Large Format Display Market Size & Growth:

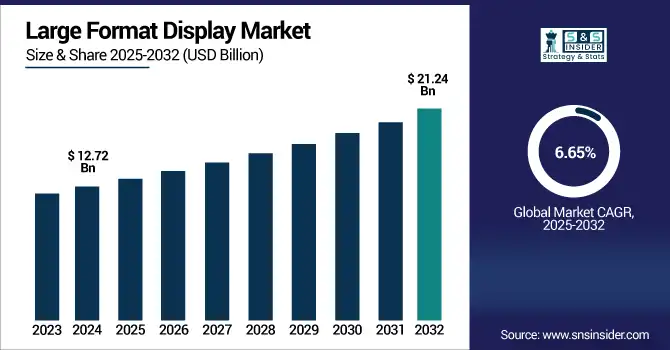

The Large Format Display Market Size was valued at USD 12.72 billion in 2024 and is expected to reach USD 21.24 billion by 2032 and grow at a CAGR of 6.65% over the forecast period 2025-2032.

To Get more information on Large Format Display Market - Request Free Sample Report

The global market is segmented on the basis of application, technology, product type, end-user, and region providing strategic insights on the various performance and trends of interest in key regions. They cite increasing demand for global retail, transportation, and corporate communication sectors combined with advancements in LED and OLED technologies, as drivers of growth. Moreover, high penetration of large format displays in smart city infrastructure and digital advertising networks, in turn, drives the overall market growth in both developed and developing economies.

Over 65% of global retail chains have adopted large format digital signage in storefronts and in-store displays as of 2024.

Visual content on large displays retains attention for 60% longer than traditional mediums, improving content retention and message clarity.

The U.S. Large Format Display Market size was USD 2.57 billion in 2024 and is expected to reach USD 4.29 billion by 2032, growing at a CAGR of 6.64% over the forecast period of 2025–2032.

In the U.S., deployment of large format displays across retail chains, transportation hubs and educational institutions is propelling market growth. They provide high consumer interaction through digital signage and are gaining traction due to smart infrastructure and heavy advertising investment. Furthermore, the increasing requirement for smooth communication between corporate and public places remains a factor in the growing need where key urban cities are more and more relying on digital participation and visual information networks.

Over 70% of U.S. retail chains have integrated large format displays for in-store promotions, branding, and customer interaction.

More than 65% of large U.S. enterprises use digital displays for internal communication and branding in lobbies and meeting spaces.

Large Format Display Market Dynamics:

Key Drivers:

-

Growth in large format displays is driven by swift transition to LED & OLED technologies

The transition to LED and OLED large format displays is accelerating, driven by higher brightness levels, energy efficiency, and long life. They provide Ben-less and High Definition viewing experiences which are essentially important for Public display and Digital walls to be immersive. Due to their thin form factor and modular design, they can be installed flexibly, e.g., even on a curved surface. These control rooms, broadcasting, and corporate high-end settings value the increased color accuracy and contrast of an ultra-high-definition display. LED and OLED solutions have great potential at considerably cheaper prices due to the decreasing production costs, and they are becoming the go-to option in many applications and many regions.

Over 80% of newly built control rooms and broadcast studios in developed economies now use LED or OLED video walls.

Production costs for LED tiles have dropped by nearly 25% over the past five years, boosting adoption across mid-tier enterprises.

Restraints:

-

Slow deployment cycles due to limited standardization and reluctance to integrate with legacy systems

That large format displays are deployed over multi-site networks is where much of the integration makes sense, especially in larger institutions where there is a legacy system already in place. Lack of uniformity in software platforms, display protocols and connectivity standards makes it difficult to ensure smooth operation. This leads to poor compatibility and delayed deployment time for system integrators. Users end up more dependent on know-how and service costs inflate as there are no plug-and-play solutions. The absence of this sort of standardization is a detriment to adoption in industry sectors such as education and government where infrastructure compatibility and budget constraints are vital criteria for decision making.

Opportunities:

-

Driving factors for the growth of interactive Large Format Display include emergence of immersive technologies and content-rich marketing strategies

Now brands are preferring to go for the interactive and dynamic large format display solutions to provide a more immersive experience for consumers. With gamified advertising, touch-enabled screens, and AR/VR-ready displays for better engagement, these are enriching retail stores, exhibitions, and events at corporate venues. In addition, such interactive LFDs are included with audience analytics and personalized content delivery to the audience for the latest data-driven marketing. Moreover, the education and enterprise sectors are witnessing the emergence of new demand due to hybrid learning, remote collaboration and digital kiosk. Advances in display solutions: There is significant long-term opportunity for advanced display solutions due to the push towards experiential marketing and smarter environments.

By 2024, nearly 35% of experiential marketing campaigns incorporated AR or VR elements using large format displays.

Over 60% of new large format displays in retail environments now feature touch or gesture-based interactivity.

