Sports Medicine Market Size:

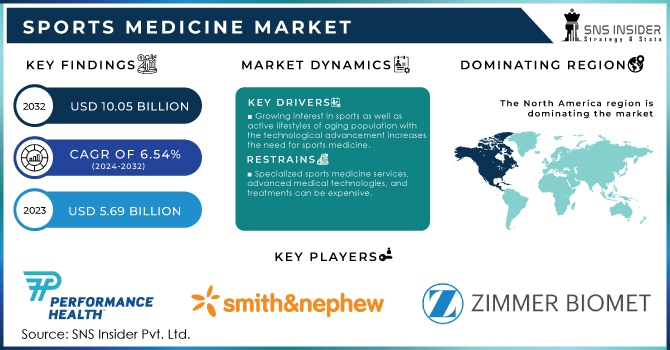

The Sports Medicine Market size was valued at USD 6.06 billion in 2025E, and is expected to grow to USD 10.05 billion by 2033, at a CAGR of 6.54% over the forecast period 2026-2033.

Sports medicine is a specialized field dedicated to enhancing the health and performance of athletes. By combining medical expertise with exercise science and rehabilitation, it focuses on preventing, diagnosing, and treating sports injuries while optimizing athletic potential. Whether they are a professional or recreational athlete, sports medicine provides essential care and help to reach their peak performance. Sports participation is widespread in the U.S., with over 210 million people engaging in some form of athletic activity annually. Unfortunately, this high level of participation is accompanied by a significant number of injuries. The CDC reports approximately 9 million sports-related injuries each year across all age groups, underscoring the need for specialized care, such as that provided by orthopedic doctors.

Sports Medicine Market Size and Forecast:

-

Market Size in 2025E: USD 6.06 Billion

-

Market Size by 2033: USD 10.05 Billion

-

CAGR: 6.54% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Sports Medicine Market - Request Sample Report

Sports Medicine Market Key Trends:

-

Growing prevalence of sports injuries – Increasing participation in professional and recreational sports is driving demand for preventive, diagnostic, and therapeutic sports medicine solutions.

-

Rising adoption of minimally invasive procedures – Arthroscopy, regenerative therapies, and platelet-rich plasma (PRP) injections are increasingly preferred for faster recovery and reduced post-operative complications.

-

Technological advancements in medical devices – Innovative orthopedic implants, wearable sensors, and rehabilitation equipment are improving injury monitoring, recovery, and performance optimization.

-

Expansion of fitness and wellness industry – The global focus on physical fitness and injury prevention is boosting demand for sports medicine services and products.

-

Integration of telemedicine and digital health – Remote monitoring, virtual physiotherapy, and app-based rehabilitation are enhancing patient accessibility and adherence.

-

Increasing awareness of musculoskeletal health – Educational campaigns and preventive care initiatives encourage early diagnosis and intervention for athletes and active populations.

The global sports medicine market is experiencing robust growth driven by the increasing emphasis on athlete performance, injury prevention, and overall well-being. As participation in sports and fitness activities rises, so does the demand for specialized care that addresses the unique physical demands athletes face. Sports medicine offers a wide-ranging solution, about injury prevention, diagnosis, treatment, rehabilitation, and performance optimization. This multidisciplinary approach, coupled with technological advancements, has solidified sports medicine as an indispensable component of the athletic landscape, driving market expansion.

Effective pain management is paramount in sports medicine as it directly influences athlete performance, recovery, and overall well-being. Traditionally reliant on pharmaceuticals often associated with side effects and addiction risks, the field is exploring innovative alternatives.

The U.S. Sports Medicine market size was valued at an estimated USD 2.65 billion in 2025 and is projected to reach USD 4.45 billion by 2033, growing at a CAGR of 6.1% over the forecast period 2026–2033. Market growth is driven by the increasing participation in sports and fitness activities, rising incidence of sports-related injuries, and growing awareness of injury prevention and rehabilitation. Advancements in minimally invasive surgical techniques, regenerative therapies, and wearable sports health technologies are accelerating market adoption. Additionally, expanding demand for orthopedic implants, arthroscopy devices, and physical therapy solutions, along with increasing healthcare expenditure and specialized sports medicine centers, further strengthen the growth outlook of the U.S. sports medicine market during the forecast period.

