Software Testing Market Report Scope & Overview:

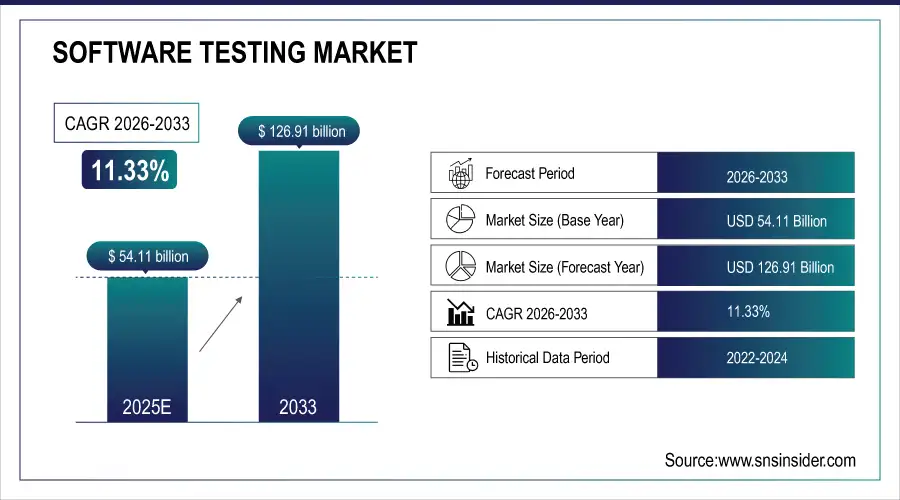

The Software Testing Market was valued at USD 54.11 billion in 2025E and is expected to reach USD 126.91 billion by 2033, growing at a CAGR of 11.33% from 2026-2033.

The Software Testing Market is growing due to increasing demand for high-quality, reliable, and secure software across industries. Rapid digital transformation, the adoption of cloud computing, AI, and IoT technologies, and the rise of agile and DevOps practices are driving the need for continuous testing solutions. Growing awareness of software vulnerabilities, regulatory compliance requirements, and the need for enhanced user experience are further accelerating the adoption of automated and advanced testing tools, fueling overall market growth.

In 2024, 78% of enterprises adopted automated testing; by 2025, over 90% are expected to integrate continuous testing in DevOps, driven by rising software complexity, security demands, and digital transformation across industries.

Software Testing Market Size and Forecast

-

Market Size in 2025: USD 54.11 Billion

-

Market Size by 2033: USD 126.91 Billion

-

CAGR: 11.33% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Software Testing Market - Request Free Sample Report

Software Testing Market Trends

-

Increasing adoption of test automation tools to accelerate release cycles and improve software quality globally

-

Growing demand for AI and ML-based testing solutions to enhance efficiency and defect detection accuracy

-

Rising focus on continuous testing within DevOps frameworks to ensure faster, reliable, and agile software delivery

-

Expansion of cloud-based testing platforms offering scalability, flexibility, and reduced infrastructure costs for enterprises

-

Increasing emphasis on cybersecurity testing due to growing threats and regulatory compliance requirements across industries

-

Integration of performance and load testing tools to ensure application reliability under high user traffic conditions

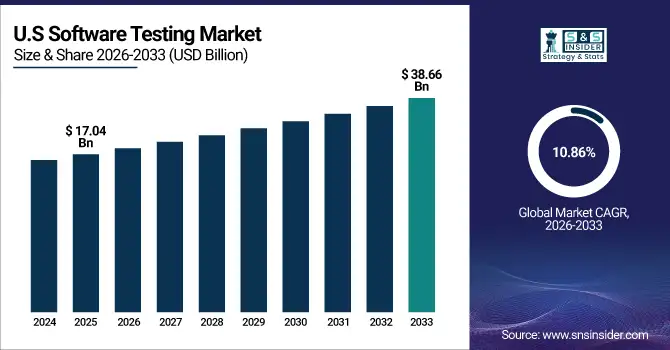

U.S. Software Testing Market was valued at USD 17.04 billion in 2025E and is expected to reach USD 38.66 billion by 2033, growing at a CAGR of 10.86% from 2026-2033.

Growth in the U.S. Software Testing Market is driven by increasing adoption of digital solutions, cloud-based applications, and AI technologies. Rising demand for secure, high-quality software, regulatory compliance, and the shift toward agile and DevOps practices are further fueling the need for automated and continuous testing solutions.

