Sonar System Market Report Scope & Overview:

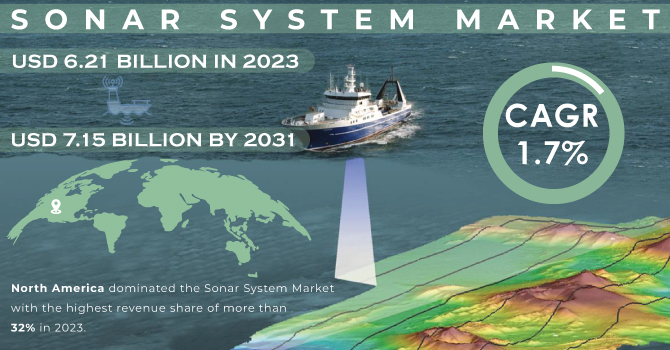

The Sonar System Market is estimated to be USD 6.21 billion in 2023 and is projected to reach USD 7.15 billion by 2031, at a CAGR of 1.7% from 2024 to 2031. Sonar remains essential for naval operations like submarine detection, mine countermeasures, and underwater surveillance. Heightened geopolitical tensions and modernization initiatives drive investment in the naval sector. Sonar is widely used for seabed mapping, pipeline inspection, and monitoring of offshore wind farms and oil platforms. Growth in these sectors fuels sonar market expansion. In addition, Increasing Naval contracts drive the growth of the sonar system market. For example, In Dec 2023, Kongsberg Naval Services (KONGSBERG), a subsidiary of Kongsberg Maritime and Kongsberg Defence & Aerospace, secured a strategic framework agreement with the Norwegian Defence Material Agency. This agreement encompasses operational support, maintenance, and life-extending services for Norway's frigates. The total value of the agreement is estimated to be up to NOK 17 billion, covering services to be provided until 2040.

To get more information on the Sonar System Market - Request Free Sample Report

In Sept 2020, L3Harris Technologies secured a lucrative contract to supply two state-of-the-art Low-Frequency Active Towed Sonar (LFATS) systems to a NATO member. These advanced systems are designed to be installed on naval vessels to effectively detect, track, and engage various types of submarines.

Navigation, collision avoidance, safety, and optimizing fishing operations all rely on sonar advancements. Oceanographic surveys, mapping the seafloor, archaeological studies, and marine life research extensively employ sonar technology. For example, NOAA (National Oceanic and Atmospheric Administration) heavily employs sonar in oceanographic surveys for climate research and marine habitat mapping.

Market Dynamics

Drivers

-

Increasing demand for underwater exploration and resource extraction

-

Growing focus on maritime security and border surveillance

-

Technological advancements in sonar systems, like miniaturization and improved resolution

-

Rising awareness of environmental protection and the need for underwater monitoring

Restraint

-

High cost associated with the use of sonar systems

-

Stringent regulations governing the use of sonar technology, especially military sonar

-

Limited awareness of the benefits of sonar systems in some industries

Opportunities

-

Development of low-cost sonar systems

-

Expansion of the commercial applications of sonar technology, such as in fisheries and aquaculture

-

Integration of sonar systems with other underwater technologies, like autonomous underwater vehicles (AUVs)

Sonar systems, the underwater workhorses for navigation and object detection, gain significant power when integrated with other technologies like Autonomous Underwater Vehicles (AUVs). This combined approach offers a more comprehensive understanding of the underwater environment, improving efficiency and safety in various applications. Sonar excels at providing range and object details but can be limited in visibility due to water conditions. Cameras or LiDAR integrated into an AUV can capture high-resolution visuals, complementing the sonar data for a clearer picture. AUVs can be pre-programmed to follow specific paths while collecting sonar data. This enables large-scale surveys, resource exploration, or bathymetry (seafloor mapping) without constant human intervention.

A recent article (February 2024) describes an Advanced Underwater Measurement System for Remotely Operated Vehicles (ROVs) that integrates sonar and stereo vision. This system is used for subsea infrastructure maintenance. The sonar provides accurate distance readings, while the cameras capture high-resolution images. By combining this data, a more complete 3D representation of the underwater environment is achieved. This allows for more precise and efficient maintenance operations.

