Smart Water Management Market Report Scope & Overview:

The Smart Water Management Market was valued at USD 20.71 billion in 2025 and is expected to reach USD 70.23 billion by 2035, growing at a CAGR of 12.99% from 2026-2035.

The Smart Water Management Market is experiencing strong growth due to increasing global water scarcity, aging infrastructure, and rising demand for efficient water use in urban areas. Governments and utilities are investing heavily in digital water technologies, including IoT-enabled sensors, AI-based analytics, and real-time monitoring systems to reduce water loss and improve supply efficiency. According to MDPI Water, smart water governance now routinely integrates IoT, AI, cloud computing, big data analytics, and digital twins, enabling adaptive decision-making and predictive analysis across urban water systems.

In North America, leaks account for 20–50% of water loss, making such innovations crucial for improving conservation outcomes.

Smart Water Management Market Size and Forecast

-

Market Size in 2025: USD 20.71 Billion

-

Market Size by 2035: USD 70.23 Billion

-

CAGR: 12.99% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Smart Water Management Market - Request Free Sample Report

Smart Water Management Market Trends

-

Rising need for efficient water usage and conservation is driving the smart water management market.

-

Growing adoption of IoT sensors, smart meters, and AI-based analytics is boosting market growth.

-

Expansion across municipal utilities, agriculture, and industrial sectors is fueling deployment.

-

Increasing focus on leak detection, real-time monitoring, and predictive maintenance is shaping adoption trends.

-

Advancements in cloud platforms, data visualization, and automated control systems are enhancing operational efficiency.

-

Rising investments in sustainable infrastructure and regulatory compliance are supporting market expansion.

-

Collaborations between technology providers, water utilities, and government agencies are accelerating innovation and global adoption.

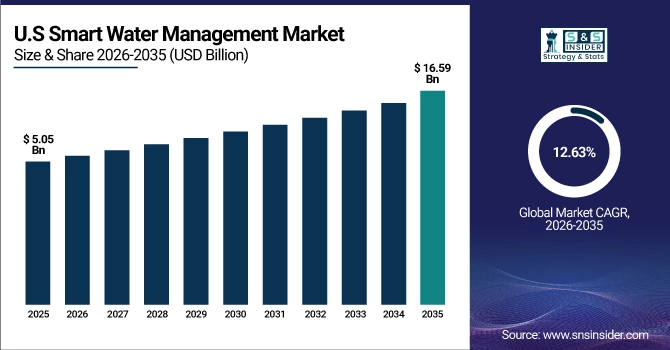

U.S. Smart Water Management Market was valued at USD 5.05 billion in 2025 and is expected to reach USD 16.59 billion by 2035, growing at a CAGR of 12.63% from 2026-2035.

The U.S. Smart Water Management Market is growing due to increasing investments in water infrastructure modernization, adoption of IoT and AI for efficient water use, rising concerns over water scarcity, and stringent federal regulations promoting sustainable and resilient water systems.

Smart Water Management Market Growth Drivers:

-

Rising urbanization is fueling demand for intelligent infrastructure that can support efficient and sustainable urban water management systems.

The rapid pace of urbanization worldwide is putting pressure on aging water infrastructure and increasing demand for smarter water distribution and monitoring solutions. As cities grow, managing complex water networks becomes more challenging without digital technologies. Smart water management systems help municipalities optimize operations through advanced analytics, IoT sensors, and automation. These tools enable leak detection, water quality monitoring, and efficient billing systems. Urban planners are increasingly integrating these technologies to support sustainable development goals, improve resilience, and reduce operational costs in metropolitan water utilities and infrastructure frameworks.

Smart Water Management Market Restraints

-

Limited technical expertise and digital literacy challenge the smooth deployment and maintenance of smart water management solutions.

Implementing smart water technologies requires specialized technical skills in areas such as IoT, data analytics, and cloud infrastructure. Many utilities, especially in rural or underfunded areas, lack trained personnel capable of handling such systems. Moreover, the integration of digital tools into traditional water management often meets resistance due to unfamiliarity or mistrust of automated systems. Insufficient training programs and lack of institutional support contribute to low adoption rates. These knowledge gaps hinder effective implementation, delay digital transformation, and undermine the reliability and functionality of smart water networks.

Smart Water Management Market Opportunities

-

Rising integration of AI and predictive analytics is opening new possibilities in proactive water resource and infrastructure management.

The integration of artificial intelligence and advanced data analytics with smart water systems offers transformative potential in detecting anomalies, predicting failures, and optimizing operations. Utilities can now use machine learning algorithms to analyze consumption patterns, identify inefficiencies, and forecast future demand. Predictive maintenance enabled by AI reduces downtime and operational costs. These advancements allow water providers to shift from reactive to proactive management strategies. As AI tools become more accessible and scalable, the smart water management market stands to benefit significantly from innovation-driven growth opportunities in both urban and industrial applications.

