IoT Telecom Services Market Report Scope & Overview:

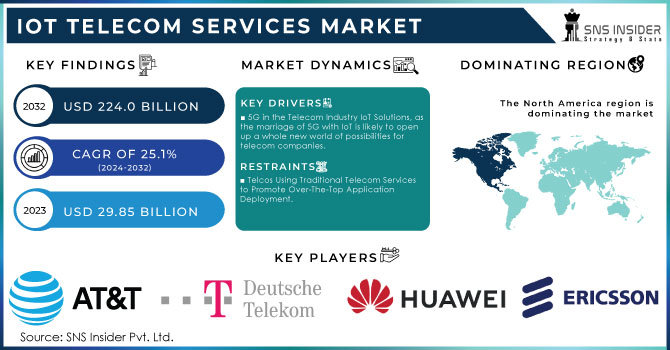

The IoT Telecom Services Market was valued at USD 30.55 billion in 2023 and is expected to reach USD 390.86 billion by 2032, growing at a CAGR of 32.78% over the forecast period 2024-2032.

Get more information on IoT Telecom Services Market - Request Sample Report

With the explosive growth of connected devices and seamless communication becoming the order of the day for various industries, the IoT Telecom Services market is rapidly expanding. With more businesses and consumers adopting IoT, a robust, effective, and secure network becomes fundamental. This is where the telecom companies claim their slice of the IoT pie, offering bespoke connectivity through options such as 5G or low-power wide-area networks (LPWAN) as the number of connected devices continues to increase. In addition to that, the growing inclination toward urbanization, automation, smart cities, and industrial Internet of Things where real-time data collection and analysis play a crucial role in improving operational efficiency is further complementing the demand for these services. As for 2024, the amount of connected IoT devices worldwide will surpass 30 billion, and 1.5 billion 5G connections will enable high-speed communications for IoT. Smart city IoT connections will exceed 800 million, while 2 billion devices will operate on LPWAN. Over 8 billion devices will be deployed in the Industrial IoT sector powered by automation and real-time analytics across industries.

In addition, rising applications in smart home automation, healthcare, vehicle telematics, and logistic tracking in the region are augmenting the growth of the market. Such sectors need dedicated network management and connectivity solutions to facilitate data-intensive operations. Another driver of the market is the growing need for security and performance monitoring in IoT ecosystems, and the management of data traffic. The unflagging growth of the IoT Telecom Services market over the coming years can be attributed, primarily, to the increasing demand for IoT solutions among businesses as they look to streamline operations, cut costs, and improve customer experience in a rapidly changing marketplace. The U.S. will have more than 400 million smart home devices by 2024, and 75% of hospitals will conduct IoT patient monitoring and asset management globally within the next few years. Over 45 million connected vehicles around the globe and 6 billion IoT devices are handled in logistics by that time for tracking in real-time. Costs of IoT investment will rise 40% toward better protection of connected devices and data traffic management.

Market Dynamics

Key Drivers:

-

5G Revolutionizes IoT Telecom Services Enabling Faster Communication and Connecting Devices Across Industries

5G revolutionizing the IoT telecom service space 5G offers ultrafast speeds, lower latency, and enormous capacity for connected devices to make it possible for many new applications to operate. It supports high-demand areas such as autonomous vehicles, industrial automation, and smart cities by enabling faster communication between IoT devices. As a result, one of the biggest reasons for the growth of IoT in real-time data-sensitive fields such as healthcare, transportation, manufacturing, etc. is the capacity to connect a vast number of devices with low latency. The global rollout of 5G networks along with the evolution of telecom service provider infrastructure to support these advanced IoT applications is also helping to accelerate market growth. In 2024, 55% of the world will be covered by the 5G network, 320 networks will be rolled out, and there will be 236 million 5G subscriptions in the U.S. Cellular IoT connections will exceed 4 billion, accounting for 22% of global IoT connections. Telefónica has reached 90% 5G mobile coverage in Spain now it serves 5,100 municipalities with 3.5 GHz band services.

