Smart Luggage Market Report Scope & Overview:

To get more information on Smart Luggage Market - Request Free Sample Report

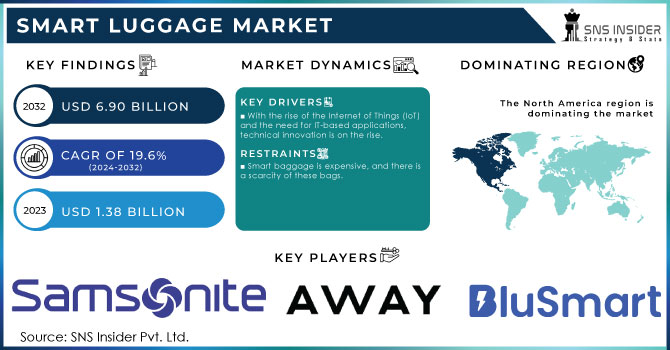

The Smart Luggage Market was valued at USD 2.38 billion in 2023 and is expected to reach USD 9.22 billion by 2032, growing at a CAGR of 16.28% over the forecast period 2024-2032.

Growing inclination towards digital traveling, accurate tracking of luggage, and also easy access, are fuelling the growth of the smart baggage market. Increasing global tourism, high business traveling frequency, and young plus tech-savvy population are demanding luggage with GPS tracking, RFID tags, USB charging ports, and Bluetooth features. But with these technologies implemented, users can keep an eye on their luggage remotely, charge their devices on the go, and have peace of mind around security, decreasing the amount of lost or misplaced bags. Moreover, the growth of smart luggage is propelled by the deployment of smart features, for instance, weight sensors and auto-lock features resolving the prominent concerns of travelers also. In the first six months of 2024, international tourist arrivals reached 1.35 billion, a 10% growth from 2023. The global business travel spend is projected to surpass USD 1.5 Trillion and 75% of travelers between the ages of 18 to 34 prefer luggage with smart technology. With the rise of smart luggage, which is believed to reduce mishandling rates by 20% by 2026, another 24 million bags were mishandled in 2023.

The growth of IoT (Internet of Things) and connectivity technologies is another primary growth driver. Increasing access to reliable Wi-Fi and Bluetooth features means baggage manufacturers are adding Wi-Fi & Bluetooth features in luggage to allow luggage to be able to be connected easily with smartphones or for these smart devices to be easily connected with luggage. In addition, a surging focus on sustainability internationally is boosting the production of smart luggage through manufacturers using eco-friendly substances and energy-efficient technologies. The supportive policies of governments promoting smart and sustainable travel infrastructure along with the increasing partnerships between tech companies and luggage manufacturers are anticipated to create new opportunities for the growth of the market over the forecast period. In 2024, there were 29.4 billion connected IoT devices in the world, 15% of which were in integrated smart home & wearable technology such as smart luggage. The number of devices with Bluetooth capability soared to 5.9 billion, and 32% of luggage manufacturers were using sustainable materials up from just 20% in 2022. More than 60 nations had already completed or were contemplating smart and sustainable travel framework projects such as electronic luggage following. In addition, over 50 partnerships between technology companies and luggage manufacturers were formed to integrate IoT features such as GPS tracking and anti-theft technology.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Disposable Incomes Fuel Demand for Premium Smart Luggage with High-Tech Features and

Sustainability

Due to increasing disposable incomes, especially in emerging markets, consumers are also opting for premium and luxury goods under travel products. Today, travelers are shifting their focus from just looking for functional pieces of luggage to looking for something more high-end, visually appealing, and technologically advanced. Smart luggage is a relatively niche product category, adding features such as biometrically locked, built-in scales, and your travel assistant. Among millennials, business travelers, and others who prize status and ease, this trend is especially apparent. As e-commerce platforms have also been proliferating the reach of these premium products has also expanded further, enabling manufacturers to target a larger mass market. Luxury goods spending should be up 2% to 4% in 2024, with more than USD 20 billion in fashion e-commerce sales globally. Beyond the trend for budget travel and cheap flight deals, demand for premium sectors and travel products that integrate technology is well established in emerging markets where smart luggage with a biometrically locked system and a built-in scale is the new norm, experiencing 12% YOY growth. 55% of millennials and business travelers want premium luggage not for comfort, but rather for status. 35% of luxury travelers want sustainable, eco-friendly travel products.

