Screen Readers Software Market Report Scope & Overview:

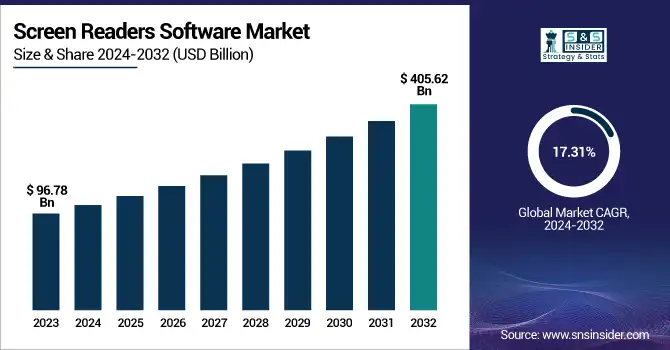

The Screen Readers Software Market was valued at USD 96.78 billion in 2023 and is expected to reach USD 405.62 billion by 2032, growing at a CAGR of 17.31% from 2024-2032.

To Get more information on Screen Readers Software Market - Request Free Sample Report

This report includes comprehensive metrics across five key dimensions: Integration & Ecosystem Metrics, Security and Privacy Statistics, Device & Platform Distribution, AI & Automation Metrics, and Training & Learning Curve Data. The market is witnessing rapid growth due to increasing adoption of assistive technologies, rising digital accessibility regulations, and integration with smart devices and AI-powered platforms. The ecosystem is evolving with robust cross-platform compatibility, enhanced security protocols, and a growing user base across both personal and enterprise applications. As automation and machine learning models improve user experience and ease of use, screen readers are becoming more intuitive, driving broader adoption and contributing significantly to the market's sustained expansion.

U.S. Screen Readers Software Market was valued at USD 96.78 billion in 2023 and is expected to reach USD 405.62 billion by 2032, growing at a CAGR of 17.31% from 2024-2032.

This significant growth is driven by rising awareness around digital accessibility, an aging population with increasing vision impairments, and strict compliance requirements under laws such as the Americans with Disabilities Act (ADA). Additionally, advancements in AI and natural language processing have enhanced the functionality and accuracy of screen readers, making them more user-friendly and efficient. The integration of screen readers into a wider range of devices—from smartphones and laptops to smart home systems has also expanded their usage, further fueling market demand across various sectors.

Screen Readers Software Market Dynamics

Drivers

-

Rising global awareness and legal mandates for digital accessibility are fueling demand for screen readers across industries and regions.

Rising global awareness and legal mandates for digital accessibility are significantly driving the screen readers software market. Regulations like the Americans with Disabilities Act (ADA), Web Content Accessibility Guidelines (WCAG), and various regional policies require websites and digital platforms to be accessible for visually impaired individuals. As businesses aim to comply with these laws and avoid legal complications, they increasingly adopt screen reader technologies. Additionally, government initiatives and advocacy by disability rights organizations have improved awareness, further encouraging companies to integrate accessible technologies. The educational sector, public services, and enterprises are rapidly digitizing their offerings, and ensuring accessibility is now a top priority. This growing emphasis on inclusive digital experiences is resulting in a steady rise in demand for reliable and advanced screen reader software solutions worldwide.

Restraints

-

Limited multilingual and regional language support hampers the usability of screen readers for non-English speaking and rural populations.

Limited multilingual and regional language support hampers the usability of screen readers for non-English speaking and rural populations. Many popular screen reader software solutions primarily focus on English and a few major global languages, leaving a significant gap for users in countries with diverse linguistic landscapes. As a result, users who speak indigenous or less commonly supported languages face challenges in navigating digital content effectively. This issue is especially prominent in regions with high literacy in native languages but limited exposure to English. Furthermore, the lack of high-quality voice synthesis and language-specific text-to-speech engines reduces the effectiveness of these tools. This linguistic limitation restricts access to education, employment, and information, thus reducing the impact of screen reader adoption in multi-lingual regions.

Opportunities

-

Rising investment in AI and machine learning is enabling smarter, more intuitive screen readers with enhanced contextual understanding and accuracy.

Rising investment in AI and machine learning is enabling smarter, more intuitive screen readers with enhanced contextual understanding and accuracy. Modern screen readers are evolving beyond basic text-to-speech functions, incorporating natural language processing (NLP), predictive algorithms, and voice recognition. These technologies allow screen readers to interpret complex interfaces, read dynamic content more effectively, and offer a user-friendly experience. AI-driven screen readers can now identify screen layouts, interpret user intent, and adapt to different web structures with higher precision. As AI capabilities grow, there's an opportunity to develop solutions that cater to a broader user base, including people with multiple disabilities. The innovation potential in AI-powered accessibility tools is attracting attention from tech giants and startups alike, creating fertile ground for market expansion.

Challenges

-

Fragmented technology standards and inconsistent web accessibility implementation make screen reader compatibility a persistent technical challenge.

