Service Delivery Platform Market Report Scope & Overview:

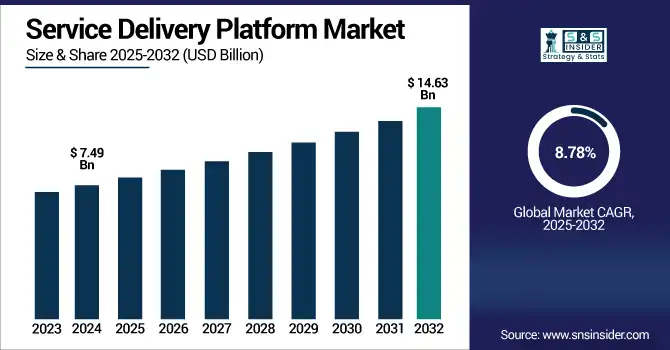

Service Delivery Platform Market was valued at USD 7.49 billion in 2024 and is expected to reach USD 14.63 billion by 2032, growing at a CAGR of 8.78% from 2025-2032.

To Get more information on Service Delivery Platform Market - Request Free Sample Report

The growth of the Service Delivery Platform (SDP) market is driven by the rapid adoption of cloud-native technologies, rising demand for seamless digital service experiences, and increasing telecom operator focus on network function virtualization (NFV) and 5G integration.

-

According to the U.S. Department of Energy (via NCBI), Software-Defined Networking (SDN) and NFV in 5G operations can reduce total cost of ownership by approximately 25%, covering both RAN and core network infrastructure.

-

Additionally, a U.S. government-supported NTIA whitepaper highlights that cloud-native, containerized architectures such as those combining AWS with RIFT.ware enable rapid deployment, auto-scaling, and elasticity, further lowering operational costs compared to traditional hardware-centric approaches.

Enterprises are leveraging SDP to centralize service orchestration, enhance time-to-market, and reduce operational complexity. The surge in connected devices and IoT services is also boosting the need for scalable and flexible platforms. Furthermore, growing emphasis on customer-centric service models, AI-based automation, and the convergence of communication and content delivery services is accelerating the platform’s adoption across diverse end-user industries.

U.S. Service Delivery Platform Market was valued at USD 1.83 billion in 2024 and is expected to reach USD 3.54 billion by 2032, growing at a CAGR of 8.57% from 2025-2032.

The U.S. Service Delivery Platform market is growing due to increased 5G deployment, rising demand for digital service integration, cloud migration, and telecom operators’ focus on virtualization and automation to streamline operations, enhance user experience, and support diverse service offerings.

Market Dynamics

Drivers

-

Surging popularity of cloud-native solutions is prompting investments in scalable and modular Service Delivery Platform frameworks.

Organizations are shifting from legacy systems to cloud-native architectures for better flexibility and scalability in delivering digital services. SDPs built on cloud-native infrastructure allow rapid deployment, dynamic resource allocation, and cost optimization. With digital transformation initiatives accelerating across telecom, media, and IT sectors, service providers increasingly rely on these platforms to ensure availability, high performance, and adaptability. Cloud-native SDPs also enhance automation and simplify orchestration across hybrid environments, further boosting adoption. Their role in enabling digital-first business models is a key driver of sustained market growth.

-

As reported in a Microsoft-led NTIA whitepaper, more than 100 mobile network operators use Microsoft’s virtualized packet core, and over 400 leverage their virtualized voice service infrastructure highlighting the shift away from hardware-centric systems.

Restraints

-

Substantial upfront investment costs and uncertain ROI discourage smaller operators from deploying Service Delivery Platforms.

Deploying an SDP often requires a considerable initial investment in hardware, software, skilled personnel, and systems integration. For small and mid-sized service providers, this can be a prohibitive barrier, especially when the return on investment remains uncertain due to rapidly evolving technologies and changing consumer preferences. The financial risks associated with large-scale deployment limit adoption in emerging markets where revenue streams are more volatile. These economic constraints hinder market expansion, particularly among telecom operators operating on tighter margins or those serving low-ARPU (average revenue per user) customer segments.

Opportunities

-

Expansion of IoT ecosystems creates a vast potential market for Service Delivery Platforms to manage diverse device-based services.

As IoT adoption accelerates across industries, there is a growing need for platforms that can seamlessly provision, monitor, and scale services across billions of connected devices. SDPs provide this functionality by enabling automated service management, authentication, and policy control for heterogeneous IoT environments. Their ability to handle real-time data flows and support open APIs positions them as foundational tools for smart home, industrial IoT, and connected mobility solutions. This surge in IoT deployments presents a long-term opportunity for SDP vendors to deliver integrated, secure, and flexible service frameworks.

