Sports Optic Market Size & Growth Trends:

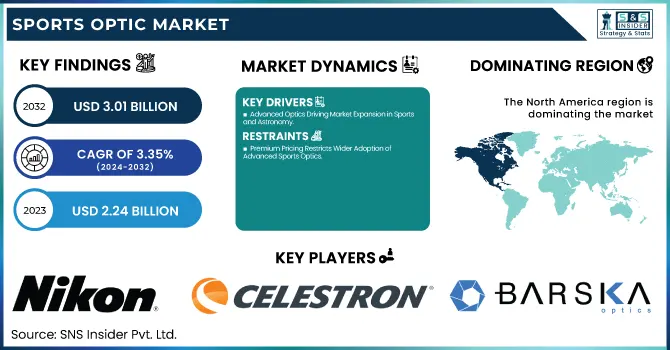

The Sports Optic Market Size was valued at USD 2.24 billion in 2023 and is projected to reach USD 3.01 billion by 2032, growing at a CAGR of 3.35 % from 2024 to 2032. As the demand for high-quality optical devices increases alongside the growing participation in outdoor activities such as hunting, birdwatching, and shooting sports, the U.S. Sports Optic Market continues to expand. The high-end optics have benefited from the premiumization trends, and technological innovations, such as AI-integrated rangefinders or image-stabilized binoculars, improve user experience. In addition, supportive regulations for wildlife observation and hunting bolster the growth of the market.

To Get more information on Sports Optic Market - Request Free Sample Report

The U.S. Sports Optic Market was valued at USD 0.76 billion in 2023 and is projected to reach USD 0.84 billion by 2032, growing at a CAGR of 1.03%. The market also benefits from innovations in military and law enforcement optics, which influence civilian product development. However, the slow growth rate suggests market maturity, with demand primarily driven by product upgrades rather than new consumer adoption.

Sports Optic Market Dynamics:

Drivers:

-

Advanced Optics Driving Market Expansion in Sports and Astronomy

The growing demand for high-precision optics is fueled by consumer preference for durable, premium products and increased government investments in top-tier training facilities for athletes. Additionally, advancements in astronomical research are accelerating market growth, with sophisticated optical instruments required for precise celestial observations. Astronomical telescopes provide unparalleled clarity in viewing distant objects, far beyond human eye capabilities. In August 2022, NASA announced a custom-built test chamber for its upcoming space telescope, set for launch in 2025. This advanced telescope aims to create a groundbreaking 3D map of the entire sky, tracking 100 million stars in the Milky Way, along with galaxies, star-forming regions, and cosmic phenomena. Such innovations not only advance space exploration but also drive technological progress in consumer and professional optics, influencing the broader sports optics market through enhanced imaging and stabilization technologies.

Restraints:

-

Premium Pricing Restricts Wider Adoption of Advanced Sports Optics

The high cost of advanced sports optics remains a significant barrier to market expansion, particularly for casual users and budget-conscious consumers. Premium models featuring AI-driven rangefinders, image stabilization, and high-precision lens coatings offer unparalleled performance but come at a steep price. This pricing challenge limits accessibility, restricting adoption primarily to professional athletes, hunters, and enthusiasts willing to invest in top-tier equipment. Additionally, research and development costs for cutting-edge technologies contribute to elevated retail prices, making it difficult for new entrants to compete with established brands. While demand for high-performance optics is rising, the affordability gap prevents mass-market penetration. Consumers often opt for mid-range or budget alternatives, hindering premium segment growth. As competition increases, manufacturers may need to explore cost-effective production methods or introduce financing options to make high-end optics more accessible. Addressing this challenge will be crucial for sustained market expansion and broader consumer adoption.

Opportunities:

-

Rising Outdoor Enthusiasm Fuels Demand for High-Performance Sports Optics

The increasing popularity of outdoor recreational activities such as hunting, birdwatching, and adventure tourism is significantly driving demand for high-performance optical devices. The need for advanced binoculars, rangefinders, and spotting scopes with enhanced clarity, durability, and weather resistance is rising. Birdwatchers and wildlife enthusiasts require optics with superior magnification and image stabilization, while hunters rely on precision optics for accurate targeting. Additionally, the rise in eco-tourism and adventure sports, such as hiking and mountaineering, has led to increased adoption of lightweight, compact, and rugged optical devices. Government initiatives promoting outdoor activities and wildlife conservation further contribute to market growth.

Challenges:

-

Sustainability regulations drive up costs, challenging sports optics manufacturers to adopt eco-friendly materials while staying competitive.

The sports optics industry is ultimately subject to heightened scrutiny as environmental laws compel manufacturers to develop sustainable materials and adopt environmentally friendly production techniques. The constant adjustment to stringent laws of hazardous substances and waste management incurs huge investments, thereby increasing the production cost. Moving to lead-free glass, recyclable polymers and energy-performance manufacturing bumps up R&D costs, so high-performance optics become pricier. Moreover, customer awareness regarding eco-friendly products forces brands to implement green movements without sacrificing price and quality. While these efforts align with global sustainability goals, they also pose financial challenges, particularly for smaller manufacturers struggling to keep costs competitive. Companies must navigate the trade-off between regulatory compliance, sustainability, and affordability to remain viable in the evolving market. Those investing in green technologies and transparent environmental policies may gain a competitive edge, but the high costs of adaptation remain a key challenge for the industry.

