Soy Protein Market Report Scope & Overview:

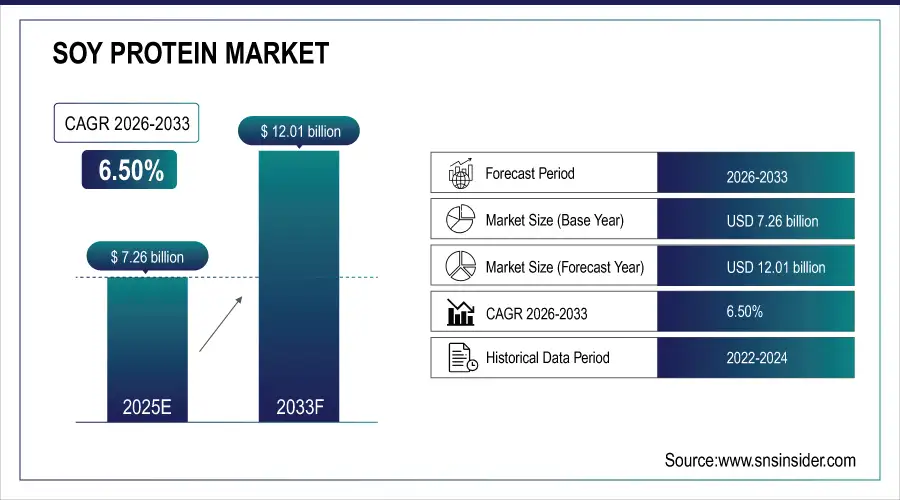

The Soy Protein Market size is valued at USD 7.26 Billion in 2025E and is projected to reach USD 12.01 Billion by 2033, growing at a CAGR of 6.50% during 2026-2033.

The Soy Protein Market analysis highlights the growing global transition to plant-based nutrition supported by health, sustainability, and nutritional trends. Rising vegan and flexitarian demographics drive demand in food, beverage, and nutraceuticals.

Global plant-based food sales reached $18.5 billion in 2024, with soy protein as the leading ingredient due to its complete amino acid profile and functional versatility

Market Size and Forecast:

-

Market Size in 2025E: USD 7.26 Billion

-

Market Size by 2033: USD 12.01 Billion

-

CAGR: 6.50% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Soy Protein Market - Request Free Sample Report

Soy Protein Market Trends

- Demand for plant-based proteins has been increasing globally owing to the growing popularity of veganism, flexitarian diets, and health-conscious consumer choices.

- As extraction technology has improved, soy protein is increasingly being used in food and beverage applications due to its enhanced texture, solubility, and flavor.

- Soy protein has gained popularity for use in meat alternatives, dairy substitutes, and sports nutrition beverages due to the growing fad for a protein-rich diet.

- Farmers’ transition to non-GMO and organic soy protein is due to the influence of the sustainable and clean-label food movement, which has resulted in an increase in production capacities.

- Food-tech firms have increasingly invested in R&D initiatives and formed collaborations with key market players to create novel functional constituents.

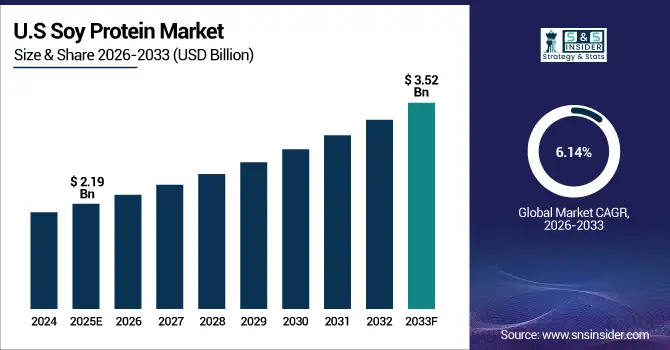

The U.S. Soy Protein Market size is valued at USD 2.19 Billion in 2025E and is projected to reach USD 3.52 Billion by 2033, growing at a CAGR of 6.14% during 2026-2033. Soy Protein Market growth is driven by increasing popularity of plant-based diets and protein-rich foods, the U.S. soy protein market is expanding rapidly. Rising demand for meat and dairy substitutes drives rapid product development.

