Shipping Container Market Report Scope & Overview:

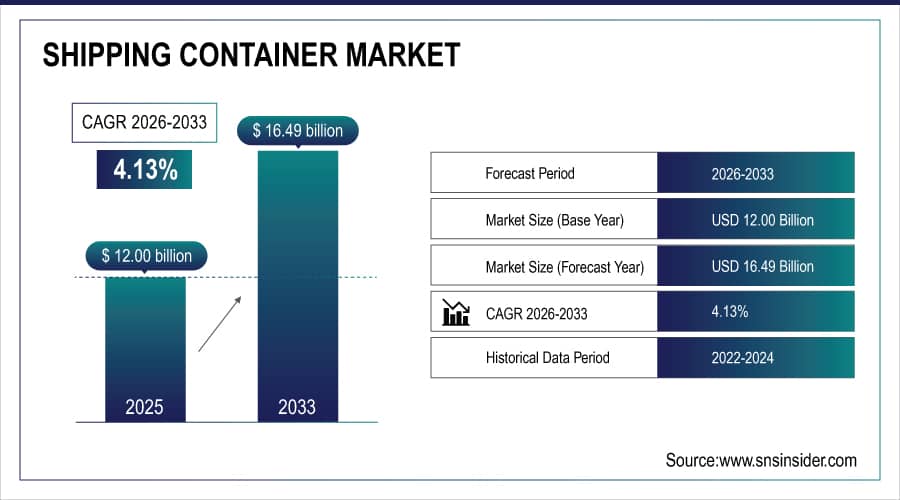

The Shipping Container Market is valued at USD 12.00 billion in 2025E and is expected to reach USD 16.49 billion by 2033, growing at a CAGR of 4.13 % from 2026-2033.

Shipping Container Market is experiencing strong growth due to rapid expansion in global trade, rising demand for efficient cargo transportation, and increasing containerization across logistics and freight operations. Growth in e-commerce and cross-border shipping is boosting container utilization, while ports and shipping companies continue to invest in fleet modernization. Additionally, increased adoption of smart and refrigerated containers to support temperature-sensitive goods, along with growing maritime infrastructure development, is further accelerating market momentum worldwide.

In 2024, over 85 million TEUs were handled globally, a 6% increase from 2023, with e-commerce and cold-chain logistics driving 20% higher demand for refrigerated and IoT-enabled containers amid expanding maritime trade corridors.

To Get More Information On Shipping Container Market - Request Free Sample Report

Shipping Container Market Size and Forecast

-

Market Size in 2025E: USD 12.00Billion

-

Market Size by 2033: USD 16.49 Billion

-

CAGR: 4.13% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Shipping Container Market Trends

-

Increasing demand for intermodal transportation due to globalization and rising international trade volumes across regions

-

Growing adoption of smart containers integrated with IoT sensors for real-time tracking and inventory management

-

Expansion of refrigerated container usage driven by cold chain growth in food, pharmaceutical, and chemical industries

-

Rising preference for lightweight and durable materials to improve fuel efficiency and reduce transportation costs

-

Growth in e-commerce and online retail boosting demand for flexible, small-batch containerized shipping solutions

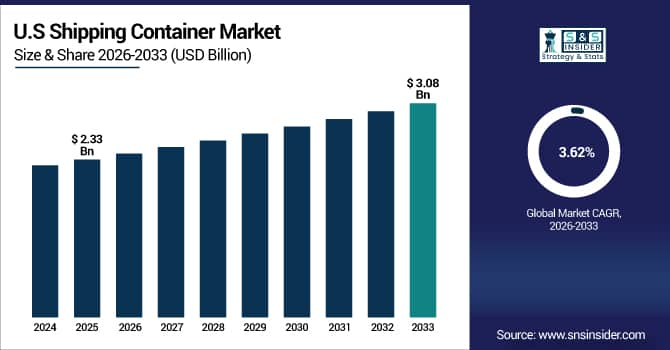

The U.S. Shipping Container Market is valued at USD 2.33 billion in 2025E and is expected to reach USD 3.08 billion by 2033, growing at a CAGR of 3.62% from 2026-2033.

