In-flight Entertainment & Connectivity Market Report Scope & Overview:

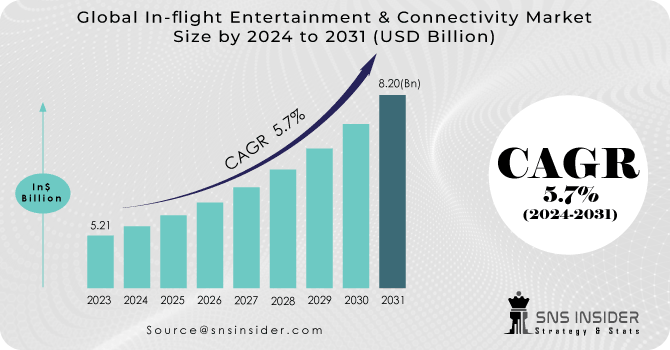

The In-flight Entertainment & Connectivity Market Size was valued at USD 5.21 billion in 2023 and is projected to reach USD 8.20 billion by 2031, at a CAGR of 5.7% Over the forecast period 2024-2031.

The growth of this market is driven mainly by an increase in the demand for on-flight experience, an increase in aircraft upgrades and aircraft delivery, and technological changes. In-flight entertainment and connectivity refer to the online service provided are commercial airline passengers by the airline. This service can be accessed using personal electronic devices such as smartphones and laptops for surfing the Internet, playing games, and watching movies, and serials. IFEC systems appear to operate without the need for virtual cables. The cables are attached to the walls of the aircraft, the wire starts from the top panel, next to the oxygen masks and air conditioning controls. These cables are then connected to electrical units, which are located in a few rows along the plane wall.

To get more information on In-flight Entertainment & Connectivity Market - Request Free Sample Report

KEY DRIVERS

To increase air traffic congestion in the Asia Pacific and developing regions, air traffic congestion has reached 88% of pre-epidemic levels. The demand for IFE is growing rapidly. With the DGCA allowing Wi-Fi in India for commercial flights by 2020, passengers look to it as an experience rather than a flight. According to Honeywell, passengers are willing to pay a premium for in-flight services as customized content.

Passengers today use more devices than ever before in an airplane. According to SITA Passenger IT trends, it turned out that 65% of customers broadcast content on their own devices compared to 44% LCDs who prefer the back seats of the unit for the purpose of entertainment on the plane. According to an Inmarsat survey, 55% of airline passengers consider Wi-Fi in the airline an essential requirement while 67% will be re-booked by the airline once the highest quality in-flight Wi-Fi is provided. Therefore, the increasing demand for aviation information drives the IFEC market growth.

RESTRAINTS

Complete entertainment in aircraft and communication system construction includes computer hardware setup, trouble-free connectivity solution, and large media streaming media content, which increases the complexity of the design. In addition, IFEC's hardware system includes expensive media tools such as game consoles, monitors, headphones, and electronic media. Damage to these devices requires high costs associated with repair services. This increases the total operating costs of the IFEC hardware program. These factors are likely to interfere with market growth during the forecast period. However, the growing trend of providing media content distribution to passenger machines could overcome the obstacle in the years to come.

OPPORTUNITIES

Emerging markets contribute significantly to the growth of aviation entertainment and telecommunications market. Southeast Asian countries such as India, China, Nepal are growing IFE & C markets. For example, in India, most airlines are low-cost carriers or low-cost network operators. Indigo, GoFirst, Spice jet are major airlines that only offer economical seats on their aircraft. Passengers do not have the aircraft entertainment available to them. According to Boeing, flights from Southeast Asian countries will need more than 4,500 flights to meet the growing demand. Over the past decade, Vietnam, Thailand and Indonesia have added the largest number of airlines in the region. Therefore, an increase in demand for new aircraft is expected to further IFEC's market share.

CHALLENGES

IFE & C market is characterized by high research and development and cost of installation. According to Zauba data, the electric parts of the seats cost USD 4500 per unit. The connection modem unit costs USD 18000 per unit. The cost of installing IFE systems increases to USD 6 million. Therefore, the high cost of IFEC programs can hamper the market growth.

THE IMPACT OF COVID-19

-

The impact of COVID-19 on the entertainment and connectivity market is unpredictable and is expected to remain active for a few years.

-

The outbreak of COVID-19 forced governments around the world to use stricter shutters and prevent the importation of immature items for much of 2020 and a few months by 2021. This has led to a sudden decline in the availability of essential production aircraft. entertainment screens (IFE) and other components.

-

In addition, the nationwide closure has forced IFE production facilities to shut down or close down their operations.

-

The negative effects of the COVID-19 epidemic have caused delays in activities and programs related to the development of advanced IFE components Globally.

