mRNA Technology Market Size &Trends:

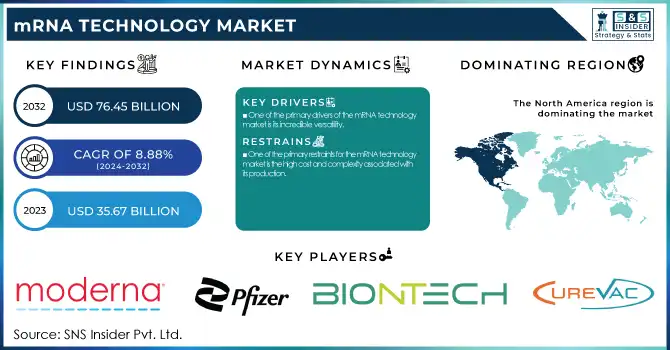

The mRNA Technology Market was valued at USD 35.67 billion in 2023 and is expected to reach USD 76.45 billion by 2032 with a growing CAGR of 8.88% over the forecast period of 2024-2032.

To get more information on mRNA Technology Market - Request Free Sample Report

The mRNA Technology Market is revolutionizing healthcare by providing rapid, scalable, and versatile solutions for disease prevention and treatment. The technology gained prominence during the COVID-19 pandemic, with mRNA-based vaccines like Pfizer-BioNTech’s Comirnaty and Moderna’s Spikevax achieving over 90% efficacy in preventing severe illness. These vaccines were developed and authorized within record-breaking timeframes of less than a year, showcasing the agility of mRNA platforms compared to traditional vaccine development.

Beyond infectious diseases, mRNA technology has expanded into cancer immunotherapy. Moderna’s personalized mRNA cancer vaccine, mRNA-4157/V940, demonstrated promising results in Phase 2b clinical trials, reducing melanoma recurrence by 44% when combined with pembrolizumab, an immune checkpoint inhibitor. Similarly, BioNTech is advancing mRNA cancer therapies targeting specific tumor antigens, with early-stage trials showing robust immune responses.

Advancements in delivery technologies have further strengthened the market’s growth. Lipid nanoparticles (LNPs), which encapsulate mRNA molecules, have enhanced stability, reduced immunogenicity, and improved delivery efficiency. These innovations have enabled breakthroughs in areas such as genetic disorders and protein replacement therapies. For example, researchers are investigating mRNA’s potential to treat cystic fibrosis by delivering functional CFTR proteins directly to affected cells.

The rapid adaptability of mRNA manufacturing processes has proven invaluable in addressing emerging health crises. The timeline for producing mRNA-based vaccines is significantly shorter—approximately 3-6 weeks from sequencing a pathogen—compared to the months or years required for traditional vaccines. This capability was crucial during the H1N1 outbreak and remains a cornerstone of pandemic preparedness.

Clinical trials also explore mRNA’s application in rare diseases and autoimmune conditions. For instance, CureVac and Arcturus Therapeutics are developing mRNA-based therapies for ornithine transcarbamylase deficiency and systemic lupus erythematosus. MRNA platforms' versatility continues redefining therapeutic paradigms, making them a transformative force in modern medicine.

mRNA Technology Market Dynamics

Drivers

-

One of the primary drivers of the mRNA technology market is its incredible versatility.

The ability to develop mRNA-based vaccines and therapeutics for a broad range of diseases is a key factor in the technology’s rapid adoption. Beyond its success in COVID-19 vaccines, mRNA is being explored in oncology, genetic disorders, and rare diseases. For example, mRNA cancer vaccines are designed to train the immune system to target tumor cells, and trials for melanoma and other cancers have shown promising results. Additionally, mRNA therapies can be tailored to address specific genetic mutations, such as in cystic fibrosis or muscular dystrophy, offering hope for precision medicine that can be customized to individual patients. This flexibility in targeting multiple disease areas ensures that mRNA technology will continue to play a pivotal role in shaping the future of healthcare.

-

Advancements in Delivery Systems and Manufacturing

Another significant driver of the mRNA technology market is the continued development of delivery mechanisms, such as lipid nanoparticles and polymer-based carriers. These innovations have addressed key challenges in mRNA delivery, such as stability, bioavailability, and targeted action. The ability to protect the mRNA molecules from degradation and direct them precisely to the cells that need them has significantly improved the efficacy and safety profile of mRNA-based drugs. Additionally, the development of faster and more efficient mRNA manufacturing processes has dramatically reduced production costs and timeframes. Unlike traditional vaccines, which may take years to develop, mRNA platforms enable the rapid development of vaccines and therapeutics, with the ability to produce doses within weeks of sequencing a pathogen. This efficiency makes mRNA technology an invaluable tool for addressing global health crises and responding quickly to emerging diseases.

