Soda Ash Market Report Scope & Overview

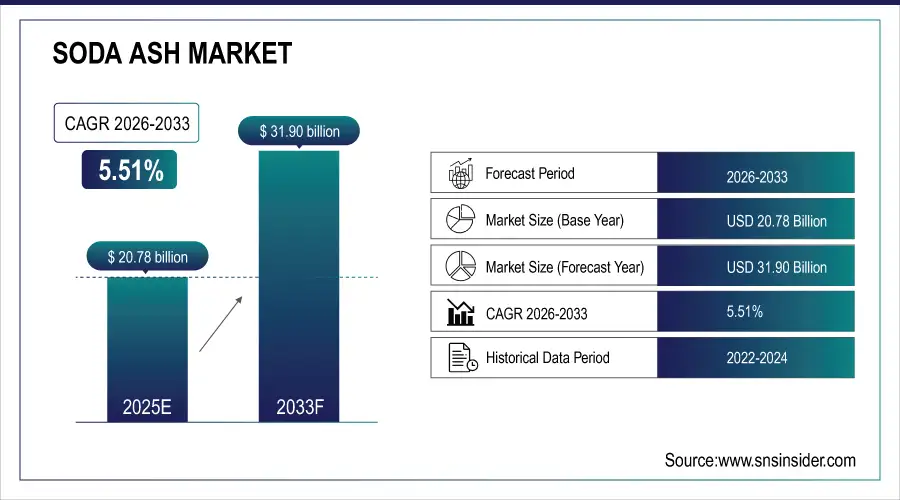

The Soda Ash Market size was valued at USD 20.78 Billion in 2025 and is expected to reach USD 31.90 Billion by 2033, growing at a CAGR of 5.51% over the forecast period 2026–2033.

The market is witnessing strong growth driven by expanding glass manufacturing, increasing detergent production, and rising demand for sustainable chemicals. Soda Ash (sodium carbonate) serves as an essential raw material in various industries, enabling energy-efficient production, environmental compliance, and cost optimization across global supply chains.

Soda Ash Market Size and Forecast:

-

Market Size in 2025E: USD 20.78 Billion

-

Market Size by 2033: USD 31.90 Billion

-

CAGR: 5.51% from 2025 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Soda Ash Market - Request Free Sample Report

Key Soda Ash Market Trends:

-

Increasing adoption of glass-based packaging driven by sustainability and recyclability goals.

-

Rapid rise in detergent and soap manufacturing due to urbanization and hygiene awareness.

-

Modernization of soda ash plants with low-carbon emission processes.

-

Expansion of natural trona mining for cost-efficient soda ash production.

-

Substitution of synthetic production with environmentally benign natural alternatives.

-

Growing use of soda ash in water treatment, desulfurization, and lithium carbonate processing.

U.S. Soda Ash Market Insights:

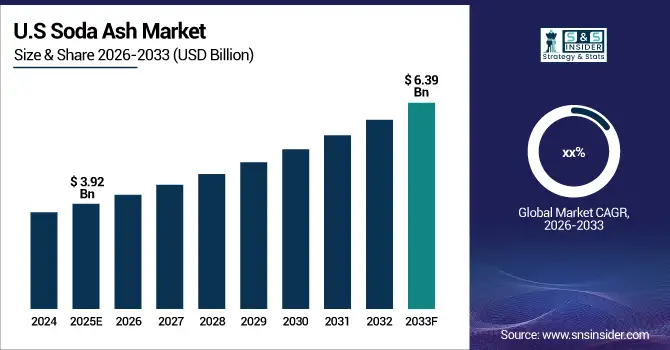

The U.S. Soda Ash market size was USD 3.92 Billion in 2025E and is expected to reach USD 6.39 Billion by 2033. According to a study, rising demand for eco-friendly glass and chemical feedstocks has boosted soda ash exports by 12% annually. This cause, rising global consumption of flat and container glass, effects expansion of natural soda ash extraction and efficient logistics. The U.S. remains a top exporter, leveraging abundant trona reserves, advanced refining technologies, and strong sustainability initiatives.

