Location-Based Services Market Size & Overview:

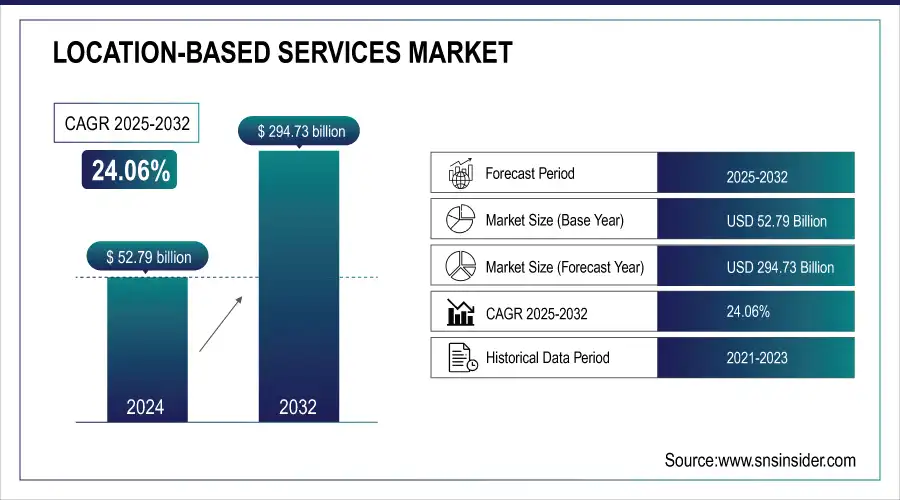

The Location-Based Services Market was valued at USD 52.79 billion in 2024 and is expected to reach USD 294.73 billion by 2032, growing at a CAGR of 24.06% from 2025-2032.

Get more information on Location-Based Services Market - Request Sample Report

The Location-Based Services market has experienced significant growth in recent years, driven by advancements in technology, particularly GPS and mobile internet connectivity. As smartphone usage continues to rise globally, with approximately 7.21 billion smartphone users, representing about 90% of the world’s population, the demand for location-based services has surged, with consumers seeking personalized, real-time location-based information. 80% of consumers are willing to share their location data in exchange for personalized offers, further fueling the growth of the location-based services market. This has led to an increased adoption of LBS across various industries, such as retail, transportation, healthcare, and entertainment, where businesses leverage location data to enhance customer experiences and improve service delivery.

Market Size and Forecast:

-

Market Size in 2024: USD 52.79 Billion

-

Market Size by 2032: USD 294.73 Billion

-

CAGR: 24.06% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Location-Based Services (LBS) Market Trends:

-

Integration of GPS, BLE, and indoor positioning systems enables real-time navigation, location tracking, and personalized services across industries.

-

AI-driven analytics and real-time data processing enhance route optimization, predictive insights, and context-aware recommendations for businesses and consumers.

-

Expansion of location-based marketing allows hyper-targeted advertising, promotions, and customer engagement, boosting sales and brand loyalty.

-

Proliferation of IoT devices and smart sensors supports asset tracking, fleet management, and smart city infrastructure development.

-

Advancements in spatial intelligence improve decision-making, logistics planning, and field service operations by leveraging accurate geospatial data.

-

Cloud-based LBS platforms facilitate secure data sharing, interoperability, and integration with enterprise systems, enhancing efficiency and operational insights.

The future of the Location-Based Services market appears promising, with significant opportunities emerging in the development of 5G technology and the expansion of Internet of Things devices. The number of IoT devices worldwide reached 15.9 billion in 2023, and with over 170 million new 5G connections added in Q3 2024 alone, the increased speed and connectivity of 5G networks will enhance the real-time capabilities of LBS, making them more accurate and responsive. Additionally, as IoT devices become more ubiquitous, the fusion of location data with these devices will unlock new applications, such as predictive analytics for traffic, location-based health monitoring, and more personalized advertising experiences, shaping the future of the LBS market.

