Industrial 3D Printing Market Size & Trends:

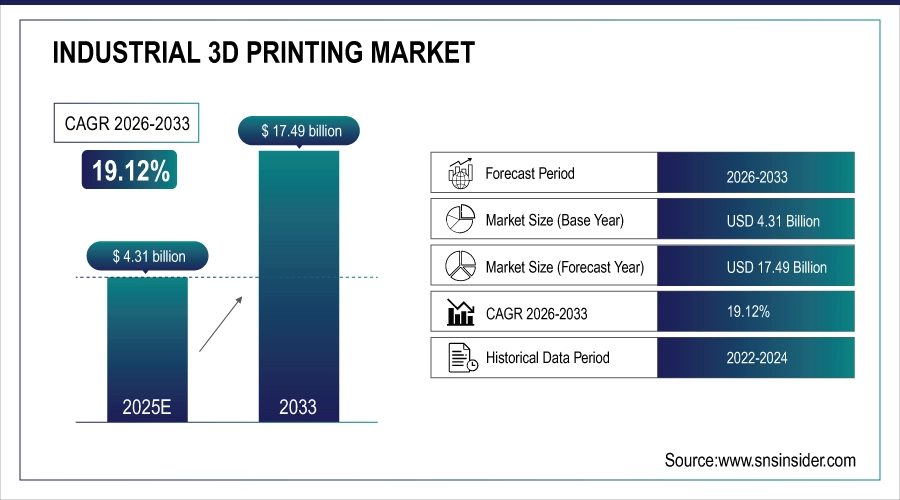

The Industrial 3D Printing Market Size was valued at USD 4.31 Billion in 2025 and is expected to reach USD 24.79 Billion by 2035 and grow at a CAGR of 19.12% over the forecast period 2026-2035.

Industrial 3D printing is going through rapid developments and growth due to the increased uptake in different sectors like aerospace, automotive, health care, and construction. For the years 2023 and 2024, government policies within the U.S., Germany, and China are the primary reason for the upsurge in adoption of 3D printing technologies. For example, the US government has invested much in additive manufacturing initiatives with its primary position pointing on defense and infrastructure projects. Meanwhile, the European Union's "Additive Manufacturing Action Plan" has supported development further in this sector. The innovations come in multi-material printing, where AI is integrated into 3D printing systems and high-speed printing processes for increased accuracy, efficiency, and scalability. For instance, Backflip-an AI technology startup founded by some of the minds behind 3D printing firm Markforged-has emerged from stealth with USD 30 million in funding.

Industrial 3D Printing Market Size and Growth Projection:

-

Market Size in 2025: USD 4.31 Billion

-

Market Size by 2035: USD 24.79 Billion

-

CAGR: 19.12% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get more information on Industrial 3D Printing Market - Request Sample Report

Industrial 3D Printing Market Highlights:

-

Customization capabilities drive demand as industries produce complex, tailored components with high precision, such as patient-specific implants and prosthetics in healthcare.

-

3D printing enables cost reduction and performance improvement in automotive parts by producing lightweight, efficient components.

-

Sustainability initiatives boost adoption by reducing material waste and aligning with global eco-friendly manufacturing goals.

-

Governments support additive manufacturing through policies promoting green production, such as the European Green Deal.

-

High upfront investment for industrial-grade 3D printers and associated software, training, and maintenance limits adoption, especially for SMEs.

-

Lack of skilled personnel further restrains growth, requiring investment in training and expertise to make technology more accessible.

U.S. Industrial 3D Printing Market Size Outlook

The U.S. Industrial 3D Printing Market Size is projected to grow from USD 1.62 Billion in 2025 to reach USD 9.30 Billion by 2035. Growth is driven by strong adoption in aerospace & defense for lightweight components, expansion in medical device and dental manufacturing, increasing use for automotive prototyping and tooling, and the transition from prototyping to serial production across major industry sectors.

Industrial 3D Printing Market Drivers:

-

Customization capabilities drive industrial 3D printing demand.

Customization is one of the major benefits of industrial 3D printing, where it allows industries to produce complex, tailored components with unprecedented precision. For instance, in the health industry, 3D printing supports the development of patient-specific implants and prosthetics for better patient results.

For instance, Singapore University of Technology and Design, working with the Foot Care and Limb Design Centre at Tan Tock Seng Hospital, employed 3D printing to develop a "patient-specific" upper limb prosthetic. It is designed to be less expensive by 20% but much cosmetically friendly with a built-in self-locking mechanism.

