Seafood Packaging Market Report Scope & Oveview:

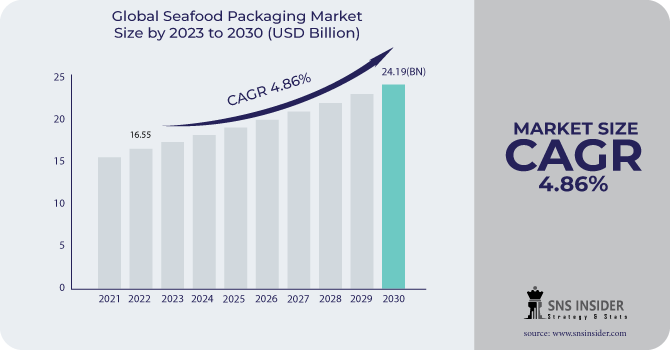

The Seafood Packaging Market size was USD 17.36 billion in 2023 and is expected to Reach USD 25.36 billion by 2031 and grow at a CAGR of 4.86% over the forecast period of 2024-2031.

Seafood packaging refers to the materials, methods and processes used to protect, preserve and present aquatic products throughout their journey from the point of harvest or production to the table of the consumer use. Proper packaging is essential in the seafood industry to maintain product quality, freshness and safety throughout the supply chain.

Get More Information on Seafood Packaging Market - Request Sample Report

One of the key drivers for the growth of the seafood packaging market is the growing demand for seafood products globally. As the world population continues to grow, so does seafood consumption due to its nutritional benefits and taste preferences. This increase in demand has put pressure on seafood producers and retailers to ensure the quality and freshness of their products, leading to a need for innovative and efficient packaging solutions.

In addition, increasing consumer awareness of sustainable and eco-friendly packaging practices has played an important role in shaping the market. Consumers have become more aware of the impact of plastics and non-recyclable packaging materials on marine ecosystems and the environment at large. This has led to a move towards eco-friendly and biodegradable packaging options, such as compostable trays and recyclable materials, which not only help reduce waste but also consistent with the social responsibility initiatives of seafood companies.

Additionally, advancements in packaging technology are also contributing to the growth of the seafood packaging market. These technologies not only reduce food waste, but also allow seafood to be transported over longer distances, facilitating global trade and distribution.

The market has also seen an increased focus on security and regulatory compliance. Seafood is a highly perishable product and improper packaging can lead to contamination or deterioration, posing a health risk to consumers. As a result, packaging companies have invested in research and development to create solutions that meet stringent food safety standards and maintain the quality and freshness of seafood during processing. transportation and storage.

MARKET DYNAMICS

KEY DRIVERS:

-

The demand for seafood continues to rise globally

Due to its nutritional value and the growing awareness of a healthy diet, the demand for seafood is rising globally. This drives the need for efficient packaging solutions to maintain the freshness and quality of seafood products during transport and storage.

-

Packaging that can endure transport difficulties, preserve product quality and give a positive unboxing experience is needed in order to cope with the growth of online shopping or home delivery services for fish.

RESTRAIN:

-

Lack of Awareness regarding proper packaging for seafoods

The benefits of good packaging as regards product quality, safety and marketing need to be adequately appreciated by some fishing companies, particularly those from the underdeveloped markets. A barrier may be the education of these stakeholders.

OPPORTUNITY:

-

Innovations and technological advancements in seafood packaging provide growth opportunities

Research and development of packaging materials, such as bioplastics, edible films, and compostable materials, provide opportunities for packaging creation Integrating technology into packaging, such as sensors to monitor monitor freshness, temperature and quality, which can add value to consumers and improve supply chain transparency.

-

Growth of online seafood sales and home delivery services.

CHALLENGES:

-

It may be hard to maintain a consistent brand and packaging quality in different product types, regions or channels of distribution for larger aquaculture companies that are offering multiple products.

IMPACT OF RUSSIAN UKRAINE WAR

The import and export of sea food from Ukrainian region was affected very badly during the war. For the importers of sea food, the war also affected currency availability and value. For all businesses not engaged in unnecessary goods, the conversion of the Ukrainian currency, the hryvnia, into foreign currency has been prohibited. The value of the hryvnia fell by a third, to 40-41 hryvnia per euro in the spring of 2023, from 28 to 30 hryvnia per euro in the months prior to the Russian invasion. The currency is now open for conversion, but it buys a fraction of what it could not very long ago. Imports that are, as a result, more expensive have been adversely affected. The fall in export and imports of sea food affected the packaging industry. There was less packaging need which dropped the market growth.

