Smart Inhalers Market Size Analysis

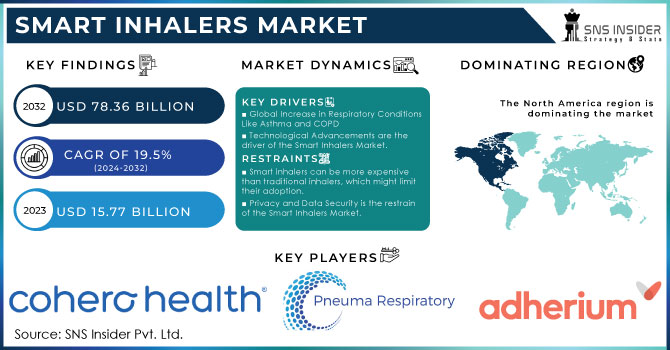

The Smart Inhalers Market size was valued at USD 1.85 Billion in 2025E and is expected to reach USD 5.30 Billion by 2033, growing at a CAGR of 14.00% over the forecast period of 2026-2033.

This report identifies the growing prevalence and incidence of respiratory illness driving demand for innovative inhalation therapy. The research analyzes trends in smart inhaler prescriptions globally by region, with a focus on differences in adoption rates and access. The report also delves into advances in technology, such as the incorporation of digital health solutions, AI-enabled monitoring, and connectivity functionalities to improve patient care. The report also evaluates regulatory and compliance patterns, including approval procedures, data protection, and compliance with healthcare standards.

Market Size and Forecast:

-

Smart Inhalers SMS Market Size in 2025E: USD 1.85 Billion

-

Smart Inhalers SMS Market Size by 2033: USD 5.30 Billion

-

CAGR: 14.00% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Smart Inhalers Market - Request Sample Report

Key Smart Inhalers SMS Market Trends

-

Development of interoperable smart inhaler ecosystems

-

Focus on reducing hospital readmissions and healthcare costs

-

Growing investments from venture capital and healthtech funds

-

Incorporation of gamification to boost patient engagement

-

Integration with wearable respiratory monitoring devices

-

Geographic expansion into emerging healthcare markets

-

Use of blockchain for secure health data management

The U.S. Smart Inhalers market size was valued at an estimated USD 0.78 billion in 2025 and is projected to reach USD 2.25 billion by 2033, growing at a CAGR of 13.8% over the forecast period 2026–2033. Market growth is driven by the rising prevalence of respiratory diseases such as asthma and COPD, increasing focus on medication adherence, and growing adoption of connected healthcare devices. Smart inhalers enable real-time monitoring, dosage tracking, and data-driven disease management, significantly improving patient outcomes. Additionally, advancements in digital health platforms, integration with mobile applications and cloud-based analytics, supportive reimbursement policies, and increasing investments in respiratory care technologies further strengthen the growth outlook of the U.S. smart inhalers market during the forecast period.

Smart Inhalers SMS Market Growth Drivers

-

The rising incidence of asthma and chronic obstructive pulmonary disease (COPD) is a primary driver of the smart inhaler market.

As per the WHO, asthma affects almost 262 million individuals across the globe, whereas COPD is the third most common cause of death and contributes to 3.23 million deaths each year. Conventional inhalers are usually plagued by low adherence, with research indicating that almost 50% of asthma sufferers fail to utilize their inhalers appropriately. Smart inhalers, which are supported by Bluetooth and AI-based monitoring systems, help enhance adherence substantially by delivering real-time medication reminders and tracking. Firms such as Propeller Health and Teva Pharmaceuticals have launched inhalers that connect to mobile apps, cutting hospitalization by as much as 50%. Also, the use of AI and IoT in intelligent inhalers is increasing customized treatment regimens, which are more attractive to insurers and healthcare providers.

Smart Inhalers SMS Market Restraints

-

High Cost and Limited Reimbursement Policies Hindering Adoption

Smart inhalers are priced from USD 100 to USD 300, while traditional inhalers are priced from USD 20 to USD 60, and hence they are less affordable, particularly among low-income patients. Additionally, most healthcare systems and payers do not cover smart inhalers completely, and thus patient adoption is restricted. A Journal of Asthma and Allergy study discovered that 30% of users of smart inhalers get reimbursement from their insurance, whereas 80% of users of conventional inhalers do. The absence of harmonized pricing and reimbursement structures between various healthcare markets also adds to the complexity of adoption, limiting the broad utilization of smart inhalers despite their clinical value.

Smart Inhalers SMS Market Opportunities

-

The growing adoption of telemedicine and digital health solutions is opening new avenues for smart inhalers.