In the auto industry, firms use 3D printing for the development of lightweight, yet efficient parts; this helps lower the weight of a vehicle up to 30%. These capabilities reduce costs, enhance performance, and offer competitive advantages, driving widespread adoption across diverse sectors.

-

Sustainability initiatives boost industrial 3D printing adoption.

Sustainability has become an important aspect of industrial processes, and 3D printing has emerged as a green manufacturing solution. The technology reduces material waste because it deposits material only where necessary, cutting material wastage. Governments around the world are encouraging sustainable manufacturing, with policies such as the European Green Deal promoting additive manufacturing as an eco-friendly alternative.

In 2024, more than half of automotive and aerospace companies reported using 3D printing to achieve sustainability objectives, underlining its use in reducing environmental footprints. The alignment with global sustainability goals highly drives the demand for industrial 3D printing solutions.

Industrial 3D Printing Market Restraints:

-

High up-front investment barriers in industrial 3D printing.

Industrial 3D printing offers many benefits. However, one of the key barriers to industrial 3D printing adoption is the high investment required in obtaining and setting up advanced 3D printers. In 2023, a typical industrial-grade 3D printer would cost between USD 100,000 and USD 500,000, with additional expenses such as software, training, and maintenance. SMEs are a significant portion of the world's manufacturing. These companies face difficulty in justifying such expenditures.

Furthermore, a lack of skilled personnel makes matters worse because training programs and special expertise require additional investments. Government grants and subsidies in North America and Europe cannot offset the capital-intensive nature of industrial 3D printing, especially in emerging markets. Making this restraint more viable will require collective efforts from the manufacturing, governmental, and education sectors to bring down the price and make it more accessible.

Industrial 3D Printing Market Segment Analysis:

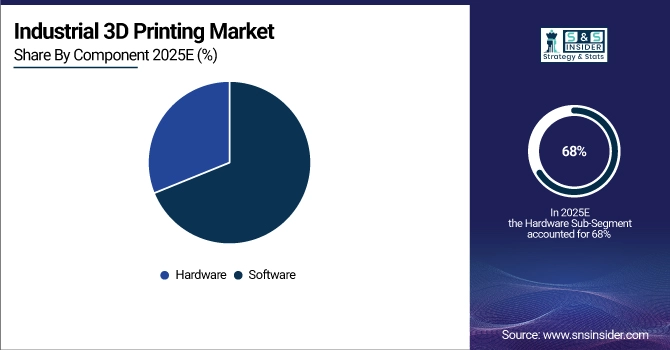

By Component

In 2025, the Hardware segment dominated the market with 68% market share due to the rising demand for advanced 3D printers in the aerospace and healthcare sectors. High-end machines are not only indispensable for manufacturing precise, reliable, and high-quality components but also critical applications such as aerospace engine parts and patient-specific medical implants. The ongoing demand for leading-edge hardware solutions points to 3D printers as the spine of industrial additive manufacturing processes, bringing unmatched accuracy and efficiency to a wide range of sectors.

The Software segment will grow at a pace of fastest CAGR 29.96% during the forecast period between 2026 and 2033. Here, the new developments in modelling, simulation, and design optimization are boosting efficiency as well as speeding up the entire production process for 3D modelling, simulation, and design optimization software.

By Technology

Stereolithography (SLA) technology dominated the Industrial 3D Printing Market in 2025, with 31% of market share, due to its high detail and smooth-finished prototype production. More applications of SLA in sectors such as dental, jewellery, and aerospace support its dominance.

SLA technology is poised to witness phenomenal growth with an estimated compound annual growth rate (CAGR) of 30.87% between 2026 and 2035. These developments in resin materials and increasing printing speeds will continue to make SLA increasingly efficient and versatile. The developments of resin formulations continue to enhance strength, accuracy, and versatility of application, while increasing the printing speeds will boost productivity across all sectors. SLA is fast becoming something that is being considered for healthcare, automotive, and consumer goods and is reshaping manufacturing with high-quality, rapid prototyping, and production solutions.

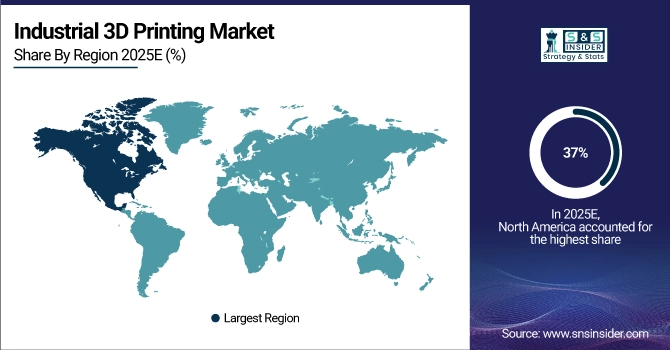

Industrial 3D Printing Market Regional Analysis:

North America Industrial 3D Printing Market Trends:

In 2025, North America dominated the Industrial 3D Printing Market with 37% of the market share, driven by robust investment in research and development and strong government support. This leadership is contributed to by the region's well-established manufacturing industries and early adoption of advanced technologies.