-

AI-powered Smart Luggage Revolutionizes the Travel Experience with Autonomous Features Voice Commands and Real-Time Tracking

One such increasingly transformative driver in this market is the solution of smart luggage powered by AI. AI-based algorithms are creeping into luggage for predictive analytics, optimized routes, and smart navigation. Some examples of such ideas include autonomous luggage that follows the user, driven by AI and sensors, and may be used shortly in airports and other travel hubs. Furthermore, this technology allows for voice-activated commands and instant notifications about changes in flights or gates, improving the travel experience. They not only add functionality but also fill a public demand for cutting-edge technology in consumer products. The emergence of more affordable and accessible AI technology at the time of the forecast period is expected to change the outlook of the smart luggage integration market by providing manufacturers with an opportunity to differentiate their products and gain a sustainable competitive advantage. More than 75% of airlines and airports worldwide will also be embracing AI-driven tools, such as autonomous luggage systems and predictive analytics in the year 2024. Investment in R&D to provide autonomous luggage has up by 25%, trials of which are taking place in airports. In addition, 43% of smart luggage designs include voice-activated commands for checking luggage status and flight updates, and 30% feature AI-based luggage tracking systems for new luggage models.

RESTRAIN:

-

Overcoming Regulatory and Compatibility Challenges to Unlock the Full Potential of Smart Luggage Solutions

An important obstacle is the regulation prohibiting battery luggage. For safety reasons, most airlines have released some strict rules for smart luggage with removable lithium-ion batteries which lead to overheating and fire hazards. This has caused some confusion among consumers and restricted other smart luggage styles. Low interoperability and standardization– High-end devices and platforms are built for proprietary use only and thus restrict users from expressing themselves, further building some key areas of restraint. Compatibility may be an issue due to the use of proprietary technologies by different manufacturers, which may not work smoothly or at all with your other smart devices. Moreover, the lack of awareness regarding smart luggage features by travellers in some regions is the biggest hindrance to smart luggage penetrating the market. Security, privacy, and personal data storage concerns concerning GPS tracking cause reservations among consumers regarding the adoption of highly connected travel solutions. These challenges must be overcome for continued market growth.

SEGMENTS ANALYSIS

BY TECHNOLOGY

Sensors accounted for 30.3% of the Smart Luggage market share in the year 2023, this is due to their key role in incorporating functionality for luggage and solving traveler problems. Multiple non-trivial features rely on the use of sensors such as weight detection, proximity alert, motion tracking, and tamper detection. The functionalities are pragmatic avoiding overweight baggage fees, making sure bags are secured, and providing peace of mind through real-time location updates. Sensor technology has become the top dog in the market, thanks to its extensive use and growing cost efficiency that makes it attractive both for producers and users.

Connectivity Technology segment will be the fastest growing from 2024 to 2032. The growth of the segment can be attributed to the growing IoT ecosystem and increasing demand for connected devices. More travelers are looking for their luggage to go hand in hand with their smartphone or smartwatch to offer GPS tracking, remote locking, and custom alerts. Bluetooth, Wi-Fi, and cellular network-driven features are being preferred as these will enable ease of access and control for the end user. Also, the increasing development of 5G connection will accelerate the growth of smart luggage as fast, heavy data transfer is going to be real. Hyper-connectivity and increased consumer demand for higher technological travel products are making Connectivity Technology the fastest-growing smart luggage market segment.

BY CONNECTIVITY

In 2023, Bluetooth maintained a leading position in the market share with 36% and is set to grow at the highest CAGR from 2024 to 2032. This dominance is powered by Bluetooth's universal applicability, low power draw, and ease of integration into smart luggage solutions. Travelers can pair their suitcase with their smartphone or other smart device so the luggage can send real-time notifications, including proximity alerts, anti-theft alarms, and location updates. Thus, extending the convenience for the user while improving security making it the go-to connectivity tech for manufacturers and consumers. Improvements in Bluetooth Low Energy (BLE) technology, which promises longer battery life and enhanced functionality, are also driving Bluetooth growth over the next several years. Moreover, the rapidly growing penetration of IoT-connected devices and smart environments within residences and attached appliances has generated a significantly increased need for Bluetooth-equipped products. The cost-effective nature of the technology, its easy implementation, and increasing consumer dependence on connected travel accessories are further promoting the growth of Bluetooth as the market and fastest-growing connectivity technology in the smart luggage market.

BY APPLICATION

In 2023, Remote Locking accounted for a significant portion of the total market share, at around 28.7%, as it gained traction in providing convenience for travelers with its unique functionality in terms of security. It enables the lock and unlock of the bag through a smart device, bringing the power and security of control to the user's play. With travelers becoming increasingly concerned about security and in the wake of rising incidences of airport and public place thefts, remote locking has become very much a desired feature. Smart luggage integrates this technology that allows users to lock items remotely to block unauthorized access and provide peace of mind.

The Proximity Sensors have the highest growth rate (CAGR) between 2024 and 2032, supported by the rapid development of sensor technology and the desire for improved security and convenience. Referring to the proximity sensor can help detect the user, when the user is closer or approaching, and the smart bag is activated to use functions like auto-lock, track the Location, and much more, you could also detect if the bag is being moved without permission. The demand for proximity sensors will subsequently swell as smart luggage entities evolve to be increasingly connected and integrated into the broader IoT ecosystem. Proximity sensors are expected to be the fastest-growing market segment, as their ability to enrich user experience through real-time alerts and avoid theft or loss not only addresses safety concerns but also caters to the connected travel solutions trend.

