Military Wearable Market Report Scope & Overview:

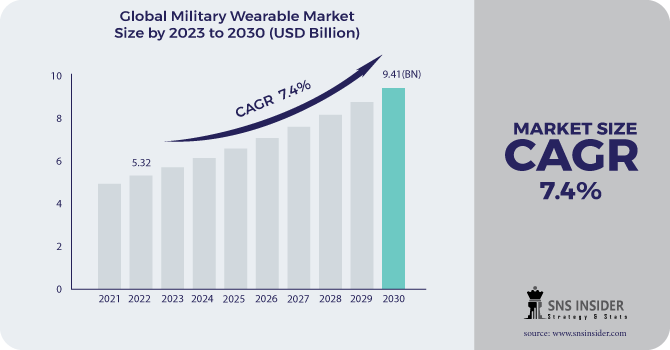

The Military Wearable Market Size was valued at USD 5.32 billion in 2022 and is expected to reach USD 9.41 billion by 2030 with a growing CAGR of 7.4% over the forecast period 2023-2030.

Military wearables are devices that soldiers wear while on missions or participating in military training. Globally, the technology minimizes soldier casualties. Military wearables are divided into numerous categories, including headwear, eyeglasses, and bodywear. Military wearables facilitate communication between troops and military stations, as well as providing total situational awareness. Military wearables also have the capacity to survive difficult climatic conditions such as high temperatures, inside water, and so on. The governments of several countries are investing in high-efficiency military wearables.

To get more information on Military Wearable Market - Request Free Sample Report

The vision and surveillance segment is regarded as the dominant market, accounting for the majority of the military wearable market. Surveillance is an important entry point into the study of military surveillance because it allows the defence team to keep track of a person or a location that is vulnerable to attack. In addition, new cameras, body wearable devices, and tracking devices are among the devices used in military and defence. As the use of these devices grows due to their miniaturisation, the market for military wearables is expanding.

MARKET DYNAMICS

KEY DRIVERS

-

Military Wearables Are Becoming More Popular Because of the Rise of Asymmetric Warfare

-

Increased Concentration on the Development of Lightweight and Rugged Military Wearables

RESTRAINTS

-

In developing countries, conventional warfare systems outnumber advanced systems.

-

Defense budgets are shrinking.

OPPORTUNITIES

-

Development and integration of advanced technologies to address shortcomings in existing military wearables

-

Increased Demand for Better and More Efficient Military Wearables to Cut Troops Casualties

CHALLENGES

-

Weight reduction of military wearables without sacrificing protection or combat performance

-

Insufficient Strategy Clarity and Technology Readiness

THE IMPACT OF COVID-19

The government's stated lockdown and restrictions on public gatherings have delayed the global production rate of military wearables manufacturers.

Training exercises like as Pitch Black 2020, Milan 2020, and others have been cancelled as a result of the COVID-19 crisis, which may have an influence on military wearable procurement.

As combat training restart following Covid-19, demand for military wearables will surge.

As government funding shifts toward economic recovery as a result of the covid-19 epidemic, the quantity of orders for military gear equipment may decline.

Soldier security has become a top priority for defence agencies, particularly in current war-like situations in Syria, Iraq, Yemen, Russia and Ukraine and elsewhere. Military wearables track soldiers' movements and provide military command with real-time situational knowledge, boosting troop collaboration with the team. Military wearables also assist troop training. As a result, the need for military wearables for army coordination and training will continue to rise.

The vision and surveillance area is likely to account for the majority of the military wearables industry, according to technology. The connection segment is predicted to develop at the quickest CAGR over the projection period of 2022 to 2028. The development of cutting-edge headsets for tactical communication, wearable computers to track enemy targets, and dismounted PNT for locating and communication will fuel the growth of the military wearables market during the forecast period.

Bodywear is expected to account for the majority of the military wearables market. The adoption of high-end bodywear that can be integrated with multiple sensors and wearable products is propelling the bodywear segment forward. The incorporation of advanced body diagnostic sensors and wireless chargers in smart textiles for health monitoring and powering various wearables is expected to propel the bodywear segment forward. Sensors in smart textiles can detect changes in soldiers' health by detecting heartbeat, pulse rate, and other fitness and medical metrics and relaying them to a transmitter.

Several military wearables have become smaller, lighter, and more efficient. The technological progress of military wearables has contributed to a rise in sales. The US Army awarded BAE Systems a USD 97 million contract to supply new night vision goggles and thermal weapon sights. As a result, as technology progresses, the military wearables industry is projected to grow even more in the future. One of the major advantages of these types of devices is their ability to withstand harsh environmental conditions such as high temperature, water, and high vibration, among others; these capabilities of these wearables also drive market growth. Furthermore, the key players are investing in and upgrading their current technology to improve their wearable technologies.

KEY MARKET SEGMENTATION

By Wearable Type

-

Headwear

-

Eyewear

-

Wristwear

-

Bodywear

-

Hearables

By End User

-

Land Forces

-

Airborne Forces

-

Naval Forces

By Technology

-

Communication & Computing

-

Connectivity

-

Navigation

-

Vision & Surveillance

-

Exoskeleton

-

Monitoring

-

Power & Energy Management and Smart Textiles

.png)

Need any customization research on Military Wearable Market - Enquiry Now

REGIONAL ANALYSIS

The North American military wearables market is predicted to develop at the largest CAGR between 2022 and 2028. Increasing funding on soldier modernization programme, as well as increased R&D activities, will fuel military wearables growth during the projection period. Exoskeletons, smart textiles, power and energy management, and developments in communication and computation are driving demand for military wearables in this region.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Lockheed Martin Corporation, BAE Systems, Elbit Systems, Aselsan A.S., Saab AB, General Dynamics, Harris Corporation, L-3 Harris Technologies, Rheinmetall AG, Safran, and other players.

Lockheed Martin Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 5.32 Billion |

| Market Size by 2030 | US$ 9.41 Billion |

| CAGR | CAGR of 7.4% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End User (Land Forces, Airborne Forces and Naval Forces) • By Technology (Communication & Computing, Connectivity, Navigation, Vision & Surveillance, Exoskeleton, Monitoring, Power & Energy Management and Smart Textiles) • By Wearable Type (Headwear, Eyewear, Wristwear, Bodywear and Hearables) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Lockheed Martin Corporation, BAE Systems, Elbit Systems, Aselsan A.S., Saab AB, General Dynamics, Harris Corporation, L-3 Harris Technologies, Rheinmetall AG, Safran, and other players. |

| DRIVERS | • Military Wearables Are Becoming More Popular Because of the Rise of Asymmetric Warfare • Increased Concentration on the Development of Lightweight and Rugged Military Wearables |

| RESTRAINTS | • In developing countries, conventional warfare systems outnumber advanced systems. • Defense budgets are shrinking. |