-

Nearly 97% of enterprises report security challenges when deploying IoT, highlighting the importance of integrated SDP security layers. Microsoft also highlighted how billions of sensors are powering complex deployments from agriculture to smart cities while pointing out that about 40% of edge data is noisy, showcasing the need for robust SDP filtering and orchestration.

Challenges

-

Ensuring security and data privacy across distributed Service Delivery Platforms remains a major technical and regulatory hurdle.

With SDPs operating across multiple services and cloud environments, maintaining robust data security and user privacy becomes complex. They are frequent targets for cyberattacks due to their role in managing critical customer and business data. Moreover, differing international regulations like GDPR, HIPAA, or CCPA increase the compliance burden. Inadequate security frameworks or misconfigurations can result in breaches, service disruptions, and reputational damage. Balancing openness and integration capabilities with stringent security controls continues to challenge both platform developers and telecom operators in this evolving threat landscape.

-

82% of data breaches involve cloud-stored data, primarily due to misconfiguration and human error underscoring how easily SDP environments can be compromised when not properly managed.

-

According to Check Point’s 2023 Cloud Security Report, 59% of security professionals cite misconfiguration as the top cloud threat, with 48% reporting a surge in cloud-based network attacks.

Segment Analysis

By Organization Size

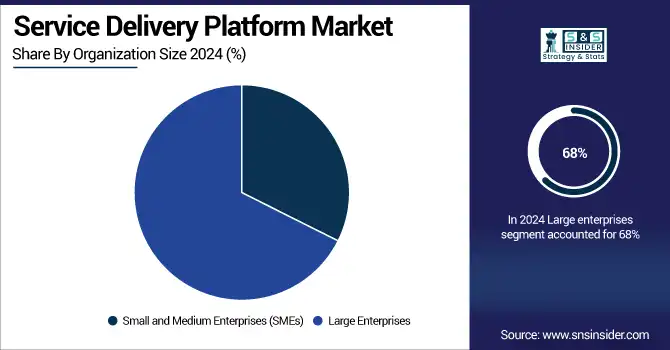

Large enterprises dominated the Service Delivery Platform Market in 2024, accounting for approximately 68% revenue share due to their ability to invest in scalable, integrated service frameworks. These organizations prioritize agility and customer experience, leveraging SDPs to streamline operations across diverse geographies and business units. Their need for managing large volumes of data and complex service ecosystems drives continued SDP adoption and high expenditure.

Small and Medium-sized Enterprises (SMEs) are projected to grow at the fastest CAGR of 10.39% from 2025 to 2032 due to increasing digitization and affordability of cloud-based SDPs. SMEs are leveraging these platforms to accelerate service innovation, reduce operational costs, and enhance customer engagement. As competition intensifies, SDPs offer them the agility and automation needed to scale efficiently without heavy infrastructure investments.

By End-User Industry

The IT and Telecom segment led the Service Delivery Platform Market in 2024 with a 28% revenue share, driven by rising demand for converged service management. Telecom operators increasingly rely on SDPs to unify billing, content delivery, and subscriber services. With the rollout of 5G, IoT, and edge services, these platforms have become critical to delivering high-performance, real-time digital experiences and optimizing network resources.

The healthcare segment is expected to grow at the fastest CAGR of 11.69% from 2025 to 2032 as providers adopt SDPs to enable telemedicine, patient engagement, and data interoperability. Increased focus on digital health transformation, remote monitoring, and compliance with data privacy regulations is pushing healthcare systems to modernize their IT infrastructure. SDPs help integrate diverse health services while ensuring scalability and patient-centric care delivery.

By Application

The Communication and Collaboration segment dominated the Service Delivery Platform Market in 2024 with a 30% revenue share, owing to widespread enterprise adoption of unified communication tools. SDPs support real-time messaging, video conferencing, and collaboration apps across distributed teams. The post-pandemic shift toward hybrid work environments has intensified the need for seamless, secure, and scalable service integration, making this segment a consistent revenue leader.

Enterprise Mobility and BYOD (Bring Your Own Device) is anticipated to grow at the fastest CAGR of 10.50% from 2025 to 2032 due to increasing workplace digitization and mobile workforce expansion. Organizations are turning to SDPs to ensure secure access, device management, and service consistency across user-owned devices. The flexibility and cost-efficiency of BYOD policies are driving higher platform adoption to support dynamic and remote work models.

