Smoke Ingredients for Food Market Report Scope & Overview:

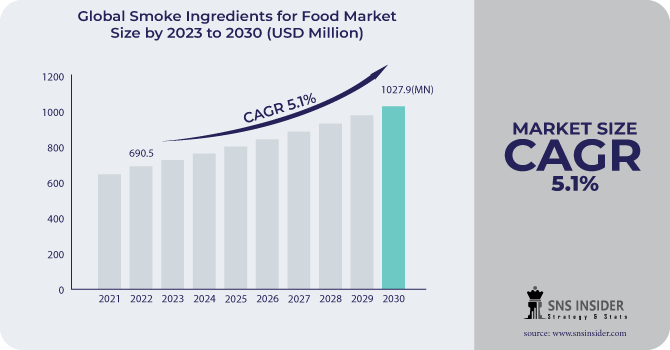

The Smoke Ingredients for Food Market size was USD 690.5 million in 2022 and is expected to Reach USD 1027.9 million by 2030 and grow at a CAGR of 5.1% over the forecast period of 2023-2030.

Smoke ingredients for food are ingredients that are used to add a smoky flavor to food. Smoke ingredients can be used in a variety of food products, such as meat & seafood poultry, dairy products, snacks, and sauces.

Smoke ingredients are available in Liquid, powder, oil, and other forms. Liquid form is widely used. Liquid smoke is a concentrated form of smoke sold in bottles. It is simple to use and can be incorporated into cuisine at any point during the cooking process. The category is expected to grow due to properties such as high water solubility and ease of handling, which make liquid components the most popular among consumers.

Based on the application segment, the Meat & seafood segment is the fastest-growing application sector accounting for 35% of the market in 2022. during the forecasted period. Meats and seafood account for a sizable portion of the market, and this trend is likely to continue during the projection period. An increase in meat & seafood consumption, as well as changes in food habits, are significant drivers driving this segment's growth. Smoke tastes improve the flavor and scent of sausage, jerky, and other cured meats, as well as shrimp, smoked fish, and other seafood products.

MARKET DYNAMICS

KEY DRIVERS

-

High demand for Smoked Food

Consumers nowadays are becoming more specific towards their various eating habits. Smoke ingredients are mostly used in the food industry sector due to the growing popularity of various cuisines that incorporate smoked ingredients, such as barbecue, Mexican, and Indian cuisines, which is driving up demand for smoked ingredients for food. Furthermore, beneficial characteristics such as ease of handling and water solubility of the Smoke Ingredients for Food Market. The growing customer desire for smoke ingredients, as well as the readily available smoke components, are expected to drive the expansion of the smoke ingredients market.

-

Rising demand for processed food products

RESTRAIN

-

Health Risks associated with smoked food

Smoke contains a variety of compounds, including carcinogens known as polycyclic aromatic hydrocarbons (PAHs). PAHs are produced when organic matter is incompletely burnt. Furthermore, smoked meals are high in sodium and fat, which can raise the risk of heart disease and stroke. Furthermore, the smoke ingredients are not as pure or concentrated as smoke flavors already on the market. These are the adverse effects of smoked food which act as a challenge in the growth of the market.

OPPORTUNITY

-

Shift towards natural and organic smoke ingredients

Traditional smoke ingredients are derived from the combustion of wood or other organic materials. These materials, however, may include hazardous compounds such as polycyclic aromatic hydrocarbons (PAHs). Plant-based resources, such as wood chips, herbs, and spices, are used to make natural and organic smoke ingredients. Consumers view these substances to be healthy because they do not contain toxic chemicals. Smoke ingredient manufacturers are creating new products that are more natural, organic, and sustainable. Some firms, for example, are developing smoke additives manufactured from plant-based sources and certified organic.

CHALLENGES

-

Competition from other flavorings

There is a wide range of other flavorings available, such as spices and herbs These flavorings are frequently natural and organic, and they provide consumers with a wide range of flavor alternatives. Smoke components are a distinct flavoring, but they can be costly when compared to other flavorings. Furthermore, smoked components may not be appropriate for all culinary products. Smoke additives, for example, may not be good for food products consumed fresh or cooked at high temperatures.

