Healthcare Data Storage Market Size & Overview:

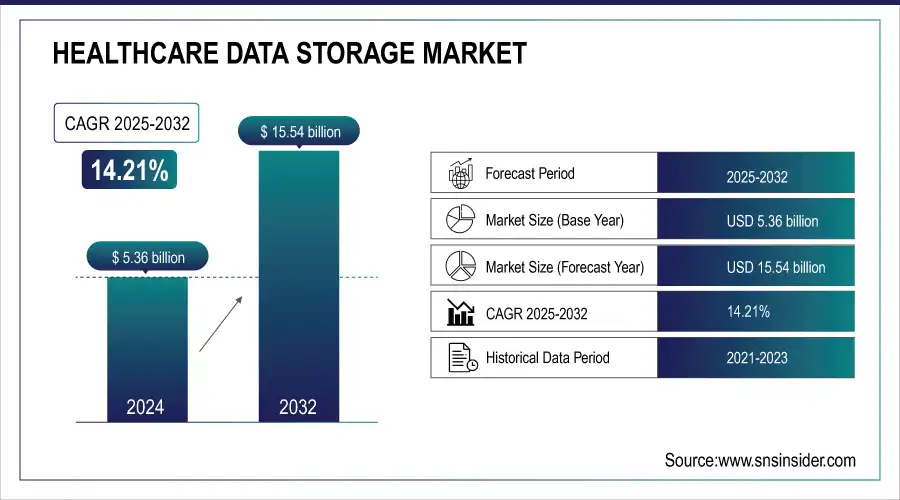

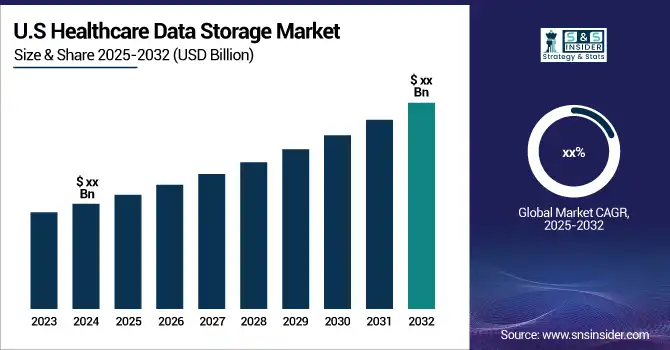

The Healthcare Data Storage Market Size was valued at USD 5.36 billion in 2024 and is expected to reach USD 15.54 billion by 2032 and grow at a CAGR of 14.21% over the forecast period 2025-2032.

The growth in the healthcare data storage market has been relatively robust, driven primarily by the relatively high panning volumes of digital data in the healthcare industry and increasing adoption rates of hybrid and cloud-based storage solutions. The huge shift to EHRs, telemedicine, and digital imaging technologies has amplified the demand for secure and efficient data storage systems exponentially. Healthcare facilities store enormous amounts of data about patients, whether it is the patient's record, medical images, or test results. Hence, the solution should be scalable and secure. Cloud-based storage solutions are seeing a growing trend especially due to their reduced cost, scalability, and high security. This will enable healthcare providers to access data from different locations, streamline operations, and therefore better patient care.

Get more information on Healthcare Data Storage Market - Request Sample Report

AI and ML are also changing the health sector. These technologies consume tremendous amounts of data to develop algorithms for medical imaging, drug discovery, and disease diagnosis. Therefore, demand has been growing for high-end storage systems that ensure better management of large datasets. The response from big tech companies like Oracle, AWS, and Google Cloud is to develop advanced cloud-based storage systems that will support the use of AI and ML applications.

Market Size and Forecast:

-

Healthcare Data Storage Market Size in 2024: USD 5.36 Billion

-

Healthcare Data Storage Market Size by 2032: USD 15.54 Billion

-

CAGR: 14.21% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Healthcare Data Storage Market Trends

• Increasing demand for secure cloud-based storage solutions in healthcare institutions.

