Retail Media Platform Market Size & Overview:

Get More Information on Retail Media Platform Market - Request Sample Report

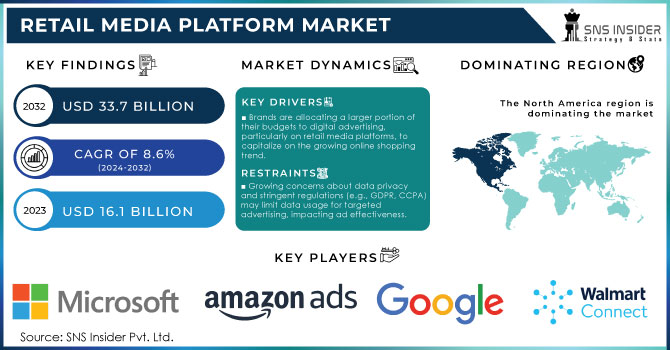

Retail Media Platform Market Size was valued at USD 16.1 Billion in 2023 and is expected to reach USD 33.7 Billion by 2032, growing at a CAGR of 8.6% over the forecast period 2024-2032.

The Retail Media Platform market is anticipated to observe significant growth driven primarily by the increasing investment from both government and private sectors in digital advertising. The most recent data presented by the Federal Trade Commission Tennessee indicate that digital advertising expenditure reached around $189 billion. The percentage increase in 2023 is calculated at approximately 15%. The increasing share of spending by consumers on e-commerce is another reason for the sudden rise. The government has taken a position to enhance competition and innovation by driving the need for digital marketing in retailers. Further, the launch of initiatives to support local businesses like reaching customers through retail media platforms is another driving factor. The upcoming goals established by the governments, like raising investment for the digital transformation agenda in the economic stimulus package, are also responsible for the development of this market. Retailers are always in search of finding ways to increase their sales. Investments in retail media platforms enable retailers to get improved sales visibility due to better targeting and personalized marketing strategies. The adoption of data analytics into the retail media is also expected to play a crucial role in attracting investments, as businesses strive to optimize their advertising efforts and better understand consumer behavior. The government support for digital marketing drives the growth of the retail media platform market.

Retail Media Platform Market Dynamics

Drivers:

-

Brands are allocating a larger portion of their budgets to digital advertising, particularly on retail media platforms, to capitalize on the growing online shopping trend.

-

The integration of online and offline shopping experiences enables brands to reach consumers at multiple touchpoints, enhancing brand visibility and customer interaction.

-

The rapid expansion of e-commerce, especially post-pandemic, has increased the demand for effective advertising solutions that can drive online sales.

One of the primary reasons behind the growth of retail media platforms is the improved capacity for brands to target consumers effectively and provide personalized advertising experiences. Recent advancements in data analytics and artificial intelligence have empowered retailers to gather and interpret immense customer data, including shopping patterns, preferences, and demographics. As 72% of consumers expect personalized marketing messages, underscoring the growing demand for tailored experiences. For instance, platforms like Walmart Connect leverage first-party data from their customer interactions to create highly targeted advertising campaigns. Such campaigns are capable of being viewed by specific subsets of consumers, targeting brand experiences suitable to their preferences, thereby increasing potential engagement. The Amazon advertising system applies purchases and browsing behavior to serve advertisement that accommodates users at their points of shopping interest.

Moreover, the integration of machine learning algorithms helps brands optimize ad placements in real-time, ensuring that the right ads reach the right consumers. This present level of personalization serves to enhance the shopping experience, as customers feel valued and understood. Consequently, the brands that have formulated such methods have been shown to exhibit improved metrics with higher click rates and increased returns to initial investment, further driving the adoption of retail media platforms.

Restraints:

-

Growing concerns about data privacy and stringent regulations (e.g., GDPR, CCPA) may limit data usage for targeted advertising, impacting ad effectiveness.

-

The increasing number of brands and platforms in the retail media space can lead to market saturation, making it challenging for individual brands to stand out.

-

As consumers are exposed to more ads, there is a risk of ad fatigue, which can lead to decreased engagement and effectiveness of campaigns.