Sports Medicine Market Drivers:

-

Growing interest in sports as well as active lifestyles of aging population with the technological advancement increases the need for sports medicine

3D printing, wearable devices, and biologics can help personalize treatment plans and monitor athletes' health and performance in real time. Other medical technologies, such as minimally invasive surgical techniques, imaging technologies, and regenerative medicine, can improve the diagnosis and treatment of sports injuries.

As more people around the world become interested in sports, they realize the importance of sports medicine in helping them stay active.

The trend towards preventive healthcare and injury prevention strategies, such as strength training, conditioning programs, and biomechanical analysis, is also driving demand for sports medicine.

In the United States, an aging population is maintaining active lifestyles, which can lead to more musculoskeletal issues and a greater need for sports medicine interventions. A surge in sports-related injuries among seniors is straining the orthopedic care system. New data reveals a staggering 67% increase in sports injuries among Americans over 65 between 2012 and 2021, with numbers projected to hit the roof another 123% by 2040. This rapid escalation far outpaces the anticipated 7.9% growth in orthopedic surgeons, creating a looming care gap. The findings underscore an urgent need for innovative solutions and a re-evaluation of care delivery models to address the evolving needs of an increasingly active aging population. People are becoming more conscious about their health and well-being, which has created opportunities for sports medicine to expand beyond professional sports activities.

Sports Medicine Market Restraints:

-

Specialized sports medicine services, advanced medical technologies, and treatments can be expensive.

-

Competitive market landscape is the restrain of the sports medicine market.

The sports medicine market is highly competitive, involving a wide array of players such as medical institutions, device manufacturers, pharmaceutical companies, and specialized service providers. This intense competition creates significant pricing pressures, as companies strive to attract healthcare providers, athletes, and fitness centers by offering cost-effective solutions. Additionally, the rapid introduction of new technologies, including regenerative therapies, orthopedic implants, wearable devices, and advanced rehabilitation equipment, increases the challenge of differentiating products and services. Providers must continuously innovate and demonstrate clinical efficacy to maintain market share. Smaller players may struggle to compete with established brands, while larger organizations invest heavily in research, marketing, and strategic partnerships. Collectively, these dynamics create a challenging landscape for sustained growth and profitability in the sports medicine sector.

Sports Medicine Market Segmentation Analysis:

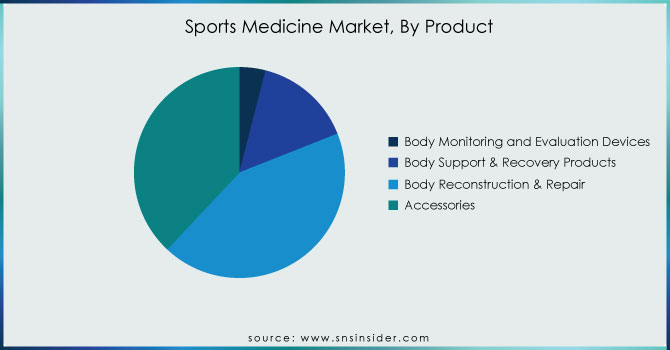

By Product, Body Reconstruction and Repair Leads Sports Medicine Market; Accessories Segment Poised for Fastest Growth

The body reconstruction and repair segment dominated the sports medicine market in 2025, captured 43% of revenue. This growth was fueled by increased utilization of fracture and ligament repair devices, coupled with the rising adoption of minimally invasive surgical techniques. The surge in accidental injuries, with millions requiring medical treatment annually, further bolstered demand for these products.

Conversely, the accessories segment is poised for the fastest growth, driven by the escalating popularity of PRICE (Protection, Rest, Ice, Compression, Elevation) therapy for immediate injury management. As athletes and active individuals prioritize injury prevention and care, the demand for bandages, tapes, and other essential accessories is expected to climb significantly.

Need any customization research on Sports Medicine Market - Enquiry Now

By Application, Knee Injuries Drive Market Growth; Ankle and Foot Injuries Segment Set for Rapid Expansion

On the basis of application, Knee injuries segment is the primary driver of the sports medicine market, reported for the largest market share with 36% in 2025. The increasing prevalence of knee problems, often stemming from high-impact activities, has fueled demand for a variety of treatments, from conservative therapies like dry needling to surgical interventions such as arthroscopy.

The ankle and foot injuries segment are projected to experience the most rapid growth. This is attributed to the rising popularity of sports and exercise, which increases the risk of ankle and foot injuries. Advancements in technology, such as 3D printed implants, combined with robust R&D efforts by industry leaders, are accelerating market expansion in this area.