Challenges:

-

Products have shorter lifecycle due to quick technological advancements but end user costs to upgrade increase

LFD technologies develop at a rapid pace ranging in innovative resolutions, brightness, and interactivity that products in the LFD market become obsolete in about 2 to 3 years. Heavily-invested older systems are an Achilles heel for businesses since they are costly to replace and are often not compatible with new software standards. The need to remain competitive keeps dovetailing them to frequent upgrades, which in turn elevates the long-term expenditure. Such lifecycle volatility disincentivizes long-term investment, particularly for cash-strapped organizations or for low display ROI. Constant R&D innovation leads to higher pressure on manufacturers. It is a challenge for both users and suppliers in keeping value with the rapid turnaround in tech.

Large Format Display Market Segmentation Analysis:

By Application

The retail segment accounted for the largest market share in 2024 owing to the high utilization of LFDs for dynamic advertising, in-store branding, and promotions. Visual technology is being leveraged by retailers to promote better customer engagement and a smooth shopping experience. Samsung Electronics offers the widest breadth of digital signage solutions for retail chains that employ high bright, slim and centrally-controlled content solutions that enable a better customer experience, which boosts foot traffic and store conversion.

The transportation segment is expected to witness the fastest CAGR due to its deployment in airports, metro stations and smart transit systems from 2024-2032. Such displays are for real-time scheduling, wayfinding and public safety messaging. LG Display is the first manufacturer to develop strong visible LFDs for the transit hub equipped with robust, anti-glare and 24-hour-operable functionality suitable for busy and high-passing facilities where non-stop digital data transmission is a must.

By Technology

The market was dominated by LCD in 2024, as LCD TVs and brilliant screens are affordable, energy-efficient, and widely available in commercial and institutional sectors. It continues to be a ubiquitous option for corporate lobbies, classrooms, and information displays. NEC Display Solutions reiterates its leadership with premium LCD products ranging from 32 to 98 inches in size and up to 8K in resolution that deliver image performance, low power consumption, and easy integration at both standalone and multi-display environments.

Brightness level outdoor durability is likely to be the rapidly rising technology segment of LED during the forecast period owing to the availability of seamless bezel-less displays. The scaling also lends itself for massive video walls and larger public spaces. As a leader in the field of LED video wall technology, Leyard offers ultra-fine pixel pitch products for immersive advertising, command centers, entertainment venues, and high-end corporate applications where high-impact long-life, ultra-high-definition images are required.

By Product Type

Digital signage accounted for the largest share in 2024, which is attributed to increasing adoption of dynamic content delivery in retail, hospitality, and corporate sectors. Large Format Displays are known to be especially relied upon for the purpose of maintaining promotions, brand messaging and engaging with customers by businesses. Offering a full suite of 4K professional signage displays with options for remote content control and low power mode, Sony Corporation targets multiple commercial markets that would benefit from increased audience engagement and visual communication.

Video walls is anticipated to grow at the highest CAGR during 2025-2032 as their increasing adoption in control rooms, command center and public installations are supporting high growth in the segment. These systems provide immersive visualisation while integrating information in real time to base for decision making. Known for state-of-the-art applications of video wall technology, Barco develops scalable, modular, high-brightness and high-image uniformity display solutions for mission-critical environments such as emergency response, broadcasting, and corporate collaboration rooms where 24/7 vigilance is required.

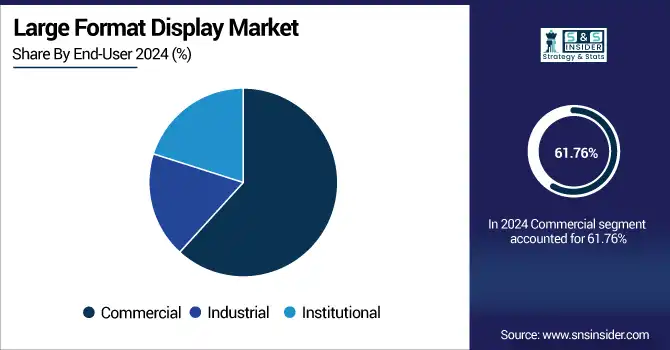

By End-User

Commercial segment held the largest revenue share in LFD market in 2024 and is likely to grow at rapid rate; the commercial segment was heavily adopted across shopping malls, airports, hotels, and corporate buildings. LFDs to promote ads, directions, events, and also internal communication are used by these venues. SummarySharp Corporation has an impressive portfolio of specially designed professional-grade large displays that seamlessly fit into the role of a commercial-grade asset with features like customizable formats, smart connectivity, and built-in content scheduling systems to save overhead costs and high visibilities.

The industrial segment is expected to experience the highest CAGR over the forecast period, as manufacturers, energy plants and transportation firms utilize LFDs for process visualization and real-time data presentation. Tough, middle men who make these displays to obtain them used in hard operational environments. ViewSonic provides industrial-grade LFDs that are characterized by high reliability, long hours of use and system compatibility that enables centralized control and machine interface in settings like factories, control rooms, and logistics centers that require precision and uptime.