Soda Ash Market Drivers:

-

Increasing Demand for Flat Glass Products Across Construction and Automotive Sectors

The rising demand for architectural glass in buildings and energy-efficient windows in automobiles is a vital driver of the soda ash market. This cause, accelerating infrastructure developments and electric vehicle production, effects greater consumption of soda ash as a fluxing agent in glassmaking. Manufacturers are scaling up output and investing in cleaner production methods to meet specifications for high-strength and low-emission glass. Continuous innovation in float glass and solar glass enhances light transmission and structural durability, pushing global soda ash demand in construction and automotive glass applications.

For example, in March 2025, Şişecam expanded its glass manufacturing facility in Turkey to supply solar and automotive industries, increasing soda ash consumption by 15% and reinforcing its role in sustainable glass production.

Soda Ash Market Restraints:

-

Environmental Regulations and Carbon Footprint Challenges Pose Production Barriers

Strict environmental standards and high CO₂ emission rates associated with traditional synthetic production are limiting soda ash manufacturing scalability. This cause, increasing regulatory pressure on carbon output, effects restricted production expansion and higher compliance costs for synthetic producers. Companies must invest in carbon capture technologies and cleaner processes, increasing operational expenses. These factors have curtailed new facility approvals across Europe and Asia. While natural production via trona reduces emissions, the limited availability of deposits constrains global replacement, maintaining input cost volatility and reducing market accessibility.

For example, in April 2024, several European producers revised downstream prices due to tightened EU emission controls, which increased operational costs and slowed synthetic soda ash output growth.

Soda Ash Market Opportunities:

-

Adoption of Low-Carbon and Lithium Integration Technologies Enhances Long-Term Market Growth

Emerging technologies integrating low-carbon soda ash processes with lithium extraction offer significant growth opportunities. This cause, accelerating electric vehicle battery demand, effects the development of eco-sustainable carbonate-based products. Integrating soda ash in lithium carbonate production ensures chemical balance and process efficiency. Global producers are partnering with energy technology firms to establish green manufacturing hubs, combining renewable power with carbon capture. These sustainability-led models promise long-term revenue diversification and resilience in evolving chemical value chains.

For example, in June 2025, Solvay partnered with a U.S.-based lithium manufacturer to implement soda ash–based direct lithium extraction technology, improving processing efficiency while reducing energy intensity by over 30%.

Soda Ash Market Segmentation Analysis:

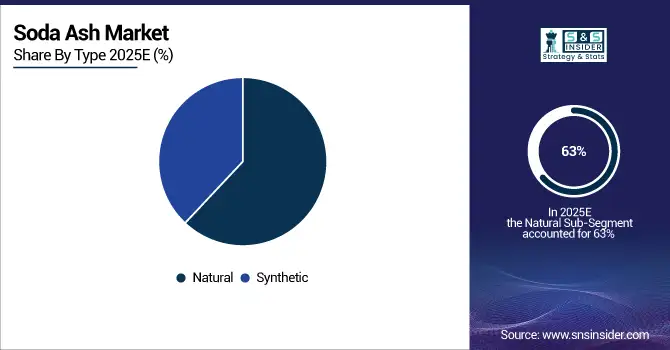

By Type, Natural Soda Ash Leads Market While Synthetic Soda Ash Registers Fastest Growth

The Natural segment dominates with 63% share in 2025E, supported by large trona reserves in the U.S. and Turkey. This cause, abundant raw material availability and cost-efficient processing, effects expansion of capacity in key export hubs. Natural soda ash offers lower emissions and competitive pricing, reinforcing its market leadership.

The Synthetic segment, projected to grow at 7.27% CAGR, benefits from rising industrialization in Asia and rising glass demand. This cause, expanding chemical manufacturing bases, effects modernization of Solvay and Hou processes with cleaner energy inputs, supporting sustainable synthetic production and market competitiveness.

By Grade, Dense Soda Ash Leads Market While Light Soda Ash Grows Fastest

Dense Soda Ash holds 39% revenue share in 2025E due to rising flat glass and container production. This cause, surging construction and automotive demand, effects continued investment in densification methods enhancing bulk density and grain uniformity, improving material performance in glass furnaces.

Light Soda Ash records the fastest growth at 5.84% CAGR, driven by expanding detergent and chemical applications. This cause, increasing hygiene awareness, effects greater utilization across powder detergents and chemical feedstocks, supporting strong global production and distribution growth.