Location-Based Services (LBS) Market Drivers:

-

The Role of IoT Integration in Generating Location Data for Enhanced Location-Based Services Market

Integrating Internet of Things devices into daily life plays a pivotal role in driving the Location-Based Services market. With the rise of smart homes, wearable technologies, and connected cars, IoT devices generate vast amounts of real-time location data. In 2033, the highest number of IoT devices will be found in China, with around 8 billion consumer devices, and in the U.S., 60.4 million households actively used smart home devices in 2023. This data can be leveraged for a variety of LBS applications, such as personalized health monitoring, real-time traffic management, and fleet optimization. For example, wearables can track an individual's health metrics while providing location-based insights, while connected cars enable more efficient routing and safety features. As the number of IoT devices grows, the demand for advanced LBS that can interpret and act on location data will expand, enhancing convenience, efficiency, and user experience across various sectors.

-

The Surge in Location-Based Advertising for Targeted Marketing Campaigns

The growing interest in location-based advertising is transforming the marketing landscape. Advertisers are leveraging location data to deliver personalized, context-aware advertisements, offers, and promotions in real time. By understanding a consumer's physical location, businesses can tailor their messaging to specific regions, shopping habits, or times of day, significantly improving relevance and engagement. 68% of companies have adopted location-based marketing to drive growth. For example, in 2023, Walmart Connect used ad targeting techniques such as purchase data, demographic information, geographic targeting, and lookalike audiences to effectively reach customer segments. This hyper-targeted approach boosts customer experience, increases conversion rates, and strengthens brand loyalty. Retailers, restaurants, and service industries are especially benefiting, using location-based ads to attract nearby customers with special offers.

Location-Based Services (LBS) Market Restraints:

-

The Impact of Inaccurate Location Data on the Reliability of Location-Based Services Market

Accurate location data is essential for the effectiveness of Location-Based Services, but several factors can lead to inaccurate or inconsistent data. GPS signal errors, network limitations, or interference from urban structures, such as tall buildings or tunnels, can distort location accuracy. This is particularly problematic for LBS applications in critical areas like emergency services, where precise location data is crucial for timely response, or autonomous vehicles, where small errors can lead to dangerous situations. Inaccurate data reduces the reliability of LBS, leading to potential safety issues and decreased user trust. As a result, businesses and service providers face challenges in ensuring data accuracy, which can limit the adoption and expansion of LBS in certain industries.

-

Privacy and Security Risks Hindering the Growth of Location-Based Services Market

The collection and use of personal location data in Location-Based Services raise significant privacy and security concerns. Consumers are increasingly wary of surveillance and the potential misuse of their sensitive information. As a result, regulatory frameworks like the GDPR and CCPA impose stringent guidelines on how location data can be collected, stored, and shared. While these regulations aim to protect users, they also restrict the scope of LBS applications, particularly when it comes to cross-border data transfers and user consent. Companies offering LBS must ensure compliance with these regulations, which can result in increased costs and limitations on service offerings. Privacy concerns may also discourage users from fully embracing LBS, impacting adoption and market growth.

Location-Based Services (LBS) Market Segmentation Analysis:

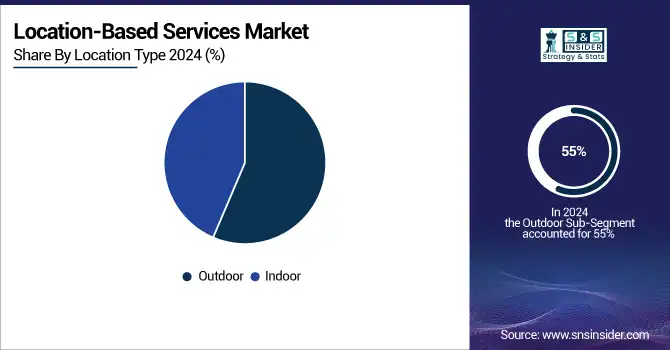

By Location Type, Outdoor Segment Dominates LBS Market, While Indoor Segment Shows Fastest Growth

In 2024, the Outdoor segment dominated the Location-Based Services market, accounting for the highest revenue share of approximately 55%. This dominance is primarily attributed to the widespread use of LBS applications for navigation, real-time traffic monitoring, and location-based advertising in outdoor settings. The increasing reliance on GPS-enabled devices in smartphones, vehicles, and wearable tech has led to a surge in demand for accurate outdoor location services, making it the most established and lucrative segment in the market.

