Soft Contact Lenses Market Size & Overview:

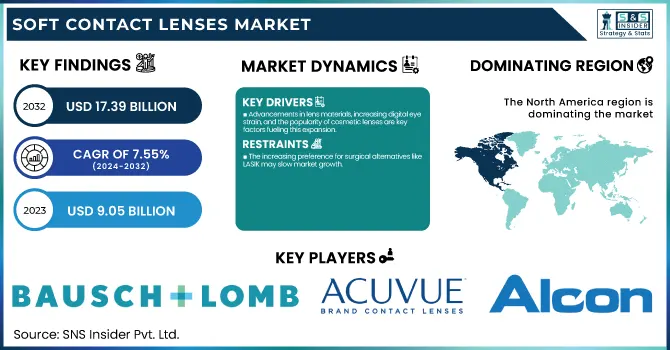

The Soft Contact Lenses Market size was valued at USD 9.05 billion in 2023 and is projected to reach USD 17.39 billion by 2032 and grow at a CAGR of 7.55% over the forecast period 2024-2032. This report examines demographic trends and usage patterns, highlighting the growing prevalence of vision problems and the increasing demand for corrective eyewear, particularly among younger consumers. The study delves into the adoption of new technologies, such as advanced lens materials, smart contact lenses, and innovative manufacturing techniques, which are transforming the market. Pricing trends and consumer spending are also analyzed, with a focus on the affordability of lenses and the influence of healthcare insurance on product accessibility. Additionally, the report explores environmental impact and sustainability trends, noting the rising demand for eco-friendly, reusable lenses and sustainable packaging options.

To Get more information on Soft Contact Lenses Market - Request Free Sample Report

Soft Contact Lenses Market Dynamics:

Drivers

-

Advancements in lens materials, increasing digital eye strain, and the popularity of cosmetic lenses are key factors fueling this expansion.

The main cause for this trend is the increased rate of refractive vision disorders. In 2023, it was estimated that more than 35% of the global population suffered from myopia. Soon, the cases are going to increase at an alarming rate. As people started demanding corrective eyewear, comfort, and convenience made soft contact lenses a preferable choice over glasses. Technological developments in lens material and design have also driven this growth. The silicone hydrogel lenses of the early 2000s provide a significantly higher oxygen-permeable solution, thereby accommodating longer wear time and decreased irritation. Several research studies have determined that silicone hydrogel lenses carry a highly statistically significant decrease in dryness and irritation as opposed to traditional hydrogel lenses. Furthermore, advancement in specialty lens types such as toric lenses for astigmatism and multifocal lenses for presbyopia has also provided the opportunity for increased market capture by leading firms.

Increased demand has been fueled by the shift in lifestyle towards greater use of digital devices. Recent surveys show that more than 70% of adults have reported screen-related eye strain, creating a rising demand for products that alleviate discomfort. Clear, uninterrupted vision is an attractive feature in soft contact lenses to users looking at addressing digital eye strain. The popularity of cosmetic contact lenses has also mushroomed in market expansion. Brands offering a range of colored and cosmetic lenses appeal to fashion-forward consumers. All these factors are expected to keep the Soft Contact Lenses market growing in the coming years.

Restraints

-

The increasing preference for surgical alternatives like LASIK may slow market growth.

The most significant restraint in the Soft Contact Lenses market is the risk of eye infections and complications resulting from improper care of the lenses. Health professionals or eye specialists note that improper cleaning and storage of the lens may lead to serious issues, such as keratitis, thereby deterring some consumers from acquiring contact lenses. This challenges the use of premium lenses. Premium lenses would include silicone hydrogel or specialty lenses for cases of astigmatism and presbyopia, among others. These are significantly more expensive compared to the general lenses, making it harder to reach a wide population in case of lens replacements, cleaning solutions, and even routine eye examinations.

Opportunities

-

The development of advanced lens materials, such as biocompatible silicone hydrogel lenses, which offer greater oxygen permeability and comfort.

This technology could be more appealing to a broader audience, particularly those with sensitive eyes, due to extended wear times and decreased dryness and irritation. It includes specialty lenses that have exceptionally high growth prospects, such as toric lenses for patients with astigmatism and multifocal lenses for presbyopia. Furthermore, this growing age group will increasingly require customized vision correction solutions, thus paving the way for new product innovations and further market expansion. Additionally, increasing awareness over eye health as well as preventative care will increase the scope to raise awareness via educational campaigns, and contact lens manufacturers can collaborate with optometrists and offer them more affordable care packages to boost adoption.

Challenges

-

The lack of consumer education regarding proper lens care, leading to misuse and health complications.

Many users, particularly first-timers, may not fully understand the importance of regular cleaning, replacement schedules, and hygiene practices, which can result in discomfort or infections like conjunctivitis. This can contribute to negative perceptions and reluctance toward using contact lenses. Another challenge is the increasing market competition from corrective eye surgeries, such as LASIK. As the popularity of these procedures grows, many individuals prefer opting for a permanent solution to vision correction instead of relying on temporary contact lenses. This trend could hinder the long-term adoption of soft contact lenses in certain regions. Additionally, the availability of low-cost disposable lenses may create price sensitivity among consumers. While premium lenses offer superior comfort and quality, the affordability of basic lenses makes it difficult for some customers to justify investing in higher-end alternatives.