Challenges

-

Competition from alternative underwater sensing technologies

-

The harsh environment in which sonar systems operate can lead to equipment failures

Impact of Russia-Ukraine War:

The Russia-Ukraine war has had a mixed impact on the sonar systems market, with some sectors experiencing a potential boost and others facing challenges. The war has prompted several European countries to significantly increase their defense budgets in response to heightened security concerns. This translates to potential growth in the military sonar market. Poland announced a defense budget increase to 4% of GDP in 2024, which could lead to more contracts for military sonar systems on new or upgraded ships. The Black Sea ports of Ukraine and Russia are major export hubs for various goods. The conflict has disrupted maritime trade in the region, potentially slowing down growth in the commercial solar sector. Commercial sonar applications like those used in fisheries or underwater resource exploration rely on a healthy maritime industry. Disruptions caused by the war can lead to a decrease in demand for these sonar systems.

Impact of Economic Downturn:

Economic downturns negatively affect the sonar systems market primarily by reducing demand from the commercial sector. During downturns, industries like fisheries and offshore resource exploration tend to curb their investments, leading to a decline in sales of sonar systems for these applications. Additionally, market fluctuations can occur due to budget constraints affecting both commercial and military spending. However, the military sonar segment may experience less severe effects compared to the commercial sector, as defense budgets are often prioritized for national security. Overall, while the sonar market might experience temporary setbacks during economic downturns, the long-term outlook remains positive due to growing applications in oceanographic research and technological advancements.

Market segmentation

By Platform

-

Commercial Vessels

-

Defence Vessels

-

Unmanned Underwater Vehicles (UUVs)

-

Aircrafts

-

Ports

By Product

-

Hull-mounted Sonar

-

Stern-mounted Sonar

-

Dipping Sonar

Hull-mounted Sonar dominated the product segment of the Sonar System Market with the highest revenue share of more than 32% in 2023. Hull-mounted sonars offer several advantages that make them ideal for various applications. It provides a strong and consistent sonar signal for superior long-range detection and tracking capabilities and minimizes drag on the vessel, ensuring efficient operation. Hull-mounted sonars are widely used in both military and commercial sectors, including Anti-submarine warfare (ASW), Underwater navigation, obstacle avoidance, and Seabed mapping and resource exploration. For example, In April 2024, the Royal Navy announced an upgrade program for its Type 26 frigates, which includes installing advanced hull-mounted sonar systems for enhanced ASW capabilities.

By Application

-

Anti-submarine Warfare

-

Port Security

-

Mine Detection & Countermeasure Systems

-

Search & Rescue

-

Navigation

-

Diver Detection

-

Seabed Terrain Investigation

-

Scientific

-

Others

The Anti-submarine Warfare segment is expected to grow at the highest CAGR during the forecast period of 2024-2031. The reasons behind this dominance are increased global competition and territorial disputes at sea are driving a renewed focus on anti-submarine capabilities. The ongoing tensions in the South China Sea have prompted several countries, including Vietnam and the Philippines, to invest in upgrading their ASW capabilities, including acquiring new sonar systems for their naval vessels. The development of more sophisticated and stealthy submarines by certain nations necessitates advancements in countermeasures. This fuels investments in next-generation sonar systems like Low-frequency sonars and Variable Depth Sonars (VDS). For example, The US Navy recently awarded a contract for the development of a new Integrated Anti-Submarine Warfare (ASW) System (IINAS) designed to enhance submarine detection capabilities using advanced sonar technology.

