Small-scale Bioreactors Market Report Scope & Overview:

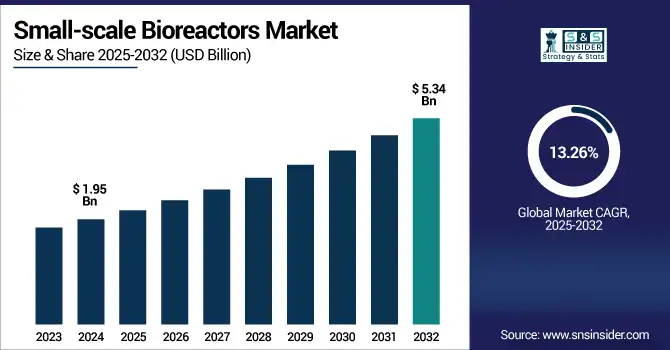

The small-scale bioreactors market size was valued at USD 1.95 billion in 2024 and is expected to reach USD 5.34 billion by 2032, growing at a CAGR of 13.26% over the forecast period of 2025-2032.

To Get more information on Small-scale-Bioreactors-Market - Request Free Sample Report

The global small-scale bioreactors market is anticipating a continuous growth with an increase in the demand for adjustable and scalable bioprocessing solutions for drug development, cell and gene therapy, and academic research. The growth of the market is attributed to factors such as growing acceptance for single-use systems, rising bioprocess automation, and an increasing number of biologics and biosimilars pipeline across the globe. An increase in R&D spending by pharmaceutical and biotech companies, paired with the emergence of contract research organizations (CROs) and contract manufacturing organizations (CMOs), has led to a demand for small bioreactors to expedite early-stage and pilot-scale bioproduction.

The U.S. small-scale bioreactors market size was valued at USD 0.64 billion in 2024 and is expected to reach USD 1.74 billion by 2032, growing at a CAGR of 13.17% over the forecast period of 2025-2032.

The U.S. leads the small-scale bioreactors market in North America, owing to the developed biotechnology industry and large number of leading pharmaceutical and bioprocessing companies located in this country, along with considerable investments for researchers. In addition, a high density of cell culture and biologics development, prominent academic and research institutes will positively impact the small-scale bioreactor market in the country.

Market Dynamics:

Drivers

-

Expansion of the Market Owing to Rising Demand for Biologics and Biosimilars

One of the most important factors promoting the small-scale bioreactors market growth is the increasing global demand for biologics, such as monoclonal antibodies, vaccines, and recombinant proteins. The demand for accurate and regulated development processes for these intricate biological medications begins early on, first at small scales throughout R&D and preclinical stages. Bioreactor small-scale equipment permits preliminary experimentation to be carried out to evaluate diverse cell lines, various culture conditions, and process variables. Moreover, with the increasing adoption of biosimilars as an affordable replacement for branded biologics, the demand for robust and scalable development platforms is amplified, thus driving the growth of small-scale bioreactors in the biopharmaceutical pipeline.

-

Growing Number of CROs and CMOs Drives the Market Growth

Pharma and biotech companies are relying more on outsourcing study, development, and manufacturing tasks with the aid of contract research organizations (CROs) and contract manufacturing organizations (CMOs) to cut back run costs and speed up market access. Small-scale bioreactors are well used by the CROs, CMOs, and early-phase drug development, process optimization, and some pilot-scale studies before large-scale commercial production. Such organizations need adaptive, economical systems that can be customized as per various projects and clients quickly. With increasing global outsourcing, there is an ever-growing requirement for these small-scale bioreactor systems in these facilities.

According to McKinsey & Company, patient-centric trial models and advanced AI technologies are influencing CROs to develop new service offerings in the area of early-stage bioprocessing.

Restraint

-

Limited Commercial Manufacturing Scalability is Restraining the Market from Growing

Scalability is one of the prominent restraining factors for the small-scale bioreactors market trends. Small-scale bioreactors are commonly utilized for initial R&D (research and development), process development, and proof-of-concept studies, but are frequently not amenable to direct scale-up for commercial manufacturing due to different configurations, mixing dynamics, oxygen transfer rates, and shear conditions. Consequently, bioprocesses that have been optimised in small-scale (1–5 liters) volumes can differ when transferred to the larger-scale bioreactor used in manufacturing.

