Social Media Listening Market Report Scope & Overview:

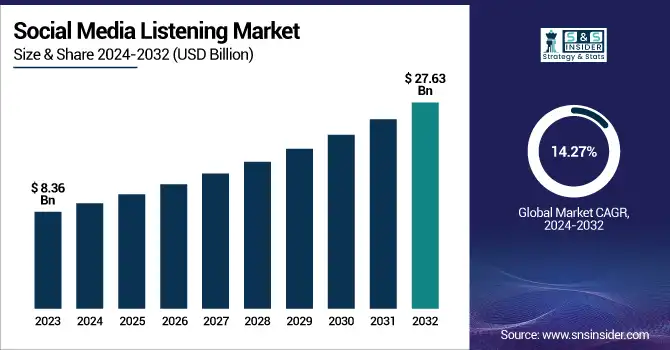

The Social Media Listening Market was valued at USD 8.36 billion in 2023 and is expected to reach USD 27.63 billion by 2032, growing at a CAGR of 14.27% from 2024-2032.

To Get more information on Social Media Listening Market - Request Free Sample Report

This market is driven by advancements in sentiment analysis, customer retention, and churn rate management, enabling businesses to gain valuable insights into customer behavior. Cost analysis and the volume of data processed further enhance the ability to make informed decisions. The growing use of Text Analytics and Natural Language Processing (NLP) enables more accurate and real-time insights from social media platforms, fostering improved customer engagement and brand positioning. As businesses increasingly rely on social media insights to refine marketing strategies and enhance customer experiences, the demand for social media listening tools continues to rise.

U.S. Social Media Listening Market was valued at USD 2.29 billion in 2023 and is expected to reach USD 7.37 billion by 2032, growing at a CAGR of 13.88% from 2024-2032. The U.S. Social Media Listening Market is growing due to the increasing need for data-driven insights to enhance customer engagement, brand perception, and marketing strategies. Advancements in sentiment analysis, Text Analytics, and Natural Language Processing (NLP) enable businesses to better understand consumer behavior. The rising volume of user-generated content on platforms like Twitter and Instagram offers more opportunities for real-time monitoring and responsiveness.

Social Media Listening Market Dynamics

Drivers

-

Rising Demand for Real-Time Consumer Insights is Fueling the Growth of the Social Media Listening Market

Growing dependency on real-time consumer insights has emerged as a key driver for companies that wish to improve decision-making and make marketing efforts more targeted. Social media platforms yield tremendous volumes of data on a daily basis, which businesses can analyze to make sense of changing consumer attitudes, opinions, and behaviors. By doing so, businesses are able to make their products, services, and campaigns more relevant and appealing to the audience directly. By accessing social media discussions, brands are able to better know market trends and thus remain one step ahead of the competition while responding quickly to shifts in customer requirements. Access to these capabilities is essential in realizing higher levels of customer engagement, brand strategy optimization, and the development of more tailored customer experiences, culminating in better-informed and more effective business decisions.

Restraints

-

Increasing Data Privacy Regulations are Limiting the Effectiveness of Social Media Listening Tools and Market Growth

With data privacy issues on the rise, companies are finding it increasingly difficult to gather and analyze social media data on consumers. In light of laws such as the GDPR and CCPA, firms have to navigate strict regulations that restrict access to personal and sensitive data. This legal structure limits the capacity to monitor, keep, and use consumer data, which weakens the operational capacity of social media listening tools. As privacy requirements continue to develop, organizations will need to comply, and this usually involves major changes to their data gathering practices and technology. These are challenges that can result in decreased data accessibility, which in turn impacts the quality of insights being produced through social media listening tools and restricts them from reaching their full potential for businesses aiming to maximize customer interaction and marketing channels.

Opportunities

-

Advancements in AI and Machine Learning are Enhancing the Accuracy and Effectiveness of Social Media Listening Tools

Recent advancements in machine learning and AI hold great promise to improve the accuracy and richness of insights that can be extracted from social media data. By integrating these technologies, social media listening tools can more effectively process and analyze large amounts of unstructured data, allowing companies to discover more detailed insights. AI-powered algorithms can enhance sentiment analysis, detect nascent trends, and forecast consumer behaviors with higher accuracy. This enables firms to make more insightful, data-based decisions and tailor their marketing efforts in real time. Moreover, as machine learning algorithms develop, social media listening software can further advance, allowing firms to remain competitive and act ahead of the market, and react to customer feedback and market trends. This innovation will fuel more market growth and operational effectiveness.

