Sodium Nitrite Market Report Scope & Overview:

The Sodium Nitrite Market size was USD 426.2 Million in 2023 and is expected to reach USD 621.8 Million by 2032 and grow at a CAGR of 4.3% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Sodium Nitrite Market - Request Sample Report

Sodium nitrite is an important ingredient for use in food preservation; mainly in processed meats, sausages, and canned foods. Its main role is to kill pathogens like the spores of Clostridium botulinum, a bacterium that produces the botulism toxin, and therefore make food safe and prolong storage. Further, sodium nitrite functions as a color stabilizer, retaining the attractive pinkish-red color that develop, and making them more visually appealing and acceptable to consumers. An increase in global processed and convenience food consumption, owing to urbanization, changing lifestyles, rapid economic development, and the growth of middle-class consumers with higher disposable incomes in different parts of the world, has been a major booster for the food sector and thus supports the growth of sodium nitrite in this segment. The trend is even more apparent in increasingly populated areas and busy urban centers where the convenience of ready-to-eat, as well as processed food, is taking precedence. Sodium nitrite is essential in modern food production and processing as it can provide food safety, quality, and aesthetics, which are major drivers of the sodium nitrite market.

The consumption of processed and ultra-processed foods has been on the rise globally. In the United States, for instance, ultra-processed foods account for over 50% of daily caloric intake.

The demand for sodium nitrite to act as soil treatment and for fertilizers has also led to new applications for end use in the agricultural sector. It maintains nitrogen in the soil, which increases nutrients and results in greater quantities and sizes of crops. This becomes especially important in cases of intensive agriculture where the soil nutrients are quickly used up. Increasing population, improving food consumption, and hence growing global demand for agricultural produce are some of the major factors that aid in the consumption of sodium nitrite in the farming area. Furthermore, it is also useful for soil treatment so it can reduce soil acid and respiration can increase the function of healthy plants. Its use in specialty fertilizers for high-value crops and efficiency in improving the quality of yield make this compound an irreplaceable tool in modern agriculture. With increasing agricultural produce on a global scale, the need for effective solutions such as sodium nitrite in sustainable farming practices is anticipated to rise, contributing to steady market growth over the forecast period.

For instance, the U.S. Environmental Protection Agency (EPA) has assessed the uses of sodium and potassium nitrates, highlighting their applications in fertilizers and the need for proper management to prevent adverse effects.

Sodium Nitrite Market Dynamics

Drivers

-

Increasing demand for water treatment drives the market growth.

A major driver of the sodium nitrite market is the increasing water treatment demand as sodium nitrite is employed as an oxygen scavenger in municipal and industrial applications. Sodium nitrite is very effective at having special protection properties in water systems by preventing the oxidation of metals to extend the useful life of pipelines, boilers, and other infrastructure. This characteristic is particularly useful in power generation, oil and gas, and manufacturing industries, where clean, efficient water systems are vital to success. Further, the increasing global demand for sustainable water management and sewage treatment owing to the increase in population and urbanization has boosted the requirement for treatment solutions such as sodium nitrite. The sodium nitrite market is directly propelled by the expansion of the water treatment infrastructure worldwide to attain environmental regulations and access to clean water from use by government and industries. The demand for advanced treatment chemicals will be more prominent in developing regions where industrialization is gaining momentum and with each passing day, the shortage of water resources is in demand.

In May 2023, BASF partnered with European pork producer Danish Crown for a pilot to cut down emissions of Nitrous oxide from feed crop fertilization by as much as 50%. This initiative showed a 3-5% reduction in the carbon footprint per kg of pork. This gave the company an edge over its other associates by adding to its portfolio of products.

Restraint

-

Fluctuating raw material prices may hamper the market growth.

Rising raw material costs are one of the major restraints for the sodium nitrite market and are expected to restrain the growth of sodium nitrite during the forecasted period. Sodium nitrite is mainly synthesized by sodium nitrate reaction with reducing agents and raw materials prices such as sodium nitrate, and natural gas are significantly fluctuate1 Movements of these raw materials are usually due to external factors such as supply chain disruptions, geopolitical tensions, and fluctuations in global demand. For example, any increase in natural gas prices, one of the important joint factors in sodium nitrite production, will affect production costs directly. The fluctuation of raw materials causes ups and downs in the manufacturing cost, which in turn pushes the prices of sodium nitrite in the market. This means consumers will find it less affordable, especially in price-sensitive industries such as agriculture and water treatment, where cost-effectiveness is vital due to high operational costs.

Sodium Nitrite Market Segmentation

By Grade

Food grade the largest market shares around 64% in 2023. The food grade segment occupies the largest share of the market in the sodium nitrite industry, due to its wide application in food preservation and processing properties. Sodium nitrite is a common preservative and color fixative used in cured meat (e.g. bacon, sausages, ham) and canned food. Due to its remarkable ability to inhibit undesirable bacteria, such as Clostridium botulinum, it is an essential ingredient to guarantee food safety, shelf life, and product quality. Sodium nitrite also preserves the desirable pink-red color of processed meats so they look better, and consumers are more accommodating if they appear appealing. Increased processing and convenience food consumption due to the busy lifestyles, urbanization, and dietary habits have provided an even greater momentum for sodium nitrite use within the food sector.