Smart Water Management Market Challenges

-

Fragmented infrastructure and data silos make real-time integration and interoperability of smart water systems highly complex.

Most existing water infrastructure is outdated and consists of isolated legacy systems that are not easily compatible with modern digital tools. Integrating smart sensors, meters, and control systems across fragmented networks presents a major technological challenge. Moreover, data is often siloed across departments or utilities, hindering centralized monitoring and decision-making. These integration issues not only delay implementation but also impact the accuracy and efficiency of smart water systems. Overcoming these challenges requires significant investment in IT standardization, cross-platform compatibility, and cooperative governance across sectors.

Smart Water Management Market Segmentation Analysis

By Offering

Water Meter segment dominated the Smart Water Management Market with a 43% revenue share in 2025 due to their essential role in consumption tracking, billing accuracy, and leak detection. Smart water meters offer real-time data and remote monitoring, reducing non-revenue water and operational inefficiencies. Governments and utilities globally are investing in meter upgrades to improve accountability and ensure equitable distribution, driving widespread meter deployment.

Solutions segment is expected to grow at the fastest CAGR of 14.29% from 2026 to 2035 as utilities seek integrated platforms that combine data analytics, visualization, control, and automation. These solutions streamline water distribution, detect anomalies, and support decision-making. With increasing focus on digital transformation, the demand for comprehensive software and analytics platforms is surging, propelling the rapid growth of smart water management solutions.

By Communication Infrastructure

Cellular Networks segment dominated the Smart Water Management Market with a 30% revenue share in 2025 due to its widespread availability, cost-effective deployment, and scalability. Utilities prefer cellular connectivity for real-time monitoring, remote control, and two-way communication with smart meters and sensors. Its compatibility with existing infrastructure and reduced need for proprietary networks further drives its adoption across both urban and semi-urban regions for water management systems.

Satellite Communication segment is expected to grow at the fastest CAGR of 16.98% from 2026 to 2035 owing to its ability to cover remote, rural, or geographically challenging areas. It ensures continuous data transmission where terrestrial or cellular networks are limited. This makes it highly valuable for water utilities operating in hard-to-reach locations, enabling comprehensive monitoring and control of distributed infrastructure with minimal dependency on ground-based connectivity.

By Technology

IoT segment dominated the Smart Water Management Market with a 35% revenue share in 2025 due to its ability to enable real-time data collection, monitoring, and remote control. IoT devices like smart sensors, meters, and actuators enhance operational efficiency, reduce water loss, and improve leak detection. Its integration across utilities supports predictive maintenance and decision-making, making it the core technology in digital water management systems.

Artificial Intelligence segment is expected to grow at the fastest CAGR of 15.58% from 2026 to 2035 as utilities increasingly adopt AI-driven analytics for predictive maintenance, anomaly detection, and demand forecasting. AI enables intelligent decision-making, automates water distribution, and reduces energy consumption. With growing interest in automation and smart analytics, AI is emerging as a transformative force in optimizing water management operations.

By End-User

Industrial segment dominated the Smart Water Management Market with a 42% revenue share in 2025 due to the sector’s high water consumption and demand for efficient resource use. Manufacturing, chemical, and energy industries require advanced water monitoring and control solutions to meet regulatory compliance and reduce operational costs. Smart systems help manage large-scale water usage, detect leaks, and ensure sustainable practices in industrial processes.

Commercial segment is expected to grow at the fastest CAGR of 14.86% from 2026 to 2035 as offices, malls, hotels, and institutions increasingly invest in efficient water solutions to reduce utility bills and support green building initiatives. Rising regulatory pressure and sustainability goals drive the adoption of smart meters, leak detection, and automated usage tracking, making commercial spaces a key growth area for smart water technologies.

Smart Water Management Market Regional Outlook

North America Smart Water Management Market Insights

North America dominated the Smart Water Management Market with a 34% revenue share in 2025 due to advanced infrastructure, early technology adoption, and strong regulatory support. The presence of leading technology providers, high investment in smart utilities, and growing emphasis on sustainability and water conservation have driven widespread implementation of smart water solutions across urban centers and industrial sectors, reinforcing the region’s leadership in digital water management.

The United States is dominating the Smart Water Management Market in North America due to advanced infrastructure, high investments, and early technology adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Smart Water Management Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 14.96% from 2026 to 2035 due to rapid urbanization, increasing water stress, and government initiatives for smart city development. Countries like China, India, and Southeast Asian nations are investing heavily in water infrastructure modernization. The growing need for efficient water distribution, coupled with rising public and private sector collaboration, is accelerating the region’s adoption of smart water technologies.

China is dominating the Smart Water Management Market in Asia Pacific due to large-scale urbanization, infrastructure investments, and strong government initiatives for water conservation.

Europe Smart Water Management Market Insights

Europe holds a significant position in the Smart Water Management Market due to stringent environmental regulations, strong emphasis on sustainability, and growing adoption of digital technologies for efficient water distribution, monitoring, and conservation across urban and industrial sectors.

