Defense Integrated Antenna Market Report Scope & Overview:

To get more information on Defense Integrated Antenna Market - Request Sample Report

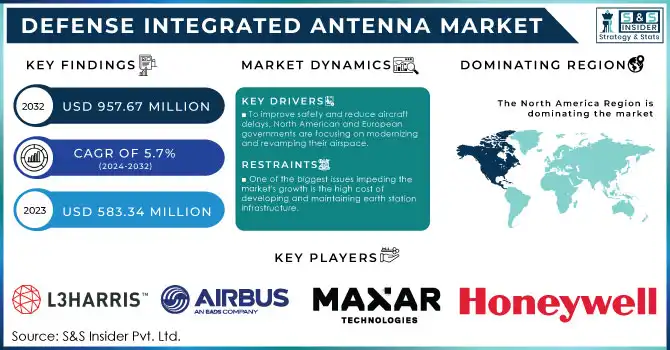

The Defense Integrated Antenna Market size was USD 583.34 million in 2023 and is expected to reach USD 957.67 million by 2032, growing at a CAGR of 5.7% over the forecast period of 2024-2032.

COVID-19 has had an unprecedented and overwhelming global impact, with military antennas experiencing a negative demand shock across all areas throughout the epidemic. According to our calculations, the worldwide market will see a significant fall of -33.6 percent in 2020. In the period 2021-2028,The abrupt increase in CAGR is due to the demand and expansion of this market, which will revert to pre-pandemic levels once the pandemic is gone.

An antenna is a device that uses a transducer to convert radio frequency into alternating electricity. Antennas have been in high demand from countries such as the United States, China, and India for airborne, maritime, and ground military operations. Companies and the government are concentrating on aerial applications in order to provide technologically upgraded antennas to their military forces.

KEY DRIVERS:

To improve safety and reduce aircraft delays, North American and European governments are focusing on modernizing and revamping their airspace. Airspace modernization, which entails the installation of new technologies and components to communicate effectively with air traffic controllers, perform multidimensional aircraft tracking, and improve navigation by generating an image of forwarding external scene topography, can result in better routing decisions, improved pilot communications, and increased efficiency. When effectively implemented, these airspace modernisation schemes can save fuel, improve air quality, and cut carbon emissions.

The need for improved and integrated antennas in new aircraft is driven by aircraft modernisation projects. These antennae are expected to be put in existing buildings as well.fleets as part of the retrofitting process For example, the Single European Sky ATM Research (SESAR), an airspace modernization programe adopted by European nations, focuses on improving air traffic management (ATM) and implementing innovative solutions to eliminate inefficiencies in European air traffic, such as unwanted route extensions of up to 50 kilometers and unnecessary delays of around 10 minutes per flight. In order to eliminate inefficiencies, advanced and integrated antennas will be fitted in airplanes.

New antennas are being designed as part of airspace modernisation efforts to improve airplane connection. In March 2021, for example, a new antenna was installed. ThinKom Solutions, which provides flexible installation options for special-purpose aeroplanes, created the design. For government and military Beyond-Line-of-Sight (BLoS) applications, the business has developed a new iteration of its Variable Inclination Continuous Transverse Stub (VICTS) antenna. The product's first units are presently undergoing integration, with official qualifying set to begin soon. Leidos Special Mission Aircraft opted to use ThinKom phased array antenna in November 2021. In early 2022, a modified Bombardier Challenger 650 with the ThinAir Ka2517 phased-array antenna will fly for the first time. The ThinAir Ka2517 phased-array antenna from ThinKom Solutions will be installed on the Leidos Special Mission Aircraft (LMSA). The low-profile Ka-band aero satellite antenna system, which is being coupled with a military-compliant modem from the United States, offers real-new capabilities. Broadband transmission to and from the aircraft in flight must be on time, dependable, and durable. The flexible antenna system is based on VICTS phased-array technology, which allows for flawless interoperation with satellites in geostationary and non-geostationary orbits enabling global connectivity.

RESTRAINTS

One of the biggest issues impeding the market's growth is the high cost of developing and maintaining earth station infrastructure. The majority of the essential components are custom-fabricated or obtained from commercial off-the-shelf (COTS) manufacturers, both of which are costly. Furthermore, the design, development, and construction of antennas and their components need a significant amount of time and effort on the part of skilled experts. The needed degree of ability is a considerable barrier to access. The value chains of these systems involve significant expenditures in R&D, production, system integration, and assembly. Satellite communication services are employed for extremely complex Defense systems, making any system breakdown unattractive. These services should be accurate, dependable, long-lasting, energy-efficient, and capable of detecting a wide range of objects. To sustain market leadership and be competitive, companies in this industry should construct highly functioning and efficient ground facilities.

OPPORTUNITIES

Electronic component costs have decreased dramatically as a result of large-scale production and circuit integration on single PCBs. This has allowed for the low-cost production of integrated antennas. Because of their dependability, efficiency, and low cost, these antennas are increasingly employed in the fishing sector, tiny aeroplanes, and unmanned aerial vehicles (UAVs). Miniaturization of electronic components on a large scale is also assisting in the reduction of the overall size of integrated antennas, as they may be readily accommodated in small places, resulting in reduced power and fuel consumption. They also assist manufacturers in reducing the size of satellites and unmanned aerial vehicles (UAVs). As a result, for companies in the Defense integrated antenna market, the development of small-sized antennas at cheap costs offers profitable growth potential.

