SiC Based Power Electronics and Inverter Market Report Scope & Overview:

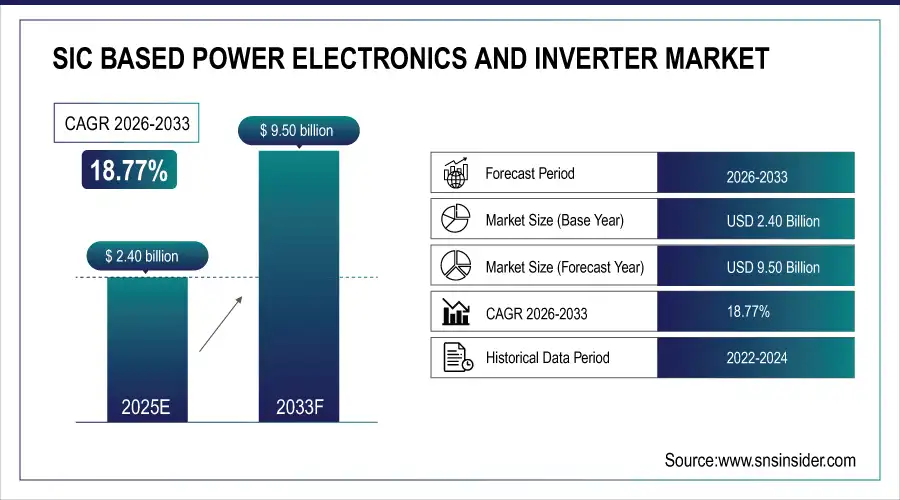

The SiC Based Power Electronics and Inverter Market size was valued at USD 2.40 Billion in 2025E and is projected to reach USD 9.50 Billion by 2033, growing at a CAGR of 18.77% during 2026-2033.

The SiC Based Power Electronics and Inverter Market is expanding due to the increasing adoption in electric vehicles (Evs), as SiC improves the vehicles overall efficiency; driving range and reduces current losses. Expanding numbers of renewable power installations, including solar and wind, require the use of efficient SiC inverters. The market is also facilitated by lower energy losses and less requirement of system size, they are used in aerospace and industrial industry.

SiC-based power devices reduce energy losses by up to 30–50% compared to silicon, enabling smaller, lighter systems with 20–40% less cooling requirements.

To Get more information On SiC Based Power Electronics and Inverter Market - Request Free Sample Report

SiC Based Power Electronics and Inverter Market Trends

-

In EVs, SiC-based inverters are being used more widely to achieve higher power efficiency, quicker charging and longer driving range — steadily emerging as the world’s largest application technology segment.

-

SiC inverters for solar and wind power assets are enabling higher conversion efficiency, lower energy losses and reduced system costs in both renewable generation systems for utilities and among end-user consumers.

-

The manufacturers are shifting from 6-inch to 8-inch SiC wafers, which would offer increased yield, cost-efficiency on a per unit basis and mass production capabilities in order to cater the increasing global demand.

-

As volume and better manufacturing process, the price of SiC MOSFETs and modules is reducing year by year. Security company has entered for automotive, energy application such as on-board chargers (OBCs) in order to solve thermal issues.

-

Major players such as Wolf speed, Infineon and STMicroelectronics are spending billions on new fabs and vertical integration, providing security of supply and reinforcing the global SiC ecosystem.

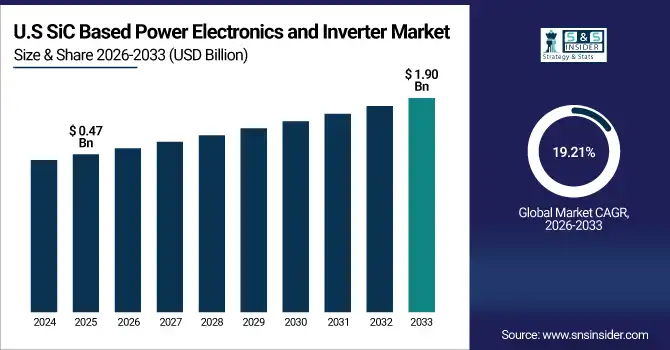

The U.S. SiC Based Power Electronics and Inverter Market size was valued at USD 0.47 Billion in 2025E and is projected to reach USD 1.90 Billion by 2033, growing at a CAGR of 19.21% during 2026-2033. SiC Based Power Electronics and Inverter Market growth is driven by growing adoption of electric vehicles wherein SiC inverters that deliver higher efficiency as well as longer driving range and faster charging, while enabling lower system costs rapidly. The growth of renewables including solar and wind farms also fuels the demand for SiC-based systems. Robust government subsidies and clean energy policies support mass use across sector.