Soy Protein Market Growth Drivers:

-

Rising Demand for Plant-Based Protein Alternatives Amid Growing Health and Sustainability Awareness

The global tendency of the market’s modalities to focus on plant-based nutrition and sustainable food sourcing keeps soy protein in high demand. Vegetarianism and veganism are gaining in popularity as more people develop chronic diseases, high cholesterol, and try to reduce their carbon footprint soon. Additionally, it has minimal manifestation in food, beverage, and supplement and a recent breakthrough in flavor and texture appealing made possible by technical advancements help justify soy protein’s widespread acceptance.

In 2025, 58% of global consumers chose plant-based proteins like soy to lower cholesterol and reduce heart disease risk, citing health as the top motivator

Soy Protein Market Restraints:

-

Concerns Over Allergenicity and Availability of Alternative Plant-Based Protein Sources

Despite soy protein’s nutritional value and a substantial allergy risk, challenges remain due to soybean’s hormone-like effects and soy genetic engineering. Soy protein suffers from an allergenicity stigma, while other plant-based proteins like pea, rice, faba bean gain popularity and attract investors due to non-GMO status. Furthermore, endemic soybean raw material price volatility and trade frictions in the world’s largest soybean-producing countries, Argentine, and Brazilian, threaten the global market’s stability, restraining growth opportunities in various regions and industry sectors.

Soy Protein Market Opportunities:

-

Expanding Applications in Functional Foods, Nutraceuticals, and Sustainable Food Innovations

Modern trends towards functional foods and sustainable eating set ample opportunities for soy protein market expansion. The pursuit of high-protein snacks, fortified drinks, and plant-based meat triggers innovation momentum. Moreover, advanced soy protein isolate and concentrate science creates opportunities for nutraceutical and self-care applications due to the soy protein-enabled cleaner labels, higher digestibility, and ND-enhanced metabolic support levels.

Global functional food sales exceeded $320 billion in 2024, with high-protein, plant-based products like soy-fortified snacks and bars growing at 12% annually

Soy Protein Market Segment Analysis

-

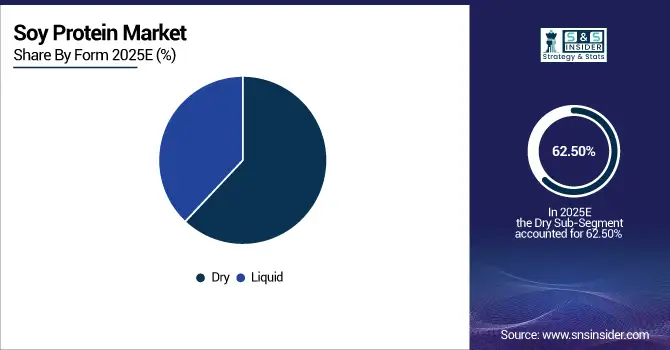

By Form, the dry segment led the Soy Protein Market with a 62.50% share in 2025, while the liquid segment is projected to be the fastest-growing, registering a CAGR of 8.60%.

-

By Application, food products dominated the market with a 38.40% share in 2025, whereas the nutraceuticals segment is expected to witness the fastest growth with a CAGR of 9.50%.

-

By Nature, the organic segment accounted for the largest share of 71.20% in 2025, while the conventional segment is anticipated to grow fastest at a CAGR of 10.30%.

-

By Function, emulsification held a 27.60% share in 2025, with the texturizing agent segment emerging as the fastest-growing category, expanding at a CAGR of 9.80%.

By Form, Dry Leads Market While Liquid Registers Fastest Growth

The dry form segment dominates the soy protein market in 2025 due to its relatively innocuous nature, longer shelf life, and ease of transport and storage. Dry presentation is commonly employed when premium stability and a smooth blend are necessary, such as bakery goods, snacks, or managed meats. Nevertheless, the liquid segment growing fastest due to liquid foods such as beverages, smoothies, or nutraceuticals. Compared to wet and dr. forms, the solubility and absorbability aspect will be critical because these days, new ideas and concepts are re-shaping the meaning of customer attractiveness.