The Indoor segment is expected to experience the fastest growth rate, with a CAGR of 27.59% from 2025 to 2032. The rapid development of indoor positioning technologies, such as Wi-Fi and Bluetooth-based systems, is driving this growth. As businesses and consumers seek enhanced navigation within malls, airports, hospitals, and large venues, the need for precise indoor location data is expanding, positioning the indoor segment as the fastest-growing segment in the LBS market.

By End User, Transportation & Logistics Lead LBS Adoption; Healthcare and Life Sciences Poised for Rapid Growth

In 2024, the Transportation and Logistics segment dominated the Location-Based Services market, capturing the largest revenue share of approximately 23%. This dominance is driven by the increasing demand for real-time tracking of goods, fleet management, and route optimization. LBS technologies provide valuable insights into traffic patterns, delivery times, and vehicle locations, enhancing operational efficiency and reducing costs, which has made them integral to the transportation and logistics industries.

The Healthcare and Life Sciences segment is projected to grow at the fastest CAGR of 27.81% from 2025 to 2032. The rising demand for patient monitoring, asset tracking, and emergency response services is fueling this growth. LBS enables precise location data for medical devices, improving patient care and operational efficiency within healthcare facilities. As the sector embraces digital transformation, the need for location-driven solutions to enhance service delivery and patient outcomes is set to expand significantly, driving rapid growth in this segment.

By Component, Hardware Leads LBS Market; Services Segment Expected to Grow Fastest

In 2024, the Hardware segment led the Location-Based Services market, capturing the largest revenue share of approximately 44%. This dominance is primarily due to the growing demand for GPS-enabled devices, sensors, and tracking equipment, which are essential for collecting accurate location data. Hardware forms the backbone of LBS solutions, providing the infrastructure required for navigation, real-time tracking, and geospatial analytics across various industries, contributing to its significant market share.

The Services segment is projected to grow at the fastest CAGR of 25.98% from 2025 to 2032. This growth is driven by the increasing need for customized, location-based solutions and the expanding adoption of cloud-based services. As businesses seek to integrate LBS into their operations for better decision-making, data analytics, and customer engagement, the demand for specialized services, such as consulting, system integration, and maintenance, is expected to surge, positioning the Services segment as the fastest-growing in the market.

By Application, GIS and Mapping Drive LBS Market, While Geo-Marketing and Advertising See Rapid Expansion

In 2024, the GIS and Mapping segment led the Location-Based Services market, securing the highest revenue share of approximately 25%. This dominance can be attributed to the critical role that Geographic Information Systems play in delivering accurate, detailed mapping and geospatial analysis. With applications spanning industries like urban planning, environmental monitoring, and infrastructure management, GIS technologies provide essential data for decision-making, boosting their widespread adoption and market share.

The Geo Marketing and Advertising segment is expected to grow at the fastest CAGR of 27.38% from 2025 to 2032. The rise of targeted, location-based advertising is driving this growth, as businesses increasingly leverage real-time location data to deliver personalized marketing messages and offers. As consumers demand more relevant, on-the-go promotions, companies are investing in advanced geo-marketing strategies to enhance customer engagement and maximize ROI, positioning this segment for rapid expansion in the coming years.

