Secure Logistics Market Report Scope & Overview:

Get More Information on Secure logistics Market - Request Sample Report

The Secure Logistics Market Size was valued at USD 86 billion in 2023 and is projected to reach USD 173.35 billion by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

The secure logistics market is poised for healthy growth as globalization and complex supply chains create a demand for safeguarding valuable goods. With increased risks of theft and breaches across borders, businesses require secure transport and storage solutions.

This trend is fueled by trade agreements like the India-Australia ECTA (India-Australia Economic Cooperation and Trade Agreement), which is expected to significantly boost bilateral trade, fostering new employment opportunities and promoting the overall well-being of both Indian and Australian citizens. Leading players like G4S and Gardaworld, holding a combined 13.5% market share, are fortifying their positions through advanced technologies strategic partnerships, workforce development, and expansion into emerging markets. By complying with regulations and offering diverse services, these companies are building resilience in the ever-changing secure logistics landscape.

MARKET DYNAMICS

KEY DRIVERS:

-

Global trade is becoming increasingly interconnected, with businesses operating across international borders.

-

The transportation industry is experiencing a significant increase in the movement of high-value goods.

The e-commerce boom and faster delivery demands are fueling the need for secure transport. Companies are investing in secure logistics solutions to safeguard valuable goods from theft, damage, and other threats. Advanced technologies like GPS tracking, RFID tags, and smart lockers are gaining traction, providing real-time monitoring and enhanced security throughout the entire transportation journey.

RESTRAINTS:

-

A security lapse resulted in the unauthorized access of sensitive data.

-

The global market faces hurdles due to a disparity in regulatory practices implemented by different countries.

The secure logistics industry faces a challenge such as a patchwork of regulations across different countries. This inconsistent regulatory landscape creates confusion for global logistics providers, who struggle to determine the legal requirements for each market they operate in. This complexity translates to higher operational costs and acts as a barrier to entry for companies seeking to expand into new territories.

OPPORTUNITY:

-

High-tech solutions like IoT, GPS, real-time tracking, and data analysis are driving the secure logistics market forward.

-

The secure and transparent nature of blockchain technology is making it a popular choice for applications within the logistics industry.

Logistics companies are increasingly turning to blockchain technology for its unique security features. This tamper-proof system creates an unchangeable record of every transaction and movement within a supply chain. This transparency translates to enhanced security, reduced fraud risk, and improved traceability all critical factors for high-value or sensitive goods.

CHALLENGES:

-

The adoption of cutting-edge security solutions can present a significant financial hurdle for logistics companies

Cutting-edge surveillance systems, secure storage facilities, and advanced tracking technologies are the guardians of valuable goods, but they can also be a financial burden. This can be a major obstacle for smaller businesses or those in cost-sensitive industries, potentially slowing down the adoption of these essential security measures.

-

The ever-increasing intricacies of secure logistics operations pose a significant challenge for the industry.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine disrupts secure logistics in the Black Sea, a critical trade route for vital goods. Ports in the region struggles with import surges and labor shortages, hindering efficient operations. The ripple effects of the conflict are felt globally as well. Shipping routes are lengthened due to sanctions imposed on Russia, forcing vessels to take longer journeys. This, in turn, disrupts established trade patterns and adds uncertainty to the already complex task of securing cargo during transport. Furthermore, the war has contributed to a rise in the number of ships operating as a "dark fleet." These vessels operate outside regulations, often lacking proper insurance and maintenance, raising concerns about safety and security standards across the board. While the overall impact on global trade volume hasn't been drastic yet, the war in Ukraine undeniably adds a layer of complexity and uncertainty to secure logistics. The long-term consequences could potentially affect costs, routes, and overall efficiency within the secure logistics market.

IMPACT OF ECONOMIC SLOWDOWN

As demand for goods fluctuates, businesses may cut back on orders, leading to potential stock surpluses and strained supplier relationships. This, coupled with rising material costs, could force secure logistics companies to adjust their pricing strategies. Additionally, reduced revenue due to lower demand might push companies to hold onto existing stock, impacting cash flow and potentially delaying investments in security upgrades.

KEY MARKET SEGMENTS

By Service

-

Static

-

Mobile

Static security dominates with nearly 60% market share due to the growing need for robust protection of valuable assets throughout storage and transport. Complex global supply chains and the rise of high-value industries like pharmaceuticals and electronics are driving the demand for these services. Static security solutions offer constant monitoring and robust safeguards, mitigating risks and ensuring peace of mind.