Challenges

-

Handling the Overwhelming Volume of Social Media Content is a Major Challenge for Effective Social Media Listening

The overwhelming amount of data produced on different social media sites makes it a considerable challenge for companies attempting to find meaningful insights. With billions of posts, comments, and interactions being made on a daily basis, it is getting more and more difficult to sift and examine the most relevant content. This information overload requires advanced tools that are able to sift through high volumes of non-structured content to reveal important trends, sentiments, and consumer behaviors. Without advanced filtering mechanisms and suitable data analysis techniques, organizations stand to miss crucial insights or reach incorrect conclusions. As social media content increases, the demand for better and more targeted data processing solutions will be paramount to unlocking the full potential of social media listening tools for decision-making.

Social Media Listening Market Segment Analysis

By Solutions

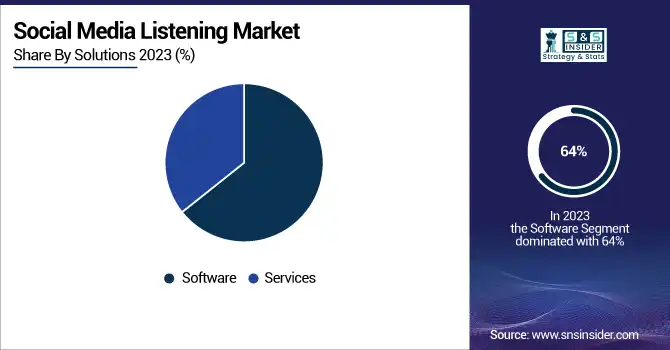

The Software segment led the Social Media Listening Market with the largest revenue share of nearly 64% in 2023 because of growing demand for sophisticated tools capable of delivering real-time, actionable intelligence from social media sites. Such software applications are essential for companies to keep tabs on brand image, customer opinions, and collecting useful information for marketing plans. With the increasing demand for data analysis, automation, and AI deployment, the software sector remains the market leader in adoption and revenue.

The Services segment will expand at the fastest CAGR of approximately 15.31% during 2024-2032 because of the growing demand for specialized consultation and customized solutions. Most companies need customized assistance to deploy and maximize social media listening tools efficiently, and this fuels demand for managed services, integration services, and analytics. With companies demanding more specialized support to maximize their social media strategies, the services segment is expected to grow strongly in the next few years.

By Vertical

The Retail & E-commerce segment dominated the Social Media Listening Market with the highest revenue share of about 25% in 2023 due to the increasing reliance on consumer feedback from social media platforms. Retailers and e-commerce businesses use social media listening tools to track customer sentiment, monitor brand reputation, and improve personalized marketing strategies. The rapid growth of online shopping and the need for real-time insights to enhance customer experience have solidified this sector’s dominance in the market.

The Travel and Hospitality segment is expected to grow at the fastest CAGR of about 17.99% from 2024-2032, driven by the growing importance of customer feedback in shaping travel experiences. With travelers increasingly sharing their experiences online, businesses in this sector are using social media listening to monitor trends, manage brand reputation, and address customer concerns swiftly. The rise of digital engagement in travel and hospitality is accelerating the demand for social media listening tools in this industry.

By Application

The Brand Management segment dominated the Social Media Listening Market with the highest revenue share of about 26% in 2023 due to the increasing need for businesses to monitor brand sentiment and reputation. Companies leverage social media listening tools to track customer feedback, identify brand perception, and respond to potential crises. This enables brands to improve customer loyalty, adjust marketing strategies, and maintain a positive public image. The growing importance of brand reputation in competitive markets continues to drive this segment's dominance.

The Product Development and Innovation segment is projected to grow at the fastest CAGR of around 17.61% from 2024-2032, with more businesses employing social media listening to inform new product concepts and innovations. Through tracking customer conversations, likes, and opinions, businesses are able to respond to gaps in the marketplace, follow trends, and make products with an appeal to their customers. Customer-inspired innovation is driving fast expansion in the segment.

