Hydrochloric Acid Market Analysis & Overview:

The Hydrochloric Acid Market Size was valued at USD 2.46 Billion in 2023 and is expected to reach USD 4.16 Billion by 2032, growing at a CAGR of 6.03% over the forecast period of 2024-2032.

To Get more information on Hydrochloric Acid Market - Request Free Sample Report

The Hydrochloric Acid Market is undergoing significant transformation driven by industrial demand and evolving global supply dynamics. Our report unravels this journey through detailed Downstream Product Flow Mapping, showcasing how hydrochloric acid supports key sectors like steel, chemicals, and oil extraction. A strategic Production Facility Distribution Heatmap highlights regional manufacturing hubs and their growth momentum. In response to rising global uncertainties, a focused Supply Chain Disruption Risk Assessment identifies logistical vulnerabilities and geopolitical pressures. The report also analyzes Hydrochloric Acid Capacity Utilization Rates, revealing efficiency trends among major producers. Furthermore, the Capacity Expansion Pipeline by Region offers forward-looking insights into upcoming projects poised to influence market balance. Together, these elements craft a compelling view of this evolving market.

The US Hydrochloric Acid Market Size was valued at USD 659.40 Million in 2023 with a market share of around 76.4% and growing at a significant CAGR over the forecast period of 2024-2032.

The US Hydrochloric Acid market is experiencing steady growth driven by its critical role in industries such as steel manufacturing, oil and gas, and chemical processing. A major growth driver is the expanding shale gas exploration activities, where hydrochloric acid is extensively used in well acidizing to enhance oil recovery supported by data from the U.S. Energy Information Administration (EIA). Additionally, the resurgence of domestic steel production, as tracked by the American Iron and Steel Institute (AISI), continues to boost demand for hydrochloric acid in pickling processes. Environmental compliance and technological advancements by U.S.-based producers such as Olin Corporation and Occidental Petroleum Corporation are further shaping market dynamics and driving capacity enhancements across the nation.

Hydrochloric Acid Market Dynamics

Drivers

-

Expanding Use of Hydrochloric Acid in Renewable Fuel Processing and Biomass-Based Industrial Applications Across Developed Economies

Hydrochloric acid is increasingly vital in biomass conversion and biodiesel production due to its effectiveness in acid hydrolysis and esterification. In the United States, rising adoption of sustainable fuels and federal support—such as the Bioenergy Technologies Office under the U.S. Department of Energy have incentivized advancements in bio-refineries. Hydrochloric acid is used to pretreat lignocellulosic feedstocks, aiding the breakdown of complex carbohydrates into fermentable sugars for ethanol. In biodiesel, it facilitates esterification reactions with free fatty acids to enhance fuel quality. As clean energy policies intensify and carbon reduction targets grow stricter, industrial players like Abengoa Bioenergy and POET are incorporating acid-driven technologies into their operations. These developments extend the application scope of hydrochloric acid from traditional sectors to renewable fuels, offering growth potential and diversification for manufacturers. The market is also driven by international demand for low-emission alternatives, where hydrochloric acid is positioned as a key processing reagent. As sustainability gains priority in government and corporate agendas, hydrochloric acid’s importance in green fuel infrastructure is poised to grow significantly over the coming years.

Restraints

-

Stringent Occupational Exposure Limits and Hazardous Material Handling Regulations Impede Uninterrupted Hydrochloric Acid Market Growth

The production, transportation, and use of hydrochloric acid are heavily regulated due to its corrosive and toxic nature. Regulatory frameworks by U.S. bodies such as the Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency (EPA), and the Department of Transportation (DOT) impose strict limitations on exposure, emissions, and hazardous material labelling. These compliance requirements add significant operational costs for storage, protective equipment, monitoring systems, and specialized logistics. Additionally, hydrochloric acid's volatility increases risks of spills and workplace injuries, prompting companies to invest in mitigation protocols and insurance. Such complexities deter new entrants and smaller manufacturers, who may find regulatory barriers too burdensome to overcome. Moreover, industries such as food and pharmaceuticals must meet additional purity standards, further complicating usage. Even downstream industries face limitations in disposal practices and are subject to local environmental scrutiny. As regulatory standards tighten globally especially in Europe and North America producers must navigate a more controlled environment, potentially slowing production expansion or deterring capacity increases, thereby restraining the market’s growth trajectory despite rising demand.