Need any customization research on Industrial 3D Printing Market - Enquiry Now

Asia-Pacific Industrial 3D Printing Market Trends:

The Asia Pacific region, on the other hand, is expected to grow the fastest with a CAGR of 20.10% during the forecast period from 2026 to 2035, driven by increasing industrialization, supporting government initiatives, and growing demand for customized manufacturing solutions in countries like China, India, and Japan. Given the plans of global manufacturers to spread their bases in the Asia Pacific region, the region is expected to become a significant force in the Industrial 3D Printing Market.

Europe Industrial 3D Printing Market Trends:

Europe is projected to hold a significant share of the Industrial 3D Printing Market, supported by strong aerospace, automotive, and healthcare sectors. In 2025, the region accounted for around 22% of the market, with growth driven by technological innovation, government incentives for advanced manufacturing, and increasing adoption of sustainable production solutions.

Latin America (LA) Industrial 3D Printing Market Trends:

Latin America is expected to witness moderate growth in the Industrial 3D Printing Market, driven by increasing adoption in automotive, aerospace, and healthcare sectors, as well as investments in digital manufacturing infrastructure. Growth is supported by government initiatives and ongoing industrial modernization.

Middle East & Africa (MEA) Industrial 3D Printing Market Trends:

The MEA region is anticipated to grow steadily in the Industrial 3D Printing Market, fueled by infrastructure development, government support for advanced manufacturing, and rising demand for rapid prototyping and customized production solutions. Adoption is increasing across aerospace, defense, and energy sectors.

Industrial 3D Printing Market Competitive Landscape:

Stratasys – Founded in 1989, Stratasys Ltd is a global leader in polymer 3D printing solutions, providing industrial-grade additive manufacturing systems, materials, and software. Serving aerospace, automotive, healthcare, and manufacturing sectors, Stratasys focuses on precision, reliability, and innovation, enabling rapid prototyping, tooling, and production of end-use parts worldwide.

-

In April 2025, Stratasys launches Neo800+ SLA 3D printer with 50% faster throughput; unveiled at AMUG 2025 and Rapid + TCT 2025, it offers improved print speed, reliability, and reduced post-processing for automotive, aerospace, and industrial applications

HP Inc. – Founded in 1939, HP Inc. is a global technology leader providing computing, printing, and 3D printing solutions. Its additive manufacturing portfolio includes Multi Jet Fusion and Metal Jet technologies, enabling cost-efficient, scalable, and sustainable production across industrial, automotive, healthcare, and consumer sectors worldwide.

-

In Nov 2024, HP accelerates 3D printing adoption with new polymer and metal innovations at Formnext 2024, introducing HP 3D Build Optimizer, halogen-free flame-retardant material, Metal Jet S100 platform updates, and collaborations with ArcelorMittal, Autodesk, and Fabrex to enhance scalability, cost-efficiency, and industrial workflow optimization

Industrial 3D Printing Companies are:

-

Materialise

-

HP Inc.

-

GE Additive

-

EOS GmbH

-

Desktop Metal

-

Formlabs

-

Renishaw

-

Ultimaker

-

Carbon

-

Markforged

-

Voxeljet

-

ExOne

-

Proto Labs

-

Zortrax

-

XYZprinting

-

FlashForge

-

Raise3D

-

Stratasys

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.31 Billion |

| Market Size by 2035 | USD 24.79 Billion |

| CAGR | CAGR of 19.12% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software), • By Process (Binder Jetting, Powder Bed Fusion, Direct Energy Deposition, Material Extrusion, Vat Photopolymerization, Material Jetting, Sheet Lamination), • By Application (Manufacturing, Prototyping, High Voltage), • By Industry (Automotive, Food & Culinary, Foundry & Forging, Jewellery, Consumer Goods, Aerospace & Defense, Printed Electronics, Healthcare, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | 3D Systems, Materialise, HP Inc., GE Additive, EOS GmbH, SLM Solutions, Desktop Metal, Formlabs, Renishaw, Ultimaker, Carbon, Markforged, Voxeljet, ExOne, Proto Labs, Zortrax, XYZprinting, FlashForge, Raise3D, Stratasys. |