Network Probe Market Report Scope & Overview:

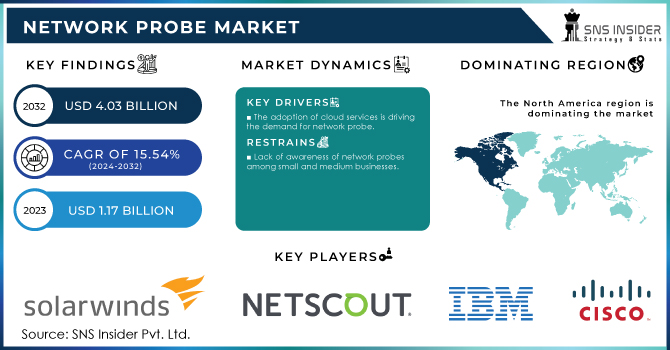

The Network Probe Market Size was valued at USD 625.12 Million in 2023 and is expected to reach USD 1642.78 Million by 2032 and grow at a CAGR of 11.4% over the forecast period 2024-2032.

Get more information on Network Probe Market - Request Free Sample Report

The Network Probe Market has been experiencing robust growth due to several key factors driving its demand. These tools, which allow businesses to monitor and analyze network performance, have become essential as organizations increasingly rely on complex IT infrastructures and high-speed networks. The primary factors driving the growth of the Network Probe Market include the rise of digital transformation, the increasing volume of network traffic, the need for enhanced cybersecurity, and the shift toward remote work.

According to research, the U.S. government reported 32,211 cyberattacks in fiscal year 2023, up from 30,659 in the previous fiscal year, underscoring the critical need for robust network monitoring tools. Additionally, the increasing sophistication of cyber threats has intensified the demand for comprehensive network security solutions. A recent Politico article highlighted an ongoing cyber intrusion by a Chinese government-linked hacking group, known as Salt Typhoon, targeting global telecommunications systems, including major U.S. providers like AT&T, Verizon, and T-Mobile. This breach underscores the necessity for advanced network monitoring to detect and mitigate such sophisticated threats.

Furthermore, the rapid adoption of cloud computing and the shift toward remote work have introduced new complexities in network management. Organizations require tools that offer visibility and control over distributed networks to ensure optimal performance and security. Network probes equipped with advanced analytics and machine learning capabilities are increasingly sought after to address these challenges effectively.

Network Probe Market Market Dynamics

Key Drivers:

-

Increasing Demand for Real-Time Network Monitoring Solutions Drives Network Probe Market Growth

The rapid expansion of digital infrastructure across industries has led to a surge in the volume of network traffic, making real-time monitoring solutions crucial for organizations. Network probes, which allow companies to observe network health and performance continuously, have gained prominence due to their ability to provide deep insights into network activity. Businesses now depend heavily on the seamless functioning of their networks to support critical operations, especially with the rise of cloud services, IoT devices, and remote work environments. This has increased the demand for advanced network monitoring tools that can offer detailed visibility into data flow, detect bottlenecks, and predict potential issues before they affect performance. Real-time monitoring tools help reduce downtime, improve resource allocation, and enhance the overall user experience. The growing importance of network security has further fueled this demand, as these probes also play an essential role in identifying unusual patterns that could signal security threats. As organizations continue to prioritize operational efficiency and security, the Network Probe Market is expected to witness continued expansion, providing advanced, real-time solutions for businesses worldwide.

-

Rising Cybersecurity Threats and Increasing Need for Network Security Drives Adoption of Network Probes

As cyber threats become more sophisticated and pervasive, the demand for robust cybersecurity solutions has escalated. Network probes are becoming essential tools for identifying and mitigating potential security breaches within network infrastructure. These solutions offer deep packet inspection, anomaly detection, and traffic analysis to proactively identify vulnerabilities and prevent attacks such as data breaches, DDoS, and ransomware. In today’s hyper-connected world, cybersecurity is a critical concern for businesses, especially with the rise of remote work, cloud computing, and connected devices. The ability of network probes to provide continuous monitoring and detect early signs of malicious activity has made them indispensable in securing sensitive data and maintaining compliance with regulatory standards.

Additionally, as companies face an increasing number of cyberattacks, many of which target network systems, they are prioritizing investments in tools that offer advanced threat detection, real-time alerts, and automated responses. The ability to safeguard the network while maintaining optimal performance is a key benefit that network probes offer, driving their widespread adoption and supporting growth in the Network Probe Market.