By Application, Glass Industry Leads Market While Detergents and Soaps Register Fastest Growth

The Glass Industry dominates with 49% share in 2025E, driven by widespread use in flat glass, packaging, and solar panels. This cause, increased energy-efficient building projects, effects higher soda ash demand for fluxing and clarity in glass furnaces.

Detergents and Soaps grow fastest due to rapid urbanization and rising cleaning product consumption. This cause, expanding hygiene standards globally, effects strong demand for soda ash as a pH regulator and builder, enhancing cleaning efficiency and performance.

By End-Use, Construction and Architecture Lead Market While Household and Industrial Cleaning Register Fastest Growth

The Construction and Architecture segment leads with 33% share in 2025E, supported by glazing demand in energy-efficient infrastructure. This cause, growing building modernization, effects heavy consumption of soda ash in flat glass used for insulation, facades, and solar integration.

Household and Industrial Cleaning exhibit the fastest expansion as consumers seek sustainable cleaning agents. This cause, increased awareness of eco-friendly chemicals, effects strong market adoption of soda ash formulations in detergents and surface cleaners, strengthening its presence across domestic and commercial sectors.

Soda Ash Market Regional Analysis:

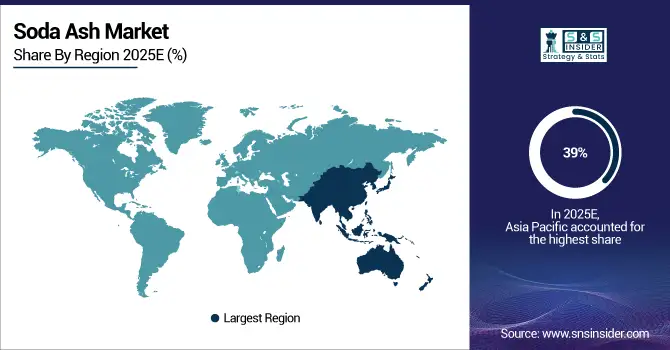

Asia Pacific Dominates Soda Ash Market in 2025E

Asia Pacific holds an estimated 39% share of the global Soda Ash market, driven by large-scale glass, detergent, and chemical manufacturing. Expanding industrial infrastructure caused increased demand for both natural and synthetic soda ash, which effects strong investment in modern processing plants and resource integration. This industrial synergy enhances production efficiency, supply security, and export capacity, positioning Asia Pacific as the leading regional hub for global soda ash supply.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Dominates Asia Pacific Soda Ash Market with Strong Industrial Integration and Cost-Effective Production

China leads the region through vertically integrated glass manufacturing sectors, massive construction projects, and low-cost production capabilities. This cause, high-volume industrial output, effects consistent leadership in both domestic consumption and global exports of soda ash, reinforcing China’s pivotal role in shaping regional and international market dynamics.

North America is the Fastest-Growing Region in 2025E

North America records the highest CAGR of around 6.88%, fueled by strong export growth and advanced soda ash extraction technologies. This cause, abundant trona reserves and sustainability-driven processing innovations, effects long-term supply stability, lower production costs, and enhanced global competitiveness. The region’s strategic investments in green manufacturing and efficient logistics further strengthen its position as a reliable and cost-effective supplier in the international soda ash market.

U.S. Strengthens Global Leadership Through Trona-Based Soda Ash Production

The U.S. drives North American dominance with vast trona reserves in Wyoming, advanced automated processing systems, and efficient trade networks. This cause, large-scale resource availability and technological innovation, effects strong export performance—supplying over 25% of global soda ash annually. Such integration ensures consistent output, cost efficiency, and reinforces the U.S. position as a global leader in sustainable soda ash production and trade.

Europe Soda Ash Market Insights, 2025

In 2025, Europe sustained strong soda ash demand, driven by renewable glass production and circular economy goals. This cause, stricter sustainability regulations and environmental compliance, effects a shift from conventional to cleaner manufacturing methods. Investments in energy-efficient technologies and recycling-based production enhance regional competitiveness, reduce emissions, and align Europe’s soda ash industry with long-term climate and green economy objectives.

Germany Drives European Soda Ash Demand Through Innovation and Industrial Strength

Germany leads Europe’s soda ash market with cutting-edge advancements in glass formulations, energy-efficient recovery systems, and a robust industrial base. This cause, continuous innovation and manufacturing excellence, effects steady soda ash consumption across automotive, construction, and packaging sectors. Germany’s commitment to technological progress and sustainability ensures consistent demand growth and reinforces its position as a key driver of Europe’s soda ash industry.