Germany is dominating the Smart Water Management Market in Europe due to strong industrial demand, advanced technology adoption, and supportive government sustainability policies.

Middle East & Africa and Latin America Smart Water Management Market Insights

Middle East & Africa and Latin America are witnessing steady growth in the Smart Water Management Market driven by increasing water scarcity, infrastructure modernization efforts, and growing awareness of the need for efficient, technology-driven water resource management solutions.

Smart Water Management Market Competitive Landscape:

Siemens AG

Siemens AG is a global technology powerhouse focused on electrification, automation, and digitalization. Its smart infrastructure solutions leverage AI, IoT, and data analytics to optimize industrial, building, and utility operations. In water management, Siemens provides AI-powered platforms for smart metering, leak detection, and predictive maintenance, helping utilities improve efficiency, reduce losses, and achieve sustainability goals. Siemens emphasizes innovation in digital twin technologies, advanced analytics, and energy-water integration to support resilient, intelligent infrastructure across global markets.

-

2024: Siemens launched SIWA Leak Finder and Blockage Predictor AI apps on Xcelerator Marketplace, helping water utilities reduce leaks and predict blockages for sustainable operations.

IBM Corporation

IBM Corporation is a multinational technology company specializing in hybrid cloud, AI, analytics, and enterprise software solutions. IBM integrates AI and data-driven approaches to solve complex global challenges, including smart infrastructure and water resource management. Its water initiatives focus on hybrid cloud platforms, AI-enabled predictive analytics, and data integration to enhance access, quality, and efficiency. IBM supports governments, utilities, and NGOs to manage scarce resources, improve operational resilience, and optimize sustainable water management across urban and rural communities worldwide.

-

2023: IBM launched an RFP inviting solutions that use AI, hybrid cloud, and data technologies to accelerate global water management projects for vulnerable populations.

Xylem Inc.

Xylem Inc. is a global water technology company providing solutions for water transport, treatment, and smart utility management. The company leverages AI, IoT, and digital analytics to improve water reuse, optimize distribution, and enhance infrastructure resilience. Xylem focuses on sustainable water management, loss reduction, and ecosystem partnerships, delivering innovative technologies for utilities, industrial clients, and communities. Its AI-driven solutions enable predictive maintenance, leak detection, and water security, supporting long-term sustainability goals in urban and industrial water systems worldwide.

-

2025: Xylem’s advanced technologies enabled reuse of 18.1 billion cubic meters of water globally, enhancing water security and resilience across smart water systems.

-

2025: Xylem highlighted AI leak detection and optimized infrastructure through its 2025 Partnerships Accelerator, advancing smart water solutions and ecosystem collaborations.

Honeywell International Inc.

Honeywell International is a diversified technology and manufacturing company providing automation, building solutions, and aerospace products. In water and environmental management, Honeywell develops technologies and partnerships to enhance conservation, monitoring, and resource efficiency. Its AI-enabled and digital solutions help utilities, agriculture, and industrial clients optimize water usage, predict shortages, and improve operational sustainability. Honeywell also collaborates with NGOs and local communities to integrate advanced water stewardship strategies, focusing on long-term environmental impact, resilience, and conservation of critical water resources.

-

2023: Honeywell partnered with Watershed Organisation Trust (WOTR) to promote soil and water conservation, enhancing water availability and sustainable land-water management in rural ecosystems.

Key Players

Some of the Smart Water Management Market Companies

-

Siemens AG

-

International Business Machines Corporation (IBM)

-

Honeywell International Inc.

-

Schneider Electric SE

-

Itron Inc.

-

SUEZ (Suez Water Technologies & Solutions)

-

Landis+Gyr AG

-

Trimble Inc.

-

Veolia Water Technologies & Solutions

-

Hydro International

-

GE Digital

-

Cisco Systems

-

Emerson Electric

-

Bentley Systems

-

Aqua Analytics

-

Kamstrup A/S

-

Arad Group

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 20.71 Billion |

| Market Size by 2035 | USD 70.23 Billion |

| CAGR | CAGR of 12.99% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Water Meter, Solutions, Services) • By Technology (IoT, Artificial Intelligence, Big Data & Analytics, Cloud Computing, Other Technologies) • By End-User (Residential, Commercial, Industrial) • By Communication Infrastructure (Cellular Networks, Radio Frequency (RF), Power Line Communication (PLC), Satellite Communication, Wi-Fi, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens AG, International Business Machines Corporation (IBM), Xylem Inc., Honeywell International Inc., Schneider Electric SE, Itron Inc., SUEZ (Suez Water Technologies & Solutions), Oracle Corporation, Landis+Gyr AG, Trimble Inc., Veolia Water Technologies & Solutions, Hydro International, GE Digital, Cisco Systems, Emerson Electric, Bentley Systems, Aqua Analytics, Kamstrup A/S, Arad Group (Arad Metering Technologies) |