With growing dependence on remote patient monitoring, telehealth-enabled smart inhalers allow real-time data exchange with healthcare professionals, allowing for timely interventions. AstraZeneca's BreathSmart initiative has reported a 30% decrease in emergency visits by integrating smart inhalers into remote care programs. Moreover, partnerships between pharmaceutical companies and technology companies are fueling innovation in this area. For instance, Google's Verily and Novartis are developing AI-enhanced inhalers to improve the management of respiratory disease. Additionally, the movement towards value-based healthcare models is prompting insurers to cover smart inhalers, considering their ability to enhance patient outcomes and reduce long-term medical costs.

Smart Inhalers SMS Market

-

Data Privacy Concerns and Regulatory Hurdles Slowing Adoption

While smart inhalers bring with them immense advantages, issues of data privacy and regulatory requirements present hurdles. Smart inhalers gather sensitive health information, which creates fears of cybersecurity and loss of data. According to IBM Security research, healthcare data breaches grew by 25% in 2023, and because of this, patients hesitate to share inhaler usage information with third parties. In addition, regulatory clearance for smart inhalers differs widely by geography, with bodies such as the FDA and EMA having strong guidelines for digital health devices. Delays in clearance may slow market entry for new entrants. Furthermore, interoperability with current electronic health records (EHR) systems complicates integration, slowing hospital and clinic adoption. Firms need to overcome these regulatory and technical hurdles to realize the full potential of smart inhalers in respiratory medicine.

Smart Inhalers SMS Market Segment Analysis

By Type

In 2025, the Metered Dose Inhalers (MDIs) segment led the smart inhalers market with the highest revenue share of 65.1%. MDIs are the most favored inhalation devices because they are portable, accurate in drug delivery, and can be used in conjunction with smart technology for real-time tracking of drug use. Their established history in the market and popularity among healthcare providers and patients also establish their stronghold. In addition, MDIs are commonly prescribed for asthma and COPD, thereby increasing their market share. Nonetheless, the Dry Powdered Inhalers (DPIs) segment is anticipated to expand at the highest rate over the next few years. The reason for such growth is the growing patient demand for breath-actuated devices that are propellant-free, thus being environmentally friendly as well as convenient for patients suffering from coordination issues. Additionally, advancements in powder formulation technology have enhanced DPI stability and potency, thus leading to its use as a top choice among young patients and eco-conscious individuals searching for sustainable products. The presence of regulatory approval for environmentally friendly inhalers further fuels innovation in DPI creation, further stimulating growth.

By Indication

COPD held the highest revenue share of 50.7% in 2025 due to the increasing incidence of chronic respiratory diseases as a result of aging populations, smoking behaviors, and growing exposure to air pollution. COPD patients need long-term care, and smart inhalers are a crucial component of treatment to track medication compliance and monitor disease progression. Moreover, the rising hospitalization burden of COPD has increased healthcare investments in digital respiratory products. The smart inhalers' capability to give real-time feedback to healthcare professionals for improved treatment adjustments has boosted their robust uptake in COPD management. On the other hand, the asthma segment is anticipated to witness the highest growth over the coming years. This growth is due to increasing awareness regarding asthma management, a growing rate of asthma diagnoses among children and adults, and the rising usage of smart inhalers for better disease control. Advances in inhaler connectivity, mobile app integration, and remote monitoring capabilities have also increased asthma control. Further, government programs that enhance respiratory health awareness and reimbursement policies for smart inhaler devices are likely to boost the demand for smart inhalers in asthma management.

By Distribution Channel

Hospital pharmacies retained the largest revenue share of 45.3% in 2025, as hospitals are still the first point of treatment for respiratory conditions. Healthcare professionals in hospitals have a critical role to play in prescribing smart inhalers, ensuring correct usage, and tracking patient compliance. The availability of specialist respiratory care units, where sophisticated treatments are typically started, also enhances the role of hospital pharmacies in dispensing smart inhalers. Besides, access to insurance reimbursement policies and availability of hospital-level coverage incentivizes greater access to these new breathing machines among more patients from the hospitals' pharmacies.

Online pharmacies will see the strongest growth, which is boosted by enhanced digitalization of the health sector, wider popularity of the internet as an e-commerce mode, and availability of doorstep delivery. Increased use of telemedicine and direct sales to consumers by pharmaceutical manufacturers has also boosted the quick growth of online pharmacies. In addition, patients wanting value for money tend to be inclined towards online stores that provide products at competitive prices, discounts, and simple accessibility to a variety of inhaler products. The growing penetration of Internet and smartphone use, especially in emerging economies, is also driving the demand for online pharmacies as a primary channel of distribution for smart inhalers.

