Smart Packaging Market Report Scope & Overview:

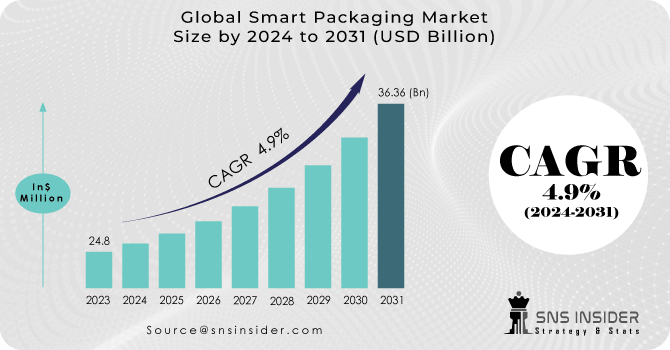

The Smart Packaging Market Size was valued at USD 24.8 billion in 2023 and is expected to reach USD 36.36 billion by 2031 and grow at a CAGR of 4.9% over the forecast period 2024-2031.

Smart packaging enhances convenience, safety, and shelf life while providing detailed information on contents, driven by rapid urbanization and changing consumer lifestyles. It is a cutting-edge technology in the packaging sector, evolving rapidly in the food industry due to its potential to boost consumer convenience. This synthesis of materials, science, and technology improves traditional packaging functions, offering benefits such as flavour enhancement, brand protection, premium pricing, and waste reduction.

Increasing demand for advanced packaging solutions stems from the aging population, shifts in consumer lifestyles, and a focus on reducing food waste. The smart packaging market is further fuelled by the growing e-commerce sector, industrialization in emerging economies, and the need for superior logistics and supply chain management. While smart packaging presents significant advantages, the associated costs, including expenses for sensors and RFID, pose challenges for widespread adoption.

MARKET DYNAMICS

KEY DRIVERS:

-

Consumer Demand for Freshness and Quality

Increasing consumer awareness regarding the freshness and quality of the products is driving the demand for smart packaging solutions.

-

Improved printing capabilities for product labels and branding drive market expansion.

RESTRAIN:

-

The initial setup and implementation costs of smart packaging technologies can be high.

-

Navigating the complex web of regional regulations and standards adds significant cost and complexity to the production process.

OPPORTUNITY:

-

Investigating the potential applications of nanotechnology through research and development.

The smart packaging industry is experiencing significant growth driven by several factors. Research into nanotechnology is creating new possibilities for food and beverage applications. Additionally, both retailers and manufacturers are increasingly seeking sustainable and shelf-stable packaging solutions. This trend, coupled with rising consumption of packaged food products, is fuelling the expansion of the smart packaging market.

-

The growing trend of personalization is driving increased consumer engagement.

CHALLENGES:

-

A key challenge facing smart packaging companies is balancing the integration of expensive new technologies with maintaining competitive pricing strategies.

-

Consumer awareness of smart packaging solutions remains low. This lack of knowledge may limit the market's growth.

Impact of Russia Ukraine War

The Russia-Ukraine conflict poses several challenges and opportunities for the smart packaging industry. Supply chain disruptions are a significant concern as Ukraine and Russia play key roles in the global technology supply chains, potentially causing delays and increased costs for manufacturing smart packaging components. Price volatility in critical materials due to geopolitical tensions could impact overall manufacturing costs. The uncertainty created by the conflict may lead to a slowdown in investment and innovation within the smart packaging sector, affecting its growth potential.

The smart packaging market faces a complex landscape. While Eastern Europe may face steeper hurdles due to stricter regulations, global tensions could also hinder international collaboration. Additionally, the rise of connected packaging solutions necessitates robust cybersecurity measures to counter cyberattacks. However, these challenges are countered by opportunities in sectors like logistics and e-commerce, where smart packaging can address the growing demand for supply chain transparency.

