Software Defined Networking Market Report Scope & Overview:

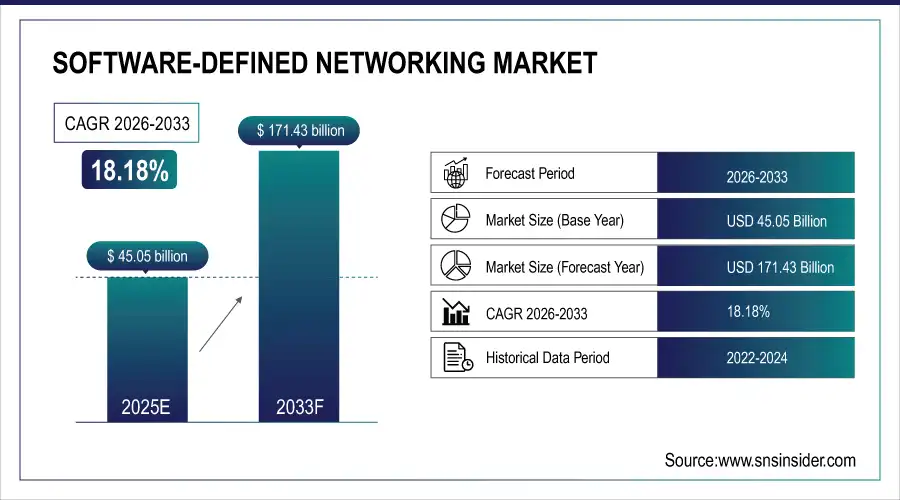

The Software Defined Networking Market was valued at USD 45.05 billion in 2025E and is expected to reach USD 171.43 billion by 2033, growing at a CAGR of 18.18% from 2026-2033.

The Software-Defined Networking (SDN) Market growth is driven by increasing adoption of network virtualization, cloud computing, and data center modernization. Rising demand for agile, scalable, and cost-efficient network infrastructure, coupled with the need for centralized management, automation, and enhanced security, is accelerating SDN deployment. Enterprises are leveraging SDN to optimize traffic, improve performance, and support hybrid and multi-cloud environments globally.

Software Defined Networking Market Size and Forecast

-

Market Size in 2025E: USD 45.05 Billion

-

Market Size by 2033: USD 171.43 Billion

-

CAGR: 18.18% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Software-Defined Networking Market - Request Free Sample Report

Software Defined Networking Market Trends

-

Rising demand for agile, scalable, and cost-efficient network management is driving the software-defined networking (SDN) market.

-

Growing adoption of cloud computing, virtualization, and data center automation is boosting market growth.

-

Expansion of enterprise, telecom, and service provider networks is fueling SDN deployment.

-

Increasing focus on network flexibility, centralized control, and traffic optimization is shaping adoption trends.

-

Advancements in AI, analytics, and security-integrated SDN solutions are enhancing performance and reliability.

-

Rising investments in 5G infrastructure and IoT connectivity are supporting market expansion.

-

Collaborations between network equipment vendors, software providers, and enterprises are accelerating innovation and global adoption.

Software Defined Networking Market Growth Drivers:

-

SDN supports dynamic and efficient network slicing for next-generation 5G networks.

As a core feature of next-generation 5G networks, SDN enables dynamic efficient network slicing. Network slicing is the ability to split one physical network into different virtual networks that can be customized for different use cases or requirements like one for ultra-low latency applications and the other for high bandwidth applications. It is especially important in the 5G era, when these use cases including enhanced mobile broadband, ultra-reliable low-latency communication, and massive machine-type communication need to coexist on a common infrastructure.

By providing centralized control and programmability, SDN enables network slicing. Operators can dynamically provision, change, and orchestrate virtual network slices through its software-based architecture. With this dynamic nature, every slice gets its own set of resources like bandwidth, latency, and security that are required based on its performance requirements. A slice for autonomous vehicles may have low latency requirements, while another slice for streaming services can be optimized for high bandwidth.

Software Defined Networking Market Restraints:

-

Technical complexity in deploying and managing SDN networks poses challenges for organizations.

Organizations face significant technical difficulties in implementing and managing Software-Defined Networking solutions. SDN makes a fundamental distinction compared to classic networks, featuring strictly decoupled control and data planes and leveraging software-centric architecture. The transition requires an in-depth knowledge of SDN concepts, protocols, and tools, many organizations may not have. One of the biggest problems is the integration of SDN in legacy systems existing. Organizations today are left with hybrid environments integrating legacy and next-gen network architectures, which can lead to intricate customizations and painstaking testing to provide the interoperability and seamless connectivity that we have come to expect. This process is heavily time and costly, along with re-aligning the network policies and protocols to SDN frameworks.