By End Use

Hospitals held the highest revenue share of 51.5% in 2025, given that they are major healthcare centers where respiratory diseases are diagnosed and treated. Smart inhalers are commonly prescribed within hospitals, particularly for patients with uncontrolled or severe asthma and COPD. The presence of sophisticated respiratory diagnostic equipment, specialized pulmonology units, and inpatient care services within hospitals explains the dominant market position of this segment. In addition, hospitals are increasingly using smart inhaler technology to enhance treatment outcomes through remote monitoring and integrated healthcare solutions.

Nevertheless, homecare settings are expected to be the fastest-growing segment due to the growing preference for home-based chronic disease management and the evolution of remote patient monitoring. In light of an increase in telehealth services, patients suffering from respiratory diseases can now receive remote consultations and digital prescriptions, minimizing the frequency of hospital visits. Ease of treatment of respiratory diseases at home and increasing availability of smart inhalers, which are synced with mobile apps for real-time monitoring, is further fueling the trend. Furthermore, the growing population of geriatric patients, who opt for home-based treatment options, and the trend toward customized healthcare are also major drivers boosting the growth of the homecare settings segment.

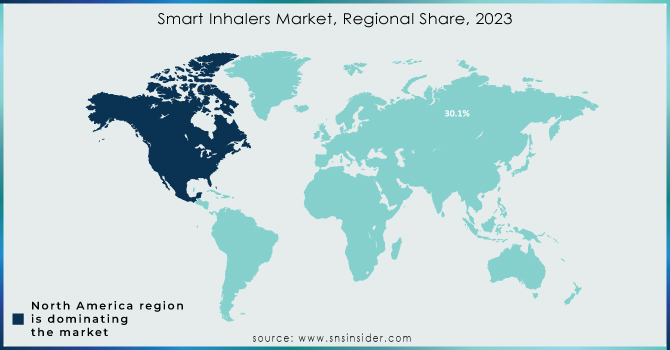

Smart Inhalers SMS Market Regional Analysis

North America Smart Inhalers SMS Market Insights

North America led the market with the highest revenue share attributed to developed healthcare infrastructure, high rates of adoption of digital health solutions, and rising respiratory disease incidence. The United States leads the market driven by favorable healthcare reimbursement policies, growing numbers of COPD and asthma patients, and improved awareness of the advantages of smart inhalers. Europe is next in line, with Germany, the UK, and France making significant contributions owing to government support for digital healthcare, favorable regulatory policies, and growing demand for networked respiratory devices. The region also enjoys the support of partnerships between pharmaceuticals and digital health companies to create sophisticated inhalation therapies.

Asia Pacific Smart Inhalers SMS Market Insights

The Asia-Pacific region is the most rapidly growing market, driven by a growing geriatric population, mounting air pollution levels resulting in rising respiratory disease rates, and rising healthcare access. China, Japan, and India are the prime contributors, with rising investments in digital healthcare technology and a trend towards remote patient monitoring solutions. The presence of large pharmaceutical companies and rising smartphone penetration also fuel market growth in this region.

Europe Smart Inhalers Market Insights

The Europe Smart Inhalers Market is witnessing robust growth in 2025, supported by the region’s strong healthcare infrastructure, advanced digital health ecosystem, and increasing prevalence of chronic respiratory conditions such as asthma and COPD. Key markets like the U.K., Germany, and France are showing rising adoption of connected inhaler devices and digital adherence platforms as part of national healthcare digitization programs. Stringent EU medical device regulations (MDR) and GDPR-driven data security norms are pushing manufacturers to develop compliant and secure smart respiratory devices. Furthermore, collaborations between pharmaceutical companies, med-tech firms, and digital health startups are accelerating innovation, driving improved patient outcomes and fueling market growth across the region.

Latin America (LATAM) Smart Inhalers Market Insights

The LATAM Smart Inhalers Market is gradually expanding in 2025, driven by increasing healthcare digitization initiatives, a rising burden of respiratory diseases, and improving access to connected medical devices. Countries like Brazil, Mexico, and Argentina are emerging as early adopters of smart inhalers integrated with mobile health platforms for remote monitoring and adherence tracking. Government-led efforts to modernize healthcare infrastructure, coupled with growing partnerships between local hospitals and international digital health providers, are boosting market entry opportunities. Moreover, the region’s expanding pharmaceutical distribution network and growing smartphone penetration are enhancing the scalability of smart inhaler solutions, contributing to consistent market growth.