Software Testing Market Growth Drivers:

-

Increasing adoption of digital transformation initiatives across industries is driving demand for comprehensive software testing to ensure application quality

As organizations embrace digital transformation, they are implementing sophisticated software solutions across business operations, including cloud platforms, enterprise applications, and mobile solutions. This widespread adoption increases the risk of software defects, performance issues, and integration challenges. Companies are investing heavily in comprehensive software testing services, including functional, non-functional, and automated testing, to ensure high-quality, reliable applications. Effective testing reduces downtime, enhances user satisfaction, and supports smooth digital transitions, driving continuous demand for software testing across industries such as IT, finance, healthcare, and retail.

In 2024, 78% of enterprises increased software testing investments due to digital transformation; by 2025, over 85% plan to adopt AI-driven testing tools to ensure quality, reduce defects, and accelerate deployment cycles across industries.

-

Rising complexity of software applications and systems is boosting the need for advanced testing solutions to prevent errors and vulnerabilities

Modern software systems are increasingly complex, integrating multiple modules, APIs, and third-party services. This complexity raises the likelihood of defects, security vulnerabilities, and performance bottlenecks. Organizations are therefore seeking advanced testing solutions, including automation, performance, security, and AI-driven testing tools, to detect issues early and ensure system reliability. By mitigating risks and enhancing software stability, these solutions help companies maintain competitive advantage, comply with regulatory requirements, and deliver seamless user experiences, driving the growth of the global software testing market across all sectors.

Over 60% of organizations report increased software complexity, with 70% citing a rise in critical bugs; 85% now invest in advanced testing tools to enhance reliability and security across development lifecycles.

Software Testing Market Restraints:

-

High costs of advanced testing tools and skilled professionals limit adoption, especially among small and medium-sized enterprises globally

The rising expense of modern testing tools, automation software, and specialized platforms creates financial barriers for many organizations. Small and medium-sized enterprises (SMEs) often lack the budgets required to invest in high-quality testing solutions or hire experienced professionals. This limits their ability to implement comprehensive testing strategies, impacting software quality and reliability. Additionally, ongoing maintenance, licensing, and training costs further strain resources, preventing widespread adoption of advanced testing technologies and slowing overall market growth, particularly among budget-constrained businesses.

Over 60% of small and medium-sized orthopedic providers cite advanced testing equipment and specialist shortages as key adoption barriers, with training costs exceeding USD50,000 annually and diagnostic tools often priced above USD100,000 per unit.

-

Rapidly evolving technologies and frequent software updates create challenges in maintaining effective and timely testing processes across applications

Constant changes in programming languages, frameworks, and platforms require software testing processes to adapt continuously. Frequent updates, patches, and new feature releases increase the complexity of testing cycles, making it difficult to ensure software stability and performance. Organizations must continually update test cases, tools, and methodologies to keep pace with evolving technology. This creates operational challenges, increases time-to-market, and raises the risk of undetected bugs. Maintaining efficiency while ensuring thorough testing across applications remains a key restraint for the software testing market.

Over 60% of medical device teams report delays in testing cycles due to frequent software updates, with 40% citing insufficient resources to validate changes, risking compliance and time-to-market for ankle replacement systems.

Software Testing Market Opportunities:

-

Increasing adoption of cloud-based applications creates demand for comprehensive software testing services to ensure performance, security, and reliability

The rapid shift toward cloud computing and Software-as-a-Service (SaaS) platforms is fueling demand for advanced software testing solutions. Organizations require thorough testing to ensure application performance, security, scalability, and seamless user experiences across cloud environments. As businesses migrate critical operations to the cloud, software testing providers have opportunities to offer specialized services including functional, performance, and security testing. The increasing complexity of cloud architectures and multi-tenant systems further drives the need for robust testing strategies to ensure reliability and compliance across industries.

Over 70% of enterprises now use cloud-based applications, driving demand for software testing; 65% of IT leaders prioritize performance, security, and reliability testing to mitigate risks in cloud deployment and operations.

-

Rising use of AI, machine learning, and automation tools enables faster, more accurate, and cost-efficient software testing solutions

The integration of AI, machine learning, and automation in software testing is transforming how applications are validated. These technologies allow predictive test analytics, intelligent test case generation, and automated defect detection, significantly reducing testing time and costs. Organizations are increasingly adopting AI-driven testing tools to improve accuracy, efficiency, and scalability in complex software environments. This trend presents substantial opportunities for software testing providers to offer cutting-edge, technology-enabled solutions that meet the evolving needs of enterprises, particularly in fast-paced, high-volume software development cycles.

AI and machine learning reduce software testing cycles by 40–60% and cut defect detection time by over 50%, while automation boosts test coverage to 80–90%, enhancing accuracy and lowering labor costs across development teams.