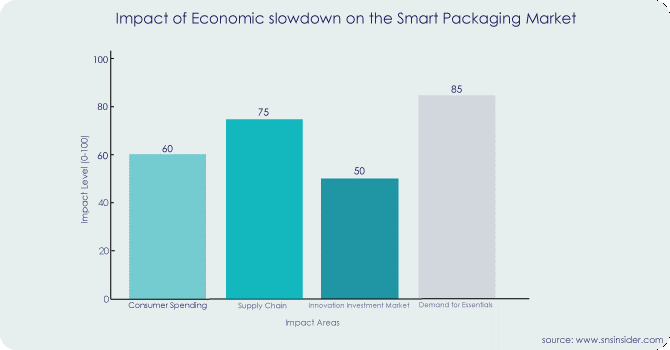

Impact of Economic Slowdown

The ongoing economic slowdown has introduced a complex impact on the Smart Packaging Market, a sector reliant on innovation and technological progress. Reduced consumer spending, a common consequence of economic downturns, directly influences the demand for smart packaging solutions in critical sectors such as food & beverages, healthcare, and personal care. Supply chain disruptions are another challenge, affecting the availability and cost of essential materials for smart packaging. In times of economic uncertainty, companies may deprioritize investments in innovative packaging solutions, potentially slowing innovation in the sector. However, there are opportunities for cost-efficient innovations as businesses aim to maintain product integrity while minimizing costs. Additionally, the shift towards prioritizing essential goods during economic slowdowns may drive increased demand for smart packaging in healthcare and food sectors, presenting growth opportunities in these areas.

The provided graph visually represents the effects of the ongoing economic slowdown on crucial aspects of the Smart Packaging Market:

-

Consumer Spending (60/100): Signifies a moderate to high impact, as diminished consumer spending directly influences the demand for products incorporating smart packaging.

-

Supply Chain (75/100): Reflects a high impact, indicating significant disruptions in the supply chain that adversely affect the availability and cost of materials crucial for smart packaging.

-

Innovation Investment (50/100): Represents a moderate impact, as economic pressures may result in reduced investments in innovation and development within the smart packaging sector.

-

Market Demand for Essentials (85/100): Indicates a very high impact, underscoring the pronounced shift towards essential goods. This shift has the potential to elevate the demand for smart packaging, particularly in sectors like healthcare and food, presenting a positive outlook in the prevailing economic conditions.

KEY MARKET SEGMENTS

By Material

-

Solid

-

Liquid

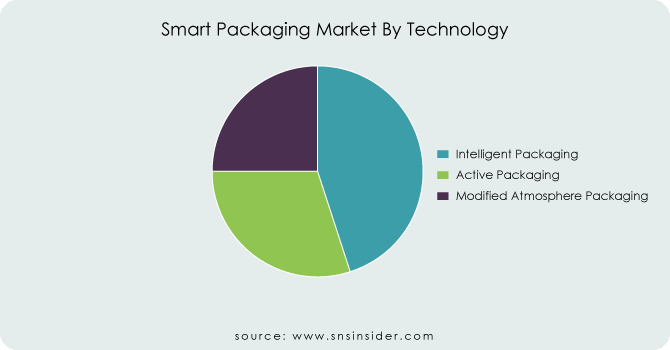

By Technology

-

Active Packaging

-

Intelligent Packaging

-

Modified Atmosphere Packaging

Smart Packaging market saw the Intelligent Packaging segment dominate revenue. This type of packaging utilizes features like sensors, RFID tags, and even printed electronics to deliver real-time data about the product it contains.

By Functionality

-

Tracking & Tracing

-

Temperature Monitoring

-

Freshness Indication

-

Security

-

Others

By Application

-

Food & Beverages

-

Healthcare

-

Personal Care

-

Automotive

-

Others

Food & Beverage segment emerged as a dominant force in the market, and it is expected to experience rapid growth during the forecast period. The growing demand for smart packaging solutions in this segment is being determined by the need to enhance the safety and quality of food products, reduce waste, and improve the overall consumer experience.