SiC Based Power Electronics and Inverter Market Growth Drivers:

-

Rising EV Adoption and Renewable Energy Integration Accelerating SiC Power Electronics and Inverter Demand.

The explosive emergence of electric vehicles and renewable energy sources are contributing to an area-wide shakeup of the SiC power electronics market. SiC inverters enable higher performance, efficient energy conversion and faster charging to extend the range of electric vehicles as well as accelerate the adoption of renewable energy sources for power generation. Favorable government policies and sustainability objectives additionally drive global market demand.

SiC inverters enable EV charging times up to 30% faster and increase driving range by 5–10% compared to silicon-based systems.

SiC Based Power Electronics and Inverter Market Restraints:

-

High Manufacturing Costs and Limited SiC Wafer Availability Restricting Large-Scale Market Expansion

Despite robust demand, the market is confronted with high production costs and a shortage of SiC wafers. Heavy manufacturing processes, poor defect rates and costly substrates stymie widespread deployment. The cost pressures restrict penetration in price sensitive applications such as consumer electronics and it has become a barrier to mass realization despite potential for strong growth at automotive and industrial side.”.

SiC Based Power Electronics and Inverter Market Opportunities:

-

Technological Advancements and Global Investments in SiC Manufacturing Creating New Growth Pathways

The 8-inch SiC wafer process technology, vertical integration and higher yield of fabrication processes are diminishing the costs and are increasing scalability. Leading companies and governments have been making investments across the globe to increase production capacity and put muscle behind their supply chains. This presents large opportunities for SiC to be used in electric vehicles (EVs), renewable energy, aerospace, and IT sectors that both drive the long-term growth and market transformation.

8-inch SiC wafers are expected to reduce per-die costs by 30–40% by 2026, with yield rates improving from 60% to over 85% in next-gen fabs.

SiC Based Power Electronics and Inverter Market Segment Analysis

-

By product, SiC MOSFETs led the market with a 55.31% share in 2025E, while SiC modules are expected to be the fastest-growing segment with a CAGR of 27.54%.

-

By application, the automotive sector dominated with a 53.11% share in 2025E and is also projected to be the fastest-growing segment at a CAGR of 29.65%.

-

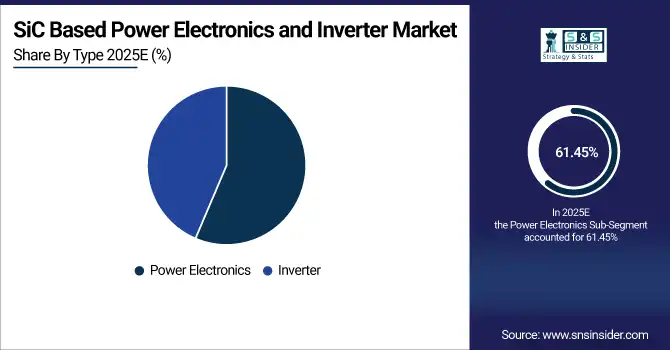

By type, power electronics accounted for the largest share of 61.45% in 2025E, whereas the inverter segment is anticipated to expand at the fastest CAGR of 26.64%.

-

By distribution channel, direct sales held a 57.34% share in 2025E, while distributors are forecasted to grow at the highest CAGR of 23.56%.

By Product, SiC MOSFETs Leads Market While SiC Modules Registers Fastest Growth

In 2025, SiC MOSFETs, available on the market nowadays, have a good performance in terms of efficiency and reliability; they are broadly used by the electric vehicle and renewable energy industry. In addition, SiC modules are rapidly penetrating the market with increased demand in industries for higher integration, smaller packages and better thermal performance. This move identifies that the trends are moving to higher converter yields with advanced SiC module solutions for automotive, industrial and energy applications.

By Application, Automotive Dominate and also Shows Rapid Growth

In 2025, the automotive industry possesses the largest share in the SiC-based power electronics and inverter market powered by growing electric vehicle (EV) manufacturing and increasing demand for high-speed charging infrastructure. SiC devices are being adopted in electric vehicles for maximum driving range, higher energy efficiency and more compact design. In time automotive will be the largest sector for SiC but until it is established and as evolving each year you can find out what trends improved consumer applications and technology advancements.