Get More Information on Secure Logistics Market - Enquiry Now

By Mode of Transportation

-

Roadways

-

Railways

-

Airways

-

Waterways

Roadways segment domiantes in secure logistics market, holding the top spot in market share. Trucks are the kings of the road because of their flexibility and ability to get deliveries done securely. Advanced GPS, real-time tracking systems, and well-established safety protocols further solidify road's dominance as the go-to mode for secure transport. Air cargo takes flight with fastest growth due to speed for valuable goods. Secure logistics providers ensure top-notch screening, facilities, and compliance.

By Application

-

Cash management

-

Precious metals

-

Confidential documents

-

Sensitive electronics

-

Others

Cash management holds dominance in the market with over 40.5% market share, when it comes to secure transport. The need to safeguard valuable currency from theft or loss fuels the cash management segment, with armored vehicles, GPS tracking, and real-time monitoring keeping cash safe on the move. As physical currency remains important in many sectors, secure cash management logistics are essential to ensure financial stability and minimize risk.

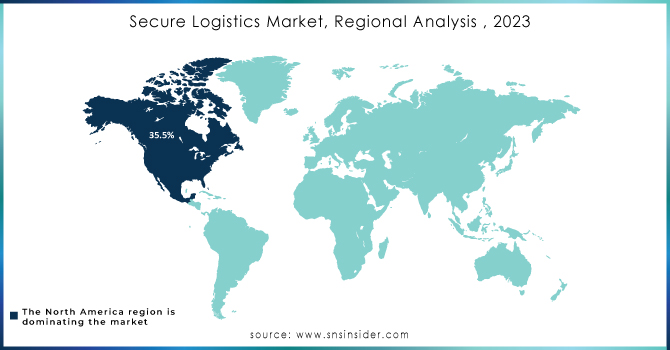

REGIONAL ANALYSIS

North America dominates in secure logistics market, holding a dominant 35.5% market share. This dominance due to a powerful combination of factors. The region boasts a strong economy, extensive cross-border trade, and a thriving high-tech sector, all of which necessitate secure transportation and storage solutions for valuable goods like pharmaceuticals and electronics. Furthermore, strict regulations and rising security concerns compel businesses to invest in secure logistics to ensure compliance and safeguard against threats. Finally, the ongoing adoption of technologies like IoT and real-time tracking keeps the North American secure logistics market at the forefront of innovation, perfectly positioned to meet the ever-changing security demands of the region.

Europe’s’ dominance is fueled by a growing network of ATMs, booming cash circulation, and frequent trade between European countries all create a strong demand for secure transport and storage solutions. Trade policies and lingering Brexit issues could shift the landscape, while the rise of electronic payments in some countries might pose a challenge.

The Asia Pacific secure logistics market is poised for explosive growth. Several factors are fueling this takeoff that are a surge in demand for ATMs, the expansion of financial institutions, and a relentless battle against cargo theft. Governments and industry leaders are taking a proactive stance against theft through initiatives like Australia's RAFT project and the collaborative TAPA forum.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Secure Logistics Market are CMS Info Systems (CMS), CargoGuard, Brink’s Incorporated, Lemuir Group, PlanITROI, Inc., Maltacourt, Prosegur, Allied Universal, Securitas AB, G4S Limited, Loomis AB, GardaWorld, SIS Group Enterprise , SECURE LOGISTICS LLC And Others Players.

RECENT DEVELOPMENTS

-

Industry leaders, Prosegur Cash and Armaguard, joined forces in June 2023 by merging their Australian cash management operations. This significant move consolidates cash transportation, management, technical services, and ATM networks, solidifying the future of cash as a secure and cost-efficient payment option for both businesses and consumers in Australia.

-

Securitas bolstered its partnership with Microsoft in July 2023 by signing a new, five-year agreement to safeguard data centers across 31 countries.

-

GardaWorld Security Systems ups its commitment to cutting-edge security solutions by partnering with Artificial Intelligence Technology Solutions (AITX) in July 2023. This collaboration brings RAD's (AITX's subsidiary) security products to GardaWorld's customers across Canada.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 86 Bn |

| Market Size by 2032 | US$ 173.35 Bn |

| CAGR | CAGR of 8.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service(Static, Mobile) • By Mode Of Transportation(Roadways, Railways, Airways, Waterways) • By Application(Cash Management, Precious Metals, Confidential Documents, Sensitive Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CMS Info Systems (CMS), CargoGuard, Brink’s Incorporated, Lemuir Group, PlanITROI, Inc., Maltacourt, Prosegur, Allied Universal, Securitas AB, G4S Limited, Loomis AB, GardaWorld, SIS Group Enterprise , SECURE LOGISTICS LLC |

| Key Drivers | • Global trade is becoming increasingly interconnected, with businesses operating across international borders. • The transportation industry is experiencing a significant increase in the movement of high-value goods. |

| Key Restraints | • A security lapse resulted in the unauthorized access of sensitive data. • The global market faces hurdles due to a disparity in regulatory practices implemented by different countries. |