Fragmented technology standards and inconsistent web accessibility implementation make screen reader compatibility a persistent technical challenge. Web developers often fail to follow universal accessibility guidelines such as WCAG, resulting in poorly structured websites that are difficult for screen readers to interpret. Additionally, the lack of standardized coding practices across industries and regions further complicates integration. Variations in browser support, application design, and software updates create unpredictable user experiences for screen reader users. Even when accessibility is considered, improper labeling of elements, missing alternative text, or dynamic content not optimized for screen readers can reduce usability. These inconsistencies force software developers to constantly update and customize their solutions, raising costs and creating frustration for users who rely on seamless, reliable digital access.

Screen Readers Software Market Segment Analysis

By Operating System

Windows segment dominated the Screen Readers Software Market with the highest revenue share of about 49% in 2023 due to its widespread adoption in enterprise and personal computing environments. Windows-based systems remain the default choice for a large portion of visually impaired users due to the extensive availability of compatible screen reader applications and robust support infrastructure. Additionally, major screen reader software such as JAWS and NVDA are optimized primarily for Windows, enhancing usability and performance. The familiarity of the Windows interface and its integration with key productivity tools make it the preferred platform for visually impaired professionals, students, and institutions, reinforcing its dominance in the screen reader software market.

Android segment is expected to grow at the fastest CAGR of about 10.91% from 2024–2032, driven by the increasing affordability and penetration of smartphones in emerging economies. With Google's TalkBack screen reader pre-installed on most Android devices, accessibility features are becoming more available to a wider audience. The open-source nature of Android encourages continuous innovation and customization, meeting the diverse needs of visually impaired users globally. Growth in mobile internet usage, combined with regional language support and accessibility-focused apps, positions Android as a key growth engine. Government and NGO-led digital inclusion initiatives also contribute to rising demand in mobile-first markets.

By Platform

Desktop segment dominated the Screen Readers Software Market with the highest revenue share of about 51% in 2023 due to its foundational role in professional, academic, and administrative workspaces. Desktop systems typically support high-performance screen reader applications with full-scale functionality, offering greater control and accessibility across various software programs. Visually impaired users often rely on desktops for education, employment, and content creation, making them essential tools in daily productivity. Enterprises, government offices, and institutions continue to invest in desktop systems with embedded accessibility tools to support inclusion. Additionally, desktop platforms offer stability and compatibility that are crucial for advanced screen reading features.

Mobile segment is expected to grow at the fastest CAGR of about 10.22% from 2024–2032, propelled by the growing ubiquity of smartphones and tablets in both developed and developing regions. As mobile devices become the primary mode of internet access, screen reader apps are evolving rapidly to meet demand. Accessibility tools such as VoiceOver (iOS) and TalkBack (Android) are now standard, making smartphones more inclusive than ever. The compact and portable nature of mobile devices appeals to users seeking convenience and constant connectivity, especially in educational and on-the-go environments. This shift in user behavior supports rapid market expansion in the mobile segment.

By Application

Personal Use segment dominated the Screen Readers Software Market with the highest revenue share of about 34% in 2023 due to the rising number of visually impaired individuals using digital devices for everyday needs. Screen reader software has become increasingly accessible and user-friendly, empowering individuals to navigate websites, read emails, access social media, and consume entertainment independently. The availability of free and low-cost solutions like NVDA also contributes to widespread personal adoption. As digital literacy improves and online engagement grows among people with visual impairments, personal use of screen reader technology continues to drive market revenue through direct software purchases and device integration.

Education segment is expected to grow at the fastest CAGR of about 10.36% from 2024–2032 due to the increasing integration of digital learning tools in academic environments and heightened focus on inclusive education. Governments and institutions are prioritizing accessibility in online and blended learning platforms to accommodate students with visual impairments. The adoption of screen readers enables these students to participate more fully in coursework and virtual classrooms. Additionally, awareness campaigns, policy support, and funding for assistive technologies in schools and universities are accelerating deployment. The shift toward digital curriculums globally is expected to fuel substantial demand in this segment.

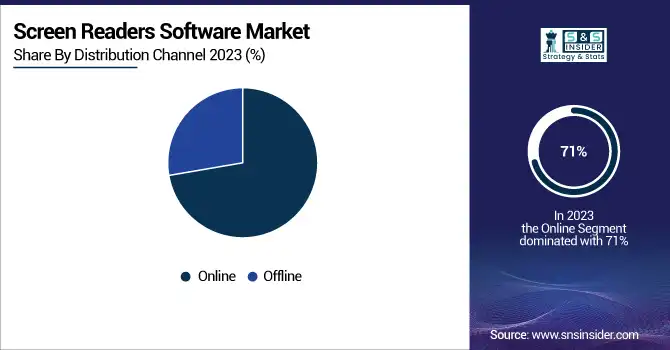

By Distribution Channel

Online segment dominated the Screen Readers Software Market with the highest revenue share of about 71% in 2023, driven by the shift toward web-based applications and cloud platforms for both personal and professional use. Increasing digitalization of services such as banking, shopping, education, and government has created a growing need for screen readers that can efficiently interpret web content. Online screen readers offer the flexibility of accessing content across multiple devices without software installations, appealing to users seeking convenience and scalability. Moreover, the rise of SaaS platforms and web-based accessibility tools allows users to stay updated with the latest features and compatibility. Cloud integration ensures data continuity and cross-platform usability, making online solutions the go-to option for many individuals and organizations seeking inclusive digital access.

