Drone Defense System Market Report Scope & Overview:

To get more information on Drone Defense System Market - Request Free Sample Report

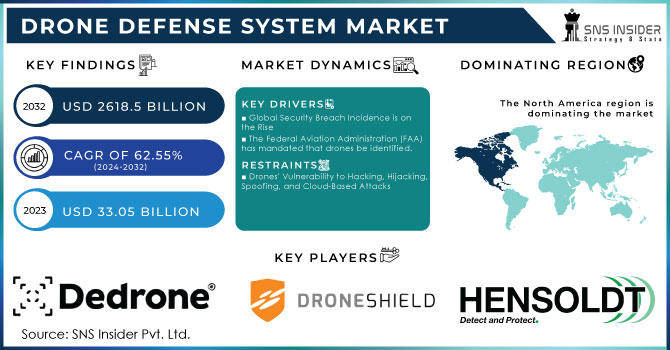

The Drone Defense System Market size was USD 33.05 billion in 2023 and is expected to reach USD 2618.5 billion by 2032, growing at a CAGR of 62.55% over the forecast period of 2024-2032.

Because of the exponential rise in the illegal entry of drones into security-sensitive areas such as military sites, the development of effective counter-drone technologies has become important. With developments in drone technology, there is a greater demand for drone defence systems to prevent unlawful drone entry and repel potential drone attacks. Several countries throughout the world have launched and adopted anti-unmanned aerial system policies. Drone monitoring devices, radio frequency analyzers, acoustic sensors, optical sensors, radars, RF jammers, and high-energy lasers are used in a drone defence system to identify and/or destroy unwanted drones. Unmanned aerial vehicles have seen a dramatic increase in usage for surveillance, recreational, and commercial uses all over the world. The lack of security rules and standards has resulted in a significant increase in security breaches at military posts, government facilities, and public areas. Furthermore, the spike in demand for detection and identification of illegal drones has become a critical aspect in ensuring overall national security, supporting the growth of the worldwide drone defence system market.

MARKET DYNAMICS

KEY DRIVERS

-

Global Security Breach Incidence is on the Rise

-

The Federal Aviation Administration (FAA) has mandated that drones be identified.

RESTRAINTS

-

Drones' Vulnerability to Hacking, Hijacking, Spoofing, and Cloud-Based Attacks

OPPORTUNITIES

-

Use of Tracking Systems to Detect Birds, Micro Drones, Aircraft, and Other Obstacles

-

Advanced Network-Based Intrusion Detection and Prohibition Systems Development

CHALLENGES

-

Regulatory, Technological, and Countering of Drones with Legal Issues Associated

THE IMPACT OF COVID-19

The influence of COVID-19 on the drone defence system industry is unclear and is projected to last through the fourth quarter of 2021.

The COVID-19 pandemic compelled governments around the world to impose stringent lockdown and ban the import-export of non-essential products for the majority of 2020. This resulted in a sharp decrease in the supply of critical raw materials.

Furthermore, nationwide lockdown compelled production plants to shut down partially or completely.

The COVID-19 epidemic has caused global delays in actions and projects aimed at developing reliable and novel drone defensive systems.

The market is divided into three segments based on end user: military, homeland security, and commercial. The military segment generated the most income in 2022, owing to a high demand for a variety of dependable and effective drone detection and countermeasure systems to prevent unauthorized drones from entering a military site. The drone defence system market is divided into identification and detecting systems and countermeasure systems based on technology. The countermeasure systems category generated the most revenue in 2022, owing to a significant increase in demand for drone countermeasure machinery to destroy and disable illicit drones Globally.

The study includes drone mounting and ground station applications. The drone mounting segment will generate the most revenue in 2022, owing to an increase in the number of terrorist attacks utilizing drones and the effectiveness of drone mountings in addressing concerns connected to the unauthorized entry of drones into restricted air spaces. Drone-related occurrences around the world, as well as the introduction of numerous startups offering drone defence systems, are projected to boost the drone defence system market over the forecast period. However, challenges with drone defense-related technologies and inefficiencies in counter-drone technologies are expected to stymie industry expansion. On the flip side, technological breakthroughs in combating drone swarms, as well as an increase in global defence spending, are projected to provide profitable opportunities in future.

KEY MARKET SEGMENTATION

By Application

-

Drone Mounting

-

Ground Station

By Technology

-

Identification & Detection Systems

-

Countermeasure Systems

By End-User

-

Military

-

Homeland Security

-

Commercial

REGIONAL ANALYSIS

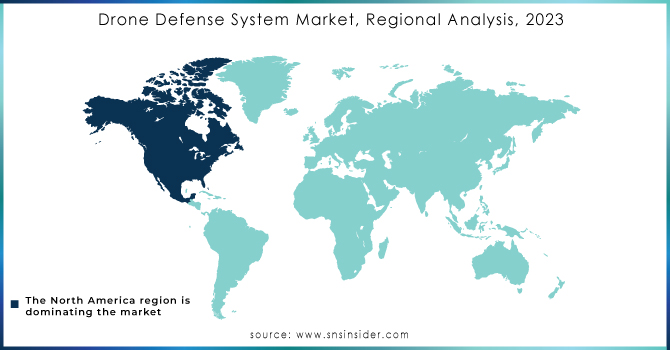

The Global Drone Defense System Market is divided into four regions: North America, Europe, Asia Pacific, and the Rest of the World. During the projected period, North America has biggest market share. The presence of major firms such as Microsoft and Google will support market growth by incorporating technical advancements into the product line. Increased corporate R&D expenditures would boost market growth across the area.

Need any customization research on Drone Defense System Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Dedrone, Inc., Droneshield, Hensoldt, Leonardo S.P.A., Mistral Solutions Pvt. Ltd., Rheinmetall AG, Rinicom Ltd., Aaronia AG, Aselsan AS, Blighter Surveillance Systems Ltd., and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 33.05 Billion |

| Market Size by 2032 | US$ 2618.5 Billion |

| CAGR | CAGR of 62.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Drone Mounting and Ground Station) • By End User (Military, Homeland Security, and Commercial) • By Technology (Identification & Detection Systems and Countermeasure Systems) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Dedrone, Inc., Droneshield, Hensoldt, Leonardo S.P.A., Mistral Solutions Pvt. Ltd., Rheinmetall AG, Rinicom Ltd., Aaronia AG, Aselsan AS, Blighter Surveillance Systems Ltd., and other players. |

| DRIVERS | • Global Security Breach Incidence is on the Rise • The Federal Aviation Administration (FAA) has mandated that drones be identified. |

| RESTRAINTS | • Drones' Vulnerability to Hacking, Hijacking, Spoofing, and Cloud-Based Attacks |