The privacy-related issues and stringent regulations are the significant challenges of the retail media platform market. Nowadays, customers pay more attention to how their personal data are collected and used. There’s an urgent need for transparency between brands’ advertisers and target audiences and control of personal information from the part of users. Legislative measures regarding personal data also include the General Data Protection Regulation in Europe and the California Consumer Privacy Act in the USA respectively. The laws determine strict rules regarding data collection and usage and restrict different ways of targeting brands within the frames of retail media. Advertisers are in a challenging situation, as they must obtain explicit consent from their target customers and cannot use any stakeholder information for targeting. Moreover, potential fines and fees prompt companies to avoid collecting and using their audiences’ data for commercial purposes. It leads to negative consequences for both companies and audiences. Targeted campaigns are less effective and help brands engage their customers and optimize efforts in the sphere of retail media platforms.

Retail Media Platform Market Segment analysis

By Platform Type

In 2023, the retailer-owned media networks comprised the largest share of 56% with regard to revenue within the retail media platform market. This growth is attributed to the growing number of retailers that introduced their media networks, which allows businesses to effectively monetize their digital assets. When it comes to omnichannel retailing, companies also apply their first-party data to create remarkable advertising scenarios adapted to customers’ needs. Such an approach results in providing a retailer with a unique opportunity to directly interact with those purchasers who are already interested in the products it sells, which enhances consumer engagement and loyalty.

As far as the third-party media networks segment is taken into consideration, it is expected to grow with a remarkable CAGR across the forecast period. This shift is explained by the expanding reliance on inner facilities, backed by broader audiences, and the possibility of using various data sources to make each ad more successful. The retail landscape's evolving dynamics highlight the importance of both retailer-owned and third-party media networks in meeting the advertising needs of brands in an increasingly competitive marketplace.

By Industry Vertical

The consumer-packaged goods segment held the largest revenue share 23% in 2023, revealing the tremendous investment that brands make in retail media to market their products. The revelation is confirmed by the recent statistics released by the Bureau of Economic Analysis, which shows that in 2023, CPG brands accounted for about $300 billion worth of retail product sales. Retail media comes up as one of the perfect solutions for CPG companies as consumers are increasingly becoming online shoppers.

The beauty and personal care segment is projected to grow significantly in the forecast period due to the emerging popularity of e-commerce and social media influencers of beauty products. The high growth rate experienced is attributed to the ease with which the industry can employ targeted advertisements through different media. Based on the government reports, consumer spending on personal care products keeps going up as it increased by 8% since August 2021. Through a combination of products aligned with the strategies in place, the brands stand as strong candidates in this category to make the best of retail media.

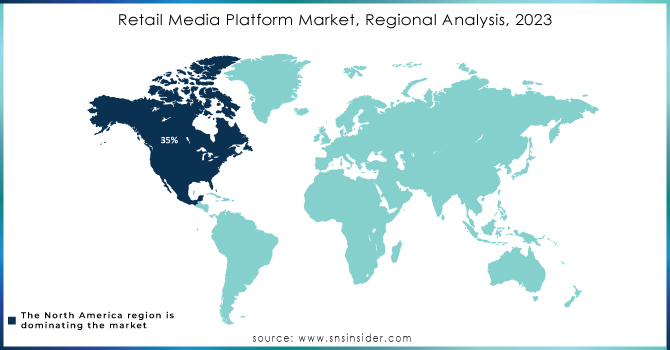

Regional Insights

In 2023, North America dominated the retail media platform market, accounted a revenue share of 35%. This region has an advanced digital infrastructure and high internet penetration among customers who frequently utilize retail media solutions. The U.S. Census Bureau reported a notable increase in online retail sales, reaching over $1 trillion in 2023, highlighting the critical role of e-commerce in the North American retail landscape. U.S. retailers are taking fuller advantage of that trend with proprietary media networks. Apart from that, the high presence of key players in the process and their significant investments in developing their media networks drive the North American market’s dominance. Moreover, the government supports the expansion of digital advertising, and competition in the retail media market is outstanding due to the high number of key retailers. As more and more brands are eager to effectively engage with the retail media ecosystem, finding new ways to reach customers and increase sales, North America is destined to continue to play a leading role in shaping the future of retail advertising.