Location-Based Services (LBS) Market Regional Analysis:

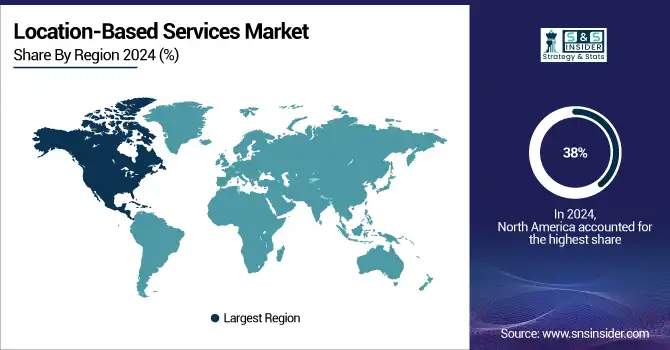

North America Dominates Location-Based Services Market in 2024

North America dominates the LBS market with an estimated 38% market share in 2024. This leadership is driven by advanced smartphone penetration, GPS infrastructure, and widespread adoption of LBS-enabled applications, resulting in efficient navigation, fleet tracking, and location-based marketing services across industries. Urbanization and tech-savvy consumers boost demand for location-driven solutions, positioning the U.S. as the central hub for LBS growth in North America.

Need any customization research on Location-Based Services Market - Enquiry Now

-

United States Leads North America’s LBS Market

The United States is the key driver of North America’s LBS market due to its mature technology ecosystem, high smartphone adoption, and extensive 4G/5G network coverage. Companies leverage real-time traffic monitoring, ride-sharing, and geospatial analytics to optimize logistics, transportation, and retail operations. The U.S. government’s support for smart city initiatives and location-aware services, combined with strong investment in GPS-based innovations, further accelerates adoption.

Asia Pacific is the Fastest-Growing Region in the Location-Based Services Market

Asia Pacific is the fastest-growing region with an estimated CAGR of 10.8% from 2024 to 2032. Rapid urbanization, high smartphone penetration, and increasing adoption of IoT-enabled devices drive the demand for LBS solutions. Businesses across retail, transportation, and healthcare sectors leverage these solutions for operational efficiency, precise marketing, and improved customer experience, positioning China as the central hub for LBS adoption in the region.

-

China Leads LBS Market Growth in Asia Pacific

China dominates due to its rapidly expanding digital infrastructure, government initiatives supporting smart cities, and extensive adoption of mobile applications requiring geolocation services. Urbanization, logistics optimization, and e-commerce growth increase demand for LBS-based analytics and navigation. Additionally, investments in AI, 5G, and IoT technologies enhance the efficiency of location tracking and targeted services.

Europe Location-Based Services Market Insights, 2024

Europe holds a significant share of the LBS market, driven by high smartphone penetration, digital infrastructure, and the adoption of location-based retail and navigation solutions. Germany’s advanced digital infrastructure and government-supported smart city programs enhance LBS adoption and improve operational efficiency across industries. Germany dominates due to strong investments in IoT, geospatial analytics, and urban mobility solutions. Leading automotive and tech companies integrate LBS for real-time traffic, logistics, and marketing analytics. Government incentives for digital innovation and smart city initiatives accelerate the deployment of location-aware applications across commercial, public, and industrial sectors.

Middle East & Africa and Latin America LBS Market Insights, 2024

The LBS market in Middle East & Africa and Latin America is expanding steadily due to rising smartphone adoption, urbanization, and growing demand for smart logistics and navigation solutions. Countries like UAE, Saudi Arabia, Brazil, and Mexico are leading the way, integrating LBS for fleet tracking, location-based marketing, and public safety applications. Investments in digital infrastructure, IoT, and 5G technologies, along with government initiatives promoting smart cities and connected services, are driving market adoption. While these regions trail North America, Europe, and Asia Pacific, steady growth reflects increasing reliance on location-driven solutions.

Competitive Landscape of the Location-Based Services Market:

Apple

Apple is a U.S.-based leader in digital mapping and location services, specializing in Apple Maps and Find My applications. With extensive experience in mobile software development, the company integrates GPS, AR, and real-time navigation features into iOS devices, providing accurate location data and an enhanced user experience. Apple operates globally, continuously improving its mapping services to support urban navigation, traffic updates, and location-based personalization. Its role in the location-based services market is vital, as it enables seamless geolocation functionality across millions of devices, fostering connectivity and smarter navigation for individual and enterprise users.