Middle East & Africa and Latin America Market Insights, 2025

In 2025, the Middle East and Africa showed steady soda ash market growth driven by infrastructure expansion and desalination initiatives, while Latin America’s progress was fueled by rising demand in detergent, textile, and food-grade applications. Saudi Arabia led MEA with major investments in soda ash-based glass for smart city projects, and Brazil dominated Latin America through increased consumption in household and packaging industries, reinforcing regional industrial diversification and economic resilience.

Competitive Landscape for the Soda Ash Market

WE Soda

WE Soda is a global leader in natural soda ash production, headquartered in London, with major operations in Turkey. The company specializes in large-scale trona-based production ensuring low emissions and high efficiency. Its sustainable mining technologies and strong global logistics make it a dominant exporter to Europe, Asia, and the U.S.

-

In March 2025, WE Soda announced the construction of a new greenfield soda ash plant in Kazakhstan, expanding its total capacity by 15% and reinforcing its low-carbon strategy.

Ciner Resources Corporation

Ciner Resources operates one of the largest natural soda ash production facilities in the U.S., utilizing high-grade trona ore refinement. The company emphasizes process automation and energy recovery systems that support consistent quality and environmental compliance.

-

In June 2025, Ciner expanded its Wyoming-based extraction site, increasing export volumes to Asia by leveraging new railway links and optimized logistics routes.

Solvay

Solvay is a global leader in synthetic soda ash and specialty chemicals, emphasizing sustainability through its Solvay One Planet program. The company integrates carbon capture technologies, cleaner Solvay processes, and circular economy practices to reduce emissions and resource use. This commitment enhances operational efficiency, environmental performance, and strengthens Solvay’s leadership in sustainable chemical manufacturing.

-

In July 2025, Solvay invested in upgrading its Rosignano plant in Italy to introduce new low-carbon evaporative crystallization units, cutting emissions by 20%.

Şişecam Group

Şişecam Group, a leading Turkish multinational, is an integrated glass manufacturer and major soda ash producer. With high-capacity production facilities in Turkey and Europe, it serves the glass, detergent, and chemical industries. The company’s vertically integrated operations ensure cost efficiency, product quality, and a strong global presence across diverse industrial applications and markets.

-

In May 2025, Şişecam announced the commissioning of an advanced soda ash production facility in Eskisehir, incorporating AI-based energy optimization technologies to improve efficiency and environmental performance.

Soda Ash market Key Players:

-

WE Soda

-

Ciner Resources Corporation

-

Solvay

-

Şişecam Group

-

Nirma Ltd.

-

DCW Ltd.

-

Genesis Alkali

-

OCI Company Ltd.

-

GHCL Ltd.

-

Kazan Soda Elektrik

-

Eti Soda

-

United Soda Ash

-

ArChemCo

-

STPP Group

-

Fondland Chemicals Co., Ltd.

-

Weifang Haizhiyuan Chemistry

-

Shouguang Dinghao Trading

-

Shandong Pulisi Chemical

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 20.78 Billion |

| Market Size by 2032 | USD 31.90 Billion |

| CAGR | CAGR of 5.51 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Natural, Synthetic) • By Grade (Light Soda Ash, Dense/Heavy Soda Ash) • By Application (Glass Industry, Detergents & Soaps, Chemical Industry, Metallurgy, Others [Paper, Pharmaceuticals, Food, etc.]) • By End-User (Automotive Glass, Construction & Architecture, Household & Industrial Cleaning, Chemical Processing, Pharmaceutical & Food Processing) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | WE Soda, Ciner Resources Corporation, Solvay, Şişecam Group, Tata Chemicals Ltd., Nirma Ltd., DCW Ltd., Genesis Alkali, OCI Company Ltd., GHCL Ltd., Shandong Haihua Group, Kazan Soda Elektrik, Eti Soda, United Soda Ash, ArChemCo, STPP Group, Fondland Chemicals Co., Ltd., Weifang Haizhiyuan Chemistry, Shouguang Dinghao Trading, Shandong Pulisi Chemical, and Others. |