Smart Air Conditioning Market Size & Trends:

The Smart Air Conditioning Market Size was valued at USD 17.65 billion in 2023 and is expected to reach USD 55.10 billion by 2032, growing at a CAGR of 13.52% over the forecast period 2024-2032. With consumers increasingly looking for energy-efficient, connected products delivering improved comfort and efficiency, the Smart Air Conditioning market is witnessing a growing adoption of smart features.

To Get more information on Smart Air Conditioning Market - Request Free Sample Report

Using product features such as integrated systems to manage temperature, humidity and ventilation is the new normal, with IoT and AI-driven controls gaining prominence. The unwavering demand makes supply chain efficiency an important pillar for manufacturers, with strategies focused on making production and delivery seamless. Moreover, consumer retention and loyalty is a big one, as customers that benefit from high comfort and an energy efficient solution may become more loyal to the brand that provides a quality and reliable smart air conditioning product.

Smart Air Conditioning Market Dynamics

Key Drivers:

-

Rising Demand for Energy Efficient Smart Air Conditioning Solutions Drives Market Growth

Constant demand for energy-efficient solutions along with growing market awareness about sustainability is fuelling the Smart Air Conditioning market. With both consumers and businesses working towards reducing energy consumption smart air conditioning systems that continuously regulate temperature, humidity, and wind volume have become extremely popular. Such systems provide accurate control allowing you to reduce energy bills while increasing comfort. Moreover, the implementation of smart technologies like IoT and AI enables remote monitoring, real-time tuning, and predictive maintenance, making these solutions a better choice for tech-savvy customers. Additionally, the global focus on decreasing carbon footprints also promotes the adoption of sustainable air conditioners, thereby propelling the growth of the market.

Restrain:

-

Challenges in Technological Integration and Infrastructure Limit Smart Air Conditioning Adoption

Several restraints within the smart air conditioning market are associated with technological integration and standardization. As these systems advance, ensuring integration into infrastructure is not simple. Many older buildings (or for that matter even infrastructure) cannot simply be retrofitted with the modern, smart systems the future will require, which can create a backlog for adoption. Finally, the fast pace of tech innovation can create problems with interconnectivity, as devices made by different companies may have trouble talking to one another, irritating end users and preventing fully connected systems from reaching critical mass. Such infrastructure divides can create barriers to broader-scale smart air conditioning solutions, especially in countries with aging infrastructure.

Opportunity:

-

Opportunities in Smart Air Conditioning Market Driven by Smart Homes and AI Integration

The rise of smart homes and commercial buildings has created vast opportunities in the Smart Air Conditioning market. With automation slowly becoming a routine, it is crucial to integrate the air conditioning systems within the smart home ecosystems which is expected to bring a lot of growth. The most significant advantage of Smart HVAC. The increasing availability of AI-based systems, which can learn about the preferences of users and adapt settings based on these preferences, is another factor that is expected to continue stimulating development in this market. Smart air conditioning systems also have great untapped potential to grow in emerging markets experiencing rapid urbanization.

Challenges:

-

Lack of Awareness and Data Privacy Concerns Hinder Smart Air Conditioning Market Growth

Lack of awareness and understanding of smart air conditioning advantages in several regions is another obstacle for the market. In other markets, consumers may be unaware of what smart air conditioners can even do to improve energy efficiency and comfort. This has led to a situation of perhaps low demand, and adoption will probably be slowing above the planned roadmap. Additionally, it can be difficult for users to put their faith in these systems, largely due to data privacy and security, as most smart systems track personal usage data. While education and strong data protection will be needed to break through these barriers, the smart air conditioning market needs to grow.

Smart Air Conditioning Market Segmentation Overview

By Product

Temperature Control Segment led the Smart Air Conditioning market with a 40.6% share in 2023. Temperature control in air conditioning systems being a basic function necessarily makes temperature control one main factor influencing comfort and energy efficiency.

Integrated Control is expected to experience the fastest growth in the market from 2024 to 2032. The market is witnessing a paradigm shift, with consumer inclinations moving toward all-inclusive solutions that can manage temperature, humidity, and ventilation together, coupled with state-of-the-art IoT and AI-driven functionalities in integrated systems, which we expect will fuel rapid growth in this segment.

By Application

In 2023, Residential Buildings held a 48.8% share in the Smart Air Conditioning market. With the trend towards increasingly energy-efficient homes, the consumer adoption of advanced air conditioning systems has played a frontal role in boosting the smart air conditioning systems market from side to side this year till now.