CHALLENGES

Defense integrated antenna manufacturers must meet military specifications for size, weight, efficiency, bandwidth, and cost. Because the integrated antenna adds to the weight of the platform, such as airplanes, UAVs, or manpacks, the weight of the integrated antenna must be kept below the acceptable limit. It has to be the right diameter, length, and power-to-length ratio. Integrated antenna designers, on the other hand, are finding it difficult to minimize antenna size and weight since different frequency ranges require varied antenna lengths. It takes time to incorporate new technology and respond to end-user expectations. These constraints raise the system's cost, limiting the Defense integrated antenna market's growth.

By Frequency

To grow at a faster rate, use a super-high frequency. As the demand for space-based applications grows, The Defense Integrated Antenna market is divided into four categories based on frequency: high frequency, ultra-high frequency, super high frequency, and extremely high frequency.

In the year 2020, the high-frequency category dominated the market. The system based on high-frequency bands has a lower cost and is more efficient in military applications such as surveillance and combat operations, which explains its supremacy. Because of its space-based and weather forecasting uses, the super-high frequency segment is expected to grow at a faster rate by 2028. Furthermore, the increased use of SG-based radar systems and the rise in satellite-based systems would drive up demand for military antennas.

By Type

Because of the growing demand for Defense radar applications, the array antenna segment will dominate.

The market is divided into dipole antennas, aperture antennas, traveling wave antennas, loop antennas, and array antennas based on type.

In 2020, the dipole antenna segment held the highest proportion of the Defense Integrated Antenna market. The majority of radar systems for military uses employ this style of antenna.

Due to rising remote sensing and Defense radar applications, the array antenna segment is expected to grow at a considerable CAGR throughout the forecast period. The business will supply the US military with a navy planar array antenna under this deal.

By Platform

Airborne, marine, and ground platforms are among the market segments.

During the projected period, the ground segment is expected to have a dominating share of the market. The increase in border security difficulties among countries, as well as the upgrade of existing military radar systems with technologically superior radar systems, explains the supremacy.

Due to the rising demand for next-generation fighter aircraft with superior antenna-based systems in established and emerging countries, the airborne segment is likely to rise at a substantial CAGR during the forecast period.

Due to the growing preference for very high-frequency antennas for submarines and other ships, the marine segment is likely to develop significantly by the end of the projection period.

By Application Analysis

Electronic Warfare Segment to Grow Due to Growing Demand for Advance Battlefield Operations The market is divided into communication, surveillance, SATCOM, electronic warfare, and telemetry in terms of application.

During the projected period, the communication sector is expected to have a major share of the market. The dominance is due to rising demand for military soldiers' battle equipment and systems during combat operations.

Due to an increase in demand for up-grading military radar and antenna systems, the electronic warfare segment is predicted to develop at a substantial CAGR over the forecast period.

THE IMPACT OF COVID-19

The COVID-19 pandemic has wreaked havoc on countries' economies all around the world. Defense integrated antenna and component manufacture has also been affected. Manufacturing processes have been halted due to supply chain disruptions. The level of COVID-19 exposure, the state of manufacturing activities, and import-export laws, among other factors, all play a role in the resumption of manufacturing activity. While companies may continue to take orders, delivery schedules may not be fixed.

KEY MARKET SEGMENTATION

By Type

-

Aperture Antenna

-

Array Antenna

-

Microstrip Antenna

-

Wire Antenna

By Platform

-

Ground

-

Combat Vehicles

-

Base station

-

Unmanned ground vehicle (UGV)

-

Airborne

-

Fighter Aircraft

-

Unmanned Aerial Vehicle (UAV)

-

Military Helicopters

-

Marine

-

Destroyers

-

Frigates

-

Corvettes

-

Amphibious Ships

-

Offshore Patrol Vessels

-

Submarine

-

Aircraft carriers

By Application

-

Navigation & Surveillance

-

Communication

-

Telemetry

By Frequency

-

HF/VHF/UHF-Band

-

L-Band

-

S-Band

-

C-Band

-

X-Band

-

Ka-Band

-

Ku-Band

-

Multi-Band

REGIONAL COVERAGE

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

To Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS

The Key Players are L3Harris Technologies, Airbus, General Dynamics, Maxar Technologies, Honeywell International Inc. & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 583.34 million |

| Market Size by 2032 | US$ 957.67 million |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Aperture Antenna, Wire Antenna, Array Antenna, Microstrip Antenna) • By Platform (Ground, Combat Vehicles, Base station, Unmanned ground vehicle (UGV), Airborne, Fighter Aircraft, Unmanned Aerial Vehicle (UAV), Military Transport Aircraft, Military Helicopters, Marine, Destroyers, Frigates, Corvettes, Amphibious Ships, Offshore Patrol Vessels, Submarine, Aircraft carriers) • By Application (Navigation & Surveillance, Communication, Telemetry) • By Frequency (HF/VHF/UHF-Band, L-Band, S-Band, C-Band, X-Band, Ka-Band, Ku-Band, Multi-Band) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | L3Harris Technologies, Airbus, General Dynamics, Maxar Technologies, and Honeywell International Inc. |

| Key Drivers | • To improve safety and reduce aircraft delays |

| RESTRAINTS | • One of the biggest issues impeding the market's growth is the high cost of developing and maintaining earth station infrastructure. |