By Type, Power Electronics Lead While Inverter Registers Fastest Growth

In 2025, Power electronics continue to be the most dominant market segment in the SiC realm due to their indispensable role for power conversion, efficiency gain and performance improvement in a wide range of applications. Yet, inverters are experiencing the greatest demand for adoption throughout electric-vehicle (EV), renewable-energy and grid-infrastructure utilization, SiC attainment in these areas result in greater efficiency with lower energy losses, smaller footprints.

By Distribution Channel, Direct Sales Lead While Distributors Grow Fastest

In 2025, Direct sales dominate the market as large manufacturers prefer establishing direct relationships with automotive, energy, and industrial clients for customized solutions. At the same time, distributors are emerging as the fastest-growing channel, supported by increasing demand from smaller companies and regional players who rely on distribution networks to access SiC-based components and expand their market reach.

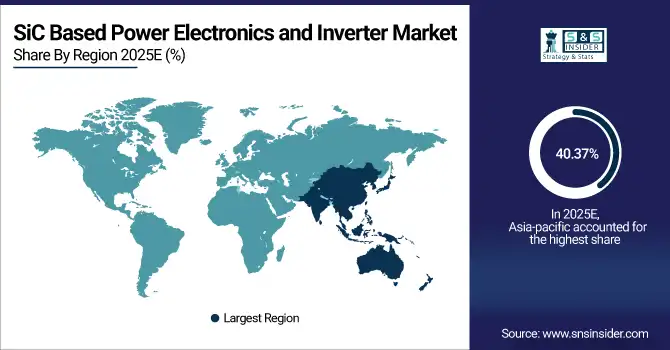

SiC Based Power Electronics and Inverter Market Regional Analysis:

Asia-pacific SiC Based Power Electronics and Inverter Market Insights

In 2025E Asia-Pacific dominated the SiC Based Power Electronics and Inverter Market and accounted for 40.37% of revenue share, this leadership is due to the expansion of renewable energy deployment, and industrial automation are the key drivers. APAC is the latest hub of growth for the global top market players. Semiconductor innovation is encouraged by government incentives, while wafer production is being scaled up by local manufacturers. Growing demand from the automotive and consumer electronics also drive adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

China SiC Based Power Electronics and Inverter Market Insights

China leads in Asia-Pacific, due to ambitious EV targets and renewable build-out. SiC wafer and device processing expansion is taking place among domestic players. Robust Government policies support building a local supply chain. Quick expansion of charging points drives need for inverters.

North America SiC Based Power Electronics and Inverter Market Insights

North America is expected to witness the fastest growth in the SiC Based Power Electronics and Inverter Market over 2026-2033, with a projected CAGR of 19.40% due to growing adoption of EVs and smart grid modernization projects along with integration of renewables. The U.S. takes precedence in the regional market on account of massive spendings made on semiconductor R&D and SiC manufacturing capacity. Demand also is boosted by aerospace and defense uses.

U.S. SiC Based Power Electronics and Inverter Market Insights

The U.S. is a vital player in the North American industry, where firms have made tremendous investments into silicon carbide (SiC) wafer fabrication and inverter technologies. Popularization of EVs, particularly from major automakers, is increasing demand.

Europe SiC Based Power Electronics and Inverter Market Insights

In 2025, Europe is an important market, as strict emission norms and higher EV penetration has pushed the demand. Germany, France and UK represent the highest demand for SiC-based solutions in automotive as well in renewables. European auto manufacturers play an active role in the SiC inverters to get more efficiency. Green transition in focus of government spurs uptake.

Germany SiC Based Power Electronics and Inverter Market Insights

Germany is the largest market for SiC in Europe, due to the presence of automotive manufacturing and a strong emphasis on electrification. Local companies are also investing in R&D to develop next-generation SiC inverters. Integration of renewable energy, especially solar and wind installations increases.

Latin America (LATAM) and Middle East & Africa (MEA) SiC Based Power Electronics and Inverter Market Insights

The SiC Based Power Electronics and Inverter Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing demand from renewable energy expansion programs and electrification initiatives. Solar, automotive and energy diversification drives adoption in Brazil, Mexico and the Gulf nations. And increasing urbanization is increasingly driving the need for efficient inverters. But constrained capacity for semiconductor production leads to import dependence. Both areas have excellent long-term growth prospects.