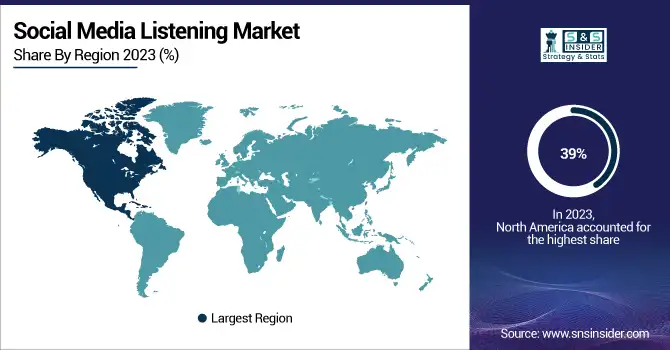

Regional Analysis

North America accounted for the largest share of the Social Media Listening Market with approximately 39% revenue share in 2023 owing to high adoption of newer technologies and a presence of top players in the region. Increasing emphasis on data-driven decision-making, brand management, and customer insights has driven companies across all industries to deploy social media listening tools. Moreover, the robust digital infrastructure and increased social media penetration in North America act as driving factors for its market leadership.

Asia Pacific will grow at the fastest CAGR of approximately 16.57% during 2024-2032 based on the fast-paced digitalization and rising social media adoption across the region. As companies in nations such as China, India, and Japan adopt data analytics to increase customer interaction, social media listening tools are gaining demand. The increasing e-commerce, retail, and technology industries in Asia Pacific are fueling the use of these tools for real-time information and market intelligence.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Brandwatch (Vizia, Consumer Research)

-

Buffer (Publish, Analyze)

-

Digimind (Digimind Social, Digimind Intelligence)

-

Hootsuite (Hootsuite Analytics, Hootsuite Insights)

-

IBM Corporation (IBM Watson, IBM Social Media Analytics)

-

Meltwater (Meltwater Social Media Monitoring, Meltwater Media Intelligence)

-

Mention (Mention Analytics, Mention Listening)

-

Sprinklr Inc. (Sprinklr Social, Sprinklr Insights)

-

Sprout Social, Inc. (Sprout Social Analytics, Sprout Social Listening)

-

YouScan (YouScan Analytics, YouScan Social Media Monitoring)

-

Google (Google Alerts, Google Trends)

-

Oracle (Oracle Social Cloud, Oracle Analytics Cloud)

-

Salesforce (Salesforce Social Studio, Salesforce Einstein Analytics)

-

Adobe (Adobe Analytics, Adobe Experience Platform)

-

SAS (SAS Visual Analytics, SAS Social Media Analytics)

-

Qualtrics (Qualtrics Social Listening, Qualtrics Experience Management)

-

Talkwalker (Talkwalker Alerts, Talkwalker Analytics)

-

Khoros (Khoros Social Listening, Khoros Analytics)

Recent Developments:

-

In 2024, Onclusive Social expanded its social listening coverage by adding BlueSky monitoring. This integration enhances its platform’s ability to track conversations and trends across emerging social networks.

-

In 2024, Brandwatch launched its next-generation audience analysis tool, incorporating AI-driven insights to help brands better understand and engage with their target audiences through more accurate and dynamic data.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.36 Billion |

| Market Size by 2032 | USD 27.63 Billion |

| CAGR | CAGR of 14.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solutions (Software, Services) • By Application (Customer Experience Management, Competitive Benchmarking, Brand Management, Marketing Campaign Management, Sales and Lead Generation, Product Development and Innovation, Others) • By Vertical (BFSI, Healthcare & Life Sciences, Retail & E-commerce, Government and Defence, Travel and Hospitality, IT & Telecommunications, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brandwatch, Buffer, Digimind, Hootsuite, IBM Corporation, Meltwater, Mention, Sprinklr Inc., Sprout Social, Inc., YouScan, Google, Oracle, Salesforce, Adobe, SAS, Qualtrics, Talkwalker, Khoros |