Sports Optic Market Segment Analysis:

By Product

The binoculars segment dominated the sports optics market, accounting for approximately 60% of total revenue in 2023. Their popularity across use cases such as birdwatching, hunting, sports, and outdoor experiences drive this dominance. And technological advancements, including image stabilization, AI-assisted rangefinders, and T* lens coatings, have improved performance and also opened the category to professionals as well as recreational users. The increase in wildlife tourism and demand for stargazing have also driven up demand. Besides, innovative compact and lighter designs that offer high magnification and brightness also make binoculars more attractive to consumers. Production is utilizing more sustainable materials and methods. Increasing premiumization is also contributing to high-end sales, with consumers increasingly ready to spend on enhanced optical performance. With continued innovation and rising outdoor activity participation, the binoculars segment is expected to maintain its market leadership in the coming years.

The riflescopes segment is the fastest-growing in the sports optics market during the forecast period (2024-2032), driven to factors such as rising participation in shooting sports, military applications, and hunting. Also you'll see optical advancements from precision reticles, night vision friendly progressive optics, AI unlockable ballistic calculators, enhancing accuracy and user experience. Defensive budgets and modernisation of law enforcement is also boosting the demand of high-performance riflescope. Moreover, growing competitive shooting sports and firearms training programs are also boosting the market growth. To endure to a variety of environments, manufacturers are focusing on lightweight, durable, and weather-resistant designs. The increased interest in long-range shooting and tactical usage is also driving innovation in terms of magnification and lens coatings. The rise of long-range shooting and tactical applications is further pushing innovation in magnification and lens coatings. Furthermore, regulatory support for hunting and the increasing number of firearm owners in regions like North America and Europe are expected to sustain demand. With continuous technological advancements, the riflescopes segment is poised for significant expansion.

By Games

The hunting and shooting segment dominated the sports optics market, accounting for approximately 55% of total revenue in 2023. This dominance is driven by the growing popularity of recreational hunting, competitive shooting sports, and firearm training programs worldwide. Advancements in riflescopes, red dot sights, and rangefinders are enhancing precision, accuracy, and target acquisition for hunters and shooters. Additionally, increasing firearm ownership in regions like North America and Europe, coupled with supportive hunting regulations, is fueling demand for high-performance optics. Military and law enforcement agencies also contribute to market expansion by adopting cutting-edge optical technologies for tactical applications. Manufacturers are focusing on lightweight, durable, and weather-resistant designs with improved magnification, night vision compatibility, and ballistic intelligence. The rise of long-range shooting and ethical hunting practices further drives innovation in optics. With continuous technological progress and strong consumer demand, the hunting and shooting segment is expected to maintain its market leadership.

The snow sports segment is the fastest-growing in the sports optics market from 2024 to 2032, driven by rising participation in skiing, snowboarding, and winter hiking. Increased demand for specialized goggles, helmets with integrated optics, and high-performance binoculars enhances visibility in extreme weather. Technological advancements, such as anti-fog coatings, polarized lenses, and augmented reality (AR) integration, are improving user experience. The expansion of winter tourism, particularly in North America and Europe, is further fueling growth. Additionally, the popularity of competitive winter sports, including the Winter Olympics and X Games, is boosting the adoption of advanced optical gear.

By Distribution Channel

The online segment dominated the largest revenue share in the sports optics market, accounting for approximately 69% in 2023. The popularity of e-commerce platforms in providing convenience, competitive pricing, and a greater variety of products has fueled this dominance. Consumers gain product details, customer reviews, leave virtual try-on technologies that improve confidence in purchasing. Big-name online retailers such as Amazon and OpticsPlanet and manufacturer-owned websites have widened their catalogs with special prices and speedy shipping options available. Digital marketing, influencer endorsements and targeted adverts have all boosted online sales even more. Additionally, the rise of direct-to-consumer (DTC) sales models allows brands to offer personalized recommendations and better customer service.

The offline segment is the fastest-growing in the sports optics market over the forecast period 2024-2032, driven by consumer preference for hands-on product evaluation before purchase. Retail stores, specialty optics shops, and sporting goods outlets provide customers with the ability to test binoculars, riflescopes, and rangefinders for clarity, magnification, and ergonomics. Expert guidance from in-store professionals enhances the buying experience, especially for high-end optics where precision and quality are crucial. Additionally, offline sales are rising popularity of hunting, birdwatching, and shooting sports, leading to increased foot traffic in brick-and-mortar stores. Many brands are also investing in experiential retail, offering product demonstrations and immersive brand experiences to attract buyers. While online sales dominate, offline channels continue to grow as they provide a tactile shopping experience that digital platforms cannot replicate, making them essential for premium and professional-grade optics purchases.

