Serum-free Media Market Size & Overview:

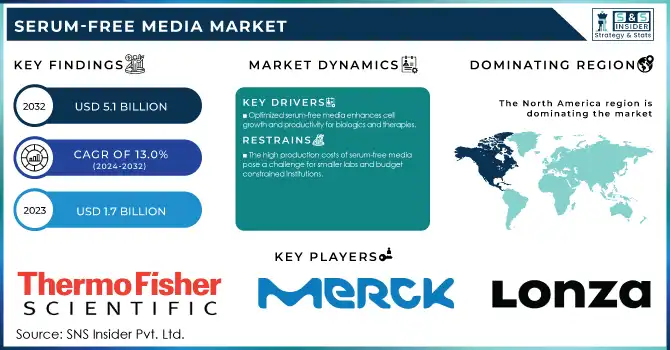

The Serum-Free Media Market Size was valued at USD 1.7 billion in 2023 and is expected to reach USD 5.1 billion by 2032, growing at a CAGR of 13.0% over the forecast period 2024-2032. The growth of the serum-free media market is attributed to the growing demand for biopharmaceuticals coupled with technological advancements in cell culture and regulatory requirements. Such market growth has been bolstered by initiatives and funding provided by governments. The National Institutes of Health (NIH) budgeted 41.7 billion dollars for fiscal year 2020, much of which was in cell culture, or other related technologies. The U.S. Food and Drug Administration (FDA) has additionally highlighted the relevance of serum-free media as part of a means of minimizing variability and increasing product quality in biopharmaceutical production as well. Horizon 2020 program invested €80 billion into research and innovation in Europe, a large subset going to engineering tricks to exploit cell culture. Boosted the usage of serum-free media, as governments around the world have been pouring megabucks into vaccine development and production. However, due to factors such as the establishment of advanced vaccine programs, e.g. the US Operation Warp Speed, which committed more than USD10 billion to vaccine development and manufacturing, the demand for serum-free media is growing for vaccine production.

To get more information on Serum-Free Media Market - Request Free Sample Report

Moreover, rising research activities of stem cells in light of personalized medicine & regenerative therapies are some of the factors supporting the market growth of serum-free media. Through its Regenerative Medicine Initiative, the Japanese government has dedicated ¥110 billion (over 10 years) to furthering research in the area of regenerative medicine, including new cell culture methods. This has enabled the introduction of favourable regulatory initiatives by the government and is also supported by increasing cases of chronic diseases as a compelling requirement for high throughput and cost-effective biopharmaceutical production processes, thus enabling faster growth of the serum-free media market.

Serum-Free Media Market Dynamics

Drivers

-

The rising prevalence of chronic diseases and the need for targeted therapies boost biopharmaceutical production. Serum-free media provide a controlled environment essential for scalable and reproducible cell culture processes in biopharmaceutical manufacturing.

-

Continuous improvements in cell culture techniques have led to the development of optimized serum-free media formulations. These advancements enhance cell growth and productivity, supporting the production of complex biologics and innovative therapies.

The increasing global burden of chronic diseases like cancer, diabetes, and autoimmune diseases has created a demand for new classes of biopharmaceuticals. Monoclonal antibodies, vaccines, and cell-based therapies are becoming increasingly common targeted therapies that are being produced on a large scale requiring standardized and reproducible cell culture systems for production. SFM has gained momentum as a key enabling technology that places biopharmaceutical production in a well-controlled and defined environment desperately needed to ensure greater efficiency and scalability. As per the latest industry reports, in 2023, the global monoclonal antibody output reached over 1400 tons; More than 80% of approved monoclonal antibody therapeutics employ serum-free culture system. In fact, Genentech uses SFM for Herceptin (trastuzumab), a common HER2-positive breast cancer therapy to maintain extended cell viability and high protein expression.

In addition, the introduction of biosimilars led to an increasing demand for cost-effective and reproducible manufacturing processes. Serum-free media will alleviate major problems related to contamination risks and variability from traditional serum-containing media. However, SFM formulations have recently been developed to use only chemically defined and protein-free components further improving their applicability to large-scale biopharmaceutical manufacturing processes. Regulatory agencies such as the FDA, and EMA require the use of well-characterized, serum-free components to further guarantee product quality and safety. The challenges of regulatory incentives as well as the need for combined therapeutic capacity continue to reinforce the fundamentals of Serum Free Media being at the foundation of biopharmaceutical manufacturing for the future.

Restraints

-

Serum-free media formulations often involve sophisticated components, leading to higher production costs compared to traditional serum-containing media. This can be a barrier, especially for smaller research laboratories or institutions with limited budgets.

-

Shifting from serum-containing to serum-free media can present technical difficulties, including the need to optimize and adapt cell culture protocols. These challenges may require additional time and resources, potentially hindering adoption.