For instance, the misalignment causes more time and resources for process revalidation and optimization in scale-up, prolonging commercialisation timelines and increasing production costs. Also, discrepancies between small and large systems can impact product yield or quality, making technology transfer even more complex. Therefore, the small-scale systems cannot be scaled up easily, so it is a big challenge for firms to run R&D to mass production smoothly.

Segmentation Analysis:

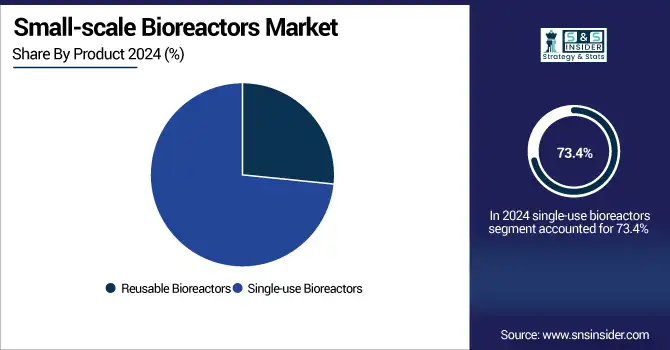

By Product

The single-use bioreactors segment dominated the small-scale bioreactors market share with a 73.4% in 2024, as it is one of the widely used types of bioreactors for research and process development for biologics, cell therapy, and gene therapy. Such systems can provide numerous advantages, such as lower cross-contamination risk, lower cleaning and validation costs, and quicker changeovers between batches. Plug-and-play design is perfect for academic institutions, biotech startups, and contract research organizations looking for speed and flexibility.

The reusable bioreactors segment is expected to experience significant growth in the forecast period due to their strength, scalability, and long-term cost management for consistent, repetitive research settings. A growing number of pharmaceutical and biopharmaceutical companies have begun the transition to scale-up production, or continuous- or high-throughput experiments, creating an increased need for reusable systems. They prove to be specifically useful in the setting in which process standardization and repeatability are required. Other technological advances, such as integrated automation or real-time monitoring, are making reusable systems even more attractive for biomanufacturing applications as they evolve.

By Capacity

The segment of 1L–3L dominated the small-scale bioreactors market share and accounted for 31.2% due to its favorable combination of volume and performance with regard to cost, which makes it suitable for early-stage research, process development, and optimization. This volume range is popular with academic research institutes, biotech, and pharmaceutical R&D labs due to it provides a significant enough volume to give a meaningful experimental output, but is still inexpensive and convenient to handle. The high level of adoption of 96-well plates across a variety of end users can be attributed to their compatibility with microbial and mammalian cell cultures and to the fact that these plates are often used in parallel bioreactor configurations.

The 3L–5L segment is projected to grow significantly during the forecast period as it serves the demand for a mid-sized system positioned between bench-scale and pilot-scale production phases. This capacity range caters to scale-up studies, high-end biologics research, and small-batch clinical manufacturing. As more organizations move toward biosimilars, cell and gene therapies, or personalized medicine, many are looking for bioreactors that can handle less simple, higher volume workflows. Scaling up to the 3L–5L range is gaining popularity across the board, from CMOs and CROs to mid-sized biopharma companies targeting efficiency, throughput, and scalability.

By End Use

The CROs & CMOs segment led the small-scale bioreactors market in 2024 with 68.04% market share, owing to the trend of increasing outsourcing of bioprocessing and drug development activities by pharmaceutical and biotech companies. Small-scale bioreactor systems within CROs and CMOs are seeing significant investments to support early-phase development, process optimization, and pilot-scale production. These facilities provide a low-cost, scalable bioprocessing solution and remain an attractive partner for new and seasoned drug developers alike. This capability of managing diverse client projects using flexible bioreactor systems has largely fueled demand in this end-use segment.

The academic & research institutes segment is anticipated to grow at the fastest CAGR as a result of increasing funding in the biotechnology research initiatives and increasing interest in biopharmaceutical innovation. There has been a marked increase in the use of small-scale bioreactors for cell biology, microbial fermentation, and process development method studies at both universities and public research institutions. Increased academic interest in early-stage R&D was encouraged by the growing emphasis on biosimilars, regenerative medicine, and personalized therapies. Furthermore, the presence of funding for research and collaborative academia and industry projects is also fostering bioreactor adoption in this segment.

