Space Militarization Market Report Scope & Overview:

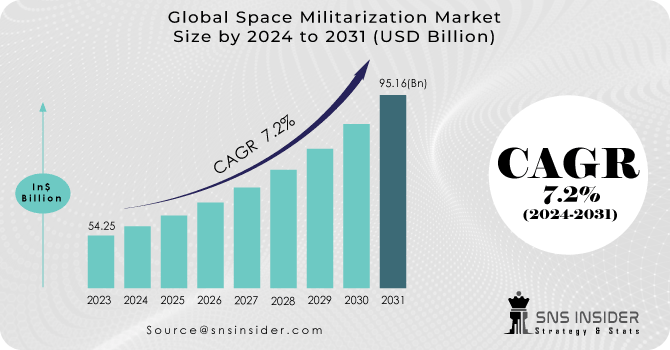

The Space Militarization Market Size was valued at USD 54.3 billion in 2023 and is expected to reach USD 101.4 billion by 2032 and grow at a CAGR of 7.2% over the forecast period 2024-2032.

The growing relevance of space for military applications, as a result of the use of space-based assets for communication, navigation, intelligence, surveillance, and reconnaissance, adds to the expansion of the space militarization industry. As space continues to play an important role in military operations, there is a growing desire for space militarization. Other countries, such as the United States and Russia, are also investing in space militarization to build their space-based assets for military objectives. This increased rivalry forces China to invest more in space militarization to maintain its military edge and strategic location in space. Furthermore, technical advancements are playing an important role in promoting the rise of China's space militarization industry.

To get more information on Space Militarization Market - Request Free Sample Report

Artificial intelligence (Al) and directed energy weapons are emerging technologies that are being developed and modified for use in space. These improvements considerably improve military capabilities in space, making it a more disputed and possibly dangerous realm. As a result, demand for space militarization rises as China seeks to boost its space-based military assets and preserve a competitive edge through the employment of cutting-edge technologies.

Space militarization refers to the development and deployment of military assets and capabilities in space. This includes various activities such as launching military satellites, developing anti-satellite technologies, creating space-based missile defense systems, and more. The space militarization market is closely tied to geopolitical considerations, national security interests, and technological advancements.

As countries compete for dominance and security, space has become a strategic frontier. Nations with advanced space capabilities seek to protect their assets and maintain an edge over potential adversaries. Satellites play a critical role in modern military operations, providing communication, navigation, reconnaissance, and surveillance capabilities. The demand for advanced satellite technology for military purposes drives the market.

Several countries have been developing anti-satellite technologies to counter potential threats. ASAT systems are designed to disable or destroy enemy satellites, disrupting their communication and reconnaissance abilities. With increased reliance on space-based communication and navigation systems, ensuring the cybersecurity of these systems becomes paramount to prevent potential attacks and disruptions.

Military satellites enable real-time monitoring of potential threats, aiding in surveillance and reconnaissance activities. The development of cost-effective and reliable launch systems is essential for deploying military satellites and other assets into space. Treaties such as the Outer Space Treaty and the Prevention of an Arms Race in Outer Space (PAROS) aim to prevent the weaponization of space. However, interpretation and enforcement of these agreements can vary.

MARKET DYNAMICS

DRIVERS

-

Intense geopolitical rivalries and the pursuit of national security interests drive countries to develop space-based military capabilities.

-

Technological Advancements is the driver of the Space Militarization Market.

Advances in satellite technology, miniaturization, propulsion systems, and sensors have made it possible to develop more capable and efficient space-based military systems. These technological advancements attract investment and drive innovation in the sector.

RESTRAIN

-

The militarization of space can lead to an arms race and increased tensions between nations.

-

International Treaties and Norms is the restraint of the Space Militarization Market.

The Outer Space Treaty and other international agreements emphasize the peaceful use of outer space and prohibit the placement of weapons of mass destruction in orbit. These treaties could restrain overt militarization efforts.

OPPORTUNITY

-

Technologies developed for space militarization often have civilian applications as well.

-

Advanced Satellite Technology is an opportunity for the Space Militarization Market.

The development of cutting-edge satellite technology, including miniaturization, high-resolution imaging, and advanced sensors, can enhance military capabilities such as reconnaissance, communication, and navigation.

CHALLENGES

-

Space-based assets are vulnerable to attacks, including cyberattacks and anti-satellite technologies.

-

Space Debris Management is the challenge of the Space Militarization Market.