By Telecom Service Sector

The mobile segment held the largest revenue share of approximately 48% in the Service Delivery Platform Market in 2024 and is projected to grow at the fastest CAGR of 9.66% from 2025 to 2032. This dominance and rapid growth are driven by the explosive increase in mobile subscribers, demand for real-time services, and widespread 4G/5G adoption. Mobile operators rely heavily on SDPs to deliver value-added services, personalized content, and seamless user experiences across devices. The growing consumption of mobile data and apps continues to fuel platform investments, especially in emerging digital economies.

Regional Analysis

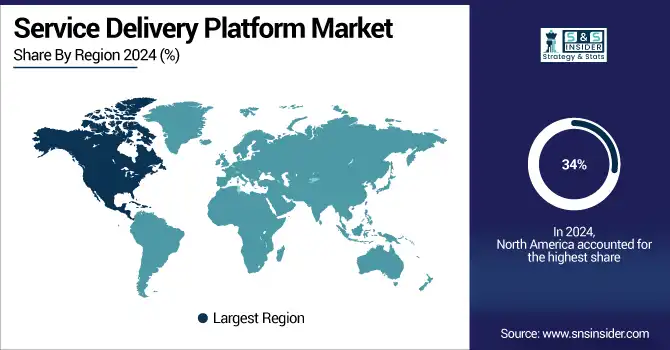

North America led the Service Delivery Platform Market in 2024 with a 34% revenue share due to its advanced digital infrastructure, early adoption of 5G, and high concentration of major telecom and IT firms. The region’s strong focus on customer experience, automation, and innovation drives continued investments in SDPs. Regulatory support and widespread enterprise digitization further strengthen North America’s leadership in platform deployment and scalability.

The United States is dominating the Service Delivery Platform Market due to its advanced telecom infrastructure, high digital adoption, and strong presence of leading technology providers.

Asia Pacific is projected to grow at the fastest CAGR of 10.43% from 2025 to 2032, driven by expanding mobile connectivity, rapid urbanization, and digital transformation across emerging economies like India and Southeast Asia. Increasing internet penetration, rising smartphone users, and government-backed digital initiatives are pushing enterprises and telecom operators to adopt SDPs. The region’s untapped potential makes it a major growth frontier.

China is dominating the Service Delivery Platform Market in Asia Pacific due to its massive mobile user base, rapid 5G rollout, and strong digital infrastructure.

Europe holds a significant share in the Service Delivery Platform Market due to growing investments in 5G, strong enterprise IT adoption, and supportive regulatory frameworks. Countries like Germany, the UK, and France lead with advanced telecom networks and digital transformation initiatives.

Germany is dominating the Service Delivery Platform Market in Europe, driven by its strong telecom sector, robust enterprise digitization, and early 5G and IoT adoption.

The Middle East & Africa and Latin America are emerging markets in the Service Delivery Platform space, driven by expanding telecom infrastructure, rising mobile penetration, and increasing digital service adoption, especially in urban centers and among younger populations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

HCL Technologies, Fujitsu, SGK International, Cisco Systems, Accenture, Tech Mahindra, BMC Software, SAP, Accelerite, Amdocs, CA Technologies, Ericsson, HP, Huawei, IBM, Oracle, Microsoft, Nokia, Telenity, ZTE and others.

Recent Developments:

-

2025 – HCLTech expands partnership with The Standard to accelerate AI‑led transformation and deliver digital‑first services at scale through GenAI‑led platform and cloud services.

-

2024 – IBM and ServiceNow collaborate: ServiceNow’s Now Platform will integrate IBM watsonx.ai and IBM Granite models into Now Assist GenAI, enhancing enterprise workflow productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.49 Billion |

| Market Size by 2032 | USD 14.63 Billion |

| CAGR | CAGR of 8.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises) • By Telecom Service Sector (Mobile, PSTN (Public Switched Telephone Network), Business Data Services, Residential Broadband) • By Application (Communication and Collaboration, Enterprise Mobility and BYOD (Bring Your Own Device), Unified Communications, Content Delivery) • By End-User Industry (Healthcare, Banking, Financial Services, and Insurance (BFSI), Retail, IT and Telecom, Government, Energy and Utilities, Manufacturing) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | HCL Technologies, Fujitsu, SGK International, Cisco Systems, Accenture, Tech Mahindra, BMC Software, SAP, Accelerite, Amdocs, CA Technologies, Ericsson, HP, Huawei, IBM, Oracle, Microsoft, Nokia, Telenity, ZTE |