• Rising need for compliance with data privacy regulations like HIPAA and GDPR.

• Expansion of telemedicine and remote patient monitoring driving high-volume data storage requirements.

• Integration of AI and analytics platforms requiring scalable storage infrastructure.

• Growing adoption of IoT and wearable health devices generating real-time data streams.

• Shift from on-premises to hybrid and multi-cloud storage solutions.

• Increasing focus on disaster recovery, backup, and business continuity solutions.

Healthcare Data Storage Market Growth Drivers

-

Cloud Computing and AI Integration Propel Healthcare Data Storage Market Growth

Cloud computing has emerged as the support element for healthcare data management. Its myriad applications are increasingly pushing the global market of storage of healthcare data forward. The cloud is transforming the way data is stored, accessed, and secured as 83% of European and North American healthcare organizations now rely on cloud-based solutions. The healthcare data volume has grown at a rapid pace. It increased to 2,314 exabytes by the end of the year 2020 from 153 exabytes in 2013. Cloud solutions provide flexible and scale resources for managing this vast amount of data; such volumes are projected to grow by 36% yearly. Another advantage is that cloud-based encryption systems have greatly improved security, which translates to healthcare organization data being protected by a 94% better system, loss through breach of which can go up to $6.45 million per case. Cloud adoption has also cut operational costs by about 15%, bringing together cost savings with security increases.

The AI system further change the running of the healthcare data storage market from now on. AI has, over the last two years, been adopted 45% more due to the irresistible need to manage a 30% annual rise in healthcare data. AI algorithms extract patterns from massive datasets so that diagnosis is improved by up to 60%, especially when it comes to the early detection of diseases. AI has further helped reduce costs from operational necessities regarding data management by 20% due to the elimination of manual entry. As a result, cost savings are not the only benefit healthcare organizations enjoy but also increased personalized and effective patient care.

Healthcare Data Storage Market Restraints

-

Cybersecurity Vulnerabilities and Rising Cyber-attacks

-

Reliance on Legacy Systems and Insufficient Cybersecurity Investment

Healthcare Data Storage Market Segment Analysis

By Type of Storage

In 2024, the market was dominated by cloud-based storage, owing to its scalable nature, cost-effectiveness, and better security features. Such cloud storage solutions support zero-latency viewing with read-only access from multiple locations, an important feature since healthcare organizations begin their journey to telemedicine and remote patient care services. Cloud-based storage led the market share into more than 55.0% in 2023 simply because it is a rather more efficient means of managing such huge amounts of medical data, whether related to EHRs or medical imaging.

The hybrid storage segment is the largest and fastest-growing segment, growing at more than 18% CAGR during the forecast period. This is because healthcare organizations want to get the option of combining the security of on-premises storage with the scalability and cost-efficient benefits of cloud-based storage. This model of hybrid model will balance sensitive information securing using data storage while doing cloud solutions for broader needs in maintaining data storage.

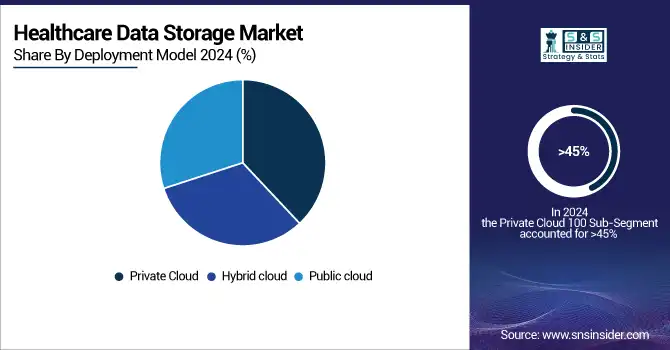

By Deployment Model

In 2024, more than 45.0% of the share in the healthcare data storage market was gained by the private cloud model. This is primarily because of the advanced security and control features of the private cloud, with most healthcare providers preferring private cloud environments due to high compliance demands in strict regulatory requirements, such as HIPAA. This private cloud is typically accredited for access to exclusive resources, thereby providing higher data protection and privacy levels, which are critical in handling sensitive information about patients.

