Satellite Antenna Market Report Scope & Overview:

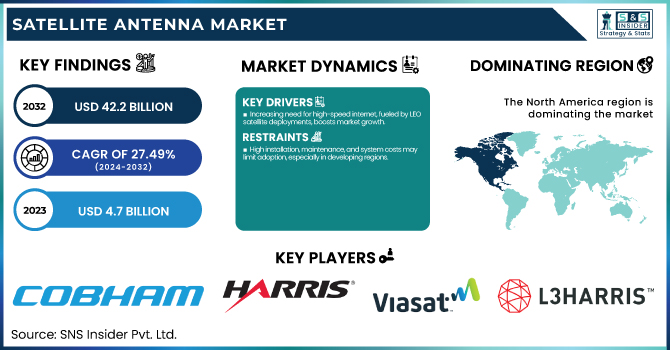

The Satellite Antenna Market was valued at USD 4.7 billion in 2023 and is expected to reach USD 42.2 billion by 2032, growing at a CAGR of 27.49% from 2024-2032.

To Get more information on Satellite Antenna Market - Request Free Sample Report

The adoption of satellite communication in remote areas is rising due to increased connectivity demands, government initiatives, and efforts to bridge the digital divide. Military applications are driving regional deployments, particularly in North America and Asia-Pacific, fueled by defense modernization and secure communication needs. Satellite-enabled IoT applications are growing across industries like agriculture, maritime, and logistics, enhancing remote tracking and operational efficiency. Additionally, rising demand for satellite broadband services in countries with limited fiber infrastructure, especially in rural regions, is boosting satellite antenna installations. The report further explores emerging technologies, regional trends, and competitive dynamics shaping market growth.

The U.S. The Satellite Antenna Market was valued at USD 1.4 billion in 2023 and is expected to reach USD 12.6 billion by 2032, growing at a CAGR of 27.22% from 2024-2032, driven by advancements in satellite technology, rising demand for high-speed broadband connectivity, and the increasing adoption of satellite communication in defense, telecommunications, and commercial applications. The rollout of 5G networks and the integration of satellite technology into Internet of Things ecosystems are further accelerating market growth.

Satellite Antenna Market Dynamics

Drivers

-

Increasing need for high-speed internet, fueled by LEO satellite deployments, boosts market growth.

The satellite antennas market is driven by the increasing demand for the internet for streaming and professional work from remote areas such as rural areas. The emergence of many Low Earth Orbit satellite constellations by companies such as Starlink and Project Kuiper is improving broadband penetration globally. It is complemented by the growing use of satellite-based communications for military, aviation , and maritime applications. Large investments in satellite technologies and the increasing application of the satellite antennas in the 5G backhaul and IoT ecosystem will ultimately bring steady growth to the market over the forecast timeframe.

Restraints

-

High installation, maintenance, and system costs may limit adoption, especially in developing regions.

The high costs involved with satellite antenna installation, maintenance, and overall system deployment is another key factor restraining the market growth. Complex and costly components are required for advanced satellite communication systems, which may discourage small enterprises and developing regions from adopting the technology. Moreover, the complexity of the installation process and the requirement of skilled personnel for the maintenance and upgrading of these systems is going to intensify operational costs. The modeling ecosystem will rely on slightly slower adoption due to this cost drag in some sensitive sectors, thereby reducing overall market usage.

Opportunities

-

LEO satellites enhance low-latency communication for IoT, autonomous vehicles, and smart cities.

The increasing number of LEO satellites constellations provide lucrative opportunities for satellite antenna market. These low-latency, high-speed communication systems are well-suited for next-generation business cases, such as the Internet of Things, autonomous vehicles, smart city infrastructure, and other forward-thinking applications. In addition, the growing demand for satellite-based broadband services and government initiatives to promote internet connectivity in underserved regions will continue to present new opportunities for companies that manufacture satellite antennas and service providers.

Challenges

-

Complex regulations and frequency congestion may disrupt communication and hinder seamless satellite operations.

Regulatory frameworks, along with spectrum allocation issues, are proving to be a hindrance to the growth of the satellite antenna market. The number of satellites increased in orbit, coupled with the increasing demand for the use of frequency bands, can lead to a confining of the spectrum, affecting the quality of the signal and disrupting the communication. Moreover, navigating the intricate and time-consuming international and regional guidelines on satellite launches, antenna employment, and frequency allocation remains a major challenge. Solving these problems is important for seamless communication and the continued growth of the market in the future.

Satellite Antenna Market Segmentation Analysis

By Platform

In 2023, the land segment dominated the market and accounted or 28% of revenue share. Both the growing need for faster internet in urban and rural settings and resilient communication infrastructure are creating a migration towards investment in land-based satellite antennas. Additionally, the growing adoption of smart cities and increasing IoT networks would further bolster segmental growth.