Software Defined Networking Market Segment Analysis

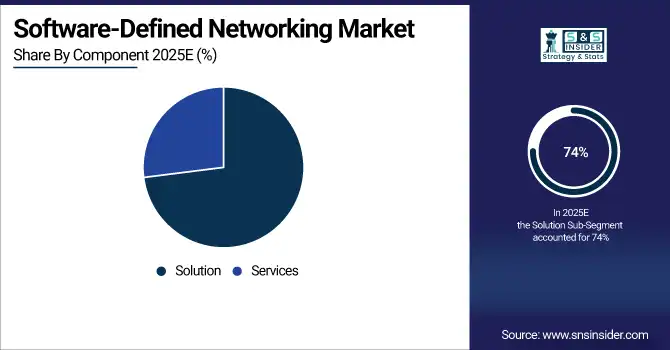

By Component, Solutions dominated the SDN market in 2025 with over 74% revenue share

The solutions segment dominated the market and represented a significant revenue share of more than 74% in 2025, SDN solutions offer specialized, customized, and goal-based approaches for specific business needs as opposed to generalized services. To synchronize business functions with modern aspects of people and industry in general, companies are focusing on upgrading network performances and reliability. The SDN solutions in the market that major companies offer help businesses secure their network better, easy control of the network, seamless cloud integration, growing demand capability in traffic volumes, and application control distribution.

The services segment is projected to exhibit the fastest CAGR during the forecast period. The growth that this segment witnessed primarily driven by the movement towards SDN technology is continuing to deepen while centralized control of resources and networks becomes increasingly important, the need for analysis and direction of increasing traffic volume and growing network threats compelling businesses and organizations to employ additional or improved security measures. SDN has services such as Consulting, training & maintenance, Integration & deployment, and managed services.

By Type, Open SDN led the market in 2025 with more than 48% revenue share

The open SDN segment dominated the market and accounted for a revenue share of more than 48% in 2025. Enterprises like user preference for protocol, development process, and standards openness because it promotes use, redistribution, and modification of software while removing constraints from purely proprietary solutions. Demand for open SDN solutions is expected to gain traction in the forecast period due to the flexibility provided by open SDN solutions, a collaborative approach allowing contributions by co-developers, versatility, innovation, and cost-effectiveness.

The hybrid SDN segment is expected to register the fastest CAGR during the forecast period. Increased demand for hybrid SDN is mainly due to the capability of providing seamless integration of existing legacy systems without a complete change of technology, helping with operational continuity, flexibility, scaling of network resources, cost savings, and support for advanced technologies such as the IoT, cloud computing, and so on. Enterprises that are forced to continue with legacy systems due to dependencies on mission-critical business functionalities, extremely high risks associated with data migration activities, and even higher costs of replacements and subsequent integrations, are increasingly adopting the hybrid SDN.

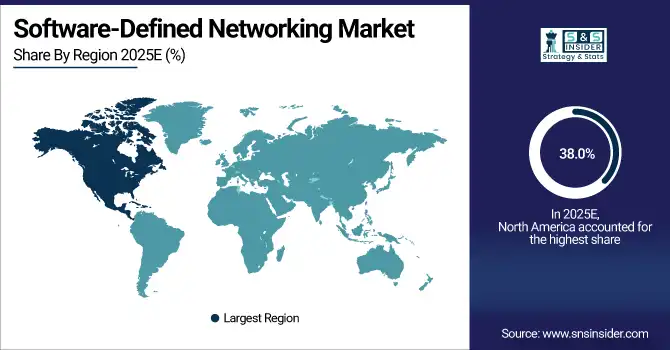

Software Defined Networking Market Regional Analysis

North America Software Defined Networking Market Insights

In 2025, North America dominated the software-defined networking market, capturing a remarkable 38.0% of revenue share. Growing usage of cloud computing technology solutions in the region and increasing digital transformation of the business from several markets along with the large enterprises operating in the technology and innovation industry are some of the factors responsible for generating the need for enhanced security solutions of companies in North America. Availability and accessibility, cost effectiveness, and increasing adoption in by telecommunication industry are expected to boost the demand for this market in upcoming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Software Defined Networking Market Insights

Asia Pacific software-defined networking market is anticipated to present the fastest CAGR during the forecast period. This is owing to the never-before-seen growth in businesses operating in the region of digital transformation, increased demand for network management solutions that support advanced emerging technologies like artificial intelligence, IoT, and machine learning, and growing needs for network-enhanced capabilities to meet the rising problems of growing telecommunication sector in the region. This flourishing requirement of network management of urban networks and modern systems by the governmental sector is proving beneficial for the regional market as well, and in turn, escalating the demand for SDN solutions.