However, Russian exports to EU went high despite the war. According to the Russian Association of Fishing Industries (VARPE), exports to the European Union increased by 18.7% in 2022, reaching a total of 198,800 tonnes. According to VARPE's annual report based on Eurostat figures, the value of Russia's fish exports went up by 57.6% to EUR 940 million ($1 billion). According to a report in Kommersant, the biggest buyers of Russian fish are Netherlands, Poland and Germany. In 2022, Russia contributed 4.5% to the EU's overall imports of 4 million tonnes of fish and shellfish.

Overall, few regions were affected due to war which affected the seafood packaging market of that regions.

IMPACT OF ONGOING RECESSION

An economic downturn can lead to disruptions in the supply chain due to reduced shipping capacity, logistical challenges and changes in business dynamics. These disruptions can affect the availability of seafood and therefore affect packaging requirements. Shipments to the US are facing a slowdown while deliveries to these countries have been hit by the energy crisis in Europe and COVID-19's spread across China. India's two biggest exporting markets for fish are the US and China. The consequences of the Russia Ukraine conflict are being felt across Europe, with energy shortages. The price of energy is rising so fast that buyers are no longer purchasing or cancelling orders. Energy bills are raised by 5-6 times. By 2021 there had been a record 920,000 tonnes of production despite the Pandemic Influenza lockdowns. In 2022, however, the amount of production is expected to be less than 900,000 tonnes, in India. If demand in the United States rises, farmers may be encouraged to increase their production. However, the odds are remote at this point in time.

These factors are likely to affect the seafood packaging, since sea food packaging market depend on total global production across regions and import and exports.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Paper

-

Metal

-

Others

By Product Type

-

Bags & Pouches

-

Trays

-

Boxes

-

Cans

-

Others

By Packaging Technology

-

Vacuum Skin Packaging

-

MAP

-

Others

By Seafood Type

-

Fish

-

Crustaceans

-

Mollusks

-

Others

By Application

-

Fresh & Frozen

-

Processed

.png)

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

Asia Pacific region holds the largest market share due to consumption and production of sea food. High sea food producing countries in this region are India, Japan, Korea, Sri Lanka and other countries situated near coastlines. There is also huge demand for sea food in south east Asian countries. People in Asia Pacific consumes fish as a staple food. Fishermen in this region covers long distances in sea for obtaining fresh seafood which can be preserved for longer time. There are huge numbers of manufacturers in this region which will give boost to the market growth. The availability of raw materials is easy in this region will have a positive impact on the seafood packaging market.

North American market is showing high demand for the packaged seafood. This is due to rise in working women, rise in disposable income. Consumer awareness about health benefits of seafood in diet is also giving growth to the market. Fish has Vitamin D in that which is major driver for its consumption ultimately driving the seafood packaging market.

European region produces sea food at large quantity due to presence of large coastline. Iceland and Portugal are two countries in the European region which have high rate of consumption of seafood. There is also the increasing demand from hospitality and hotel sector which will drive the market growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Seafood Packaging market are Smurfit Kappa, Crown Packaging, Print Pack, Amcor Plc, WINPAK Ltd, DS Smith, Silgan Holdings Inc, FFP Packaging Ltd, Sealed Air, Sirane Group and other players.

Smurfit Kappa-Company Financial Analysis

RECENT DEVELOPMENT

-

Tesco will use plastic that has been thrown away from the beach area in new fish packaging.

-

Iceland is working in partnership with Parkside to replace the LDPE packaging for its frozen fish range by a recycled paper carton, which includes water-based coatings that are said to break down during repulping.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.36 Billion |

| Market Size by 2031 | US$ 25.36 Billion |

| CAGR | CAGR of 4.86% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Paper, Metal, Others) • by Product Type (Bags & Pouches, Trays, Boxes, Cans, Others) • by Packaging Technology (Vacuum Skin Packaging, MAP, Others) • by Seafood Type (Fish, Crustaceans, Molluscs, Others) • by Application (Fresh & Frozen, Processed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Smurfit Kappa, Crown Packaging, Print Pack, Amcor Plc, WINPAK Ltd, DS Smith, Silgan Holdings Inc, FFP Packaging Ltd, Sealed Air, Sirane Group |

| Key Drivers | • The demand for seafood continues to rise globally • Packaging that can endure transport difficulties, preserve product quality and give a positive unboxing experience is needed in order to cope with the growth of online shopping or home delivery services for fish. |

| Market Restraints | • Lack of Awareness regarding proper packaging for seafoods |