-

The mRNA technology market is significantly bolstered by substantial investments from the government and private sectors.

Governments worldwide have recognized the potential of mRNA-based therapeutics and vaccines, leading to large-scale funding initiatives. For instance, the U.S. government’s Operation Warp Speed provided billions of dollars in support for the rapid development of COVID-19 vaccines, demonstrating the power of mRNA platforms. Similarly, the European Commission’s HERA Incubator has driven innovation in pandemic preparedness. In addition to government funding, private sector companies, such as Moderna, BioNTech, and CureVac, have raised significant capital to advance mRNA-based technologies, focusing not only on vaccines but also on treatments for diseases like cancer, cardiovascular disorders, and autoimmune conditions. These investments ensure the rapid acceleration of mRNA research and development, paving the way for its broad application in the future.

Restraints

-

One of the primary restraints for the mRNA technology market is the high cost and complexity associated with its production.

While mRNA-based vaccines and therapeutics offer rapid development timelines, the manufacturing process is still resource-intensive. Producing large-scale quantities of mRNA with high purity and quality requires specialized infrastructure, including advanced cold storage and transportation systems due to the inherent instability of mRNA molecules. This makes scaling up production challenging and costly. Additionally, lipid nanoparticles, used to deliver mRNA into cells, are complex to manufacture and require precise formulations, adding another layer of complexity to the process. These production challenges result in higher costs compared to traditional vaccine manufacturing methods. As a result, the high cost of production may limit the widespread adoption of mRNA therapeutics, especially in low-income regions, and could hinder market growth unless more cost-effective solutions and manufacturing techniques are developed.

mRNA Technology Market Segmentation Analysis

By Application

In 2023, the Infectious Diseases segment dominated the mRNA technology market, accounting for over 70% of the market share. This dominance is primarily attributed to the significant success of mRNA vaccines, particularly for COVID-19, which accelerated the global acceptance and application of mRNA technology. The rapid development and high efficacy of vaccines for infectious diseases such as COVID-19, influenza, and RSV have demonstrated the potential of mRNA platforms, paving the way for further mRNA vaccine research and deployment.

The Cancer Immunotherapy segment is the fastest growing within the mRNA technology market. This growth is driven by the ongoing advancements in mRNA vaccines for cancer, where the technology is used to stimulate the immune system to target and destroy cancer cells. Early-stage clinical trials have shown promising results for various cancer types, including melanoma, breast cancer, and lung cancer, which has generated significant interest and investment in this field.

By Delivery Method

In 2023, Lipid Nanoparticles held the largest share of the mRNA delivery method market, accounting for 80% of the mRNA technology market. LNPs became the gold standard for delivering mRNA vaccines, such as the Pfizer-BioNTech and Moderna COVID-19 vaccines. They provide a reliable mechanism for protecting mRNA from degradation, facilitating its transport into cells, and enhancing overall vaccine efficacy.

The Polymeric Carriers segment is the fastest growing in the mRNA delivery method category. Research into polymer-based delivery systems is expanding as these systems offer the potential for more targeted and controlled release of mRNA, with less toxicity than lipid-based alternatives. Polymeric carriers are emerging as promising tools for delivering mRNA vaccines and therapeutics more efficiently, which is driving their increased adoption in research and clinical applications.

mRNA Technology Market Regional Insights

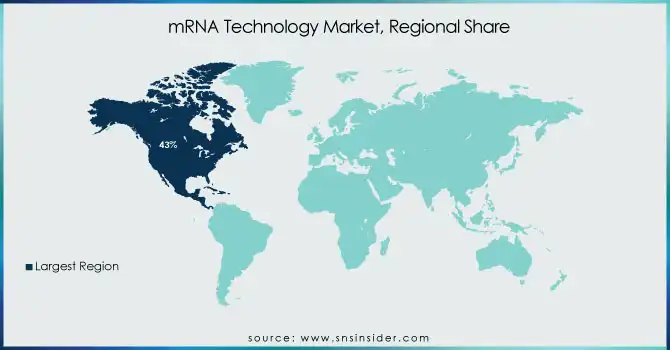

North America held the largest market share 43% in 2023, particularly due to the robust healthcare systems, increased government investments, and leading pharmaceutical companies in the region, such as Moderna and Pfizer. The success of COVID-19 mRNA vaccines in the U.S. and Canada has propelled further research and funding into mRNA technology, particularly in oncology, infectious diseases, and genetic disorders.