Middle East & Africa (MEA) Smart Inhalers Market Insights

The MEA Smart Inhalers Market is gaining significant momentum in 2025, fueled by increasing healthcare investments, rising prevalence of respiratory ailments, and rapid adoption of telehealth solutions. Key countries such as the UAE, Saudi Arabia, and South Africa are increasingly implementing connected inhaler systems as part of broader national health digitalization strategies. Regional healthcare providers are partnering with global med-tech firms to deploy remote patient monitoring solutions that leverage smart inhalers for real-time data collection and personalized therapy. Additionally, government efforts to expand universal healthcare access, coupled with growing health insurance coverage and digital literacy, are accelerating the adoption of smart inhaler technologies across the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Smart Inhalers SMS Market Competitive Landscape

Modivcare Inc.

Modivcare Inc. is a leading provider of technology-enabled healthcare services, offering remote patient monitoring (RPM), personal health engagement, and care coordination through its subsidiaries VRI and Higi Care. The company focuses on improving patient outcomes and reducing healthcare costs by integrating innovative digital health solutions.

-

In October 2024, Modivcare Inc., through its subsidiaries VRI and Higi Care, partnered with Tenovi to integrate Adherium’s Hailie Smart Inhalers into its remote patient monitoring solutions. This collaboration aims to enhance respiratory care, reduce hospitalizations, and lower healthcare costs for patients with chronic respiratory diseases.

Aseptika Ltd.

Aseptika Ltd. is a UK-based health technology company specializing in connected health solutions and self-monitoring platforms for patients with long-term respiratory and cardiac conditions. The company develops devices and software that support early intervention and improve treatment adherence.

-

In June 2024, Aseptika introduced the PUFFClicker3, a universal inhaler dose counter compatible with 101 SNOMED-coded inhalers across both pressurized metered-dose inhalers (pMDIs) and dry powder inhalers (DPIs). This innovation enhances medication tracking and adherence, contributing to the growing adoption of smart respiratory management solutions.

Key Players in the Smart Inhalers Market

-

Presspart Verwaltungs GmbH – eMDI

-

Personal Air Quality Systems Pvt Ltd – Respiratory Monitoring Device

-

COHERO Health Inc. (AptarGroup, Inc.) – HeroTracker Sense

-

Cognita Labs – CapMedic

-

Adherium – Hailie Smart Inhaler

-

Amiko Digital Health Limited – Respiro

-

Teva Pharmaceuticals Industries Ltd. – ProAir Digihaler, AirDuo Digihaler

-

Propeller Health (ResMed) – Propeller Sensor

-

Novartis AG – Enerzair Breezhaler, Breezhaler

-

Pneuma Respiratory Inc. – Pneuma Inhaler

-

3M – 3M Intelligent Inhaler

-

AireHealth, Inc. – AireHealth Smart Inhaler

-

FindAir Sp. z o.o – FindAir ONE

-

Sanofi – Smart Inhaler Device

-

Sana Health – Digital Respiratory Device

-

Cureatr – Connected Inhaler Solution

-

Boehringer Ingelheim – Respimat

-

Cipla – Cipla Smart Inhaler

-

MediSprout – Remote Monitoring Inhaler

-

AeroFuck – Smart Inhaler Technology

-

GlaxoSmithKline – Ellipta Smart Inhaler

-

Mylan – Smart Respiratory Device

-

Incube Labs – Digital Inhaler Platform

-

Rugged Science – Connected Inhaler System

| Report Attributes | Details |

| Market Size in 2025E | USD 1.85 Billion |

| Market Size by 2033 | USD 5.30 Billion |

| CAGR | CAGR of 14.00% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Dry Powdered Inhalers (DPIs), Metered Dose Inhalers (MDIs)] • By Indication [Asthma, COPD, Others] • By Distribution Channel [Hospital Pharmacies, Retail Pharmacies, Online Pharmacies] • By End Use [Hospitals, Homecare Settings, Others] |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Presspart Verwaltungs GmbH, Personal Air Quality Systems Pvt Ltd, COHERO Health Inc. (AptarGroup, Inc.), Cognita Labs, Adherium, Amiko Digital Health Limited, Teva Pharmaceuticals Industries Ltd., Propeller Health (ResMed), Novartis AG, Pneuma Respiratory Inc., 3M, AireHealth, Inc., FindAir Sp. z o.o, Sanofi, Sana Health, Cureatr, Boehringer Ingelheim, Cipla, MediSprout, AeroFuck, GlaxoSmithKline, Mylan, Incube Labs, Rugged Science. |