data-driven marketing strategies, the demand for advanced analytics and personalized advertising continues to rise, propelling the cloud advertising market growth.

Digital marketing is evolving rapidly, with B2B organizations increasingly focusing on brand building alongside demand-generation efforts. Studies show that 26% of marketers find brand investments enhance demand generation by up to 50%, highlighting the growing importance of integrating marketing initiatives. This need for more cohesive marketing strategies correlates with the increasing demand for cloud-based solutions, which enable businesses to track and manage performance in real-time across multiple channels. The demand for digital marketing skills is also rising, with job growth in the sector outpacing the average, fueled by advancements in AI-powered marketing tools and the ongoing shift toward social media marketing. 76% of consumers engage with brands on social media, driving the need for advanced marketing tools and a focus on social selling, particularly across platforms like Instagram and LinkedIn.

Cloud Advertising Market Dynamics

Drivers

-

Growth in Cloud Advertising Driven by Mobile and Social Media Integration

The growing use of mobile devices and social media is a key driver for the cloud advertising market. With consumers increasingly spending time on mobile platforms and engaging with content via social media channels, advertisers are focusing more on optimizing their campaigns for various screen sizes and formats. Cloud advertising platforms offer seamless integration across these multiple channels, ensuring consistent messaging and enhancing engagement with audiences. Moreover, social media advertising has experienced rapid growth, with a significant increase in mobile-first ad formats, including video, interactive, and native ads, as reported by Sprout Social. This trend is further amplified by the rising importance of mobile-centric advertising as more people access content via smartphones and tablets. Cloud-based advertising platforms not only enable businesses to create responsive and adaptive ad campaigns for various devices but also facilitate real-time tracking and optimization, improving overall marketing effectiveness. The ability to integrate across diverse digital ecosystems—mobile apps, websites, and social media makes cloud advertising an essential tool for businesses looking to capitalize on the growing shift toward mobile and social media consumption. This demand is expected to continue to accelerate as mobile ad spending and social media engagement keep rising.

Restraints

-

Navigating Ad Fraud and Brand Safety Challenges in the Cloud Advertising Market

As businesses increasingly rely on programmatic advertising and third-party data, the risks associated with inflated impressions and clicks lead to wasted budgets and inefficiency. The lack of transparency in automated platforms exacerbates this issue, making it difficult for advertisers to assess the true impact of their campaigns. Additionally, ensuring brand safety, particularly on social media platforms, remains a pressing concern, as ads may appear alongside harmful or controversial content that can damage a brand's reputation and consumer trust. Despite the scalability and efficiency advantages of cloud-based advertising solutions, businesses must rely on third-party platforms, raising the potential for misaligned ad placements. The growing demand for programmatic advertising has underscored the need for enhanced safety measures to mitigate ad fraud and protect brand integrity.

Cloud Advertising Market Segmentation Analysis

By Service

In 2023, Platform as a Service (PaaS) dominated the cloud advertising market, accounting for approximately 54% of the total revenue. PaaS offers a comprehensive platform for businesses to design, develop, and manage their advertising campaigns without the complexity of managing infrastructure. This service allows companies to leverage cloud-based tools and resources, which include data analytics, machine learning algorithms, and automation features, all integral to optimizing ad campaigns across multiple channels. The scalability and flexibility provided by PaaS are key drivers of its growth, as businesses can easily scale their operations to meet changing demands while maintaining high levels of performance and efficiency. Additionally, PaaS platforms enable real-time data processing, which is essential for delivering personalized, targeted advertising and improving ROI. The increasing shift towards data-driven marketing strategies further contributes to the growing adoption of PaaS in cloud advertising. PaaS solutions, such as Google Cloud, Amazon Web Services, and Microsoft Azure, provide integrated advertising and analytics tools that help advertisers reach their target audiences more effectively, streamline their operations, and reduce costs.

By Deployment

In 2023, the hybrid deployment model accounting for approximately 44% of revenue, in the cloud advertising market share. Hybrid deployment combines the benefits of both public and private cloud environments, providing businesses with greater flexibility and control over their advertising data and operations. This model allows organizations to store sensitive data on private clouds while utilizing the scalability and efficiency of public clouds for their advertising campaigns. As businesses continue to prioritize data security, compliance, and performance optimization, the hybrid approach offers a balanced solution that meets diverse needs. Furthermore, hybrid cloud environments enable seamless integration across multiple advertising platforms, enhancing cross-channel marketing strategies and ensuring more effective campaign execution. The growing demand for hybrid cloud solutions reflects businesses' increasing need to adapt to changing market dynamics while maintaining operational flexibility.

