Helicopters Market Report Scope & Overview:

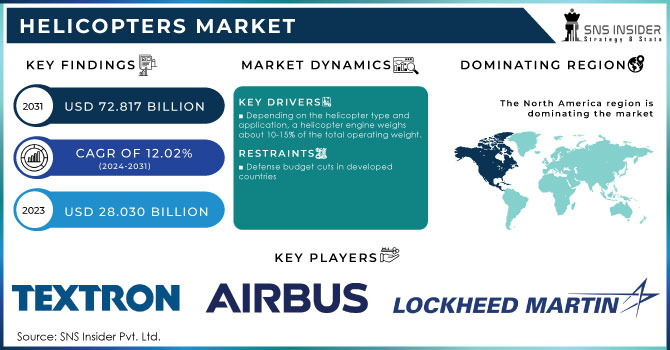

The Helicopters Market Size was valued at USD 28.030 billion in 2023 and is expected to reach USD 72.817 billion by 2031 with a growing CAGR of 12.02% over the forecast period 2024-2031.

The helicopter is also called the chopper in the world market and is a type of rotor-craft where thrust and lift are provided by rotors. This allows the helicopter to take off and land directly, to fly forward, to retreat, and to take off. These features allow helicopters to be used in crowded or adjoining areas where fixed-wing aircraft and more Vertical Take Off and Landing (VTOL) aircraft can be manufactured.

To get more information on Helicopters Market - Request Free Sample Report

A major factor contributing to the growth of the helicopter market is the increased demand for helicopter services, medical and emergency services, and helicopter services. In addition, growth in the tourism industry is expected to increase the demand for helicopter market during the forecast period. In addition, replacement of worn-out helicopters is expected to support market growth. However, higher travel costs limit market growth.

MARKET DYNAMICS

KEY DRIVERS

-

There is an increasing demand for emergency medical service helicopters.

-

Depending on the helicopter type and application, a helicopter engine weighs about 10-15% of the total operating weight.

RESTRAINTS

- Defense budget cuts in developed countries

OPPORTUNITIES

-

Commercialization of urban air mobility and electric vertical takeoff and landing can serve as an alternative to helicopters.

-

This is expected to provide opportunities for helicopter market players who have the design and manufacturing capabilities to integrate electric-hybrid propulsion as well as autonomous flight capabilities in their helicopters in order to increase their market share.

CHALLENGES

-

Strict regulations govern the manufacture of helicopter components.

-

Before they can be assembled in a helicopter, all components must go through a one-time inspection.

THE IMPACT OF COVID-19

The rapid spread of the novel COVID-19 in markets such as Europe, the United States, and Asia Pacific has resulted in a significant drop in global demand for helicopters. Due to factors such as late delivery and manufacturing shutdown, there has also been a corresponding reduction in the revenue quantum for various helicopter suppliers, followed by service providers across all market locations. Furthermore, the availability of limited staff at manufacturing facilities, as well as limited availability of equipment, is impeding market growth.

Civil, commercial, and military helicopters have seen significant growth in recent years. The increased demand for light helicopters for civil and commercial applications such as transport and offshore is one of the major factors driving this growth. Military helicopter procurement by military around the world, particularly demand for attack helicopters from emerging economies, has increased the order book of military helicopters. This demand, which has resulted in an increase in helicopter deliveries, is expected to propel the OEM market during the forecast period. Because of the increase in offshore activities and demand from offshore rigs, civil and commercial offshore helicopters are expected to have the highest CAGR. The number of global offshore rigs has steadily increased in recent years and is expected to rise further during the forecast period. Demand for offshore helicopters is expected to rise as offshore activities expand. With the growth of the aviation industry and relatively short travel times to any part of the world, the world has become a relatively small area. It also provided a boost to the personal atmosphere, a significant expansion of places, cultures, people, or a sense of humor as travelers could gain access by simply booking flights. Individual rising incomes associated with aging vessels are expected to further the market demand for helicopters. In addition, the growing tourism industry is expected to increase the demand for the helicopter market during the forecast period. However, tight ventilation systems and the high costs associated with helicopters can serve as challenges to the growth of the helicopter market market. Most countries pay taxes on commercial helicopters, thus hampering growth at some point. Helicopters produce noise levels up to 110 decibels slightly lower than the sound produced by a large chainsaw. The pressure on manufacturers of helicopters to design environmentally friendly helicopters is likely to increase in the near future due to the increase in the number of helicopters entering the service.