Growth of the U.S. Shipping Container Market is driven by strong demand for domestic and international freight movement, expanding e-commerce volumes, and modernization of port infrastructure. Rising adoption of smart and refrigerated containers for high-value and temperature-sensitive goods also supports market expansion as logistics operators focus on improving supply-chain efficiency.

Shipping Container Market Growth Drivers:

-

Growing global trade and e-commerce demand are driving the need for shipping containers to transport goods efficiently across international and domestic supply chains

The rapid expansion of international trade, cross-border e-commerce, and globalized supply chains is significantly increasing demand for shipping containers. Businesses require reliable, standardized containers to transport raw materials, finished products, and consumer goods efficiently across oceans and land routes. E-commerce growth has created a need for frequent, smaller shipments, further boosting container utilization. Shipping containers offer safety, cost-efficiency, and streamlined logistics for manufacturers, retailers, and distributors. As global trade volumes rise and supply chains expand, the demand for shipping containers continues to grow, supporting the market’s steady development worldwide.

In 2024, global e-commerce shipments accounted for over 30% of containerized cargo, with cross-border trade volumes increasing by 6.5% and driving a 7% rise

-

Expansion of intermodal transportation and port infrastructure is boosting container usage for cost-effective, safe, and standardized cargo movement worldwide

Intermodal transportation, integrating sea, rail, and road logistics, relies heavily on standardized shipping containers to ensure seamless cargo transfer. Modernized port facilities, container terminals, and improved rail networks facilitate faster loading, unloading, and storage of goods. Efficient infrastructure reduces transit times, lowers operational costs, and enhances cargo safety, making containerized shipping the preferred solution for businesses. The increasing adoption of intermodal transport systems in developed and emerging regions is further driving container demand. As companies prioritize efficiency, sustainability, and cost optimization, containerized logistics continues to expand globally.

In 2024, intermodal freight volumes grew by 8%, supported by USD22 billion in global port infrastructure investments, driving a 7.5% increase in container utilization for standardized, multimodal cargo transport across key trade routes.

Shipping Container Market Restraints:

-

High manufacturing and maintenance costs of shipping containers limit affordability, particularly for small logistics providers and developing regions

Shipping containers require durable materials, precise manufacturing, and regular maintenance to ensure structural integrity and safety. High production costs, along with ongoing expenses for repair, inspection, and replacement, pose challenges for smaller logistics companies and operators in developing markets. Limited capital availability restricts investment in new or specialized containers, impacting service quality and operational efficiency. Cost constraints also affect the adoption of refrigerated or technologically enhanced containers. Consequently, affordability issues hinder market penetration among small-scale providers, slowing overall market growth, particularly in regions where capital investment and infrastructure support are limited.

In 2024, new dry container prices averaged USD4,500, with maintenance and repair costs adding 15–20% annually—placing them out of reach for 60% of small logistics firms and many operators in developing regions.

-

Volatile fuel prices, trade uncertainties, and geopolitical tensions disrupt shipping operations, impacting container utilization and overall market growth

The shipping container market is closely linked to global trade stability. Rising fuel costs increase transportation expenses, while geopolitical tensions, trade wars, and sanctions can delay or reroute shipments. These uncertainties affect container utilization rates, scheduling, and overall supply chain efficiency. Disruptions in key shipping lanes or port operations reduce container turnover, leading to lower demand and potential revenue losses. Companies may hesitate to expand container fleets under volatile conditions. Such macroeconomic and geopolitical challenges act as significant restraints, creating risk and limiting sustained growth in the global shipping container market.

In 2024, geopolitical tensions and trade volatility led to a 9% drop in container utilization on key routes, while fluctuating fuel costs increased shipping expenses by up to 25%, dampening fleet expansion and market growth.

Shipping Container Market Opportunities:

-

Increasing demand for refrigerated and specialized containers presents opportunities for innovation in temperature-controlled logistics for pharmaceuticals, food, and perishable goods

Rising demand for perishable food products, frozen goods, and temperature-sensitive pharmaceuticals is creating opportunities for specialized shipping containers. Refrigerated, insulated, and climate-controlled containers ensure product quality and compliance with safety regulations. Manufacturers and logistics providers are investing in innovative container designs with advanced cooling systems and energy-efficient technologies. Growing pharmaceutical exports, global cold chain development, and e-commerce food delivery services further drive demand for these specialized solutions. Expanding product applications and improving container performance offers significant market growth potential while supporting the safe and efficient transport of temperature-sensitive goods worldwide.