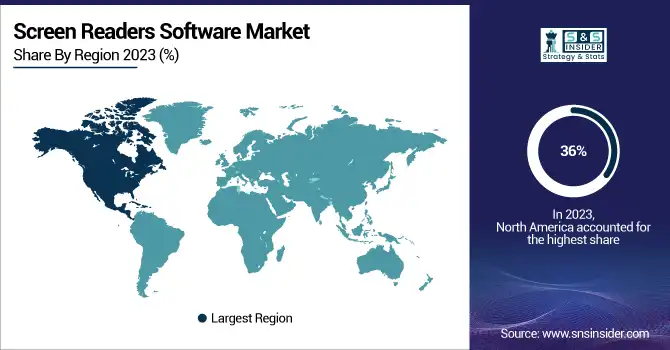

Regional Analysis

North America dominated the Screen Readers Software Market with the highest revenue share of about 36% in 2023 due to the presence of strong regulatory frameworks, widespread digital adoption, and high awareness of accessibility standards. The region benefits from established infrastructure, extensive use of assistive technologies, and early adoption of screen reader tools in education, corporate, and government sectors. Key market players are also headquartered in the region, driving innovation and distribution. Investments in inclusive technology and compliance with ADA and WCAG standards further support market dominance.

Asia Pacific is expected to grow at the fastest CAGR of about 11.42% from 2024–2032, fueled by rapid digital transformation, expanding smartphone penetration, and government-led accessibility initiatives. Countries like India, China, and Indonesia are witnessing a surge in visually impaired users gaining access to digital platforms. Growing awareness of assistive technology, coupled with affordable Android-based devices and multilingual support, is accelerating adoption. Educational reforms and inclusive development policies are also pushing institutions to integrate screen reader solutions across public and private sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Freedom Scientific (JAWS, ZoomText Fusion)

-

NV Access (NVDA, NVDA Remote)

-

Dolphin Computer Access Ltd. (SuperNova, Dolphin ScreenReader)

-

Apple Inc. (VoiceOver, Speak Screen)

-

Microsoft Corporation (Narrator, Windows Speech Recognition)

-

Kurzweil Education (Kurzweil 1000, Kurzweil 3000)

-

Serotek Corporation (System Access, Accessible Event)

-

Texthelp Ltd. (Read&Write, Snap&Read)

-

Claro Software Ltd. (ClaroRead, ClaroSpeak)

-

Baum Retec AG (VisioBraille, COBRA)

-

Cambium Learning Group (Learning Ally, Kurzweil Education)

-

TPGi – A Vispero Company (JAWS Inspect, ARC Toolkit)

-

Sonocent Ltd. (Audio Notetaker, Glean)

-

Code Factory (Mobile Speak, Eloquence TTS)

-

HumanWare (Victor Reader, Brailliant)

Recent Developments:

-

In October 2024, Freedom Scientific released version 2025 of JAWS, ZoomText, and Fusion. The update introduced FS Companion, an AI-powered assistant for task guidance, enhanced language detection, improved EPUB support, and performance boosts in ZoomText.

-

In July 2024, Texthelp integrated Co:Writer and Snap&Read features into Read&Write for Google Chrome and Microsoft Edge. This update introduced Co:Writer Prediction, Topic Dictionaries, and new toolbar modes, aiming to enhance literacy support for students and educators.

-

In January 2025, TPGi, a Vispero company, partnered with Storm Interface to enhance accessible self-service kiosks. Integrating JAWS for Kiosk with Storm's assistive technology products, the collaboration aims to provide seamless, inclusive experiences for users with disabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 37.29 Billion |

| Market Size by 2032 | US$ 454.50 Billion |

| CAGR | CAGR of 32.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chipset Type (CPU, GPU, FPGA, ASIC, Others) • By Application (Information Cognition, Traffic Prediction and Classification, Resource Management and Network Adoption, Performance Prediction and Configuration Extrapolation) • By End Use (Telecom Service Provider, Cloud Service Provider, Managed Network Service Provider, Other Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Micro Devices, Inc., Apple Inc., Arm Holdings plc, Broadcom Inc., Cerebras Systems, Google Inc., Graphcore, Intel Corporation, Micron Technology, Inc., Mythic AI, NVIDIA Corporation, Qualcomm Technologies, Inc., Xilinx Inc. |