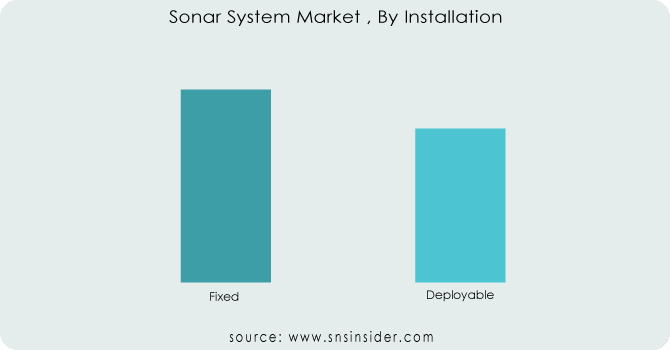

By Installation

-

Fixed

-

Deployable

Need any customization research on the Sonar Systems Market - Enquiry Now

Regional Analysis

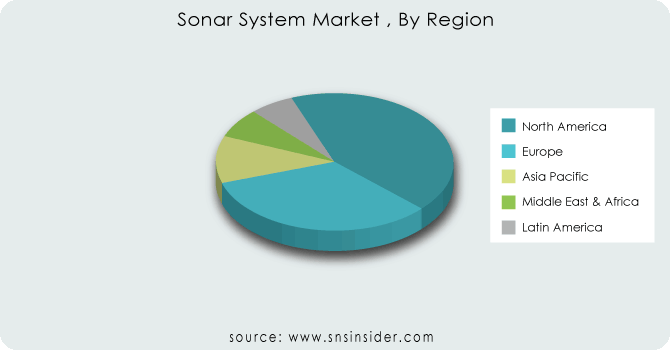

North America dominated the Sonar System Market with the highest revenue share of more than 32% in 2023. The United States has the world's most powerful navy, constantly upgrading its fleet with advanced sonar technology. This translates into significant investments in High-performance hull-mounted and towed sonar systems for submarines and surface vessels for enhanced anti-submarine warfare (ASW) and underwater navigation and Autonomous underwater vehicles equipped with sonars for oceanographic research and intelligence gathering. In Nov 2022, Saab was awarded the prime contract for the MK39 Expendable Mobile Anti-Submarine Warfare (ASW) Training Target by the Naval Undersea Warfare Center Division in Newport. This contract, with a potential value of USD 173.2 million (SEK 1.73 billion) over a 10-year ordering period, will involve deliveries through 2032.

North America boasts a well-developed commercial maritime sector, driving demand for various sonar applications like Offshore oil & gas exploration. For Example, Companies like Exxon Mobil utilize advanced sonar technology in their offshore exploration projects in the Gulf of Mexico. Sonar systems aid in sustainable fishing practices by helping track fish populations and monitor fishing activity.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Players are Raytheon Technologies Corporation, ASELSAN A.Ş., Thales Group, Lockheed Martin Corporation, ATLAS ELEKTRONIK INDIA Pvt. Ltd., L3Harris Technologies, Inc. Ultra Electronics Holdings, FURUNO ELECTRIC CO., LTD., Japan Radio Co., KONGSBERG, Teledyne Technologies Incorporated., DSIT Solutions Ltd., NAVICO, SONARDYNE, and EdgeTech.

L3Harris Technologies-Company Financial Analysis

Recent Development:

-

In March 2024, Aselsan unveiled its new low-frequency towed active sonar system, showcasing it in a promotional video aboard the Powhatan-class fleet ocean tug, A-590 TCG Inebolu, during trials.

-

In April 2021, Thales made a contract with Lockheed Martin as a tier-one supplier for the delivery of up to 55 airborne anti-submarine warfare sonars. The ALFS (Airborne Low-Frequency Sonar) dipping sonars will be integrated into the MH-60R platform for the U.S. Navy and three other navies. The initial delivery of 42 systems is scheduled over the next five years, with an additional 13 optional systems to be delivered in the sixth year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.21 Billion |

| Market Size by 2031 | US$ 7.15 Billion |

| CAGR | CAGR of 1.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Platform (Commercial Vessels, Defense Vessels, Unmanned Underwater Vehicles (UUVs), Aircrafts, and Ports) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Raytheon Technologies Corporation, ASELSAN A.Ş., Thales Group, Lockheed Martin Corporation, ATLAS ELEKTRONIK INDIA Pvt. Ltd., L3Harris Technologies, Inc. Ultra Electronics Holdings, FURUNO ELECTRIC CO., LTD., Japan Radio Co., KONGSBERG, Teledyne Technologies Incorporated., DSIT Solutions Ltd., NAVICO, SONARDYNE, and EdgeTech. |

| DRIVERS | • Increasing demand for underwater exploration and resource extraction • Growing focus on maritime security and border surveillance • Technological advancements in sonar systems, like miniaturization and improved resolution • Rising awareness of environmental protection and the need for underwater monitoring |

| RESTRAINTS | • High cost associated with the use of sonar systems • Stringent regulations governing the use of sonar technology, especially military sonar • Limited awareness of the benefits of sonar systems in some industries |