Hybrid cloud deployment models are expected to constitute the largest CAGR, at around 20%. The primary advantage of a hybrid cloud is that organizations can maintain critical healthcare data on private cloud infrastructure and use public clouds for scaling up and cost efficiency when it comes to data that is not too sensitive. Thus, it is an extremely attractive model for healthcare providers in terms of security and flexibility.

By End User

In 2024, the largest end-user segment has been hospitals, which have accounted for over 60.0% of the market. Hospitals are always producing immense data on healthcare, such as EHRs, medical imaging, and patient records, that demand advanced and secure data storage solutions. Thus, with the high adoption of digital health solutions in hospitals combined with a need for real-time patient information, strong data storage systems are in high demand.

The fastest-growing end-user would be pharmaceutical companies, expanding at a strong 19% CAGR during the forecast period. Because of the enhanced adoption of big data and AI in drug development, clinical studies, and genomic research, the demand for advanced healthcare data storage solutions is very high in this sector. Pharmaceutical companies need large-scale data storage and secure systems to handle sensitive research information about their patients, making it the highest-growing segment.

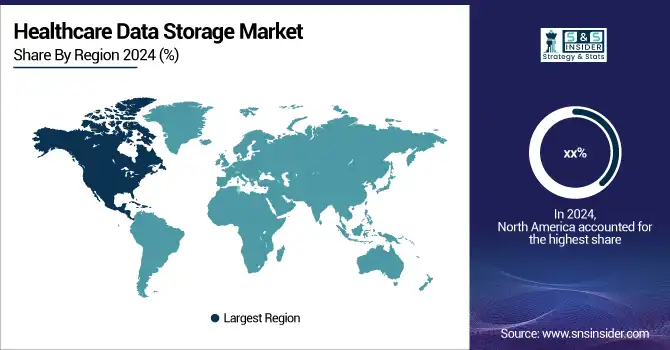

Healthcare Data Storage Market Regional Analysis

North America Healthcare Data Storage Market Insights

North America held the largest share of the healthcare data storage market in 2024, driven by the escalating volume of unstructured healthcare data and rapid advancements in technology. The region's healthcare sector has seen a significant shift towards digitalization, resulting in a growing need for secure, reliable, and cost-effective data storage infrastructure. The adoption of electronic health records (EHRs), the expansion of telemedicine, and the implementation of AI and machine learning in healthcare operations have further increased the demand for sophisticated data management solutions. In addition, stringent regulatory frameworks, such as HIPAA, reinforce the need for advanced data security and storage solutions, propelling market growth in North America.

Need any customization research on Healthcare Data Storage Market - Enquiry Now

Asia Pacific Healthcare Data Storage Market Insights

Meanwhile, Asia Pacific is poised to witness the fastest growth during the forecast period, with a compound annual growth rate (CAGR) significantly outpacing other regions. This growth is largely attributed to the rising adoption of cloud-based storage solutions in developing economies, where healthcare systems are rapidly modernizing. Factors such as increasing government initiatives to enhance healthcare infrastructure, the growing adoption of telehealth, and the rising prevalence of digital health solutions contribute to the burgeoning demand for reliable healthcare data storage in these regions. The expanding use of AI and big data analytics in healthcare research and diagnostics is also fueling the need for advanced data storage solutions in the RoW, making it a critical growth area in the global healthcare data storage market.

Europe Healthcare Data Storage Market Insights

The Europe Healthcare Data Storage Market is witnessing steady growth in 2024, driven by the region’s advanced healthcare infrastructure, widespread adoption of electronic health records (EHRs), and government initiatives promoting digital health. Key markets such as Germany, the U.K., and France are increasingly leveraging cloud-based and on-premises storage solutions to manage patient data securely. Regulatory frameworks like GDPR are encouraging healthcare providers to adopt compliant and secure storage systems. Additionally, investments in AI-driven analytics and telemedicine platforms are further propelling demand for scalable healthcare data storage solutions.