Developing countries such as Brazil, India and China are facing increasing demand for commercial helicopters due to the growth of the tourism industry. In addition, manufacturers expect that attractive financial systems will boost market share, as consumers find favorable targets for buying new helicopters.

KEY MARKET SEGMENTATION

By Helicopter Type

-

Light Helicopter (< 4.5 T)

-

Medium Helicopter (4.5 to 8.5 T)

-

Heavy Helicopter (> 8.5 T)

By Application

-

Military

-

Civil & Commercial

By Sales Channel

-

OEM (Original Equipment Manufacturer)

-

MRO (Maintenance, Repair and Operation)

By Component

-

Main Air-frame

-

Engine

REGIONAL ANALYSIS

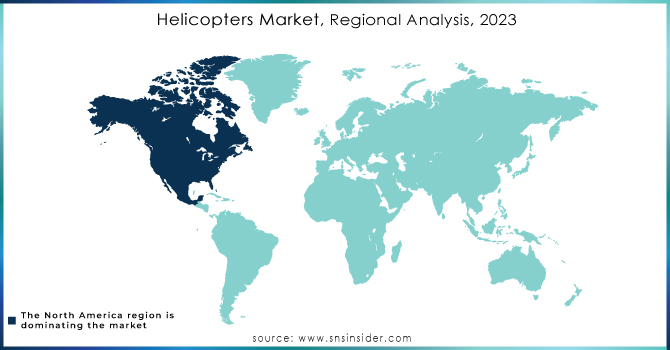

The helicopter market is divided worldwide based on the North American region, the Asia-Pacific region, the European region, the Latin American region, and the Middle East and the African region. The largest market share in the global market is occupied by the North American region due to the presence of countries such as Mexico, Canada, and the US with high rates of urbanization and that is why it creates a great demand for this region. The presence of various key players is another factor driving the market demand. Rising air travel and rental services also drive market demand.

The largest market share in the global market is occupied by the Asia-Pacific region due to the presence of densely populated countries such as China, India and Japan, South Korea and many others driving market demand in the region. In addition, the growth of trade, military, and civil society is another factor driving market demand.

The third largest market share in the world market is held by the European region due to the presence of well-developed infrastructure that requires a helicopter market to develop and create more opportunities for growth in the region. The Middle East and Africa region, as well as the Latin American region, show a very small market share due to the availability of low infrastructure in both regions. Low per capita income is another factor that hinders market growth in these regions.

Need any customization research on Helicopters Market - Enquiry Now

REGIONAL COVEREGE:

- North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Textron Inc., Airbus SAS, Lockheed Martin Corporation, Leonardo SpA, Hindustan Aeronautics Limited, Boeing, Aviation Industry Corporation, Russian Helicopters, JSC, Robinson Helicopter Company, MD Helicopters, Inc., Korea Aerospace Industries, Ltd., Enstrom Helicopter Corporation and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 28.030 Billion |

| Market Size by 2031 | US$ 72.817 Billion |

| CAGR | CAGR of 12.02% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Helicopter Type (Light Helicopter (< 4> 8.5 T)) • By Application (Military, Civil & Commercial) • By Sales Channel (OEM (Original Equipment Manufacturer), MRO (Maintenance, Repair and Operation)) • By Component (Main Air-frame, Engine) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Textron Inc., Airbus SAS, Lockheed Martin Corporation, Leonardo SpA, Hindustan Aeronautics Limited, Boeing, Aviation Industry Corporation, Russian Helicopters, JSC, Robinson Helicopter Company, MD Helicopters, Inc., Korea Aerospace Industries, Ltd., Enstrom Helicopter Corporation, |

| DRIVERS | • There is an increasing demand for emergency medical service helicopters. • Depending on the helicopter type and application, a helicopter engine weighs about 10-15% of the total operating weight. |

| RESTRAINTS | • Defense budget cuts in developed countries |