IMPACT OF RUSSIA-UKRAINE WAR

Russia and Ukraine are both exporters and consumers of wood and other organic materials used in the manufacture of smoke components. Because of the disruption in supply caused by the war, the price of smoke ingredients has risen. The United States and other nations' trade sanctions against Russia have made it more difficult for Russian enterprises to export smoke ingredients. This has further restricted the global availability of smoke components. Since the commencement of the war, the global supply of smoke ingredients has been reduced by more than half. Since the start of the war, demand for smoke components in Europe has dropped by more than 10%.

IMPACT OF ONGOING RECESSION

Recession has impacted the food industry which indirectly affected the sales of smoke ingredients products used in the food industry which adds flavors and international cuisines such as barbecue, grilled food, and other items. The price of liquid smoke, a popular type of smoke ingredient, has increased by more than 20% since the start of the war. During inflation, people tend to spend less on expensive items. Inflation also affects consumers coming to restaurants, and hotels to enjoy cuisines. People may look for alternative options like wood, coal, and others which may impact climatic conditions.

MARKET SEGMENTATION

By Form Type

-

Oil

-

Liquid

-

Powder

-

Others

By Application

-

Pet Food

-

Bakery & Confectionary

-

Meat & Seafood

-

Dairy Products

-

Snacks & Sauces

-

Others

.png)

REGIONAL ANALYSIS

North America is currently the largest market for smoked ingredients for food, followed by Europe and Asia Pacific. The USA Smoke ingredients market is predicted to grow at a CAGR of 8.8% from 2022 to 2030. Consumption of ready-to-eat food products is increasing in North America as a result of disposable income in this region, increased consumer adoption, and rising demand for processed food in other countries.

Europe is expected to witness ample opportunities in 2022 with the growing popularity of smoky-flavored foods in Germany, the market will expand if commercial organizations seek smoke additives for food. Germany's smoked ingredients for food market is predicted to grow to USD 83.19 million by 2030. Major key players in the country are working on enhancing the quality of existing ingredients, which is driving the country's market growth.

Asia Pacific is one of the rising economies that will begin to offer growth prospects in the next years. It is attributable to the region's increased consumption of smoke-flavored food products and growing technological advancement in the food processing sector. The market size for smoke-related food ingredients in China was estimated at USD 53.18 million in 2022. India is growing with a CAGR of 5.7% from 2023 to 2030. Market growth is driven by technological advancements in the food processing industry and increasing consumption of products with smoked flavors.

The Middle East & Africa and South America are expected to support and increase the overall utilization of smoke components for food.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Smoke Ingredients for Food Market are Dempsey Corporation, Azelis, Associated British Foods plc, B&G Foods, Redbrook Ingredient Services, Besmoke, Kerry Ingredients, Red Arrow, MSK WIBERG GmbH, and FRUTAROM Savory Solutions GmbH., and other key players.

Dempsey Corporation-Company Financial Analysis

RECENT DEVELOPMENTS

In 2021, Azelis established a smoke flavor extraction and distillation factory. This new factory is one of just a few in the world that produces extremely concentrated smoke flavors for a variety of food applications such as mixes and sauces.

| Report Attributes | Details |

| Market Size in 2022 | US$ 690.5 Million |

| Market Size by 2030 | US$ 1027.9 Million |

| CAGR | CAGR of 5.1 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Oil, Liquid, Powder, and Others) • By Application (Pet Food, Bakery & Confectionary, Meat & Seafood, Dairy Products, Snacks & Sauces, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dempsey Corporation, Azelis, Associated British Foods plc, B&G Foods, Redbrook Ingredient Services, Besmoke, Kerry Ingredients, Red Arrow, MSK WIBERG GmbH, and FRUTAROM Savory Solutions GmbH |

| Key Drivers | • High demand for Smoked Food • Rising demand for processed food products |

| Market Restrain | • Health Risks associated with smoked food |