In Asia Pacific, the development of the retail media platform will experience the fastest growth from 2024 to 2032. Asia Pacific will become the fastest-growing market, with the upsurge of e-commerce development in countries like India, China and Southeast Asia, which will require relevant retail media platforms for engaging customers. With the high penetration rate of mobile devices in Asian countries, including but not limited to China, India, and Indonesia, it operates as a mobile-first economy. As consumers increasingly shop via mobile devices, retail media platforms are optimizing for mobile to effectively reach and target shoppers on their preferred devices, fuelling growth across Asia Pacific's diverse markets.

Need any customization research on Retail Media Platform Market - Enquiry Now

Recent News

-

In March 2024, Lowe’s and Google disclosed a detailed plan for a new retail media initiative. The novel collaboration will allow the home improvement retail chain and its brand partners to use Google’s data-ad technologies for more precise and effective online marketing. The main purpose is to enable brands from the home improvement sector to engage with their target audiences catering to topics like home redesign and DIY tools across Google Search and Shopping websites.

-

In August 2023, Walmart announced the launch of its updated retail media network designed to provide a solution for targeting. The initiative is aligned with its perspective on the importance of effective first-party data concentration to enhance Walmart’s partner ads.

-

July 2023, Target shared its new features of retail media platform that are purposed to offer individual advertisement solutions, pitchers reflect sales initiatives, and an opportunity for report download. Target’s online store puts emphasis on asking brands to inform about their presence in the advertisement space provided by retailers.

-

Amazon’s increased advert usage increases its retail media importance. The article reports that Amazon has experienced a 20% increase in ad spending by brands. It implies more brands implement Amazon’s retail media for their digital marketing.

Key Players

-

Amazon Advertising (Amazon DSP, Sponsored Products)

-

Google (Google Ads, Shopping Ads)

-

Criteo (Criteo Retail Media, Criteo Dynamic Retargeting)

-

Walmart Connect (Walmart Media Group, Sponsored Products)

-

Target (Roundel, Sponsored Ads)

-

Rakuten Advertising (Rakuten Marketing, Rakuten Insight)

-

Meta (Facebook) (Facebook Ads, Instagram Shopping Ads)

-

Kroger Precision Marketing (Kroger Media, KPM Insights)

-

Microsoft (Microsoft Advertising, Bing Shopping Campaigns)

-

Verizon Media (Oath, Verizon Media DSP)

-

Adobe (Adobe Advertising Cloud, Adobe Experience Manager)

-

Mediavine (Mediavine Ads, Mediavine Publisher Network)

-

ChannelAdvisor (ChannelAdvisor Retail, ChannelAdvisor Advertising)

-

Taboola (Taboola Commerce, Taboola Feed)

-

Sizmek by Amazon (Sizmek Ad Suite, Sizmek Insights)

-

PubMatic (PubMatic Retail, PubMatic OpenWrap)

-

Magnite (Magnite Retail, Magnite OpenMarketplace)

-

Skimlinks (Skimlinks Monetization, Skimlinks Analytics)

-

Impact (Impact Partnership Cloud, Impact Attribution)

-

Zalando (Zalando Media Solutions, Zalando Advertising) and others.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.1 Billion |

| Market Size by 2032 | USD 33.7 Billion |

| CAGR | CAGR of 8.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Advertising Format (Display Ads, Search Ads, Sponsored Content, Others) • By Deployment (Cloud, On-Premises) • By Platform Type(Retailer-Owned Media Networks, Third-Party Media Networks, Integrated Media Platforms) • By Industry Vertical(Consumer Packaged Goods (CPG), Electronics and Technology, Apparel and Fashion, Grocery and Food Delivery, Beauty and Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Advertising, Google, Criteo, Walmart Connect, Target, Rakuten Advertising, Meta, Kroger, Microsoft, Verizon Media, Adobe, Mediavine (Mediavi |

| Key Drivers | • Brands are allocating a larger portion of their budgets to digital advertising, particularly on retail media platforms, to capitalize on the growing online shopping trend • The integration of online and offline shopping experiences enables brands to reach consumers at multiple touchpoints, enhancing brand visibility and customer interaction. |

| RESTRAINTS | • Growing concerns about data privacy and stringent regulations (e.g., GDPR, CCPA) may limit data usage for targeted advertising, impacting ad effectiveness. |