The airborne segment is projected to register the fastest CAGR during the forecast period, owing to the rising need for superior communication solutions in aviation. This extends to satellite antennas for commercial airlines, military aircraft, and UAVs. Moreover, the segmental growth is being fueled by the growing trend of connecting the passengers with internet access during air travel, even live television.

By Frequency

The Ku-band dominated the market and accounted for the largest share of the market in 2023 due to its widespread acceptance, especially in direct-to-home television services, and well-established infrastructure. The frequency range between 12-18 GHz allows for very reliable, high-quality communication, which is one of the reasons it is commonly used for broadcasting, maritime, and aeronautical services. The cost-effectiveness and operational flexibility of the Ku-band over higher frequency bands, including its resilience to weather breakdown, is likely to drive segmental growth.

The Ka-band segment is expected to be the fastest-growing from 2024 to 2032. This segmental growth is driven by its better bandwidth and increasing demand for High-Throughput satellites. Ka-band: With frequencies from 26.5 to 40 GHz, the Ka-band facilitates high-data-rate applications such as high-speed internet and high-definition video streaming.

By Technology

In 2023, the SATCOM-On-the-Move segment dominated the market and accounted for the 59% of revenue. Its growth can be attributed to its important function in delivering uninterrupted high-speed communication from mobile platforms. Military and defense operations rely on SATCOM on-the-move systems to transmit and communicate in real time with vehicles, aircraft, and ships. Transportation, logistics, and media broadcasting, relying on constant connectivity, are just a few commercial sectors benefiting from SOTM.

The SATCOM On the Pause segment is expected to register the fastest CAGR during the forecast period, as applications in numerous domains, where networking is necessary to be established in a stationary position. SOTP systems are especially important for military operations, emergency response, and remote field research that requires temporary, high-bandwidth satellite communications in sites without existing infrastructure.

Regional Analysis

In 2023, North America dominated the market and accounted for 40% of the revenue share. This supremacy is mainly attributed to the evolution of the satellite technology namely high-throughput satellites and phased array antennas developing the functioning and capability of systems. Demand for satellite antennas is also driven by the popularity of satellite TV and direct-to-home services in North America, as consumers look for a wide array of channels and content.

The Asia Pacific satellite antenna market is expected to grow at the fastest CAGR from 2024 to 2032. The market growth in the region is driven due to the rapid urbanization and increasing demand from urban and rural areas for high-speed internet connectivity. What will not cut it: Non-starving satellite antennas to cross the digital gap and give trustworthy communication services.

Key Players

Get Customized Report as per Your Business Requirement - Enquiry Now

The major key players along with their products are

-

Cobham Limited – SATCOM Antenna

-

Harris Corporation – Lightweight Tactical Antennas

-

Viasat Inc. – Ka-band Antenna Systems

-

General Dynamics Mission Systems, Inc. – SATCOM On-the-Move Antenna

-

L3Harris Technologies, Inc. – VSAT Antenna

-

Honeywell International Inc. – JetWave Satellite Communication Antenna

-

Airbus SE – SKYNET Satellite Antenna

-

Gilat Satellite Networks Ltd. – AeroEdge Antenna System

-

Hughes Network Systems, LLC – Jupiter System Antenna

-

Ball Aerospace – Phased Array Antenna

-

Comtech Telecommunications Corp. – X-band Antenna

-

Intellian Technologies – v100NX Antenna

-

Kymeta Corporation – Kymeta u8 Terminal

-

Maxar Technologies – Reflector Antennas

-

Advantech Wireless – Satcom GaN-based Antenna

Recent Developments

-

December 2024: The U.S. Space Force's rapid acquisition arm announced plans to begin fielding new antennas to enhance its aging Satellite Control Network by the end of 2025, aiming to address increased demand and modernize infrastructure.

-

February 2024: C-COM Satellite Systems Inc. received Eutelsat Type Approval for its iNetVu Ka-74G antenna system, facilitating its use on Eutelsat's broadband services.

-

January 2024: C-COM Satellite Systems Inc. announced the suspension of quarterly dividends to prioritize strategic investments, reflecting a shift towards enhancing research and development initiatives.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.7 Billion |

| Market Size by 2032 | USD 42.2 Billion |

| CAGR | CAGR of 27.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Land, Space, Maritime, Airborne) • By Technology (SATCOM-On-the-Move (SOTM) SATCOM On-the-Pause (SOTP)) • By Frequency (L Band, S-band, C-band, X-band, Ku-band, Ka-band, Q band, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cobham Limited, Harris Corporation, Viasat Inc., General Dynamics Mission Systems, Inc., L3Harris Technologies, Inc., Honeywell International Inc., Airbus SE, Gilat Satellite Networks Ltd., Hughes Network Systems, LLC, Ball Aerospace, Comtech Telecommunications Corp., Intellian Technologies, Kymeta Corporation, Maxar Technologies, Advantech Wireless |