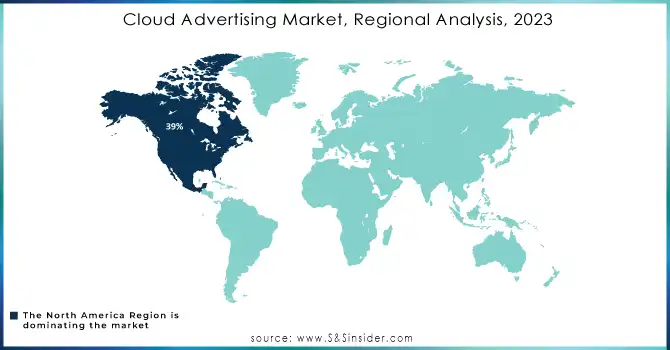

Cloud Advertising Market Regional Analysis

In 2023, North America dominated the cloud advertising market, capturing around 39% of the global revenue. This growth is driven by the region's advanced digital infrastructure, strong presence of tech giants like Google, Facebook, and Amazon, and high consumer demand for digital ads. The integration of AI and machine learning in cloud platforms has fostered innovation, making real-time, data-driven marketing more efficient. Additionally, the rise of programmatic advertising and the increasing use of mobile and social media have further boosted cloud-advertising adoption. With businesses focusing on enhancing targeting and customer engagement, North America remains a key player, and this trend is expected to continue as digital marketing continues to expand.

Asia-Pacific (APAC) is the fastest-growing region in the cloud advertising market, driven by the rapid adoption of digital technologies in countries like China, India, Japan, and Southeast Asia. Mobile usage and internet penetration have significantly increased, resulting in a surge in online ad spend, particularly on mobile and social media platforms. The region's expanding e-commerce sector, especially in China and India, also boosts demand for cloud-based advertising solutions. Governments' investments in digital infrastructure further support this growth. The rise of social media influencers and localized content creators accelerates cloud advertising's adoption, with businesses leveraging cloud platforms for personalized, data-driven campaigns. As digital transformation continues, APAC's cloud advertising market is poised for further expansion.

Need Any Customization Research On Cloud Advertising Market - Inquiry Now

Key Players in Cloud Advertising Market

Some of the major players in Cloud Advertising Market with their product:

-

IBM (Watson Advertising)

-

Acquia (Acquia Marketing Cloud)

-

Oracle (Oracle Advertising and Customer Experience)

-

Imagine Communications (Versio)

-

Salesforce (Salesforce Marketing Cloud)

-

FICO (FICO Advertising Solutions)

-

Google (Google Ads, Google Marketing Platform)

-

Adobe (Adobe Advertising Cloud)

-

SAP (SAP Customer Experience)

-

Demandbase (Demandbase One)

-

Sailthru (Sailthru Marketing Cloud)

-

Experian (Experian Marketing Services)

-

Kubient (Kubient Advertising Platform)

-

Nielsen (Nielsen Marketing Cloud)

-

InMobi (InMobi Advertising Solutions)

-

HubSpot (HubSpot Marketing Hub)

-

Marin Software (MarinOne)

-

MediaMath (MediaMath TerminalOne)

-

PEGA (PEGA Marketing Cloud)

-

Sitecore (Sitecore Experience Platform)

List of companies that are potential customers for the cloud advertising market:

-

Amazon

-

eBay

-

Google

-

Microsoft

-

Apple

-

Ford

-

BMW

-

Walmart

-

Target

-

Expedia

-

Airbnb

-

HSBC

-

JPMorgan Chase

-

Netflix

-

Disney

Recent Development

-

On October 7, 2024, AWS showcased its innovations in content monetization and cloud broadcast at Advertising Week and NAB Show in New York. The AWS Media & Entertainment, Games, and Sports team highlighted strategies for enhancing customer engagement and content monetization across platforms, with a focus on leveraging data for personalized experiences.

-

July 30, 2024 – Acquia introduced Multi-Experience Operations, a new feature of the Acquia Cloud Platform, designed to streamline the delivery of digital experiences at scale. This enhancement combines the multi-site advantages of Drupal CMS with the performance and scalability of Acquia Cloud Next

-

July 29, 2024 – Experian launched a new retail media solution aimed at enhancing identity resolution, ad targeting, and attribution for retail media networks. Leveraging its identity graph and measurement tools, the solution helps connect advertising actions to measurable outcomes, improving overall ad effectiveness for retailers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.20 Billion |

| Market Size by 2032 | USD 19.88 Billion |

| CAGR | CAGR of 18.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)) • By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud) • By End User (BFSI, Government, IT & Telecommunication, Media & Entertainment, Retail Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Acquia, Oracle, Imagine Communications, Salesforce, FICO, Google, Adobe, SAP, Demandbase, Sailthru, Experian, Kubient, Nielsen, InMobi, HubSpot, Marin Software, MediaMath, PEGA, and Sitecore |

| Key Drivers | • Growth in Cloud Advertising Driven by Mobile and Social Media Integration |

| Restraints | • Navigating Ad Fraud and Brand Safety Challenges in the Cloud Advertising Market |