Regional Analysis:

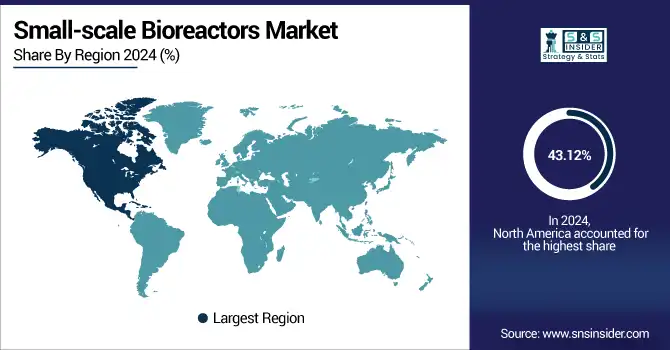

The small-scale bioreactors market dominated in North America with 43.12% market share in 2024, is driven by a strong presence of established biotechnology and pharmaceutical sectors that are significant end-users of advanced bioprocessing technologies. It has the major market players, research institutions, key academic institutions involved in this field, and a significant number of contract research and manufacturing organizations (CROs and CMOs). Moreover, significant government and private sector spending towards R&D, especially in biologics, biosimilars, and cell and gene therapies, has markedly increased demand for small-scale bioreactors for early-stage development and process development.

The small-scale bioreactors market analysis in Asia Pacific is estimated to grow at the fastest rate with a 13.96% CAGR over the forecast period, owing to the high biopharmaceutical manufacturing activity in the region, increasing government support for biopharmaceutical innovation, and the development of R&D infrastructures in developing countries such as China, India, South Korea, and Japan. Furthermore, the emergence of single-use disposable technologies, in addition to expanding local CROs/CMOs, is contributing to the expansion of market growth in the case of these biotechnology clusters. In addition, the growing demand for economical, across a wide scale of bioprocessing solutions for the bioproduction in academia and industry, is further stimulating the adoption of small-scale bioreactors across the region.

Europe exhibits significant growth over the forecast period due to the increasing adoption of advanced, flexible bioprocessing technologies, and expanding biopharmaceutical R&D activities are driving the growth of the small-scale bioreactors market. A robust presence of global market players, together with mature research infrastructure and increasing public and private sector support for biotechnology innovation, is stimulating growth in the region.

Moreover, growing adoption of single-use bioreactors, especially in the developmental phase and academic research, is expected to drive the market growth. Europe is gradually becoming a core regional growth segment of the global and small-scale bioreactors landscape owing to increasing investments in biomanufacturing capabilities amid the growth momentum in biosimilars and personalized medicine.

The steady growth of the Latin American small-scale bioreactors market is attributed to the rising implementation of bioprocessing technologies in the pharmaceutical, biotechnology, and food and beverage sectors. The country is directing funds toward research infrastructure and supporting the adoption of small bioreactor systems across university laboratories and new bioentreprises. An upsurge in indigenous CMOs and collaborations with global players is further helping the market grow throughout the region.

Gradual growth is found in the MEA region as well, with increasing life science investments steadily in countries such as the UAE and Saudi Arabia. With these countries improving their healthcare and biotech capacity, the bioreactors used for early-stage research and pilot-scale production are only going to rise. Although market penetration is still low when compared to the rest of the globe, the aspirational push for economic diversification & innovation in biomanufacturing is showing a modestly optimistic market trajectory for the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Small-scale bioreactor companies, Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA, GE Healthcare, Danaher Corporation, Eppendorf AG, Lonza Group AG, Miltenyi Biotec B.V. & Co. KG, Solaris Biotechnology Srl, Infors AG, and other players.

Recent Developments

-

April 2025 – Thermo Fisher Scientific Inc., the global leader in science and laboratory solutions, is pleased to introduce its 5L DynaDrive Single-Use Bioreactor (S.U.B.) that meets the changing needs of contemporary bioprocessing. The new 5L model expands Thermo Fisher's full range of bioreactors to provide scalability from 1 to 5,000 liters to facilitate bench-scale process development.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.95 Billion |

| Market Size by 2032 | USD 5.34 Billion |

| CAGR | CAGR of 13.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reusable Bioreactors, Single-use Bioreactors) • By Capacity (5 mL–100 mL, 100 mL–250 mL, 250 mL–500 mL, 500 mL–1 L, 1 L–3 L, 3 L–5 L) • By End Use (Pharmaceutical & Biopharmaceutical Companies, CROs & CMOs, Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA, GE Healthcare, Danaher Corporation, Eppendorf AG, Lonza Group AG, Miltenyi Biotec B.V. & Co. KG, Solaris Biotechnology Srl, Infors AG, and other players. |