In 2024, demand for refrigerated containers surged by 11%, driven by pharmaceutical and perishable food shipments, with specialized containers for vaccines and biologics growing 18% amid expanding cold-chain logistics worldwide.

-

Adoption of smart container technologies, IoT sensors, and digital tracking enhances operational efficiency, transparency, and customer satisfaction, offering growth potential in global shipping

The integration of smart technologies into shipping containers is transforming the logistics industry. IoT-enabled containers allow real-time tracking, temperature monitoring, and condition reporting, improving operational efficiency and reducing cargo loss. Data analytics from connected containers enhances supply chain visibility, predictive maintenance, and route optimization. Adoption of digital tracking technologies builds customer trust and supports regulatory compliance. As logistics providers and shipping companies increasingly embrace digital solutions, the demand for smart, sensor-equipped containers is rising. This trend presents substantial growth opportunities, enabling more efficient, transparent, and secure global shipping operations.

In 2024, over 30% of new shipping containers integrated IoT sensors and smart tracking, improving cargo visibility and reducing transit delays by 20%, while boosting customer satisfaction and driving a 12% rise in digital container adoption globally.

Shipping Container Market Segment Highlights

-

By Type: Dry Containers led with 45.8% share, while Refrigerated Containers is the fastest-growing segment with CAGR of 6.2%.

-

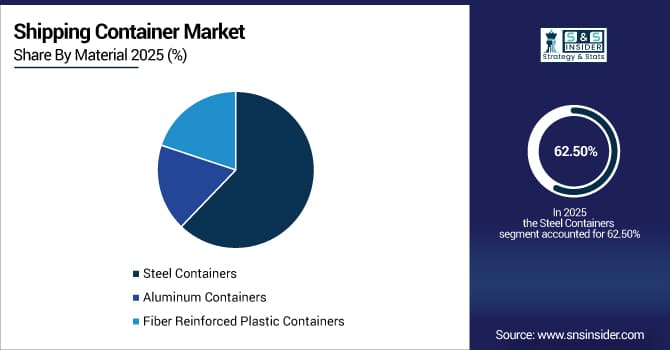

By Material: Steel Containers led with 62.5% share, while Fiber Reinforced Plastic Containers is the fastest-growing segment with CAGR of 6.8%.

-

By Application: Marine Shipping led with 53.7% share, while Road Transport is the fastest-growing segment with CAGR of 5.9%.

-

By End-User: Logistics & Freight Companies led with 48.3% share, while E-commerce & Retail Companies is the fastest-growing segment with CAGR of 6.5%.

Shipping Container Market Segment Analysis

By Type: Dry Containers Dominate Market; Refrigerated Containers Fastest-Growing Segment

Dry Containers hold the largest share due to their versatility, robustness, and widespread use in transporting non-perishable goods. They are cost-effective, easy to handle, and compatible with standard loading equipment across global logistics networks. Their structural durability and standardization simplify fleet management for operators, making them a preferred choice for heavy-duty long-haul transport. The segment benefits from established infrastructure, extensive OEM support, and consistent demand from global logistics providers, ensuring continued dominance in the hydrogen truck container segment.

Refrigerated Containers are the fastest-growing segment, driven by the increasing demand for temperature-sensitive goods transport, including food, pharmaceuticals, and chemicals. Advances in energy-efficient refrigeration technologies and integration with hydrogen-powered trucks allow longer transit times without compromising product quality. Rapid expansion of cold-chain logistics, urban e-commerce deliveries, and government regulations on food safety accelerate adoption. Manufacturers and fleet operators are investing in advanced refrigerated units to support zero-emission long-distance and last-mile deliveries, driving strong growth in this segment.