-

Growing Demand for Data-Driven Decision Making Powered by IoT Across Industries Enhances Operational Efficiency

The other key factor is the growing demand for data-driven decision-making. Businesses in multiple industries are collecting massive amounts of data from IoT devices, increasingly using it to enhance operational efficiency, facilitate better customer experiences, and optimize resource utilization. Retail, manufacturing, logistics, and agriculture use IoT data for actionable insights, supply chain management, equipment health monitoring, and energy consumption optimization. The scale of data that is being generated increases every day, hence the need for strong IoT telecom services to allow data to be transferred, processed, and analyzed in real time. Telecoms are expanding their services around safe, scalable, and high-performance targeted toward the evolving needs of industries looking to make better and faster decisions. Predictive maintenance tech is anticipated to be used by 70% of manufacturers while IoT devices will generate 5.6 zettabytes of data annually by 2024. More than 50 billion IoT devices will be integrated into retail and 80 % of farms will embrace IoT for precision farming. Furthermore, 63% of enterprises in the logistics, healthcare, and manufacturing sectors will use IoT-enabled data analytics to aid in decision-making.

Restrain:

-

Overcoming Network Security Challenges and Interoperability Issues in the Expanding IoT Telecom Services Market

Network Security & Privacy concerns one of the significant restraints in the IoT Telecom Services Market. The growth of IoT devices generates an enormous volume of data needing safe transfer and storage. Data risks, hacking, and unauthorized access are critical cybersecurity issues to worry about. This is especially true in areas such as healthcare, where sensitive data is involved. The need of the telecom sector to protect user data and to develop trust with the widespread use of sound security measures & regulatory compliance leads to a significant investment, which can make acquiring ground in the market challenging. The IoT ecosystem consists of a wide array of devices, technologies, and platforms that tend to have poor interoperability across manufacturers and network providers. It adds friction in the area of smooth communication and data exchange between devices. Integration problems caused by a lack of common standards make it difficult, or even impossible, to deploy large-scale IoT solutions, especially in the case of smart cities where devices must work consistently.

Segment Analysis

By Connectivity Technology

In 2023, Cellular Technologies accounted for the largest revenue of the overall IoT Telecom Services market at 38.6%. Cellular networks like 4G and 5G provide fast connectivity, wide coverage, and reliability necessary for a variety of IoT applications in industries such as automotive, healthcare, and smart cities. These high-bandwidth technologies are a prerequisite for data-heavy applications like video surveillance, autonomous vehicles, and real-time monitoring of critical infrastructure. The widespread deployment of 5G networks around the world only solidifies the superiority of cellular technologies by providing ultra-low latency and the capability to interconnect millions of devices and its game-changing potential as a new IoT use case not possible with legacy technologies.

In contrast, NB-IoT (Narrowband IoT) anticipates its highest CAGR between 2024 and 2032, owing to its unique benefits for certain types of applications. NB-IoT is optimized for a low-power, wide-area network that is particularly well-suited for use cases that require long-range communication and long battery life, such as smart metering, agricultural sensors, and asset tracking. It works well in areas where cellular networks do not work well, such as in rural areas or underground locations. NB-IoT is being rapidly adopted due to the increasing need for low-cost and low-power IoT solutions. Moreover, since NB-IoT can use existing cellular infrastructures for its deployment, this is decreasing its deployment costs which entices telecom providers as well as the end user.

By Network Management Solution

In 2023, Network Performance Monitoring and Optimization (NPMO) has the largest share of the market 36.2%, due to the growing dependence of various industries on reliable and efficient network infrastructures. As higher need for high-speed internet, cloud computing, and IoT devices increases, it has become essential for businesses to ensure that networks are working at their optimum. These solutions play a key role in monitoring the traffic data, identifying bottlenecks, and providing insights that enhance its total performance. Particularly for eCommerce, healthcare, and finance sectors, businesses are pushed by their need for no downtime and seamless user experience consolidation of this trend.

Network Security Management (NSM) is anticipated to grow with the highest CAGR during the period 2024 to 2032, because of the increasing number of cyber threats as well as the growing sophistication of network environments. As the pandemic has propelled remote working, cloud adoption, and the use of connected devices, networks today are more susceptible than ever before to security breaches. This means that organizations need to be constantly vigilant, ensuring their network security against data breaches, DDoS attacks, malware, and other types of cyberattacks. This has accelerated the adoption of NSM solutions that secure sensitive data while ensuring compliance with regulatory standards. Rapid market growth will be spurred by the increasing sophistication of cyberattacks, which will require more advanced security management systems.

