Sports Betting Market Size & Overview:

Sports Betting Market size was USD 92.0 billion in 2023 and is expected to reach USD 221.4 billion by 2032 and grow at a CAGR of 10.2% over the forecast period of 2024-2032.

Get More Information on Sports Betting Market - Request Sample Report

The sports betting market analysis highlights phenomenal growth, owing to the increasing pace of legalization and regularisation of betting activities in most of the regions. As per the government’s latest statistics, the sports betting industry witnessed a significant commercial boost in 2023. With many governments continuing to derive substantial revenue, the information report shows that the government’s tax collection from these activities recorded an increase of 30% for the first time.

The legalization of sports betting in over 30 states was the most important driver of this increase in tax revenue. Most European countries, such as the U.K. and Italy have also experienced an increase in sports betting revenue, contributing to the overall sports betting market growth and success of the developed countries. The government is in the final stages of implementing regulatory measures to offer consumers more advantages of betting in the open and the ending of illegal betting. These laws not only generate enormous amounts of money for the government, but they also ensure more consumers put their trust in the activity.

Sports Betting Market Dynamics:

Drivers:

- The increasing legalization of sports betting in various regions, particularly in the U.S. and Europe, is driving market growth.

- The development of mobile apps and online platforms has made sports betting more accessible, contributing to market expansion.

- Growing interest in sports globally, including major events, such as the FIFA World Cup, Super Bowl, and the Olympics, fuels betting activities.

- Widespread internet access allows more people to participate in online sports betting, enhancing market reach.

- Secure and convenient payment methods, including digital wallets and cryptocurrencies, have simplified the betting process, encouraging participation.

The legalization and regulation of sports betting is one of the most important factors contributing to the growth of the market. Decisive steps toward the legalization of sports betting, particularly in the United States, have opened up new opportunities both for earning profits and for growing the market. After the U.S. Supreme Court decided to overturn the Professional and Amateur Sports Protection Act more than 30 states have already legalized sports betting and others are considering it. This regulation has allowed the states to earn significant amounts of tax revenues.

For instance, New Jersey and Pennsylvania have become major sports betting regions. The U.K. remains highly regulated, and it is currently the leader in terms of the well-established system. At the same time, countries including Germany and the Netherlands have updated their gambling laws to regulate the industry, and include sports betting in these laws. The trend of legalization will continue to develop, constituting one of the most powerful growth drivers for the sports betting market. At the same time, it will allow the governments to earn revenue and regulate the market.

Restraints:

- In many countries, sports betting is still illegal or heavily regulated, limiting market potential.

- Concerns about gambling addiction and its social impact can lead to stricter regulations and reduced consumer participation.

- Issues related to fraud, match-fixing, and the integrity of sports can negatively affect the reputation and growth of the market.

One of the major restraints to the growth of the sports betting market is legal restrictions. In many regions, sports betting is either illegal or faces stringent regulations that limit its growth. Governments impose these restrictions due to concerns about the potential for gambling addiction, the social consequences of betting, and the integrity of sports. The illegal status of sports betting in certain jurisdictions forces operators to operate in the shadow economy, which can lead to a lack of consumer protections, increased risk of fraud, and lower trust among potential users.

Even in regions where sports betting is legal, the regulatory environment can be complex and burdensome, requiring operators to navigate a maze of laws, obtain various licenses, and comply with strict operational guidelines. This not only limits the entry of new players into the market but also increases operational costs and challenges for existing businesses, ultimately restricting market growth.

Sports Betting Market Segmentation Analysis:

By Type

In 2023, the online platform was the leading segment covering approximately 65% of the sports betting market share. The adoption of the online betting platform is justified by the high levels of convenience and access it provides, and the higher ownership of smartphones and high-speed internet. The government statistics reveal these sports betting market trends in the U.K. where 20% of the bets were placed offline with 80% on the online platform. The government’s intent to focus on regulating online betting platforms has also increased the trust levels among consumers resulting in high rates of operations. The contribution of the offline betting process, although relevant to the market, has reduced in the market shares due to the gradual shift towards online platforms by more consumers.