Software Testing Market Segment Highlights

-

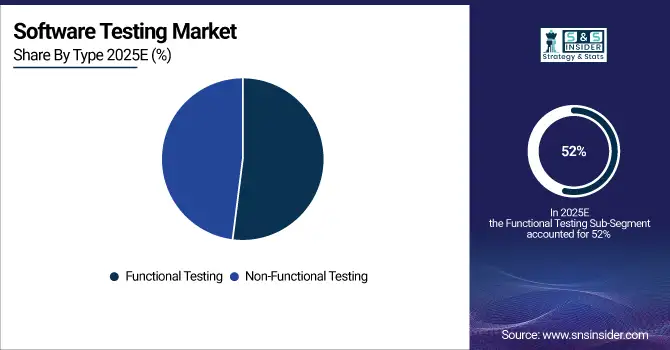

By Type: In 2025, Functional Testing led the market with 52% share, while Non-Functional Testing is the fastest-growing segment with the highest CAGR (2026–2033)

-

By Testing Type: In 2025, Automation Testing led the market with 53% share, and is also the fastest-growing segment with the highest CAGR (2026–2033)

-

By Business Model: In 2025, B2B led the market with 85% share, while B2C is the fastest-growing segment with the highest CAGR (2026–2033)

-

By Organization Size: In 2025, Large Enterprises led the market with 60% share, while Small & Medium Enterprises (SMEs) is the fastest-growing segment with the highest CAGR (2026–2033)

-

By Application: In 2025, BFSI (Banking, Financial Services, Insurance) led the market with 40% share, while Healthcare & Life Sciences is the fastest-growing segment with the highest CAGR (2026–2033)

Software Testing Market Segment Analysis

By Type, Functional Testing segment led in 2025; Non-Functional Testing segment expected fastest growth

Functional Testing segment dominated the Software Testing Market with the highest revenue share of about 52% in 2025 due to its essential role in verifying software functionality, ensuring applications meet specified requirements, and minimizing defects before deployment.

Non-Functional Testing segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing focus on performance, security, scalability, and usability of software, driven by complex applications, rising cyber threats, and demand for enhanced user experience across digital platforms.

By Testing Type, Automation Testing segment led in 2025; Automation Testing segment expected fastest growth

Automation Testing segment dominated the Software Testing Market with the highest revenue share of about 53% in 2025 and is expected to grow at the fastest CAGR from 2026-2033 because it significantly reduces manual effort, increases test coverage, ensures faster release cycles, and enhances accuracy. Growing adoption of DevOps, agile methodologies, and continuous integration/continuous deployment (CI/CD) practices across industries is driving demand, while the increasing complexity of software applications necessitates efficient automated testing frameworks to maintain quality, reduce costs, and accelerate time-to-market in competitive environments.

By Business Model, B2B segment led in 2025; B2C segment expected fastest growth

B2B segment dominated the Software Testing Market with the highest revenue share of about 85% in 2025 because enterprises heavily rely on software solutions for operations, supply chain management, and enterprise applications, requiring rigorous testing for reliability and compliance.

B2C segment is expected to grow at the fastest CAGR from 2026-2033 due to the proliferation of consumer apps, increasing digital adoption, and the need for seamless, high-quality user experiences in highly competitive consumer markets.

By Organization Size, Large Enterprises segment led in 2025; SMEs segment expected fastest growth

Large Enterprises segment dominated the Software Testing Market with the highest revenue share of about 60% in 2025 owing to substantial IT budgets, complex software ecosystems, and critical need for error-free enterprise applications.

Small & Medium Enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2026-2033 driven by digital transformation initiatives, increasing adoption of cloud-based solutions, and growing recognition of testing importance to ensure software reliability and customer satisfaction.

By Application, BFSI segment led in 2025; Healthcare & Life Sciences segment expected fastest growth

BFSI (Banking, Financial Services, Insurance) segment dominated the Software Testing Market with the highest revenue share of about 40% in 2025 due to stringent regulatory requirements, high-volume transactions, and the critical need for secure and error-free software systems.

Healthcare & Life Sciences segment is expected to grow at the fastest CAGR from 2026-2033 owing to rising adoption of digital health solutions, telemedicine, and medical software, where accuracy, compliance, and reliability are paramount for patient safety and operational efficiency

Software Testing Market Regional Analysis

North America Software Testing Market Insights

North America dominated the Software Testing Market with a 39% share in 2025 due to the presence of major IT and software companies, advanced technological infrastructure, and high adoption of automated testing solutions. Strong demand for quality assurance, regulatory compliance, and early adoption of AI-driven testing tools further reinforced the region’s market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Software Testing Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 13.08% from 2026–2033, driven by rapid digital transformation, expanding IT and telecom sectors, and rising adoption of cloud-based and automated testing solutions. Increasing software development activities, growing startup ecosystem, and government initiatives supporting digitalization accelerate the region’s future market growth.