REGIONAL ANALYSIS

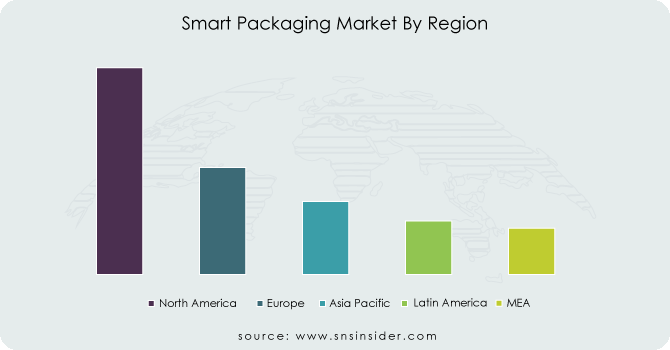

North America stands as a significant hub for smart packaging, propelled by leading technology companies and heightened consumer awareness. North America dominates the market with share by 40%. Robust investments in research and development, notably in the United States and Canada, have spurred innovations, particularly in food and healthcare applications. Key growth drivers include the imperative for product traceability, enhanced food safety measures, and the surge in e-commerce popularity. In Europe, including Germany, the UK, and France, smart packaging is driven by stringent food safety regulations and a focus on sustainability. Meanwhile, in the Asia-Pacific region (China, India, Japan, and South Korea), the smart packaging market is growing due to the expansion of e-commerce, increasing consumer awareness, and a rising trend of adoption in healthcare and pharmaceutical sectors.

Latin America, including pivotal markets like Brazil, Mexico, and Argentina, is gradually adopting smart packaging technologies driven by urbanization, rising disposable incomes, and a growing awareness of the benefits, particularly in product authentication and anti-counterfeiting. In the Middle East and Africa, smart packaging adoption is in its early stages compared to other regions. Noteworthy opportunities, especially in the pharmaceutical sector, exist due to increasing demand for anti-counterfeiting measures and temperature-sensitive packaging, alongside economic development and investments in healthcare infrastructure expected to propel the smart packaging market in this region.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the Smart Packaging Market are Avery Dennison Corporation, BASF SE, Ball Corporation, Sysco Corporation, Zebra Technologies Corp. (Temptime Corporation), International Paper, R.R. Donnelley & Sons Company, 3M, Crown, Stora Enso and other players.

Avery Dennison Corporation-Company Financial Analysis

RECENT TRENDS

-

In April 2023, Tetra Pak, a leading food processing and packaging company, announced that top European fruit juice producer's cartons now include innovative smart packaging that offers an interactive and engaging experience for consumers. This new feature, designed in collaboration with creative technology studio Appetite Creative, allows consumers to connect to a web app and take a personality test by scanning a QR code on one-litre bottles of passion fruit, pineapple, and mango beverages. The test identifies the drink that best matches each user's personality type, encouraging them to explore new products or rediscover old favorites.

-

In March 2023, Identiv has partnered with Tapwow to enhance its tag management, content distribution, and analytics solutions through the use of the DIRX2 smart packaging and connected products platform. This collaboration will allow brands to choose the best technology for their specific needs and customize tags based on product, location, or other factors. Tapwow will provide technical solutions for Identiv and work with clients to develop tailored experiences for consumer engagement, authentication, traceability, and reuse/recycling. This strategic partnership will offer a diverse range of solutions for brands, partners, packagers, and creative agencies across various industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 24.8 Billion |

| Market Size by 2031 | US$ 36.36 Billion |

| CAGR | CAGR of 4.9 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Solid, Liquid) • By Technology (Active Packaging, Intelligent Packaging, Modified Atmosphere Packaging) • By Functionality (Tracking & Tracing, Temperature Monitoring, Freshness Indication, Security, Others) • By Application (Food & Beverages, Healthcare, Personal Care, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avery Dennison Corporation, BASF SE, Ball Corporation, Sysco Corporation, Zebra Technologies Corp. (Temptime Corporation), International Paper, R.R. Donnelley & Sons Company, 3M, Crown, Stora Enso |

| Key Drivers | • Consumer Demand for Freshness and Quality • Improved printing capabilities for product labels and branding drive market expansion. |

| Restraints | • The initial setup and implementation costs of smart packaging technologies can be high. • Navigating the complex web of regional regulations and standards adds significant cost and complexity to the production process. |