By Service Type

The Device & Application Management Services retained the market dominance with a 28.7% market share in 2023, owing to the growing nexus of devices and applications in personal and business environments. Because both organizations and individuals are increasingly dependent on various devices (smartphones, laptops, IoT devices, etc.) and applications, managing and maintaining these systems has become essential. Effective operation, performance monitoring, updates, and security for entire ecosystems of devices and applications have become services companies want to consume. Such trends are noteworthy against the backdrop of an increase in the number of remote work environments, digital transformation plans, and heightened reliance on mobile applications all of which help underpin consistent demand for these services management.

IoT billing & subscription management is projected to be the fastest-growing segment in terms of CAGR from 2024 to 2032, owing to the increasing proliferation of IoT devices and services in terms of usage. With IoT becoming omnipresent in areas such as manufacturing, healthcare, automotive, and smart cities, organizations have increasing complexity in managing the billing and subscription business model related to IoT services. They could be pay-per-use, data, or subscription-based, but they will require complex billing solutions to accommodate the deluge of transactions across devices and platforms and process them efficiently.

By Application

Industrial Manufacturing and Automation dominated the market in 2023 with a 24.7% share of the market from smart technologies becoming pervasive in manufacturing processes. With automation being increasingly adopted across industries to improve operational efficiency, minimize labor costs, and increase product quality, the need for connected systems capable of monitoring machinery, inventory, and processes has skyrocketed. Automation has been a big booster for productivity in manufacturing, enabling robotics, AI, and machine learning-based predictive maintenance and performance tuning. This trend is especially prevalent in applications where tight tolerances, fast throughput, and high volume are required, such as automotive, electronics, and consumer products industries.

The smart building and home automation segment is projected to grow at the highest CAGR during the forecast period (2024-2032) owing to the increase in demand for energy-efficient, connected, and comfortable living and working environments. Growing awareness over sustainable development, energy conservation, urbanization, and use of electricity and other natural resources has led to smart building technologies that facilitate automatic control over lighting, HVAC systems, security, and other crucial systems of a building, making them more attractive for consumers and enterprises across the globe. The sector is being driven by advancements in building management systems (BMS) that will integrate IoT devices like smart thermostats, security cameras, and home assistants, among others. Market expansion is further propelled by growing demand for home automation to enhance convenience and security, and most recently, the drive toward "green" buildings.

Regional Analysis

North America held the highest market share of 31.4% in 2023, due to modern technological infrastructure, innovative demand, and conducive economic conditions. Its dominance within industrial automation, IoT, and the smart sector has empowered the key verticals comprising greater automotive, healthcare, and manufacturing sectors around the region. Further, North American regions like the. S. have always been the first-world nation to adopt modern technology, with automated and digitization enterprises popping in rapidly. Where Gigafactories of Tesla would feature the most automated manufacturing, advanced robotics & AI would be used for warehouse operations by Amazon, already outsetting the global standards. In addition, the growing adoption of smart infrastructure, including smart grids, smart traffic management, and green buildings, in U.S. and Canadian cities is also boosting the growth of the market in the region.

Asia Pacific is projected to achieve the fastest compound annual growth rate during the period ranging from 2024 to 2032 owing to its swift urbanization the implementation of digital technologies along with rising middle class in developing economies. Nations such as China, India, and Japan are pouring more dollars into smart cities, IoT, and automation because of their growing populations and existing industrial requirements. Within the industrial automation space, China has emerged as a front-runner, with specific mention of smart city projects and 5G technological advancements being propelled via Huawei, while India is revolutionizing the digitalization process areas like agriculture, health care, and education. Japan has been a robotics powerhouse for decades, with manufacturers such as Fanuc and Kawasaki Robotics leading the way in factory automation. The expansion of Asia Pacific is expected to be faster than any other region during the next few years, as these nations keep updating their infrastructure and industry.