By Application

The coatings segment held the largest market share around 34% in 2023. It is owing to the remarkable properties exhibited by polysiloxane-based coatings, making them suitable for a large number of applications. Characterized by exceptional durability, resistance to weather and environment including moisture, UV attack, and extreme temperatures, these coatings are prized and long-lasting. Polysiloxane coatings are being adopted widely in the construction, automotive, and industrial sectors as sustainability and energy efficiency become a more important focus for the industry. The other use in the construction industry is as protective to building facades to prolong the life of exposed building materials from floods and extreme weather events. In addition, polysiloxane coatings play a crucial role in the automotive sector due to their anti-corrosion and anti-scratch features that enhance the durability and aesthetic looks of vehicles.

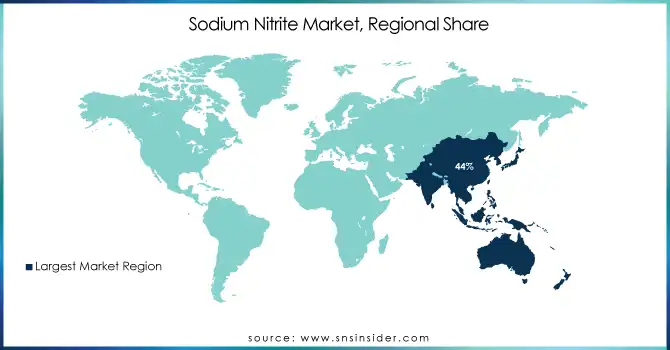

Sodium Nitrite Market Regional Analysis

Asia Pacific held the largest market share around 44% in 2023. The growing need to buy processed food and agricultural products are some of the main factors driving growth of the sodium nitrite market. China and India are some of the extensive consumers of sodium nitrite owing to increased food processing industry as it is used as a preservative and color fixative in processed meats and other food products. Besides this, the growing agriculture industry in the region due to increasing consumption of fertilizers and soil treatment has eased the sodium nitrite usage in the agriculture applications. The consumption of sodium nitrite has also been aided by industrial growth (requiring sodium nitrite across various sectors such as water treatment and chemicals). In addition, rapid urbanization in the Asia-Pacific region has resulted in a shift in the consumption of processed and convenience foods, directly fuelling the food-grade sodium nitrite market. Its dominance in the global sodium nitrite market is also attributed to the presence of leading manufacturing players and increasing infrastructure and technology investments in the region. Due to the growing demand for sodium nitrite for varied applications regionally the sodium nitrite market is anticipated to grow at a continued rate further establishing Asia-Pacific as the number one market for sodium nitrite globally.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (Formic Acid, Ammonium Formate)

-

Airedale Chemical Company Ltd. (Sodium Formate, Calcium Formate)

-

Deepak Nitrite Ltd. (Sodium Formate, Methanol)

-

Shijiazhuang Fengshan Chemical Co. Ltd. (Formic Acid, Sodium Sulfide)

-

Ural Chem JSC (Urea, Ammonia)

-

Linyi Luguang Chemical Co. Ltd. (Formic Acid, Sodium Nitrite)

-

Radiant Indus Chem Pvt. Ltd. (Calcium Formate, Acetic Acid)

-

Yingfengyuan Industrial Group Limited (Sodium Formate, Oxalic Acid)

-

SABIC (Methanol, Ethylene Glycol)

-

Perstorp Holding AB (Formic Acid, Pentaerythritol)

-

Kemira Oyj (Calcium Formate, Formic Acid)

-

Eastman Chemical Company (Acetic Acid, Propionic Acid)

-

Celanese Corporation (Acetic Acid, Vinyl Acetate Monomer)

-

Luxi Chemical Group Co. Ltd. (Formic Acid, Ammonium Formate)

-

Honeywell International Inc. (Hydrogen Fluoride, Acetone)

-

OCI N.V. (Melamine, Urea)

-

Shandong Baoyuan Chemical Co. Ltd. (Formic Acid, Sodium Formate)

-

Guangzhou Shuangqiao Co. Ltd. (Formic Acid, Calcium Formate)

-

Henan Botai Chemical Building Materials Co. Ltd. (Calcium Formate, Sodium Nitrate)

-

Yara International ASA (Urea, Ammonium Nitrate).

Recent Development:

-

In 2023: Dow introduced its new line of DOWSIL Silicone Coatings specifically designed for sustainable building applications. These coatings offer enhanced energy efficiency and durability, supporting the construction industry's shift toward more eco-friendly materials.

-

In 2022: Recticel launched RectiSil, a new high-performance silicone rubber material. This product is designed to meet the growing demand for energy-efficient insulation solutions, particularly in the automotive and construction sectors.

| Report Attributes | Details |

| Market Size in 2023 | USD 426.2 Million |

| Market Size by 2032 | USD 621.8 Million |

| CAGR | CAGR of 4.3% From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Food Grade, Industrial Grade) • By Application (Food & Beverages, Pharmaceuticals, Corrosion Inhibitors, Dyes & Pigments, Fertilizer, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Airedale Chemical Company Ltd., Deepak Nitrite Ltd., Shijizhuang Fengshan Chemical Co. Ltd., Ural Chem JSC, Linyi Luguang Chemical Co. Ltd., Radiant Indus Chem Pvt. Ltd., Yingfengyuan Industrial Group Limited, SABIC, and other key players. |

| Key Drivers | •Increasing demand for water treatment drives the market growth |

| Market Opportunities | • Fluctuating raw material prices may hamper the market growth. |