The presence of high production costs in serum-free media is a major restraint of the serum-free media market. Serum-free media are formulated to encourage proper growth and productivity of cells with exact nutrient, growth factor, and supplement composition, in the absence of serum. The development and manufacture of some of these formulations can require highly priced starting components, as well as sophisticated processing technologies to maintain the product's uniformity, stability, and efficacy.

In addition, developing a media specific to cell type/application requires a lot of basic research and ultimately drives up costs. While serum-free media provide many advantages, these costs may deter adoption in smaller research labs and other organizations with limited budgets. Moreover, the change from serum-containing systems to serum-free systems frequently necessitates further investments in optimization studies, thereby raising costs even further. With a high entry barrier for their commercial use, serum-free media remain largely and tremendously inaccessible to widespread adoption amongst lower-income locations or universal health systems.

Serum-Free Media Market Segmentation Analysis

By Product

In 2023, the CHO Media segment dominated the serum-free media market with a 31% share, attributed to the widespread biopharmaceutical production activity, especially for recombinant protein and monoclonal antibody production systems in CHO media. CHO cells dominate biopharmaceutical production due to their capacity to produce complex proteins with post-translational modifications resembling those of humans, high productivity, and adaptation to serum-free conditions. Through government support, CHO cell technology has advanced tremendously. One example of this is the CHO genome project initiated by the US National Institute of Standards and Technology (NIST) that aims to enhance cell line development and product yield.

Several projects funded by the European Commission within its Horizon 2020 program that are related to the improvement of CHO cell culture processes, as well as the development of customized media suited for the serum-free culture of CHO cells. Driven by the "Made in China 2025" strategy, the government has heavily invested in biopharmaceutical development, with CHO cell technology and media getting a boost. CHO cells also play an important role in the production of many biopharmaceutical products and therefore the FDA released a guidance document on manufacturing process based on CHO cells. Such steps from different Governments have played a major role in making the CHO media to improve continuously, and by dominating the serum-free media market.

By Application

In 2023, the biopharmaceutical production segment accounted for a dominating revenue share of 72% in the serum-free media market, a reflection of the growing demand for biologics, and a gradual shift towards serum-free production processes. Behind this dominance are government policies and government and other initiatives designed to promote both biopharmaceutical research and production. The United States Biomedical Advanced Research and Development Authority (BARDA) has spent billions of dollars to substantially develop biopharmaceutical manufacturing capabilities, including those based on advanced cell culture technologies.

Current practices in biopharmaceutical manufacturing evolve around the use of serum-containing media, but the European Medicines Agency (EMA) published new guidelines in 2010 encouraging the use of serum-free media to help improve product Quality by Design and to help lower contamination risk. The Japanese government has introduced the "Sakigake" strategy which has expedited the approval process for innovative biologics, thereby attracting investments in other biopharmaceutical-related manufacturing processes and technologies. The biopharmaceutical industry has a special place in China, as stated in the "Healthy China 2030" plan, which continues to increase funding for research and manufacturing facilities. Government initiatives have played a crucial role in funding for this purpose which is expected to boost biopharmaceutical production driving the demand for serum-free media application segment.

By End-use

In 2023, pharmaceutical and biotechnology companies accounted for the largest revenue share of 56% in the serum-free media market, in line with their prominent role in biopharmaceutical research and production A combination of government support and policies helps maintain this leadership position. The NIAID invested $5.9 billion in researching proven technology platforms to facilitate the swift development of vaccines and therapeutics for the country in FY2020. Deep funding for biotech startups and scale-ups is also available as part of the European Innovation Council €10 billion fund for 2021-2027. The Chinese government has successfully recruited leading biologists using the "Thousand Talents Plan," which has attracted traffic within the sector. The UK Life Sciences Industrial Strategy pledged £500 million to support biotech companies and strengthen the biomanufacturing capacity of the nation. This development in enabling commercial players to make significant investments in research and development has further promoted the adoption of cell culture technologies, such as serum-free media, at advanced levels across the pharmaceutical or biotechnology industry, owing to these supportive government initiatives.

By Type

In 2023, the liquid media segment captured over 62% revenue share of the serum-free media market owing to significant ease of use, scalability, and adaptability with different cell culture systems. Liquid media has arisen and evolved largely with the support of government agencies. In the US, the National Institute of Standards and Technology (NIST) has designed reference materials for liquid cell culture media, providing uniformity and quality assurance in both research and manufacturing environments. The Joint Research Centre of the European Commission has carried out work to harmonize liquid cell culture media to make them more widely used in biopharma production. In Japan, the Ministry of Economy, Trade and Industry (METI) has promoted research on advanced liquid media formulations under the umbrella of its strategy to foster biotechnology. Such government-driven efforts have been supported for smiling availability and expansion of liquid serum-free media with a wide variety of applications.