Europe Software Defined Networking Market Insights

Europe’s Software-Defined Networking (SDN) Market is growing due to widespread adoption of cloud computing, network virtualization, and digital transformation initiatives. Enterprises are deploying SDN solutions to improve network agility, scalability, and operational efficiency. Strong IT infrastructure, regulatory support, and demand for centralized management, automation, and secure network operations across industries like BFSI, IT, and manufacturing are driving market expansion.

Middle East & Africa and Latin America Software Defined Networking Market Insights

Middle East & Africa and Latin America Software-Defined Networking (SDN) Markets are growing due to rising cloud adoption, network virtualization, and digital transformation initiatives. Enterprises are deploying SDN solutions to enhance scalability, operational efficiency, and centralized network management. Increasing demand for SD-WAN, software-defined data centers, and automated network operations, along with expanding IT infrastructure and growing awareness of advanced networking technologies, is driving market adoption across these regions.

Software Defined Networking Market Competitive Landscape:

Cisco Systems, Inc.

Cisco is a global networking and IT leader delivering software-defined networking (SDN), AI-ready data center solutions, and secure, programmable infrastructure. Its platforms integrate intelligent automation, unified management, and advanced security to simplify complex enterprise and cloud networking. Cisco focuses on network programmability, hybrid cloud connectivity, and AI-driven operations, enabling organizations to scale, optimize traffic, and streamline operations across multi-cloud, on-premises, and hybrid environments.

-

2025 – Cisco unveiled new Smart Switches with embedded services, converging network programmability, security, and AI-ready data center capabilities to reinforce software-defined network operations.

-

2024 – Cisco launched its Networking Cloud vision to centralize SDN-oriented network management across on-prem and cloud infrastructure.

-

2023 – Cisco showcased a simplified networking and management platform (Cisco Networking Cloud) to unify operations using SDN principles.

VMware, Inc.

VMware delivers software-defined cloud, edge, and networking solutions, enabling enterprises to automate, secure, and scale hybrid IT environments. Its SDN, SD-Edge, and cloud-native platforms support AI workloads, flexible connectivity, and centralized orchestration. VMware focuses on simplifying infrastructure management, improving operational efficiency, and enabling seamless integration of hybrid and multi-cloud deployments. Its solutions underpin software-defined operations for enterprises and service providers, optimizing AI, SDN, and cloud-edge workflows.

2024 – VMware expanded software-defined edge products and connectivity at Explore 2024 to support AI workloads and flexible networking.

2023 – VMware continued broad SDN portfolio support post-Broadcom acquisition, including cloud-native and SD-Edge services.

Juniper Networks, Inc.

Juniper Networks provides AI-driven networking, software-defined infrastructure, and automated operations for enterprise and cloud environments. Its AI-native platforms integrate AIOps, network automation, and hybrid connectivity, simplifying complex wired and wireless deployments. Juniper focuses on scalable, programmable networks, operational intelligence, and secure infrastructure to accelerate digital transformation and optimize network performance across data centers, edge, and cloud environments.

-

2025 – Juniper demonstrated AI-native data center networking with automated, software-driven architectures and recognized industry growth.

-

2024 – Continued deployment of AI-native networking solutions with simplified operations and automation across enterprise infrastructures.

-

2023 – Expanded AI-native networking platform and AIOps-enabled solutions across wired and wireless networks, supporting software-defined operations.

Key Players:

Some of the Software Defined Networking Market Companies

-

Cisco Systems, Inc.

-

VMware, Inc.

-

Juniper Networks, Inc.

-

Huawei Technologies Co., Ltd.

-

Arista Networks, Inc.

-

Nokia Corporation

-

Hewlett Packard Enterprise (HPE)

-

Big Switch Networks

-

Pluribus Networks

-

Ciena Corporation

-

Extreme Networks, Inc.

-

Dell Technologies

-

Broadcom Inc.

-

Fortinet, Inc.

-

Palo Alto Networks, Inc.

-

Silver Peak (HPE)

-

Citrix Systems, Inc.

-

Riverbed Technology

-

F5 Networks, Inc.

-

ADVA Optical Networking

|

Report Attributes |

Details |

|

Market Size in 2025 |

USD 45.05 Billion |

|

Market Size by 2033 |

USD 171.43 Billion |

|

CAGR |

CAGR of 18.18% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Components (Solutions,Services) |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

Cisco Systems, Inc., VMware, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., Arista Networks, Inc., Nokia Corporation, Hewlett Packard Enterprise (HPE), Big Switch Networks, Pluribus Networks, Ciena Corporation, Extreme Networks, Inc., Dell Technologies, Broadcom Inc., Fortinet, Inc., Palo Alto Networks, Inc., Silver Peak (HPE), Citrix Systems, Inc., Riverbed Technology, F5 Networks, Inc., ADVA Optical Networking |