Opportunities

-

Increasing Infrastructure Investments Across Emerging Economies Fuel Hydrochloric Acid Demand in Steel and Construction Industries

Hydrochloric acid plays a vital role in steel pickling, a process critical for preparing metal surfaces before galvanizing, rolling, or coating. As developing economies in Asia, Latin America, and the Middle East invest in infrastructure from transportation networks to urban housing demand for treated steel is expanding rapidly. For instance, initiatives like India’s National Infrastructure Pipeline (NIP) and Brazil’s Growth Acceleration Program require vast quantities of steel for bridges, railways, and public buildings. This translates into higher demand for hydrochloric acid in metal cleaning operations. Additionally, as these countries ramp up domestic manufacturing under government-led industrialization plans, steel output and its allied chemical usage continues to rise. Hydrochloric acid is also used in the production of titanium dioxide, concrete additives, and certain construction plastics. International steel producers expanding into these regions often rely on localized chemical sourcing, further boosting the market. The opportunity lies in scaling up hydrochloric acid facilities in proximity to industrial hubs and steel mills, enabling agile supply chains that serve fast-growing construction and manufacturing sectors across these dynamic regions.

Challenge

-

Logistical Limitations in Bulk Transportation and Specialized Storage Requirements Create Barriers for Market Scalability

Hydrochloric acid is highly corrosive and requires specialized containers usually lined with rubber or plastic for safe transport and storage. Railcars, tankers, and intermediate bulk containers (IBCs) must meet stringent regulatory and safety guidelines, especially in regions like the United States where the Department of Transportation oversees hazmat logistics. This makes transportation costly and complex, particularly over long distances or across international borders. Moreover, hydrochloric acid has a relatively low shelf life under improper storage conditions, limiting stockpiling capacity for end-users. These logistical hurdles disproportionately impact smaller chemical processors and remote industrial operations that struggle with reliable supply. Supply chain disruptions like port closures or rail strikes can significantly delay delivery and impact production schedules in dependent sectors such as oil well acidizing or steel processing. These challenges also restrict market expansion into rural or emerging industrial zones without established chemical logistics infrastructure. As demand grows in diverse sectors, the ability to overcome logistical and storage constraints becomes crucial for hydrochloric acid producers aiming for scale and regional diversification.

Hydrochloric Acid Market Segmental Analysis

By Grade

Synthetic segment dominated the Hydrochloric Acid Market in 2023 with a market share of 58.7%. The synthetic grade hydrochloric acid segment holds the majority share due to its high purity and suitability for critical applications in pharmaceuticals, food processing, and electronic-grade chemicals. Synthetic hydrochloric acid is manufactured through the direct synthesis of hydrogen and chlorine gases, ensuring better quality control and consistent concentrations. For instance, in the United States, the Food and Drug Administration (FDA) enforces strict purity standards for acids used in food and pharmaceutical production, driving demand for synthetic-grade variants. Major chemical producers like Olin Corporation and OxyChem prioritize synthetic production for these regulated markets. Additionally, the growth in water purification and high-performance polymers also depends on cleaner acids, further solidifying this segment’s dominance. Government mandates around water treatment such as the U.S. EPA’s Safe Drinking Water Act encourage use of higher-grade chemicals, making synthetic hydrochloric acid the preferred choice in critical industries.