Sports Medicine Market Regional Analysis

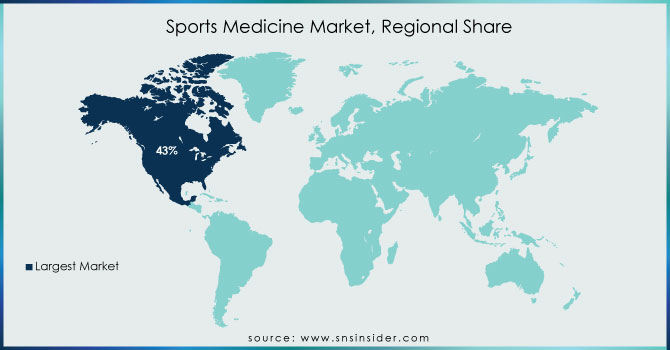

North America dominates the Sports Medicine market in 2025

In 2025, North America holds an estimated 38% share of the Sports Medicine market, driven by rising sports participation, increasing prevalence of musculoskeletal injuries, and high adoption of advanced medical technologies. The region benefits from robust healthcare infrastructure, widespread insurance coverage, and a growing focus on preventive care and rehabilitation. Strong investments in orthopedic devices, minimally invasive surgical techniques, and physiotherapy solutions are accelerating market growth. Collaborations between sports organizations, clinics, and technology providers further enhance accessibility and innovation in sports medicine. These factors collectively maintain North America’s leadership position and support sustained market growth.

-

United States leads North America’s Sports Medicine market

The U.S. dominates due to its advanced healthcare system, large number of professional and amateur athletes, and rapid adoption of innovative surgical and rehabilitation technologies. Government and private investments in sports facilities, orthopedic centers, and advanced treatment solutions further drive growth. Rising awareness of injury prevention, minimally invasive procedures, and physiotherapy services enhances adoption. Strategic partnerships between hospitals, clinics, and sports medicine device providers ensure comprehensive treatment availability. Combined with high disposable income, strong healthcare infrastructure, and regulatory support, the United States remains the largest contributor to North America’s sports medicine revenues.

Asia-Pacific is the fastest-growing region in the Sports Medicine market in 2025

The Asia-Pacific market is projected to expand at an estimated CAGR of 8.5% from 2026 to 2033, driven by growing sports participation, increasing disposable income, and expanding healthcare infrastructure. Rising prevalence of sports-related injuries and growing awareness of rehabilitation services further stimulate demand.

-

China leads Asia-Pacific’s Sports Medicine market

China dominates due to its expanding sports culture, government initiatives promoting physical activity, and rising disposable incomes. Increasing injuries among youth and professional athletes create strong demand for orthopedic devices and rehabilitation services. Hospitals are rapidly adopting minimally invasive surgeries, physiotherapy solutions, and advanced imaging technologies for injury management. Collaborations between local and global sports medicine companies enhance accessibility and technological innovation. Focus on preventive care, fitness programs, and rehabilitation centers positions China as the leading contributor to Asia-Pacific’s sports medicine market growth.

Europe Sports Medicine market insights, 2024

Europe shows steady growth in 2025, supported by high sports participation rates, advanced healthcare infrastructure, and adoption of minimally invasive surgeries and rehabilitation therapies. The region benefits from increasing awareness of injury prevention, performance optimization, and orthopedic care solutions.

-

Germany drives Europe’s Sports Medicine market

Germany dominates due to its robust healthcare system, high sports culture, and early adoption of advanced sports medicine technologies. Government support for sports facilities, orthopedic research, and rehabilitation centers encourages growth. Rising awareness of injury prevention and rehabilitation drives market adoption, making Germany the largest contributor to Europe’s sports medicine revenues.

Middle East & Africa and Latin America Sports Medicine market insights, 2025

The Middle East & Africa and Latin America markets show moderate growth in 2025. In the Middle East, countries like Saudi Arabia and the UAE are investing in sports infrastructure and advanced rehabilitation centers. Africa’s emerging sports culture and growing healthcare investments are gradually driving adoption. In Latin America, Brazil and Mexico lead demand due to increasing sports participation, rising injuries, and government-supported healthcare initiatives. Awareness of preventive care, physiotherapy, and orthopedic solutions supports steady market expansion across both regions.