Latin America (LATAM) Healthcare Data Storage Market Insights

The LATAM Healthcare Data Storage Market is expanding gradually in 2024, fueled by increasing digitalization of healthcare services, growing adoption of EHRs, and the rise of telemedicine in countries like Brazil, Mexico, and Argentina. Local hospitals and clinics are implementing cloud storage solutions to enhance patient data management and ensure regulatory compliance. Government initiatives to modernize healthcare IT infrastructure and the increasing use of mobile health applications are driving demand for secure and scalable storage solutions across the region.

Middle East & Africa (MEA) Healthcare Data Storage Market Insights

The MEA Healthcare Data Storage Market is gaining momentum in 2024, supported by rising investments in digital health, growing adoption of cloud-based healthcare solutions, and expansion of telemedicine services. Countries such as the UAE, Saudi Arabia, and South Africa are increasingly deploying secure storage solutions to manage electronic patient records, telehealth data, and medical imaging. Government-led initiatives promoting healthcare modernization and compliance with international data protection standards are further accelerating the adoption of advanced healthcare data storage systems across the region.

Healthcare Data Storage Market Competitive Landscape

Microsoft Azure is a leading cloud computing platform offering scalable infrastructure and advanced analytics solutions for healthcare and other industries.

-

In July 2024, Microsoft Azure enhanced its Healthcare Data Services by launching new AI-driven analytics tools. These tools aim to improve patient outcome predictions and optimize data management, helping healthcare providers more effectively implement value-based care models.

Amazon Web Services (AWS)

Amazon Web Services is a global cloud services provider delivering secure, scalable, and compliant storage and computing solutions for healthcare organizations.

-

In June 2024, Amazon Web Services (AWS) rolled out its advanced data archiving solution tailored for healthcare organizations. This solution features improved encryption and automated compliance checks, addressing the rising demand for secure and scalable storage options in light of increasing regulatory requirements and data volumes.

Healthcare Data Storage Market Key Players

-

Dell – Dell EMC Healthcare Data Solutions

-

IBM Corporation – IBM Healthcare Data Management

-

NetApp – NetApp Healthcare Data Storage Solutions

-

Hewlett Packard Enterprise Development LP – HPE Healthcare Storage Solutions

-

Pure Storage, Inc. – Pure Storage for Healthcare

-

Hitachi, Ltd. – Hitachi Healthcare Data Solutions

-

Toshiba Corporation – Toshiba Healthcare Storage Systems

-

Western Digital Corporation – WD Healthcare Storage

-

Scality – Scality Healthcare Data Management

-

Huawei Technologies Co., Ltd. – Huawei Healthcare Data Infrastructure

-

Fujitsu – Fujitsu Healthcare Data Storage Solutions

-

Samsung – Samsung Healthcare Storage Solutions

-

Drobo – Drobo Healthcare Data Storage

-

Tintri – Tintri Healthcare Data Storage Systems

-

Cloudian – Cloudian Healthcare Storage Solutions

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.36 billion |

| Market Size by 2032 | US$ 15.54 billion |

| CAGR | CAGR of 14.21% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Storage (On-premise storage, Cloud-based storage, Hybrid storage) • By Deployment Model (Public Cloud, Private Cloud, Hybrid cloud) • By End Users (Hospitals, Clinics, Research institutions, Pharmaceutical companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Dell, IBM Corporation, NetApp, Hewlett Packard Enterprise Development LP, Pure Storage, Inc., Hitachi, Ltd., Toshiba Corporation, Western Digital Corporation, Scality, Huawei Technologies Co., Ltd., Fujitsu, Samsung, Drobo, Tintri, Cloudian |