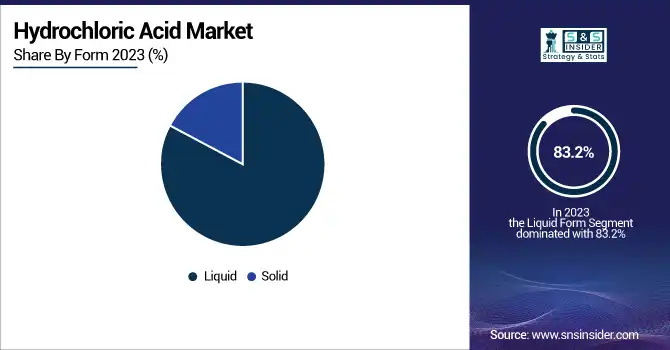

By Form

Liquid form dominated the Hydrochloric Acid Market in 2023 with a market share of 83.2%. Liquid hydrochloric acid is widely used due to its ease of transport, application efficiency, and versatility across industries. It is especially preferred in bulk applications such as steel pickling, water treatment, and chemical synthesis. In contrast, solid hydrochloric acid often in the form of gas or absorbed onto solid carriers is limited to niche applications due to handling complexity and higher processing costs. In the U.S., the National Association of Chemical Distributors (NACD) promotes safe logistics for liquid chemicals, with infrastructure like ISO tankers and bulk storage facilities that favor liquid formats. Furthermore, the American Chemistry Council highlights hydrochloric acid as a core input for high-volume chemical processes where liquid delivery is essential. With rising investments in industrial infrastructure and increasing domestic steel output in countries like the U.S. and China, liquid form hydrochloric acid remains the most feasible and widely adopted variant.

By Application

Steel Pickling segment dominated the Hydrochloric Acid Market in 2023 with a market share of 36.5%. Steel pickling uses hydrochloric acid to remove scale and rust from steel surfaces before further processing such as galvanizing or coating. This application has remained dominant due to global growth in construction, automotive, and heavy machinery industries. The World Steel Association reported a production surge in crude steel in the U.S. and India in 2023, directly influencing hydrochloric acid consumption. In the U.S., initiatives such as the Infrastructure Investment and Jobs Act (IIJA) are spurring massive investments in highways, bridges, and railways, boosting steel demand. As a result, the need for pickling operations has surged. Hydrochloric acid is also preferred in continuous pickling lines for its effectiveness and lower environmental load compared to sulfuric acid. The steel pickling process aligns well with circular economy goals since spent acid is often regenerated. These dynamics have solidified steel pickling as the leading application in the global hydrochloric acid landscape.

By End-use Industry

The steel industry dominated the hydrochloric acid market in 2023 with a market share of 31.8%. The steel industry remains the largest consumer of hydrochloric acid due to its heavy use in descaling, pickling, and cleaning operations. Steel manufacturing facilities, especially in countries like the United States, China, and Germany, rely on hydrochloric acid to prepare metal surfaces for finishing and coating. According to the American Iron and Steel Institute (AISI), domestic steel production in the U.S. saw consistent growth in 2023, driven by automotive, aerospace, and infrastructure demand. Hydrochloric acid's efficiency and recyclability via acid regeneration units also appeal to environmentally conscious manufacturers. Furthermore, emerging steel producers in Latin America and Southeast Asia have begun adopting hydrochloric acid-based pickling due to its lower temperature requirement and faster reaction rate compared to traditional methods. With major industrial zones expanding across North America and Asia, the steel sector continues to anchor global hydrochloric acid consumption, making it the top-performing end-use segment.

Hydrochloric Acid Market Regional Outlook

North America dominated the Hydrochloric Acid Market in 2023 with a market share of 35.1%. North America's dominance in the hydrochloric acid market is rooted in its well-established industrial infrastructure, growing steel production, and high demand from oil and gas exploration. The United States leads regional consumption, particularly through sectors like steel pickling, water treatment, and oil well acidizing. According to the U.S. Geological Survey and the Energy Information Administration (EIA), increased drilling activities in the Permian Basin and other shale-rich areas have significantly boosted hydrochloric acid usage in fracking and well stimulation. U.S.-based chemical giants such as Olin Corporation, Occidental Petroleum (OxyChem), and Westlake Chemical Corporation operate integrated manufacturing facilities with dedicated hydrochloric acid units, ensuring steady domestic supply. Government incentives under the Infrastructure Investment and Jobs Act are also driving regional steel and chemical demand, strengthening hydrochloric acid's role. Canada, while smaller, is growing steadily due to its mining and oil sectors. Mexico’s expanding auto manufacturing and industrial base also contribute to regional demand. Strong logistics networks and high-capacity chemical handling ports give North America an edge in maintaining its market lead.