The Commercial Buildings segment is expected to experience the fastest growth in CAGR from 2024 to 2032. The demand for smart air conditioning solutions will be driven by the growth of commercial properties and businesses focusing on energy savings, sustainability, and automation this demand will be particularly high for large-scale buildings with centralized control and optimized operations.

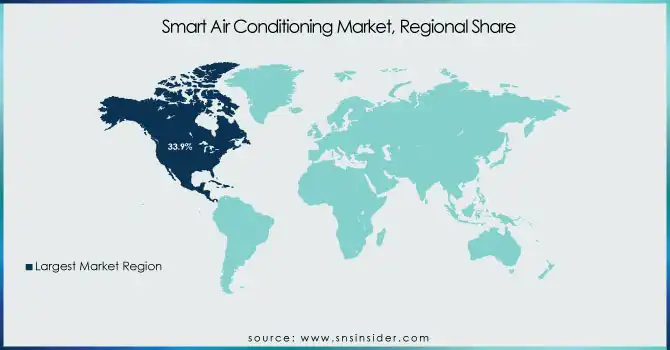

Smart Air Conditioning Market Regional Analysis

North America led the global smart air conditioning market, holding a 33.9% market share in 2023, owing to rising consumer concerns over energy-efficient solutions & quick technological progress. This is attributed to the high disposable income, sustainable environment awareness, and extensive utilization of smart home technologies in the area. For instance, in the U.S. Nest Labs sells smart thermostats that work with air conditioning systems. Elsewhere in North America, there is also widescale adoption of smart HVAC systems for commercial premises like Carrier's IoT-equipped AquaEdge 19DV system that reduces commercial high-yield energy consumption.

Asia Pacific is projected to witness the fastest growth in terms of compound annual growth rate (CAGR) from 2024 to 2032, owing to the high rate of urbanization, economic growth coupled with rapidly increasing adoption of smart technologies. This growth is driven by countries such as China, India and Japan. Take the example of Daikin, a key foreign manufacturer of equipment used in residential or commercial buildings in Japan, leading the innovations in smart air conditioning systems. Recently, smart systems have also been integrated into new high-rise residential buildings in China as well, with companies testing the limits of the smart air conditioning boundaries like Midea, Gree Electric and others.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart Air Conditioning Market are:

-

Daikin (Daikin Intelligent Touch, Daikin Ururu Sarara)

-

Carrier (Infinity 20, Performance Series)

-

Mitsubishi Electric (Mitsubishi MSZ-GL, Mitsubishi SEZ-KD)

-

LG Electronics (LG Art Cool, LG Dual Inverter)

-

Panasonic (Panasonic Econavi, Panasonic Nanoe X)

-

Samsung Electronics (Wind-Free AC, SmartThings AC)

-

Honeywell (Lyric T5, Honeywell Wi-Fi Smart Thermostat)

-

Fujitsu General (Fujitsu Airstage, Fujitsu Split System)

-

Toshiba (Toshiba SMMSU, Toshiba VRF)

-

Voltas (Voltas Inverter AC, Voltas 1.5 Ton Split AC)

-

Trane (Trane XL824, Trane XR14)

-

Johnson Controls (York YVFA, York YVAA)

-

Blue Star (Blue Star Inverter AC, Blue Star Split AC)

-

Gree Electric (Gree Inverter AC, Gree Smart AC)

-

Haier (Haier i-Climate, Haier Smart Air Conditioner)

Recent Developement

-

In December 2024, Daikin announced the release of its Smart Control System (SCS), designed to optimize HVAC system performance for small to medium-sized commercial spaces.

-

In March 2024, Voltas launched its IoT-enabled SmartAir ACs with super-silent operation, featuring energy tracking and compatibility with Alexa and Google Home.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.65 Billion |

| Market Size by 2032 | USD 55.10 Billion |

| CAGR | CAGR of 13.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Temperature Control, Humidity Control, Ventilation Control, Integrated Control) • By Application (Residential Buildings, Commercial Buildings, Industrial Buildings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin, Carrier, Mitsubishi Electric, LG Electronics, Panasonic, Samsung Electronics, Honeywell, Fujitsu General, Toshiba, Voltas, Trane, Johnson Controls, Blue Star, Gree Electric, Haier. |