Europe Software Testing Market Insights

Europe held a significant share in the Software Testing Market in 2025, supported by a mature IT industry, strong presence of software development firms, and high adoption of automated and AI-driven testing solutions. Growing focus on software quality, regulatory compliance, and digital transformation initiatives further strengthened Europe’s position in the market.

Middle East & Africa and Latin America Software Testing Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Software Testing Market in 2025, driven by increasing IT infrastructure investments, rising software development activities, and growing demand for quality assurance solutions. Expanding digital transformation initiatives, adoption of cloud-based and automated testing tools, and emerging startup ecosystems support the regions’ market growth.

Software Testing Market Competitive Landscape:

Tata Consultancy Services (TCS)

Tata Consultancy Services (TCS) is a global IT services, consulting, and business solutions company headquartered in Mumbai, India. Founded in 1968, it provides software development, application testing, digital transformation, and IT consulting services to clients worldwide. TCS has a strong focus on quality assurance, automation, and agile testing solutions across multiple industries, including banking, healthcare, and telecom. Its global presence, robust R&D, and technology-driven approach make it a leading player in the software testing market.

-

2024, TCS set up a dedicated NVIDIA Business Unit, combining its AI. Cloud capabilities with NVIDIA’s platforms to scale AI adoption across industries.

Accenture plc

Accenture plc, headquartered in Dublin, Ireland, is a leading multinational professional services company specializing in strategy, consulting, digital, technology, and operations. It provides end-to-end software testing services, including functional, automation, performance, and security testing, helping clients ensure high-quality software delivery. Accenture leverages advanced testing frameworks, AI-driven tools, and cloud-based platforms to optimize QA processes. Its extensive global network and focus on innovation position it as a top player in the software testing industry.

-

2024, Accenture and Google Cloud announced that 45% of their joint generative AI projects moved from proof-of-concept to production, highlighting scalable AI & cloud engineering capabilities.

Capgemini SE

Capgemini SE, headquartered in Paris, France, is a global consulting, technology, and outsourcing services company. The firm delivers comprehensive software testing solutions, including automation, performance, security, and mobile application testing. With expertise in agile and DevOps methodologies, Capgemini helps enterprises accelerate digital transformation while ensuring high-quality software delivery. Its strong client base across industries, combined with a focus on innovation and advanced testing tools, establishes Capgemini as a major player in the global software testing market.

-

2024, Capgemini, in collaboration with Sogeti, co-published the World Quality Report, revealing that 68% of companies are now leveraging Generative AI for quality engineering. The report emphasized the growing adoption of AI-driven solutions, particularly in test automation, to enhance software quality, efficiency, and delivery speed across industries.

Cognizant Technology Solutions

Cognizant Technology Solutions, headquartered in Teaneck, New Jersey, USA, is a multinational IT services and consulting company. It offers end-to-end software testing services, including functional, performance, automation, and security testing across diverse industries. Cognizant emphasizes digital transformation, AI-driven testing frameworks, and DevOps-enabled quality assurance to deliver reliable, high-performance software solutions. Its extensive global operations, technological expertise, and client-centric approach make it a leading company in the software testing and QA market.

-

2023: The company launched its AI‑driven Neuro IT Operations platform designed to automate and optimize enterprise IT infrastructure, reducing costs while improving resilience and observability

Key Players

Some of the Software Testing Market Companies

-

Tata Consultancy Services (TCS)

-

Accenture plc

-

Capgemini SE

-

Cognizant Technology Solutions

-

IBM Corporation

-

Infosys Limited

-

Wipro Limited

-

HCL Technologies

-

Tech Mahindra Limited

-

Atos SE

-

Tricentis AG / Tricentis

-

Micro Focus (OpenText)

-

Cigniti Technologies

-

Parasoft Corporation

-

SmartBear Software

-

Keysight Technologies

-

Sauce Labs, Inc.

-

Synopsys

-

Original Software

-

QATestLab

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 54.11 Billion |

| Market Size by 2033 | USD 126.91 Billion |

| CAGR | CAGR of 11.33% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Functional Testing, Non-Functional Testing) • By Testing Type (Manual Testing, Automation Testing) • By Business Model (B2B, B2C) • By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises) • By Application (BFSI – Banking, Financial Services, Insurance; IT & Telecom; Healthcare & Life Sciences; Retail & E-Commerce; Manufacturing; Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Tata Consultancy Services, Accenture plc, Capgemini SE, Cognizant Technology Solutions, IBM Corporation, Infosys Limited, Wipro Limited, HCL Technologies, Tech Mahindra Limited, Atos SE, Tricentis AG, Micro Focus (OpenText), Cigniti Technologies, Parasoft Corporation, SmartBear Software, Keysight Technologies, Sauce Labs, Inc., Synopsys, Original Software, QATestLab |