Competitive Landscape for the Sports Medicine Market:

Stryker Corporation

Stryker Corporation is a U.S.-based global leader in medical technologies, specializing in orthopedic implants, surgical equipment, and sports medicine solutions. With decades of expertise, the company develops, manufactures, and markets advanced products for fracture repair, ligament reconstruction, and minimally invasive procedures. Stryker operates through hospitals, clinics, and distributors worldwide, providing training, technical support, and comprehensive product portfolios. Its role in the sports medicine market is pivotal, as it delivers innovative solutions that enhance patient recovery, improve surgical outcomes, and support injury prevention and rehabilitation for athletes and active individuals.

-

In 2024, Stryker launched updated arthroscopy and ligament repair devices, featuring enhanced ergonomics, precision instrumentation, and integrated digital guidance systems for improved surgical accuracy.

Zimmer Biomet Holdings, Inc.

Zimmer Biomet is a leading U.S.-based orthopedic and sports medicine company, focusing on joint reconstruction, biologics, and trauma products. The company designs and supplies innovative implants, surgical instruments, and rehabilitation solutions to hospitals, clinics, and specialized sports medicine centers. Its role in the sports medicine market is central, as it provides technology-driven solutions that enhance surgical efficiency, accelerate recovery, and improve patient mobility. Zimmer Biomet’s global presence and partnerships with healthcare providers strengthen its position in the competitive sports medicine landscape.

-

In 2024, Zimmer Biomet introduced advanced minimally invasive implants and biologic products, improving treatment options for athletes and active patients worldwide.

Smith & Nephew plc

Smith & Nephew, headquartered in the U.K., is a global innovator in advanced surgical devices, orthopedics, and sports medicine products. The company offers solutions for ligament repair, arthroscopy, wound care, and rehabilitation, serving hospitals, clinics, and sports medicine specialists. Smith & Nephew’s role in the market is significant, as it provides high-quality, technologically advanced products that enhance surgical outcomes, enable faster recovery, and reduce complications in sports injury management.

-

In 2024, Smith & Nephew unveiled new arthroscopic instruments and soft tissue repair technologies, designed to optimize performance and safety in sports-related procedures.

Medtronic plc

Medtronic plc is a global medical technology leader based in Ireland, offering a wide range of devices and solutions, including minimally invasive surgical tools, orthopedic implants, and rehabilitation technologies for sports medicine. The company serves hospitals, rehabilitation centers, and specialty clinics, focusing on improving patient outcomes and recovery times. Medtronic’s role in the sports medicine market is crucial, delivering cutting-edge innovations that enhance surgical precision, enable faster healing, and support preventive care for active individuals.

-

In 2024, Medtronic launched next-generation ligament repair systems and rehabilitation devices, integrating digital monitoring and patient-specific treatment planning.

Sports Medicine Market Key Players:

-

Stryker Corporation

-

Zimmer Biomet Holdings, Inc.

-

Smith & Nephew plc

-

Medtronic plc

-

CONMED Corporation

-

Arthrex, Inc.

-

DJO Global, Inc.

-

Breg, Inc.

-

Wright Medical Group N.V.

-

Hanger, Inc.

-

Globus Medical, Inc.

-

Ossur hf

-

DePuy Synthes (Johnson & Johnson)

-

Terumo Corporation

-

ArthroCare Corporation (Smith & Nephew)

-

Aesculap, Inc.

-

Teleflex Incorporated

-

Orthofix Medical Inc.

-

Invacare Corporation

-

Active Implants LLC

| Report Attributes | Details |

| Market Size in 2025E | US$ 6.06 Bn |

| Market Size by 2033 | US$ 10.05 Bn |

| CAGR | CAGR of 6.54% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Body Monitoring and Evaluation Devices, Body Support & Recovery Products, Body Reconstruction & Repair, Accessories) • By Application (Shoulder Injuries, Knee Injuries, Back & Spine Injuries, Ankle & Foot Injuries, Hip Injuries, Elbow & Wrist Injuries, Other Injuries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Medtronic plc, CONMED Corporation, Arthrex, Inc., DJO Global, Inc., Breg, Inc., Wright Medical Group N.V., Hanger, Inc., Globus Medical, Inc., Ossur hf, DePuy Synthes (Johnson & Johnson), Terumo Corporation, ArthroCare Corporation (Smith & Nephew), Aesculap, Inc., Teleflex Incorporated, Orthofix Medical Inc., Invacare Corporation, Active Implants LLC |