Impact of Ukraine and Russia Crisis

By 2021, many planes began to recover from the epidemic, but the dark clouds of the Russian-Ukrainian conflict cast doubt on the stability of the aviation industry. Total revenue from passenger airlines in the US was $ 304 billion by 2019, down more than 50% to $ 103 billion following the outbreak of the COVID-19 epidemic by 2020. In 2021, the market recovered, recording $ 171 billion. in revenue. Russia's total revenue from passenger airlines was $ 22 billion by 2021, an increase of 29% compared to 2020. Similarly, other countries such as the UK, Germany, and Ukraine have also seen significant revenue growth. The Russia-Ukraine crisis comes as markets begin to reopen in the wake of the COVID-19 epidemic and airlines saw a great need.

By Type Analysis

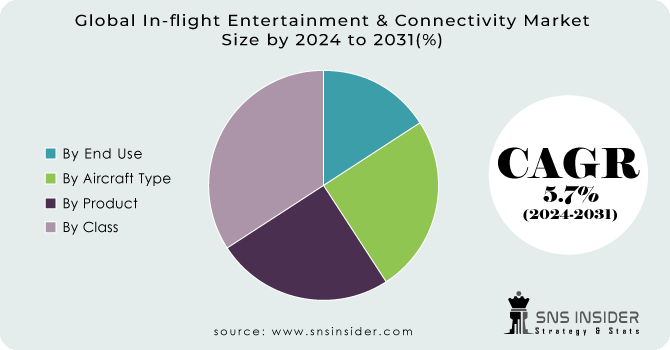

Based on the type, the market is divided into IFE hardware, IFE connection, and IFE content.

The hardware component of the IFE is divided into a portable IFE system and an intangible IFE system. The IFE component of computer systems is estimated to hold a large market share in the base year due to increased flight delivery. In 2019, Airbus SE released a total of 863 aircraft compared to 800 in 2018.

IFE Content Component for Higher Growth Registration Due to SATCOM Technological Enrollment

The IFE connecting component is further divided into wireless communication. This segment is likely to experience significant growth during forecasting due to the increasing demand for wireless entertainment solutions. For example, in September 2020, Global Eagle Entertainment Inc. introduces its new battery or IFE wireless solution with aircraft powered by Airconnect Go 2.0. This portable WIFI allows the passenger to stream media content to their mobile phones.

The share of IFE content is expected to grow with the highest CAGR at the time of forecasting. This growth was due to the growing adoption of SATCOM technology-based flight communications services. The SATCOM-based IFEC system provides high-speed internet access to passengers to stream media content that helps pilots keep passengers happy, busy, and secure during flight.

By Class Analysis

Growing Premium Classroom Classification Seats from Cheap Airlines to Spur Demand In terms of segment, the market is divided into first class, business class, advanced economy category, and economy class.

Part of the business sector dominates the market with a large share in 2019. This major allocation is attributed to the growing focus of pilots on providing additional comfort and safety as well as advanced flight experience by providing them with superior services. In addition, increased spending on top passengers is expected to further the growth of the business segment.

The share of the premium economy segment is expected to grow with the highest CAGR at the time of forecasting. This increase is due to the increase in the installation of high-quality seats by low-cost carriers to provide the passenger with improved travel information. Besides, many travelers prefer a premium economy class to a business class because of the high cost of business class tickets.

By Aircraft Type Analysis

The aircraft-based market includes slimmer aircraft, wider aircraft, business jets and regional aircraft

The segment of the subspecies is expected to control the market during forecasting. This is due to the growing demand for low-cost airlines to provide for domestic and international flights.

By End-User Analysis

Among these, the rear market segment has registered its largest market share in 2021. This increase is due to the increase in current shipping capacity to improve the comfort and safety of passengers. The OEM segment is expected to grow at a high growth rate during the forecast period. This growth is due to the development of improved seating facilities integrated with advanced IFE commercial aviation systems, which travel long distances around the world.

KEY MARKET SEGMENTATION

By Product

-

IFE Hardware

-

IFE Connectivity

-

IFE Content

By Class

-

First Class

-

Business Class

-

Premium Economy

-

Economy

By Aircraft Type

-

Narrow Body Aircraft

-

Wide Body Aircraft

-

Business Jets

By End Use

-

OEM

-

Aftermarket

Need any customization research on In Flight Entertainment And Connectivity Market - Enquiry Now

REGIONAL ANALYSIS:

Asia Pacific is expected to grow at a rate of almost 13% between 2024 and 2031. A major factor contributing to market growth is the increase in passengers, which in turn creates the need for a plane connected to the next generation of entertainment and communication technologies. Some of the best airlines in the region offer state-of-the-art entertainment and connectivity services for their first-class passengers. For example, Garuda Indonesia, an Indonesian flagship company, offers a wide range of boat-based entertainment services, such as live TV broadcasts, in-flight shopping, and games for its elite class travel passengers.

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

Key Players

The Key Players are Thales Group, Viasat, Inc., Astronics Corporation, Iridium Communications Inc., Gogo LLC & Other Players.

Astronics Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.21 Billion |

| Market Size by 2031 | US$ 8.20 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (IFE Hardware, IFE Connectivity, IFE Content) • By Class • By Aircraft Type (Narrow Body Aircraft, Wide Body Aircraft, Business Jets) • By End User |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thales Group, Viasat, Inc., Astronics Corporation, Iridium Communications Inc., Gogo LLC |