The testing of anti-satellite weapons and other space activities contributes to the creation of space debris, which poses a threat to operational satellites and the sustainability of space activities.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia attacked Ukraine in 2022, igniting a conflict that has spilled into space, with satellites supplying internet and intelligence and long-standing international ties in outer space altering swiftly. Despite US-Russia concerns over the incursion, American astronauts will return to Earth aboard a Russian Soyuz spacecraft. Despite the invasion, NASA and Russia's space agency Roscosmos have both stated that their joint International Space Station activities have continued as usual. The European Space Agency is gathering to explore the consequences of Russia's escalating invasion of Ukraine for ESA space programs. In the first ten months after Russia invaded Ukraine, leading Washington to authorize $33 billion in military aid, the US delivered Ukraine so many Stinger missiles from its own inventories that replacing them would take 13 years at current capacity levels. According to Raytheon, the business that contributes to the missile systems, it has provided so many Javelin missiles that replacing them would take five years at last year's rates.

IMPACT OF ONGOING RECESSION

Space has always been a powerful incubator for innovation, initially from governments and huge carriers, and now from a wide range of private firms. According to the non-profit Space Foundation, the space industry will be worth $469 billion in 2021, an 11.2% increase over 2020 and the greatest reported rise since 2016. Although the space economy now creates the most value by enabling or improving operations on Earth, in-orbit service, research and development, and manufacturing might generate considerable future value. Satellite services available today will continue to be significant and may be vital in some developing use cases. In the ongoing recession, the Space Militarization Market is gaining profit up to 4.2-4.8%.

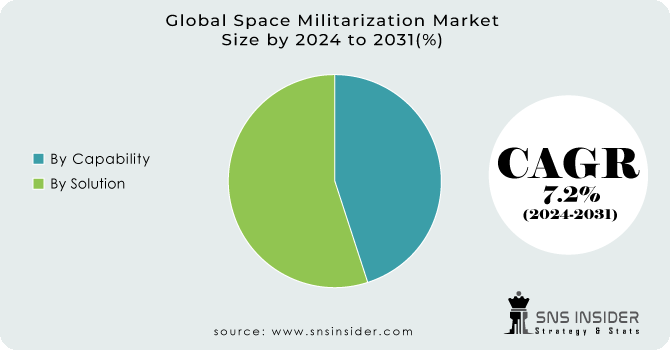

KEY MARKET SEGMENTATION

By Capability

-

Support

-

Defense

By Solution

-

Ground-based Equipment

-

Space-based Equipment

-

Logistics & Services

Need any customization research on Space Militarization Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

North America: The United States is predicted to have the greatest market share in the space militarization industry from 2024 to 2032. Several reasons contribute to its supremacy. To begin with, the United States has substantial space militarization manufacturers who contribute greatly to the industry's expansion. The existence of well-known firms such as The Boeing Company, Lockheed Martin Corporation, General Dynamics Corporation, Raytheon Technologies Corporation, and Northrop Grumman Corporation boosts the country's market position. Second, the US understands the strategic value of space in defence and has been at the forefront of space technological breakthroughs.

Asia Pacific: During the projected period, China is predicted to have the highest growth rate in the Space Militarization market. The rising military value of space has resulted in an increase in demand for space militarization. Space assets are critical in a variety of military applications, including communication, navigation, information collection, surveillance, and reconnaissance. As governments continue to rely on these capabilities for military operations, the necessity to safeguard and improve their space assets grows. This tendency indicates that the space militarization industry will expand as governments invest in technology and tactics to strengthen their military capabilities in space. However, the geopolitical ramifications and international agreements concerning space weaponization must be considered.

Key Players

The Key Players are MBDA Inc., Lockheed Martin, Northrop Grumman Corporation, Boeing Company, BAE Systems, Raytheon Company, Israel Aerospace Industries, Orbital ATK, L3 Harris Technologies, General Dynamics Corporation, and other players.

Lockheed Martin-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022: The Northrop Grumman Corporation exhibited its Tactical Intelligence Tars Access Node (TITAN) prototype. It is an all-domain ground station that will deliver satellite photos and data to command centers across the world in real time.

In 2021: Lockheed Martin Corporation created cloud-based ground control software. V is a service that combines a network of low-cost receivers with cloud computing and storage capacity.

| Report Attributes | Details |

| Market Size in 2023 | USD 54.3 Billion |

| Market Size by 2032 | USD 101.4 Billion |

| CAGR | CAGR of 7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Capability (Support, Defense) • By Solution (Ground-based Equipment, Space-based Equipment, Logistics & Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | MBDA Inc., Lockheed Martin, Northrop Grumman Corporation, The Boeing Company, BAE Systems, Raytheon Company, Israel Aerospace Industries, Orbital ATK, L3 Harris Technologies, General Dynamics Corporation |

| Key Drivers | • Intense geopolitical rivalries and the pursuit of national security interests drive countries to develop space-based military capabilities. • Technological Advancements is the driver of the Space Militarization Market. |

| Market Challenges | • Space-based assets are vulnerable to attacks, including cyberattacks and anti-satellite technologies. • Space Debris Management is the challenge of the Space Militarization Market. |