By Application, Food Products Dominate While Nutraceuticals Shows Rapid Growth

In 2025, food products accounted for the highest share of the soy protein market owing to extensive use in meat alternatives, bakery, and dairy substitute formulations. As consumers demand healthy and sustainable eating options, high-protein, low-fat foods have gain demanded. The nutraceutical segment is expected to be the fastest-growing, fueled by a growing understanding of preventative health and the benefits of protein supplementation. Soy protein is being used more in protein powders, energy bars, and supplements designed for the burgeoning population of health enthusiasts.

By Nature, Organic Lead While Conventional Registers Fastest Growth

In 2025, organic soy protein accounted for the largest revenue share, due to the growing trend toward clean-label, non-GMO, and chemical-free products among customers. Increased awareness about health and regulatory backing for organic farming had prompted its use in food and beverage applications. The fastest-growing segment is conventional soy protein. Its growth is driven by its cost-effectiveness, widely available, consistent quality, extensive application in mass-market processed foods, and various animal feed industries. Its use is growing, mainly in developing nations, due to the need affordability in food purchases.

By Function, Emulsification Lead While Texturizing Agent Grow Fastest

Emulsification segment is dominate the market due to properties improve the stability and texture quality of processed foods adding to sauces, dressings, meat analogs. While, texturizing agent would make the fastest growth due to the rise of plant-based processed meat and animal dairy alternatives trend among flexitarians. The product provides respective chewiness and texture closely resembling animal-based products backed by extruded soy and hybrid product development.

Soy Protein Market Regional Analysis:

North America Soy Protein Market Insights

In 2025 North America dominated the Soy Protein Market and accounted for 41.25% of revenue share, this leadership is due to the consumers’ interest towards plant-based food and sustainability. The region primarily uses soy protein for animal feed, meat alternatives and sports nutrition. Moreover, the rising vegan and flexitarian population have increased the innovation across soy formulations. Notably, the partnership between ingredient manufacturers and food technology companies is significantly expanding the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Soy Protein Market Insights

The U.S. is the largest consumer-market for soy protein in North-America. This is due to the large demand for plant-based proteins and clean-label products. Major food and beverage manufacturers are incorporating soy protein into functional and fortified products.

Asia-pacific Soy Protein Market Insights

Asia-pacific is expected to witness the fastest growth in the Soy Protein Market over 2026-2033, with a projected CAGR of 7.06% due to demand for plant-based nutrition and functional food. India, Japan and South Korea contribute significantly across food, beverage and animal feed industry. Growing vegetarian population and expanding food processing industry are some of the factors expanding the market.

China Soy Protein Market Insights

China plays a vital role in the Asia-Pacific soy protein market due to its huge soybean processing abilities and high domestic consumption. The desire for protein ingredient self-reliance and the advancement of soybean processing technologies are being propelled by the lead market drivers.

Europe Soy Protein Market Insights

In 2025, Europe is a mature and growing consumer market for soy protein in Europe. The region is switching towards a more sustainable and plant-based diet. Europe has strict food regulations. The government supports the respectful use of non-GMO and organic soy. The increasing vegan and vegetarian population provide more demand. Furthermore, soy protein is employed in bakery, dairy alternatives, and meat substitute formulations.

Germany Soy Protein Market Insights

Germany is a strong consumer-market of soy protein in Europe. The growing vegan population and clean-label trends are driving the German industry. The German food innovation ecosystem supports the launch of high-quality plant-based protein products.

Latin America (LATAM) and Middle East & Africa (MEA) Soy Protein Market Insights

The Soy Protein Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to modernization of the food industry. South America produces massive quantities of soy protein private as Brazil and Argentina, one of the leading global exporters. The MEA region is already observing increased interest in soy protein as the local population seeks affordable plant-based protein amid major dietary shifts. Support for expanded food processing capabilities and rising population’s awareness of nutritional needs also contribute to the growing demand for soy protein in the region.