REGIONAL ANALYSIS

The North American region held the market share with 36.1% in 2023 owing to its high per capita income, faster adoption of advanced technologies, and high presence of smart luggage manufacturing key players. The rising adoption of sensible luggage answers as a key trend in selecting the path for the North American smart luggage market is driven by increasing the importance of convenience, security, and technological innovations among North American consumers for their travel accessories. Additionally, the region has a well-established travel and tourism sector, leading to a strong demand for high-end products such as smart luggage. Take Away, the US-based smart luggage manufacturer, whose high-tech luggage with USB terminals and location tracking features has become an international hit.

Asia Pacific is predicted to have the largest CAGR amongst all the regions during the forecast period 2024-2032, due to rapid urbanization, an increasing middle-class population in the region, and an increase in international travelers. Against the backdrop of increased adoption of technology by consumers, emerging markets such as the China and India regions are expected to offer opportunities for the growth of the smart luggage market. One of the most glaring examples is the German luggage brand Rimowa, which has developed smart luggage with GPS and Bluetooth capabilities and launched in partnership with Chinese e-commerce behemoth Alibaba. The move addresses a growing, predominantly tech-savvy market in the Asia Pacific region while underscoring the increased investment in smart luggage technology. As the region witnesses an increase in travel activities and the rising focus on innovation.

Need any custom research on Smart Luggage Market - Enquiry Now

Key players

Some of the major players in the Smart Luggage Market are:

-

Away (The Bigger Carry-On, The Bigger Carry-On Pro)

-

Samsonite (GeoTrakR Smart Luggage, Samsonite Pro-DLX4)

-

Rimowa (Rimowa Electronic Tag, Rimowa Essential Cabin S)

-

Tumi (Tumi 19 Degree, Tumi Alpha 3 Expandable)

-

Travelpro (Platinum Elite Expandable Spinner, Smart Luggage Backpack)

-

Arlo Skye (The Carry-On, The Check-In)

-

Monos (The Carry-On, The Check-In Large)

-

Bluesmart (Bluesmart One, Bluesmart Carry-On)

-

Nomatic (Nomatic Travel Bag, Nomatic Backpack)

-

Cargo (Cargo Carry-On, Cargo Medium Check-In)

-

Okoban (Okoban Smart Luggage Tag, Okoban Luggage Tracker)

-

Trunkster (Trunkster Carry-On, Trunkster Checked)

-

Lumo (Lumo Smart Luggage, Lumo Briefcase)

-

Béis (The Béis Roller, The Béis Weekender)

-

eBags (eBags Smart Luggage, eBags Professional Slim Laptop Backpack)

-

Samsara Luggage (Samsara Smart Luggage, Samsara Carry-On)

-

Away (The Bigger Carry-On, The Larger Carry-On)

-

Liteway (Liteway Luggage with Smart Technology, Liteway Carry-On)

-

G-RO (G-RO Smart Luggage, G-RO Cabin)

-

Tripp (Tripp Smart Luggage, Tripp Smart Spinner)

Some of the Raw Material Suppliers for companies:

-

BASF

-

Dow Chemical Company

-

Covestro

-

SABIC

-

DuPont

-

3M

-

Lanxess

-

Teijin Limited

-

Hyosung Corporation

-

Eastman Chemical Company

RECENT TRENDS

-

In April 2024, Away introduced four new colors for its popular suitcases, offering customers a broader selection to match their style. The updated designs also feature enhanced functionality with improved interior organization and additional travel-friendly features.

-

In April 2024, Samsonite teamed up with BOSS to launch a premium aluminum luggage capsule, featuring stylish, limited-edition suitcases with the BOSS monogram.

-

In September 2024, Rimowa launched the Original Bag, a compact, everyday version of its iconic suitcase. Made with the brand's signature aluminum shell, it offers a stylish and durable option for daily use.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 2.38 Billion |

|

Market Size by 2032 |

USD 9.22 Billion |

|

CAGR |

CAGR of 16.28% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Technology (Sensors, SIM Cards, USD Charging, Connectivity Technology) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Away, Samsonite, Rimowa, Tumi, Travelpro, Arlo Skye, Monos, Bluesmart, Nomatic, Cargo, Okoban, Trunkster, Lumo, Béis, eBags, Samsara Luggage, Liteway, G-RO, Tripp. |

|

Key Drivers |

• Rising Disposable Incomes Fuel Demand for Premium Smart Luggage with High-Tech Features and Sustainability |

|

RESTRAINTS |

• Overcoming Regulatory and Compatibility Challenges to Unlock the Full Potential of Smart Luggage Solutions |