-

In March 2025, Apple introduced updated Apple Maps with enhanced AR navigation, real-time congestion alerts, and refined pedestrian routing across major U.S. and European cities.

Google LLC

Google LLC is a global leader in digital mapping and location-based solutions, with flagship services including Google Maps and Google Earth. The company provides real-time traffic, navigation, geospatial analytics, and location-based advertising tools, enabling users and businesses to make data-driven decisions. Google’s LBS offerings integrate with cloud infrastructure, AI algorithms, and mobile platforms, enhancing accessibility and precision worldwide. Its role in the market is critical, supporting billions of users with navigation, geolocation, and location-based insights, driving operational efficiency for enterprises and improving everyday mobility experiences.

-

In May 2025, Google Maps introduced live location sharing with augmented reality directions and enhanced transit information, improving urban navigation globally.

HERE Technologies

HERE Technologies, based in the Netherlands, is a leader in location-based services, offering HERE Maps and HERE Location Services. The company provides advanced navigation, geospatial data analytics, and mapping solutions for automotive, transportation, and enterprise sectors. Its platform integrates real-time traffic, fleet management, and IoT connectivity, enabling businesses to optimize routes and enhance operational efficiency. HERE Technologies plays a vital role in the global LBS market, delivering high-quality location intelligence and mapping services to support urban mobility, logistics, and smart city initiatives.

-

In July 2025, HERE Technologies launched a new urban mobility platform, combining real-time traffic analytics with predictive route optimization for smart city applications.

TomTom N.V.

TomTom N.V., headquartered in the Netherlands, specializes in navigation and traffic solutions, including TomTom Navigation and TomTom Traffic services. The company provides mapping data, fleet management solutions, and connected car navigation systems, supporting automotive, logistics, and consumer markets. TomTom leverages real-time traffic, GPS, and cloud-based analytics to optimize travel efficiency and enhance location intelligence. Its role in the LBS market is significant, helping enterprises and individuals make informed decisions with precise navigation, geolocation, and mobility data.

-

In April 2025, TomTom introduced a next-generation connected navigation platform with AI-based traffic predictions and enhanced geofencing features for enterprise fleet management.

Location-Based Services Market Key Players:

-

Google LLC

-

HERE Technologies

-

TomTom N.V.

-

Cisco Systems, Inc.

-

ESRI

-

Microsoft Corporation

-

Oracle Corporation

-

Qualcomm Inc.

-

Telenav, Inc.

-

Zebra Technologies Corporation

-

Ericsson AB

-

Navigine

-

Navisens

-

AirSage Inc.

-

Bluedot Innovation

-

Geoloqi

-

LocationSmart

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 52.79 Billion |

| Market Size by 2032 | USD 294.73 Billion |

| CAGR | CAGR of 24.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (GPS, Assisted GPS, Enhanced GPS, Enhanced Observed Time Difference, Observed Time Difference, Cell ID, Wi-Fi, Others) • By Location Type (Indoor, Outdoor) • By Application (GIS and Mapping, Navigation and Tracking, Geo Marketing and Advertising, Social Networking and Entertainment, Fleet Management, Others) • By End User (Banking, Financial Services, and Insurance, IT and Telecommunications, Retail, Transportation and Logistics, Government, Healthcare and Life Sciences, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple, Google LLC, HERE Technologies, TomTom N.V., Foursquare Labs, Inc., Cisco Systems, Inc., ESRI, IBM Corporation, Microsoft Corporation, Oracle Corporation, Qualcomm Inc., Telenav, Inc., Zebra Technologies Corporation, Ericsson AB, Navigine, Navisens, AirSage Inc., Bluedot Innovation, Geoloqi, LocationSmart. |