Soft Contact Lenses Market Segmentation Insights:

By Material

The silicone hydrogel segment dominated the Soft Contact Lenses market in 2023, accounting for more than 66.9% of the total revenue. This dominance is driven by the superior benefits of silicone hydrogel lenses, including increased oxygen permeability, which enhances comfort and reduces the risk of eye infections, allowing for longer wear times. These lenses are specially designed for keeping the eyes healthy and comfortable during the day. The hydrogel segment, while growing, will experience a lesser growth rate as compared to the silicone hydrogel lenses, considering the latter possess more advanced features.

By Design

The spherical soft contact lenses were the most widely used design, accounting for the largest market share in 2023. Their popularity is mainly attributed to their simplicity and effectiveness in correcting common vision issues such as myopia and hyperopia. These lenses are easier to manufacture and more affordable, making them a preferred option for the majority of contact lens users. The toric lens segment is expected to expand the most, based on the fact that astigmatism prevalence is increasing. The strong CAGR in the market is expected to be attributed to its increasing awareness among the population.

By Usage

The daily disposable lens segment accounted for the largest share of revenue, over 29.8%, in 2023. Their convenience, hygiene benefits, and reduced risk of eye infections make them a popular choice among consumers, particularly those with active lifestyles. The disposable nature eliminates the need for cleaning and storage, appealing to younger and tech-savvy individuals. On the other hand, disposable lenses are likely to demonstrate an enormous growth rate because consumers increasingly choose lenses that are flexible in terms of their wear schedules.

By Application

The corrective lens application was the dominant in 2023, representing more than 42.6% of the market share. The primary reason is the high penetration of contact lenses in correcting various refractive errors like near-sightedness, farsightedness, and astigmatism. As an increasing number of people opt for contact lenses due to aesthetic considerations and comfort reasons, corrective lenses remain the most sought-after category. However, the cosmetic lenses segment is expected to grow at a higher CAGR on account of increasing interest in fashion and novelty lenses, particularly among youths as well as patrons who are seeking colored or themed lenses.

By Distribution Channel

In 2023, the retail segment accounted for the largest revenue share, more than 45.2%. The retail channels of both physical stores and optical clinics allow consumers to try on lenses in person and receive professional advice from eye care experts. Such trust in in-person consultations continues to be a strong driver for the retail segment. The e-commerce segment, on the other hand, is anticipated to witness a strong CAGR, with growing online shopping penetration and increased preference for buying contact lenses from home.

Soft Contact Lenses Market Regional Analysis:

North America held a 37.9% share of the market in 2023, led by the high adoption rate of contact lenses, especially in the U.S., where over 45 million people wear contact lenses. Demand is driven by advances in lens technology, growing prevalence of vision disorders, and strong retail and e-commerce distribution channels. Lifestyle-oriented and cosmetic contact lenses also increasingly contribute to North America's dominant position.

Asia-Pacific is anticipated to be the fastest growing due to spurred growing awareness on eye health, growing disposable incomes, and having the largest population affected by refractive vision disorders. The increased urbanization rates in countries like China, India, and Japan have further stimulated the demand for contact lenses along with the current rising trend in digital eye strain.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

-

Bausch + Lomb Inc. - UltraSoft, SofLens, BioTrue ONEday, PureVision

-

Acuvue (Johnson & Johnson) - Acuvue Oasys, Acuvue 1-Day Moist, Acuvue Oasys for Astigmatism

-

Alcon Vision LLC - Air Optix, Dailies, FreshLook, Precision1

-

Carl Zeiss AG - Zeiss Contact Lenses

-

CooperVision Inc. - Biofinity, Proclear, Clariti

-

Essilor International - Varilux, Crizal (focused on eyewear, some contact lens offerings)

-

Hoya Corporation - Hoya Contact Lenses

-

Menicon Co., Ltd. - Menicon Z, Menicon PremiO, Menicon Soft

-

SEED Co., Ltd. - SEED 1day Pure, SEED Toric

-

Contamac Ltd. - Zen Lens, Optimum

-

Ciba Vision (now part of Alcon) - Focus Dailies, Focus Night & Day, AirOptix

-

Ginko International Co., Ltd. - Ginko Color Contact Lenses

-

SynergEyes, Inc. - Duette Hybrid Lenses

Recent Developments:

In July 2024, UK researchers received a USD 2.604 million grant to develop a "bandage" contact lens designed to aid in eye damage repair. This innovative lens will transfer corneal epithelial cells directly to the eye’s surface, providing a new method for treating eye injuries using soft contact lenses.

In June 2024, Bausch + Lomb launched its INFUSE for Astigmatism daily disposable contact lenses in the U.S. The company plans to begin shipping these lenses to eye care professionals in July 2024, marking a significant addition to its product lineup.

| Report Attributes | Report Attributes |

|---|---|

|

Market Size in 2023 |

USD 9.05 Billion |

|

Market Size by 2032 |

USD 17.39 Billion |

|

CAGR |

CAGR of 7.55% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Material (Silicone Hydrogel, Hydrogel) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Bausch + Lomb Inc., Acuvue (Johnson & Johnson), Alcon Vision LLC, Carl Zeiss AG, CooperVision Inc., Essilor International, Hoya Corporation, Menicon Co., Ltd., SEED Co., Ltd., Contamac Ltd., Ciba Vision (now part of Alcon), Ginko International Co., Ltd., SynergEyes, Inc., and UltraVision CLPL. |