On the other hand, the Asia Pacific region emerged as the fastest growing region with rapid growth in the hydrochloric acid market due to rising demand from steel, chemical, textile, and food processing industries. China and India, in particular, are major contributors. China’s booming industrial base and large-scale infrastructure development under initiatives like the Belt and Road Initiative require significant volumes of steel and hence hydrochloric acid for pickling processes. India’s growing steel production, driven by Make in India and National Infrastructure Pipeline projects, has spurred demand for acid in both metallurgy and construction materials. According to the Indian Ministry of Steel, crude steel production in India is expected to exceed 300 million metric tons by 2030. Moreover, in Southeast Asia, countries like Vietnam and Indonesia are emerging manufacturing hubs with growing requirements for industrial-grade chemicals. The chemical and pharmaceutical industries in Asia are also expanding, with hydrochloric acid used in intermediates, dyes, and cleaning agents. Local production capacity is increasing, with regional players expanding facilities to serve domestic and export markets, cementing Asia Pacific as the fastest-growing region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AGC Chemicals (AGC Inc.) (Hydrochloric acid, Caustic soda, Sodium hypochlorite)

-

BASF SE (Hydrochloric acid, MDI production by-product, Nitric acid)

-

Covestro AG (Hydrochloric acid, Methylene diphenyl diisocyanate, Chlorine)

-

Detrex Corporation (High-purity hydrochloric acid, Anhydrous hydrochloric acid, Specialty acids)

-

Dongyue Group (Hydrochloric acid, Chloromethane, Caustic soda)

-

Ercros SA (Hydrochloric acid, Sodium hypochlorite, Caustic soda)

-

ERCO Worldwide (Hydrochloric acid, Sodium chlorate, Chlorine dioxide)

-

Formosa Plastics Corporation (Hydrochloric acid, Vinyl chloride monomer, Caustic soda)

-

Inovyn (Hydrochloric acid, Sodium hydroxide, Vinyls)

-

Kemira (Hydrochloric acid, Aluminum chloride, Coagulants)

-

Nouryon (Hydrochloric acid, Chlorine, Sodium chlorate)

-

Occidental Petroleum Corporation (OxyChem) (Hydrochloric acid, Caustic soda, Chlorine)

-

Olin Corporation (Hydrochloric acid, Chlorine, Caustic soda)

-

PCC Group (Hydrochloric acid, Polyether polyols, Caustic soda)

-

Shin-Etsu Chemical Co., Ltd. (Hydrochloric acid, Vinyl chloride, Caustic soda)

-

Solvay (Hydrochloric acid, Hydrogen peroxide, Soda ash)

-

Tata Chemicals Limited (Hydrochloric acid, Soda ash, Sodium bicarbonate)

-

Tessenderlo Group (Hydrochloric acid, Potassium hydroxide, Sulfur-based chemicals)

-

Toagosei Co., Ltd. (Hydrochloric acid, Sodium hypochlorite, Acrylic polymers)

-

Westlake Chemical Corporation (Hydrochloric acid, Vinyl chloride monomer, Caustic soda)

Recent Developments

-

January 2025: Olin Corporation’s Winchester division acquired the ammunition assets of Ammo Inc., including GunBroker.com. This acquisition aimed to enhance Olin’s commercial ammunition capabilities and digital reach, combining legacy manufacturing with Ammo Inc.’s e-commerce platform to better serve the expanding ammunition market.

-

November 2024: Nouryon opened a new Innovation Center in Deventer, Netherlands, to boost global R&D capabilities. The facility supports sectors like agriculture and personal care, promoting collaboration and sustainable chemistry while strengthening the company’s technical services and innovation footprint across key international markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.46 Billion |

| Market Size by 2032 | USD 4.16 Billion |

| CAGR | CAGR of 6.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Synthetic, By-product) •By Form (Solid, Liquid) •By Application (Steel Pickling, Oil Well Acidizing, Ore Processing, Food Processing, Pool Sanitation, Calcium Chloride, Biodiesel, Others) •By End-use Industry (Food & Beverage, Pharmaceutical, Textile, Steel, Oil & Gas, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Olin Corporation, Occidental Petroleum Corporation (OxyChem), Westlake Chemical Corporation, Formosa Plastics Corporation, ERCO Worldwide, AGC Chemicals (AGC Inc.), Covestro AG, Nouryon, Detrex Corporation, Dongyue Group and other key players |