SiC Based Power Electronics and Inverter Market Competitive Landscape:

Wolfspeed is a provider of high-performance silicon carbide (SiC) power products, including SiC MOSFETs and diodes, SiC and gan on sapphire substrates and related circuit protection. Their 300 kW 3-phase inverter, using latest generation mod-ular SiC power modules, exhibits system level power density and efficiency. Its has also increased its SiC manufacturing capabilities, under a large supply agreement with Renesas Electronics to manufacture large-volume production of SiC power semiconductors from 2025.

-

In August 2025, Wolfspeed launched its 200mm silicon carbide (SiC) materials to the commercial market, marking a significant advancement in its effort to accelerate the industry's shift from traditional silicon to SiC technologies.

Infineon Technologies AG is a world leader in semiconductor solutions that make life easier, safer and greener. Their CoolSiC™ MOSFET technology aims at reaching new levels of power density and inverter efficiency for on-board charging, fast charging electronics and DC-DC converters, with their HybridPACK Drive module featuring CoolSiC to be first available optimized for EV traction inverters.

-

In May 2025, Infineon introduced its 1200V CoolSiC™ TSJ MOSFETs in ID-PAK packages, targeting automotive drivetrain applications. These devices offer up to 40% improved RDS (on) and 25% higher current capability, with volume production expected by 2027.

STMicroelectronics is developing the fourth generation of its STPOWER silicon-carbide (SiC) metal-oxide-semiconductor field-effect transistor (MOSFET) technology, which integrates advanced control features to increase the efficiency of electric vehicle traction inverters. These new devices range from 750V to 1200V, and are ideal for automotive and industrial applications.

-

In September 2024, STMicroelectronics unveiled its fourth-generation STPOWER silicon carbide (SiC) MOSFET technology, designed to improve power efficiency and density in electric vehicle (EV) traction inverters. The devices, offered in 750V and 1200V variants, target both automotive and industrial applications.

ON Semiconductor is driving adoption of silicon-carbide-based solutions for high-growth applications and addressing increased demand for power devices in advanced markets. Their SiC modules consisting of SiC MOSFETs and diodes see application in solar inverters. The company is placing investments in SiC manufacturing and has a roadmap to scale production, making it well positioned as a major player in the future of power electronic devices.

-

In August 2024, ON Semiconductor entered into a long-term supply agreement with Entegris Inc.. Entegris will provide co-optimized chemical mechanical planarization (CMP) solutions for silicon carbide (SiC) applications, supporting ON Semiconductor's manufacturing needs amid increased demand for semiconductors driven by the growth in artificial intelligence applications.

SiC Based Power Electronics and Inverter Market Key Players:

Some of the SiC Based Power Electronics and Inverter Market Companies are:

-

Wolfspeed

-

Infineon Technologies

-

STMicroelectronics

-

ON Semiconductor

-

ROHM Semiconductor

-

Mitsubishi Electric

-

Toshiba

-

Fuji Electric

-

Littelfuse

-

Microchip Technology

-

Texas Instruments

-

GeneSiC Semiconductor

-

Power Integrations

-

SemiQ

-

Alpha & Omega Semiconductor

-

Renesas Electronics

-

Dynex Semiconductor

-

StarPower Semiconductor

-

UnitedSiC (Qorvo)

-

Hitachi Power Semiconductor Device

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.40 Billion |

| Market Size by 2033 | USD 9.50 Billion |

| CAGR | CAGR of 18.77% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (SiC MOSFETs, SiC Diodes, SiC Modules and Other Devices), • By Application (Automotive, Consumer Electronics, Aerospace, Information Technology (IT and Others) • By Type (Power Electronics and Inverter) • By Distribution Channel (Direct Sales, Distributors and Resellers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Wolfspeed, Infineon Technologies, STMicroelectronics, ON Semiconductor, ROHM Semiconductor, Mitsubishi Electric, Toshiba, Fuji Electric, Littelfuse, Microchip Technology, Texas Instruments, GeneSiC Semiconductor, Power Integrations, SemiQ, Alpha & Omega Semiconductor, Renesas Electronics, Dynex Semiconductor, StarPower Semiconductor, UnitedSiC (Qorvo), Hitachi Power Semiconductor Device |