By Material: Steel Containers Lead Market Share; Fiber Reinforced Plastic Containers Exhibit Fastest Growth

Steel Containers dominate the market due to their superior strength, durability, and reusability in transporting heavy and bulk goods. Steel’s resistance to wear, corrosion, and extreme weather conditions makes it ideal for long-haul hydrogen truck operations. Operators benefit from lower maintenance costs, longer service life, and standardization across global shipping networks. Combined with regulatory compliance for safe cargo transport, steel containers continue to be the preferred material choice for logistics providers, ensuring consistent adoption and a strong market share.

Fiber Reinforced Plastic (FRP) Containers are growing rapidly due to their lightweight, corrosion-resistant properties that improve fuel efficiency and payload capacity. FRP containers reduce overall truck weight, allowing hydrogen trucks to carry higher loads with lower energy consumption. These containers are increasingly used for specialized cargo, including chemicals and perishable items, benefiting from improved durability and long-term operational cost savings. Technological advancements and growing environmental regulations support the adoption of FRP containers, positioning this segment for fast growth.

By Application: Marine Shipping Holds Largest Share; Road Transport Segment Growing Fastest

Marine Shipping applications dominate the market, as hydrogen trucks transport containers efficiently to ports and shipping hubs for long-distance international trade. The segment benefits from high-volume shipments, predictable routes, and integration with existing port infrastructure. Hydrogen trucks provide low-emission solutions for container transport, aligning with global maritime sustainability targets. Fleet operators and logistics providers prefer this application due to route predictability, cargo standardization, and compatibility with intermodal transport systems, reinforcing its strong market presence.

Road Transport applications are growing fastest, fueled by rising demand for last-mile deliveries, regional distribution, and urban logistics. Hydrogen trucks provide zero-emission solutions with sufficient range and payload capacity for road transport networks. Rapid expansion of e-commerce, retail distribution, and local delivery infrastructure drives adoption. Technological advances in hydrogen refueling stations, compact container design, and smart fleet management accelerate deployment, making road transport the fastest-growing application for hydrogen-powered container logistics.

By End-User: Logistics & Freight Companies Command Market; E-commerce & Retail Companies Fastest Growing Segment

Logistics & Freight Companies dominate as end-users due to their reliance on bulk transport, predictable routes, and long-term fleet investment strategies. Hydrogen trucks with standardized containers reduce emissions, improve operational efficiency, and lower total cost of ownership over time. Fleet operators benefit from incentives, regulatory compliance, and compatibility with intermodal transport infrastructure. This end-user segment continues to capture the largest market share by leveraging hydrogen technology for sustainable, high-capacity transport across global supply chains.

E-commerce & Retail Companies are the fastest-growing end-users, driven by rapid online retail expansion and increasing demand for efficient, zero-emission deliveries. Hydrogen trucks enable timely distribution with sufficient range and payload, particularly for urban and regional last-mile logistics. Retailers are adopting lightweight and temperature-controlled containers for perishable and high-value goods. Government incentives, urban sustainability programs, and the need for flexible, environmentally friendly delivery fleets further accelerate adoption, positioning this segment for rapid market growth in hydrogen-powered container transport.

Shipping Container Market Regional Analysis

North America Shipping Container Market Insights:

North America: North America held a significant share in the Shipping Container Market in 2025, supported by strong import-export activities, advanced port infrastructure, and high adoption of containerized logistics. Well-established trade networks, technological integration in shipping operations, and growing e-commerce demand further reinforced the region’s market position.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Shipping Container Market Insights

Asia dominated the Shipping Container Market with a 44.65% share in 2025 due to its status as a global manufacturing and export hub, high trade volumes, and well-established port infrastructure. Rapid industrialization, growing e-commerce, and increasing international shipping activities further strengthened regional dominance. The market is also expected to grow at the fastest CAGR of about 5.28% from 2026–2033, driven by rising intra-Asia trade, expansion of containerized logistics, government investments in port modernization, and increasing demand for efficient, large-scale transportation solutions.

Europe Shipping Container Market Insights

Europe: Europe captured a notable share in the Shipping Container Market in 2025 due to its extensive maritime trade routes, modern port facilities, and robust manufacturing and export sectors. High intra-European trade, technological advancements in logistics, and increasing adoption of containerized transportation strengthened Europe’s market presence.