Need any customization research on IoT Telecom Services Market? - Ask For Customization

Key players

Some of the major players in the IoT Telecom Services Market are:

-

Verizon (IoT Connectivity, ThingSpace Platform),

-

China Mobile (OneNET IoT Platform, 5G IoT Modules),

-

AT&T, Inc (IoT Data Plans, Control Center),

-

Vodafone Group PLC (IoT Connectivity, Managed IoT Platforms),

-

Deutsche Telekom (IoT Connectivity, Data Intelligence Hub),

-

Reliance Jio (Jio 4G/5G Internet Connectivity, Jio GigaFiber),

-

Tata Communications (IoT Connectivity, Device Management),

-

Cavli Wireless (C-Series IoT Modules, Cavli Hubble Platform),

-

Telit Cinterion (IoT Modules, deviceWISE IoT Platform),

-

Plintron (IoT Connectivity, CPaaS Solutions),

-

MTN Group (5G Connectivity, IoT Solutions),

-

Telefónica (IoT Connectivity, Kite Platform),

-

Orange Business Services (IoT Connectivity, Live Objects Platform),

-

SK Telecom (IoT Connectivity, ThingPlug Platform),

-

NTT Docomo (IoT Connectivity, Toami Platform),

-

KDDI Corporation (IoT Connectivity, KDDI IoT Cloud),

-

Singtel (IoT Connectivity, IoT Managed Services),

-

Rogers Communications (IoT Connectivity, Smart Cities Solutions),

-

Telstra (IoT Connectivity, Telstra IoT Platform),

-

Swisscom (IoT Connectivity, IoT Platform)

Some of the Raw Material Suppliers for IoT Telecom Services Companies:

-

Quectel

-

Thales Group

-

Fibocom Wireless

-

u-blox Holding

-

Gigalight

-

Fibras Ópticas de México

-

NAG.company

-

Huawei Technologies

-

Cisco Systems

-

Ericsson

Recent Trends

-

In August 2024, Deutsche Telekom expanded its global IoT business by joining the Bridge Alliance, enabling streamlined IoT solutions across Asia, Europe, and beyond. Additionally, its partnership with Software AG enhances its Cloud of Things platform with advanced analytics and scalability for diverse industries.

-

In August 2024, Reliance Jio is expanding its 5G and IoT solutions with an indigenous 5G stack and innovative IoT platforms like JioKrishi to transform farming and other sectors. The company is also investing in edge computing to support real-time IoT applications across India.

-

In December 2024, Cavli Wireless launched its new CQM205 5G-NR IoT module offering high-speed connectivity for Industry 4.0 applications, alongside CQ10 and CQ20 LTE modules for diverse IoT solutions. These modules feature built-in eSIM/iSIM technology and global connectivity subscriptions through Cavli Hubble.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 30.55 Billion |

| Market Size by 2032 | USD 390.86 Billion |

| CAGR | CAGR of 32.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Connectivity Technology (Cellular Technologies, LPWAN, NB-IoT, RF-Based) • By Network Management Solution (Network Performance Monitoring and Optimization, Network Traffic Management, Network Security Management) • By Service Type (Business Consulting Services, Device and Application Management Services, Installation and Integration Services, IoT Billing and Subscription Management, M2M Billing Management) • By Application (Smart Building and Home Automation, Capillary Networks Management, Industrial Manufacturing and Automation, Vehicle Telematics, Transportation, Logistics Tracking, and Traffic Management, Energy and Utilities, Smart Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Verizon, China Mobile, AT&T, Vodafone Group, Deutsche Telekom, Reliance Jio, Tata Communications, Cavli Wireless, Telit Cinterion, Plintron, MTN Group, Telefónica, Orange Business Services, SK Telecom, NTT Docomo, KDDI Corporation, Singtel, Rogers Communications, Telstra, Swisscom. |

| Key Drivers | • 5G Revolutionizes IoT Telecom Services Enabling Faster Communication and Connecting Devices Across Industries • Growing Demand for Data Driven Decision Making Powered by IoT Across Industries Enhances Operational Efficiency |

| RESTRAINTS | • Overcoming Network Security Challenges and Interoperability Issues in the Expanding IoT Telecom Services Market |