Serum-Free Media Market Regional Outlook

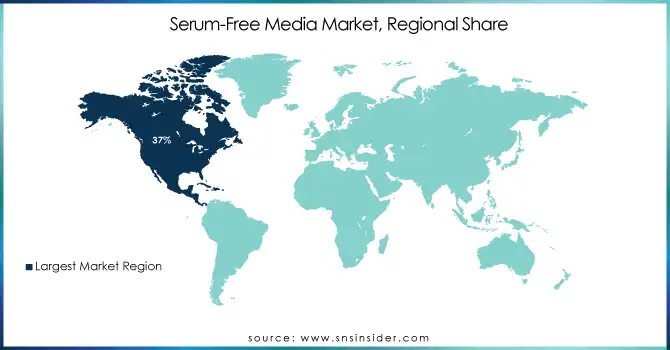

In 2023, the serum-free media market was led by North America with about 37% of the global market share. The region's strong biopharma sector high R&D investment, and its welcoming regulatory climate all contribute to this leadership position. The U.S. government continues to strongly support biomedical research, as reflected in the over $41.7 billion National Institutes of Health budget in fiscal year 2020. Moreover, the FDA guidance on cell culture-based vaccine production has promoted the adoption of serum-free media in the area.

The growth of the serum-free media market driven by the increased use of vegan products over the forecast period Asia Pacific is expected to grow fastest over the forecast period. The steady pace of expansion is due to growing government support for biotechnology, the demand for biopharmaceuticals, the increase in healthcare infrastructure, etc. China has also focused on the biopharma sector as part of its 14th Five-Year Plan (2021-2025), investing heavily in its research and manufacturing capacities. This includes the National Biopharma Mission ($250 million), launched by India's Department of Biotechnology to stimulate biopharma research and production. Moreover, initiatives related to regenerative medicine in Japan and the Bio-Health Industry Innovation Strategy of South Korea have also enhanced the development of the serum-free media market in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Recent developments

-

Thermo Fisher Scientific launched its Gibco CTS OpTmizer One Serum-Free Medium in April 2024 to enable superior scalability in cell therapy production.

-

Merck KGaA, In August 2022, Merck KGaA purchased Biochrom AG, a producer and distributor of cell culture media and buffer solutions. This strategic acquisition aided Merck Millipore's Type solutions business unit in strengthening and driving revenue growth.

Key Players

Key Service Providers/Manufacturers

-

Thermo Fisher Scientific Inc. (Gibco™ Advanced DMEM, Gibco™ CTS™ OpTmizer™ T-Cell Expansion SFM)

-

Merck KGaA (EX-CELL® Advanced CHO Fed-Batch Medium, Probumin-Free SFM)

-

Lonza Group AG (TheraPEAK™ T-VIVO™ Medium, PowerCHO™ Serum-Free Media)

-

Corning Incorporated (SFM4HEK293, SFM4CHO)

-

GE Healthcare (Cytiva) (HyClone™ SFM4CHO, HyClone™ SFM4HEK293)

-

HiMedia Laboratories (HyaQuil™ CHO Medium, HyaQuil™ Serum-Free Media)

-

Irvine Scientific (FujiFilm) (CHO-Choice SFM, PRIME-XV™ Hematopoietic SFM)

-

PromoCell GmbH (Serum-Free Media for Endothelial Cells, Hematopoietic Serum-Free Medium)

-

CellGenix GmbH (CellGenix® T Cell Medium, CellGenix® DC Medium)

-

Sartorius AG (CHOgro® Expression Medium, BalanCD® HEK293 Medium)

Key Users of Serum-Free Media

-

Amgen Inc.

-

Genentech, Inc. (A Member of the Roche Group)

-

Novartis AG

-

Pfizer Inc.

-

Bristol Myers Squibb

-

Sanofi S.A.

-

GlaxoSmithKline plc (GSK)

-

Eli Lilly and Company

-

Johnson & Johnson (Janssen Pharmaceuticals)

-

Regeneron Pharmaceuticals, Inc.

Serum-free Media Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.7 Billion |

| Market Size by 2032 | USD 5.1 Billion |

| CAGR | CAGR of 13.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (CHO Media, HEK 293 Media, BHK Medium, Vero Medium, Stem Cell Medium, Other Serum-free Media) • By Type (Liquid Media, Semi-solid & Solid Media) • By Application (Biopharmaceutical Production, Tissue Engineering & Regenerative Medicine) • By End User (Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Merck KGaA, Lonza Group AG, Corning Incorporated, GE Healthcare (Cytiva), HiMedia Laboratories, Irvine Scientific (FujiFilm), PromoCell GmbH, CellGenix GmbH, Sartorius AG. |

| Key Drivers | • The rising prevalence of chronic diseases and the need for targeted therapies boost biopharmaceutical production. Serum-free media provide a controlled environment essential for scalable and reproducible cell culture processes in biopharmaceutical manufacturing. |

| Market restrain | • Serum-free media formulations often involve sophisticated components, leading to higher production costs compared to traditional serum-containing media. This can be a barrier, especially for smaller research laboratories or institutions with limited budgets. |