Restrain:

-

High Initial Costs and Complexity of Network Probe Solutions Hinder Widespread Adoption

Despite the many advantages of network probes, the high initial costs and complexity of implementation pose significant challenges for small and medium-sized enterprises (SMEs). These solutions often require substantial upfront investment in both software and hardware, as well as ongoing maintenance costs. Moreover, deploying network probes in complex network environments can be a challenging and resource-intensive task. SMEs, which may have limited budgets and IT staff, often find it difficult to justify the expense and effort required for deploying these systems. Additionally, the complexity of configuring and managing these solutions can be a barrier, as organizations may need specialized expertise to fully utilize the capabilities of network probes. While larger enterprises with extensive IT budgets can afford to implement these advanced monitoring tools, the high total cost of ownership (TCO) can be a deterrent for smaller businesses. This restraint may slow the adoption of network probes, particularly in industries where budget constraints are more significant. As such, vendors may need to focus on offering more affordable, user-friendly solutions to cater to this segment of the market.

Network Probe Market Segments Analysis

By Components

The Solution segment in the Network Probe Market accounted for the largest share, contributing 64.00% of the revenue in 2023. This dominance can be attributed to the increasing demand for advanced network performance monitoring solutions that provide real-time insights into network traffic, performance, and security. Solutions such as network probes offer a comprehensive approach to network management, enabling businesses to detect performance bottlenecks, optimize bandwidth, and ensure network security.

For instance, SolarWinds introduced its Network Performance Monitor, which is designed to offer deeper visibility into network traffic and performance with automatic alerts for performance degradation.

The Service segment within the Network Probe Market is expected to experience the largest CAGR of 12.17% during the forecast period. This growth is primarily driven by the rising demand for managed services and consulting services that support the deployment and optimization of network probes. As organizations navigate the complexities of modern network infrastructures, including cloud environments, IoT, and 5G, there is a growing need for professional expertise to ensure optimal performance and security.

Moreover, with organizations focusing on improving their network efficiency and security, demand for service-based solutions, including installation, training, and ongoing support, is expected to rise. This trend indicates that the service segment will continue to expand and complement the growth of the network probe solutions, forming a crucial component of the overall market.

By End-Use Vertical

The IT and Telecom Services segment held the largest revenue share of 32.00% in the Network Probe Market in 2023. This is primarily due to the critical role of network performance monitoring in ensuring the seamless operation of telecom and IT infrastructures, which are foundational to communication and business operations. As telecom providers expand their 5G networks and IT companies shift to more complex hybrid cloud environments, the need for sophisticated network monitoring solutions has increased.

Similarly, NETSCOUT launched the nGeniusONE platform, which provides end-to-end network visibility, enabling telecom providers to identify and resolve performance issues quickly. As the demand for faster data transmission, greater bandwidth, and secure communication networks grows, especially with the roll-out of 5G technology, the Network Probe Market continues to experience expansion.

The BFSI segment is expected to experience the largest CAGR of 13.02% during the forecast period in the Network Probe Market. This growth is primarily driven by the increasing reliance of financial institutions on secure, reliable, and efficient networks to support real-time transactions, mobile banking, and cloud services.

Additionally, Riverbed’s SteelCentral has helped financial institutions monitor end-to-end network performance, ensuring optimal customer experiences and secure transactions. The increasing frequency of cyberattacks targeting financial institutions further drives the demand for advanced monitoring tools that can detect and mitigate threats in real time.

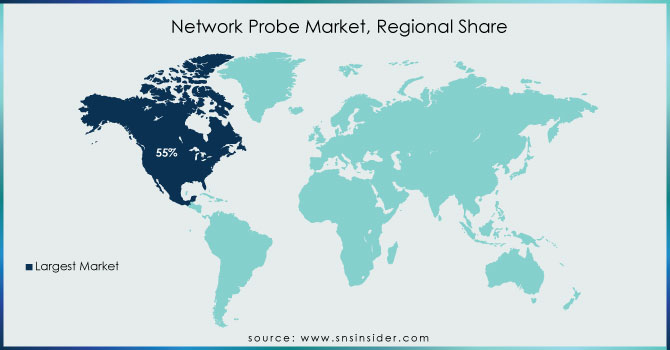

Regional Analysis

In 2023, North America dominated the Network Probe Market, holding an estimated market share of 37.00%. This dominance can be attributed to the advanced technological infrastructure and early adoption of network monitoring solutions across various industries, including IT, telecommunications, finance, and healthcare. For instance, ThousandEyes by Cisco offers cloud-based visibility into both private and public networks, which is critical for ensuring high-quality service in dynamic, distributed network environments. The high focus on cybersecurity and real-time network monitoring further strengthens the position of North America in this market. With an increasing number of enterprises focusing on digital transformation and network security, the North American region is expected to continue its leadership in the Network Probe Market.