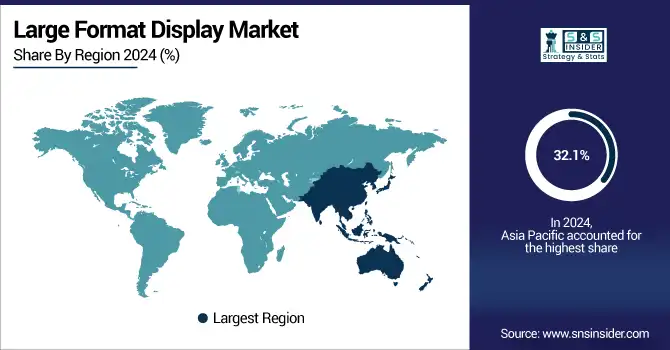

Large Format Display Market Regional Outlook:

North America’s large format display market is experiencing steady growth due to high demand across retail, corporate, and transportation sectors. Strong investments in smart infrastructure, advertising technologies, and public information systems are driving adoption. The region benefits from early technology adoption, presence of key players, and increasing deployment of digital signage in high-traffic environments like airports, malls, and corporate campuses.

-

The U.S. dominates the North American LFD market due to its advanced digital infrastructure, high retail density, and rapid adoption of smart signage. Strong corporate investments and robust public sector deployments further strengthen its leadership in the region.

Asia Pacific dominated the Large Format Display Market with the highest revenue share of about 32.1% in 2024. The region’s leadership is supported by strong infrastructure development, booming retail sectors, and expanding corporate environments in countries like China, Japan, and India. Government investment in smart city projects and public transportation further fuels adoption. Asia Pacific is also expected to grow at the fastest CAGR of about 8.05% from 2024-2032. This growth is driven by rapid urbanization, increasing consumer electronics spending, and technology-driven modernization of public information systems across emerging economies.

-

China leads the Asia Pacific LFD market owing to large-scale urbanization, extensive smart city projects, and widespread digital transformation. Government support and massive demand in transportation, retail, and education sectors continue to drive the country's dominant position in regional market growth.

Europe’s large format display market is growing steadily, driven by increased adoption in retail, transportation, and corporate sectors. Smart city initiatives, rising demand for digital out-of-home advertising, and technological advancements in LED and OLED displays are key contributors. Countries like Germany, the UK, and France are leading in deployment across public spaces, corporate environments, and infrastructure projects.

-

Germany is the dominating country in the European Large Format Display (LFD) market. This leadership is driven by its strong industrial base, advanced retail sector, and widespread adoption of digital signage in public infrastructure and transportation. Germany’s investment in smart cities and digital transformation across corporate and commercial spaces further reinforces its dominant position in the region.

The UAE dominates the Middle East & Africa LFD market due to extensive smart city developments, digital advertising growth, and high-tech infrastructure. In Latin America, Brazil leads the market with strong urban demand, expanding retail sectors, and increasing use of digital displays in public services and transportation across major metropolitan areas.

Get Customized Report as per Your Business Requirement - Enquiry Now

Large Format Display Companies are:

Major Key Players in Large Format Display Market are Samsung Electronics Co., Ltd., LG Display Co., Ltd., Sony Corporation, Sharp Corporation, NEC Display Solutions, Ltd., Barco NV, Leyard Optoelectronic Co., Ltd., ViewSonic Corporation, Panasonic Corporation, Delta Electronics, Inc and others.

Recent Developments:

-

In May 2025, At SID Display Week 2025, LG unveiled several next-gen display technologies, spotlighting a 22″ Micro‑LED panel designed for both automotive and large-format applications, alongside stretchable and slidable OLED solutions. These innovations highlight LG’s push toward flexible, scalable LFDs across mobility and commercial sectors.

-

In February 2025, Samsung launched its next-generation interactive smart signage displays at ISE 2025. The 105″ QPD‑5K (5K UHD, 21:9) and 115″ QHFX (4K, ultra-high brightness) feature bezel-free designs, multi-view capabilities, and AI-driven SmartThings Pro integration, marking a leap in workplace collaboration and immersive retail/display experiences.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.72 Billion |

| Market Size by 2032 | USD 21.24 Billion |

| CAGR | CAGR of 6.65% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Retail, Transportation, Corporate, Education, Entertainment) • By Technology (LCD, LED, OLED, DLP, Projection) • By Product Type (Digital Signage, Video Walls, Transparent Displays, Interactive Displays) • By End-User (Commercial, Industrial, Institutional) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co., Ltd., LG Display Co., Ltd., Sony Corporation, Sharp Corporation, NEC Display Solutions, Ltd., Barco NV, Leyard Optoelectronic Co., Ltd., ViewSonic Corporation, Panasonic Corporation, Delta Electronics, Inc. |