Middle East & Africa and Latin America Shipping Container Market Insights

Middle East & Africa and Latin America: The Middle East & Africa and Latin America together showed steady growth in the Shipping Container Market in 2025, driven by expanding port infrastructure, rising international trade, and growing adoption of containerized shipping solutions. Investments in logistics networks, industrial expansion, and increasing demand for efficient freight movement further supported regional market development.

Shipping Container Market Competitive Landscape:

China International Marine Containers (CIMC)

China International Marine Containers (CIMC) is the world’s largest manufacturer of shipping containers, supplying a comprehensive range including dry containers, refrigerated containers, tank containers, and specialty units. With advanced production technology, extensive global distribution, and large-scale manufacturing capacity, CIMC plays a key role in supporting global logistics and maritime trade. The company emphasizes quality, durability, and innovation, ensuring high performance for container fleets and international shipping operators across diverse industries and supply chains.

-

2024, CIMC launched the next-generation Smart Reefer 2.0, an intelligent refrigerated container featuring, AI-driven temperature and humidity control that reduces energy consumption by up to 18%

Maersk Container Industry A/S

Maersk Container Industry A/S is a leading global manufacturer specializing in refrigerated and dry shipping containers engineered to support efficient long-distance cargo transportation. The company is recognized for advanced cold-chain solutions that help preserve perishable goods, benefiting industries such as food and pharmaceuticals. Leveraging decades of engineering expertise and strong maritime industry connections, Maersk Container Industry focuses on energy-efficient designs, reliable performance, and sustainability to enhance fleet operations for global shipping and logistics customers.

-

2024, Maersk Container Industry launched RCM 3.0, a major upgrade to its cloud-based Remote Container Management platform for refrigerated containers.

CXIC Group Containers Co., Ltd.

CXIC Group Containers Co., Ltd. is one of China’s major shipping container manufacturers, offering a wide range of products including dry containers, reefer containers, offshore containers, and customized industrial units. The company is known for precision engineering, strict quality standards, and the use of high-strength materials to ensure durability in demanding shipping environments. CXIC supports global logistics providers, freight operators, and leasing companies, delivering container solutions that combine reliability, longevity, and cost-effectiveness for worldwide transportation networks.

-

2025, CXIC Group launched a new series of standard 20ft and 40ft dry containers engineered with hydrogen-compatible materials and labeling, preparing for future use in green hydrogen transport corridors.

Shipping Container Market Key Players

Some of the Shipping Container Market Companies are:

-

China International Marine Containers

-

Maersk Container Industry A/S

-

CXIC Group Containers Co., Ltd.

-

Singamas Container Holdings Ltd.

-

Dong Fang International Container

-

W&K Container Inc.

-

Sea Box Inc.

-

TLS Offshore Containers International

-

Storstac Inc.

-

CARU Containers B.V.

-

China Eastern Containers

-

Valisons & Co.

-

YMC Container Solutions

-

American Intermodal Container Manufacturing Inc.

-

Triton International

-

Textainer Group Holdings

-

Florens Container Services

-

CAI International, Inc.

-

Touax Group

-

UES International

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 12.00 Billion |

| Market Size by 2033 | USD 16.49 Billion |

| CAGR | CAGR of 4.13% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Dry Containers, Refrigerated Containers, Open Top Containers, Flat Rack Containers, Tank Containers) • By Material (Steel Containers, Aluminum Containers, Fiber Reinforced Plastic Containers) • By Application (Marine Shipping, Rail Transport, Road Transport, Air Transport) • By End-User (Logistics & Freight Companies, E-commerce & Retail Companies, Manufacturing & Industrial Companies, Agriculture & Food Industry, Chemical & Pharmaceutical Companies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | China International Marine Containers (CIMC), Maersk Container Industry A/S, CXIC Group Containers Co., Ltd., Singamas Container Holdings Ltd., Dong Fang International Container (DFIC), W&K Container Inc., Sea Box Inc., TLS Offshore Containers International, Storstac Inc., CARU Containers B.V., China Eastern Containers, Valisons & Co., YMC Container Solutions, American Intermodal Container Manufacturing Inc., Triton International, Textainer Group Holdings, Florens Container Services, CAI International, Inc., Touax Group, UES International |