Europe followed closely, with significant investments in mRNA vaccine development, particularly in countries like Germany, the U.K., and Switzerland. The European Union has also heavily funded vaccine research and development, and the region is now focusing on expanding mRNA technology for other therapeutic applications. The ongoing collaboration between biotech firms, academic institutions, and government bodies in Europe is fostering innovation, particularly in the oncology and rare disease sectors.

Asia-Pacific is experiencing rapid growth, driven by countries like China, Japan, and India. The region is witnessing a surge in mRNA vaccine development, with China increasing efforts in both research and manufacturing capabilities. Japan and India, with their established biotechnology sectors, are also becoming key players in mRNA technology, not only for vaccines but also for genetic and chronic disease therapies. The growing demand for advanced healthcare and vaccination programs is further fueling market expansion in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

mRNA Technology Companies

-

CureVac N.V.

-

Arcturus Therapeutics

-

Sanofi

-

Genentech (Roche)

-

Vaxart

-

eTheRNA immunotherapies

-

GSK (GlaxoSmithKline)

-

Helmholtz Center for Infection Research (HZI)

-

AstraZeneca

-

Tiba Biotech

-

Acuitas Therapeutics

-

Recode Therapeutics

-

Vertex Pharmaceuticals

-

Beam Therapeutics

-

RaNA Therapeutics

-

Sangamo Therapeutics

-

Intellia Therapeutics

-

RNAimmune

-

StemiRNA Therapeutics

-

Genevant Sciences

-

Orbital Therapeutics

Recent Developments

In Jan 2025, The University of Queensland’s BASE facility and Vaxxas, a Brisbane-based biotechnology company, were named stage winners of the prestigious USD 50 million Biomedical Advanced Research and Development Authority (BARDA) Patch Forward Prize. This award aims to accelerate the commercialization of patch-based mRNA vaccines for COVID-19 and influenza, recognizing their innovative work in microneedle patch technology.

In Jan 2025, The U.S. announced new funding for the development of mRNA vaccines and expedited the approval process for bird flu tests. This initiative aimed to advance vaccine research and improve preparedness for future pandemics.

In Jan 2025, BioVaxys Technology Corp. highlighted the potential of its DPX non-systemic immune-educating platform to overcome the limitations of lipid nanoparticles (LNPs) for mRNA delivery. The company had focused on developing DPX-mRNA formulations and sought collaborations with companies and academic institutions working on promising tumor and virus-specific polynucleotide antigens.

In Sept 2024, GSK reported positive headline results from its Phase II clinical trial of a seasonal influenza mRNA vaccine. The company’s mRNA-based flu vaccine showed promising efficacy, advancing its efforts in mRNA vaccine development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 35.67 Billion |

| Market Size by 2032 | USD 76.45 Billion |

| CAGR | CAGR of 8.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology Platform [mRNA Vaccines, Therapeutic mRNA] • By Delivery Method [Lipid Nanoparticles (LNPs), Polymeric Carriers, Electroporation] • By Application [Infectious Diseases, Cancer Immunotherapy, Genetic Disorders, Cardiovascular Diseases] • By End-User [Pharmaceutical & Biotechnology Companies, Research Institutes, Hospitals & Clinics] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Moderna, Pfizer, BioNTech SE, CureVac, Arcturus Therapeutics, Translate Bio, Sanofi, Genentech (Roche), Vaxart, eTheRNA immunotherapies, GSK, Helmholtz Center for Infection Research, AstraZeneca, Tiba Biotech, Acuitas Therapeutics, Recode Therapeutics, Vertex Pharmaceuticals, Beam Therapeutics, RaNA Therapeutics, Sangamo Therapeutics, Intellia Therapeutics, RNAimmune, StemiRNA Therapeutics, Genevant Sciences, Orbital Therapeutics. |

| Key Drivers | • One of the primary drivers of the mRNA technology market is its incredible versatility. • Advancements in Delivery Systems and Manufacturing • The mRNA technology market is significantly bolstered by substantial investments from the government and private sectors. |

| Restraints | • One of the primary restraints for the mRNA technology market is the high cost and complexity associated with its production. |