Sports Optic Market Regional Outlook:

North America dominated the sports optics market in 2023, accounting for approximately 50% of global revenue, driven by strong consumer demand and advanced technological innovations. The region benefits from a high participation rate in outdoor activities such as hunting, birdwatching, and shooting sports, which fuels the need for high-performance optical devices. The presence of leading manufacturers and continuous investments in R&D contribute to the development of superior optics with features like AI integration, image stabilization, and enhanced durability. Additionally, government initiatives promoting wildlife conservation and regulated hunting further support market growth. The growing involvement of women in outdoor sports and recreational shooting is also expanding the customer base, driving sales of user-friendly and ergonomically designed optics. With a strong retail network and increasing interest in premium sports optics, North America is expected to maintain its market dominance in the coming years.

Asia Pacific is the fastest-growing region in the sports optics market from 2024 to 2032, fueled by a surge in outdoor recreational pursuits, enhanced disposable income, and heightened enthusiasm for activities like hunting, birdwatching, and shooting sports. Technological developments, which lead to the growing penetration of e-commerce in various countries such as China, India, and Japan, have created a need for high-performance optical devices, which is also largely contributing to their demand. This further fuels the market growth to adventure tourism and wildlife conservation supported by government initiatives. In addition, domestic manufacturers invest in innovations and, therefore technologically advanced optics for the mass consumer. The regional growth is also aided to the rise in the application of sports optics in military applications. With rapid urbanization and growing awareness of outdoor activities, Asia Pacific is expected to sustain its strong growth momentum throughout the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Key Players in Sports Optic Market along with their product:

-

Nikon Corporation (Tokyo, Japan) – Binoculars, Riflescopes, Rangefinders

-

Carl-Zeiss Stiftung (Stuttgart, Germany) – Binoculars, Riflescopes, Spotting Scopes

-

Swarovski AG (Absam, Austria) – Binoculars, Spotting Scopes, Riflescopes

-

Celestron LLC (California, U.S.) – Binoculars, Spotting Scopes, Telescopes

-

MEOPTA-OPTIKA (S.R.O.) (Prerov, Czech Republic) – Binoculars, Riflescopes, Spotting Scopes

-

Barska (Pomona, U.S.) – Binoculars, Riflescopes, Spotting Scopes

-

GPO GmbH (Ammersee, Germany) – Binoculars, Riflescopes, Rangefinders

-

Fat Birder (Kent, U.K.) – Binoculars, Birding Optics

-

Leica Camera AG (Wetzlar, Germany) – Binoculars, Riflescopes, Rangefinders

-

The Vanguard Group Inc. (Pennsylvania, U.S.) – Binoculars, Tripods, Spotting Scopes

-

Safilo S.p.A. (Veneto, Italy) – Sports Eyewear, Sunglasses, Optical Frames

-

Vista Outdoor Operations LLC (Minnesota, U.S.) – Binoculars, Riflescopes, Rangefinders

List of Suppliers who provide raw material and component in Sports Optic Market:

-

Universal Optics

-

Ohara Corporation

-

Lytkarino Optical Glass Plant

-

Jenoptik AG

-

Inra Optics

-

Crescent Components and System

-

Nantong Diamonti Optical Components Co., Ltd.

-

Pujiang Wisebillion Crystal Gifts Co., Ltd.

-

Pujiang Yijia Crystal Craft Co., Ltd.

-

Pujiang Feiyi Crystal Craft Co., Ltd.

-

Yiwu Years Crafts Co., Ltd.

-

Pujiang Shining Crystal Crafts Co., Ltd.

-

Pujiang HBL Handicraft Co., Ltd.

-

Nantong Guoguang Photoelectric Technology Co., Ltd.

-

Haian Sea World Machinery Equipment Co., Ltd.

-

Lianyungang Dighen Composite Material Technology Co., Ltd.

Recent Development:

-

On October 9, 2024, Nikon introduced its new STABILIZED binocular series, featuring a compact design with an original image-stabilized system that reduces hand movement vibrations by approximately 80%, offering up to 12 hours of battery life for extended use.

-

On October 25, 2024, Zeiss and vivo highlighted their collaboration in advancing mobile photography, leveraging Zeiss' optical expertise to enhance vivo's smartphone camera technology for superior image quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.24 Billion |

| Market Size by 2032 | USD 3.01 Billion |

| CAGR | CAGR of 3.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Riflescopes, Rangefinders, Binoculars, Field Scopes) • By Games (Hunting & Shooting, Snow Sports, Water Sports, Golf, Others) • By Distribution Channel(Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nikon Corporation (Japan), Carl-Zeiss Stiftung (Germany), Swarovski AG (Austria), Celestron LLC (U.S.), MEOPTA-OPTIKA (Czech Republic), Barska (U.S.), GPO GmbH (Germany), Fat Birder (U.K.), Leica Camera AG (Germany), The Vanguard Group Inc. (U.S.), Safilo S.p.A. (Italy), Vista Outdoor Operations LLC (U.S.). |