Soy Protein Market Competitive Landscape:

Archer Daniels Midland Company is one of the largest soy protein manufacturers worldwide, offering a broad range of plant-based protein solutions. The company’s innovation is targeted at sustainable food protein solutions, such as soy protein isolates and concentrates. ADM’s global supply chain and research and development capabilities support high-quality products and leading positions in the market.

-

In August 2025, ADM announced the planned closure of its Bushnell, Illinois soy protein facility and the consolidation of operations into its recommissioned Decatur East plant, streamlining production and improving cost efficiency.

Cargill Incorporated is a notable player in the soy protein market, offering high-quality protein ingredients for the food, beverage, and feed industry sections. Cargill focuses on sustainability of sourcing, innovative processing technologies, and clean-label solutions. The company’s global distribution and strategic partnerships contribute to high potential in meeting the growing demand for plant-based protein ingredients worldwide.

-

In September 2024, Cargill introduced a “Specialized Nutrition” portfolio at Vitafoods Asia, featuring plant-based high protein bars and powders—including soy protein solutions—to support holistic health across life stages.

Dupont De Nemours Inc. produces innovative soy protein ingredients suitable for the food, nutrition, and health applications. The company uses its food science and food technology expertise to create quality, functional, organic, and non-GMO plant-based protein ingredients. Duponts’ unique selling proposition is the quality of taste, texture, and nutrition they add to food formulations in the plant-based and functional food niches.

-

In July 2024, DuPont Nutrition & Health launched new SUPRO 90% soy protein nuggets designed for high-protein bars and cereals, enabling formulators to replace dairy proteins while maintaining taste and texture.

Soja Austria is a soy protein manufacturer with a focus on producing and distributing high-quality organic and GMO-free soy protein ingredients. The company serves the European food, beverage, and nutraceuticals market. Soja Austria targets consumer needs in sustainability and product purity, offering innovative soy-based solutions required from the market-oriented food manufacturers.

-

In December 2024, Soja Austria was awarded “Top Sustainable Food Company 2024” by a U.S. industry magazine for its dedication to non-GMO soy sourcing and sustainable production practices.

Soy Protein Market Key Players:

Some of the Soy Protein Market Companies are:

-

Archer Daniels Midland Company

-

Cargill Incorporated

-

DuPont de Nemours Inc.

-

Soja Austria

-

Kerry Group plc

-

Agri-Mark Inc.

-

CHS Inc.

-

The Scoular Company

-

Axiom Foods Inc.

-

Best Natural Inc.

-

The Green Labs LLC

-

Emsland Group

-

Prolupin GmbH

-

Soy Protein Inc.

-

Nutrition Resource Inc.

-

Wilmar International Limited

-

Bunge Limited

-

Burcon NutraScience Corporation

-

Sonic Biochem Extractions Pvt. Ltd.

-

Farbest Brands

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.26 Billion |

| Market Size by 2033 | USD 12.01 Billion |

| CAGR | CAGR of 6.50% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Dry and Liquid) • By Application (Food Products, Beverages, Nutraceuticals, Dietary Supplements, Cosmetics, Personal Care, Animal Feed, Pharmaceuticals, and Others) • By Nature (Organic and Conventional) • By Function (Solubility, Gelation, Emulsification, Foaming, Texturizing Agent, Nutrients, Fat, Water Absorption, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland Company, Cargill Incorporated, DuPont de Nemours Inc., Soja Austria, Kerry Group plc, Agri-Mark Inc., CHS Inc., The Scoular Company, Axiom Foods Inc., Best Natural Inc., The Green Labs LLC, Emsland Group, Prolupin GmbH, Soy Protein Inc., Nutrition Resource Inc., Wilmar International Limited, Bunge Limited, Burcon NutraScience Corporation, Sonic Biochem Extractions Pvt. Ltd., Farbest Brands |