By Sports Type

Football was the leading sports type in the sports betting market in 2023 contributing to about more than 25% of the share. Football is, by nature, the most popular sport globally, with a wide viewership by the fans. There is higher league play coverage with more in-depth statistical analysis in this particular sport. For instance, the government statistics on the U.K., Italy, and Brazil suggest that football was a substantial contributor to sports betting due to the high viewer attention and interest in the respective countries. The U.K. government gambling commission reported a 60% contribution to the market of sports betting in 2023 from football. In addition, the availability of different bet types such as outcomes of the game, players’ and incidences in the game, such as penalties, and other in-play betting have been a significant attraction in football betting. The regulated governance by the governments to implement fair play regulations in football has also increased the trust of consumers in the market.

By Betting Type

Fixed odds wagering was the dominant betting type in the sports betting market in 2023 with an allocation of 27% of the market share. The fixed odds betting types have always attracted more consumers to the government’s statistics from across governments. This betting type has always been considered the simplest, easiest, and most understandable by consumers. For instance, the U.K. government gambling commission reported that 70% of the sports bets in the U.K. in 2023 were placed on fixed-wage betting types. Furthermore, this betting type is more available across both online and offline platforms than the other betting types. The governments have regulated the fixed betting types, including the responsible gambling aspects which have increased the trust of stakeholders in the industry.

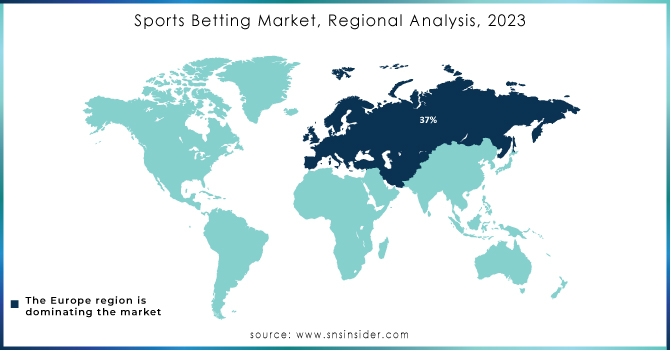

Regional Analysis:

As of 2023, Europe was the leading region in the global sports betting market and held a market share of approximately 37%. The dominance of this region results from the region's long-standing tradition of sports betting, well-established regulatory frameworks, and the presence of major sports leagues and events that attract bettors.

Europe’s regulatory framework is also highly developed, given the stringent gambling legislation adopted by most of the region’s territories. Besides, most of the largest sports leagues are in Europe, resulting in a higher proportion of people willing to engage in sports betting. According to the U.K. Gambling Commission, sports betting will generate substantial revenue in the U.K., which include not only football but horse racing and other sports. There is a certain optimism surrounding the European market resulting from the extremely stable regulatory and social environment it possesses.

The high degree of transparency and fairness promised by the government regulation of sports betting has been a crucially important factor in the great success of this market. The accumulated experience of all governmental bodies in the market ensures that fraud is minimal and licenses granted are of high quality. This also has a positive impact on consumer habits, as they trust the system and engage in betting on sports.

The dominance of the European market is further promoted by the high levels of internet penetration and the use of a variety of sports betting websites. In combination, these two factors lead to Europe being the largest market in the world for sports betting. The region sports the most developed betting infrastructure in the world, largely due to the support of the government.

Need any customization research on Sports Betting Market- Enquiry Now

KEY PLAYERS:

The major sports betting market companies are Bet 365 Group Ltd., GVC Holding plc., The Stars Group, Paddy Power Betfair plc.,William Hill plc., Fortuna Entertainment Group, Betfred Ltd., mybet Holding, Hong Kong, Jockey Club, Kindred Group, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 92.0 Billion |

| Market Size by 2032 | US$ 221.4 Billion |

| CAGR | CAGR 10.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Offline and Online) • By Betting Type (Fixed Odds Wagering, Exchange Betting, Live/In-Play Betting, eSports Betting, and Others) • By Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bet 365 Group Ltd., GVC Holding plc., The Stars Group, Paddy Power Betfair plc.,William Hill plc., Fortuna Entertainment Group, Betfred Ltd., mybet Holding, Hong Kong, Jockey Club, Kindred Group. |

| Key Drivers | • The increasing legalization of sports betting in various regions, particularly in the United States and Europe, is driving market growth. • The development of mobile apps and online platforms has made sports betting more accessible, contributing to market expansion. |

| Market Restraints | • Concerns about gambling addiction and its social impact can lead to stricter regulations and reduced consumer participation. • Issues related to fraud, match-fixing, and the integrity of sports can negatively affect the reputation and growth of the market. |