The Asia Pacific region is the fastest growing in the Network Probe Market, with an estimated CAGR of 12.82% during the forecast period. The rapid digital transformation in countries such as China, India, Japan, and South Korea is one of the key drivers of this growth. Similarly, Huawei has been at the forefront of providing network visibility and optimization solutions to telecom operators in the region. The growing e-commerce sector, increasing internet penetration, and the rise of data centers in emerging economies contribute to the surge in network traffic, further driving the demand for network probes in Asia Pacific.

Additionally, the shift towards remote work and hybrid cloud models has increased the complexity of network management in the region, making network probes indispensable for businesses. This rapid technological advancement and the evolving demand for network security make the Asia Pacific the fastest-growing region in the Network Probe Market.

Need any customization research on Network Probe Market - Enquire Now

Key Players

Some of the major players in the Network Probe Market are:

-

SolarWinds (Network Performance Monitor, Network Configuration Manager)

-

NETSCOUT (nGeniusOne, nGeniusPULSE)

-

Broadcom (Broadcom Network Performance Monitoring, Broadcom Packet Inspection)

-

IBM (IBM Netcool, IBM Cloud Pak for Network Automation)

-

Cisco (Cisco Prime Network, Cisco ThousandEyes)

-

Nokia (Nokia Network Insights, Nokia Service Assurance)

-

NEC (NEC Network Monitoring, NEC Service Management)

-

AppNeta (AppNeta Performance Management, AppNeta Network Monitoring)

-

Catchpoint (Catchpoint Digital Experience Monitoring, Catchpoint Network Performance Monitoring)

-

Accedian (Accedian Skylight, Accedian Network Performance Monitoring)

-

Paessler (PRTG Network Monitor, PRTG Enterprise Monitor)

-

ManageEngine (OpManager, NetFlow Analyzer)

-

Progress (Ipswitch WhatsUp Gold, Progress Telerik Network Monitoring)

-

Nagios (Nagios XI, Nagios Network Analyzer)

-

Dynatrace (Dynatrace Network Monitoring, Dynatrace Application Performance Monitoring)

-

HelpSystems (Intermapper, HelpSystems Network Monitoring)

-

Riverbed (SteelCentral, Riverbed Network Performance Management)

-

ExtraHop (ExtraHop Reveal(x), ExtraHop Network Detection and Response)

-

Micro Focus (Network Node Manager, ArcSight Network Security Monitoring)

-

Cubro (Cubro Network Packet Broker, Cubro Flow Collection and Analysis)

Recent Trends

-

In April 2024, Broadcom faced a European Union complaint regarding alleged unfair licensing practices with VMware. VMware accused Broadcom of imposing restrictive conditions on licensing terms following its acquisition of VMware, potentially undermining fair competition in the market. This complaint highlighted concerns over the impact on customers and the competitive landscape within the network probe and broader technology sectors.

-

In April 2024, aims to enhance IBM's hybrid cloud and AI capabilities. HashiCorp’s infrastructure automation tools are expected to boost IBM’s strategic growth in IT automation, data security, and consulting. This investigation is part of broader efforts to ensure effective competition in the cloud market

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 625.12 Million |

| Market Size by 2032 | US$ 1642.78 Million |

| CAGR | CAGR of 11.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment (On-Premise, Cloud-based) • By Organization Size (Large Enterprise, Small and Medium-Sized Enterprise) • By End-Use Vertical (IT, Telecom Services, Government, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SolarWinds, NETSCOUT, Broadcom, IBM, Cisco, Nokia, NEC, AppNeta, Catchpoint, Accedian, Paessler, ManageEngine, Progress, Nagios, Dynatrace, HelpSystems, Riverbed, ExtraHop, Micro Focus, Cubro. |

| Key Drivers | • Increasing Demand for Real-Time Network Monitoring Solutions Drives Network Probe Market Growth • Rising Cybersecurity Threats and Increasing Need for Network Security Drives Adoption of Network Probes |

| Restraints | • High Initial Costs and Complexity of Network Probe Solutions Hinder Widespread Adoption |