Stadium Security Market Report Scope & Overview:

The Stadium Security Market was valued at USD 12.57 billion in 2025 and is expected to reach USD 26.45 billion by 2035, growing at a CAGR of 7.72% from 2026-2035.

The Stadium Security Market growth is driven by the high incidences of security threats, crowd related incidents, and terrorism on large public events. Growing investments in advanced surveillance systems, access control, and emergency response solution fueling the safety of stadiums. AI-based video analytics, integrated facial recognition and IoT-enabled monitoring are driving better real-time threat detection and incident response too. Moreover, growing sports events, concerts, and large gatherings globally are driving demand for strong security infrastructure.

-

The SAFETY Act Program of the U.S. Department of Homeland Security, which provides anti-terrorism security solutions via its Best Practices in Anti-Terrorism Security (BPATS I) and BPATS II, and offers critical security standards and quantitative benchmarks to assess anti-terrorism measures at venues.

-

Furthermore, more than 70% of sports organizations are targeted by cyberattacks annually, according to the Cybersecurity and Infrastructure Security Agency (CISA), creating increased demand for so-called holistic cyber and physical security solutions.

Stadium Security Market Size and Forecast

-

Market Size in 2025: USD 12.57 Billion

-

Market Size by 2035: USD 26.45 Billion

-

CAGR: 7.72% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Stadium Security Market - Request Free Sample Report

Stadium Security Market Trends

-

Rising need for safety and crowd management at sports and entertainment venues is driving the stadium security market.

-

Growing adoption of video surveillance, access control, and intrusion detection systems is boosting market growth.

-

Expansion of large-scale events, concerts, and international sports tournaments is fueling deployment.

-

Increasing focus on emergency response, threat detection, and perimeter security is shaping adoption trends.

-

Advancements in AI, facial recognition, and IoT-enabled security systems are enhancing monitoring and efficiency.

-

Rising concerns over terrorism, vandalism, and unauthorized access are supporting market expansion.

-

Collaborations between technology providers, stadium authorities, and security agencies are accelerating innovation and global adoption.

The U.S. Stadium Security Market was valued at USD 3.45 billion in 2025 and is expected to reach USD 7.07 billion by 2035, growing at a CAGR of 7.45% from 2026-2035.

Growth in the U.S. Stadium Security Market is fueled by rising security threats, stricter safety regulations, and increasing adoption of advanced surveillance, access control, and AI-driven monitoring systems to ensure public safety during major sports and entertainment events.

Stadium Security Market Drivers

-

Rising Frequency of Large-Scale Sporting and Entertainment Events Demanding Advanced Security Measures to Ensure Crowd Safety and Incident Prevention Globally

The increasing frequency of large-scale sporting events, concerts, and cultural gatherings will fuel demand for the stadium security infrastructure. Large crowds heighten potential dangers including crowd crushes and terrorism, increasing the demand for advanced technologies surveillance, facial recognition, and access control necessary. A lot of money is being spent by event organizers and government to ensure the safety and protect the venue reputation. Increased international security climate excited via main events, followed through implementation of incorporated safety solutions, is predicted to force the marketplace steadily as human protection and operational efficiency comprise highest essential task inside of government.

-

DHS SAFETY Act approval has been granted for 24/7 Software, Inc., for a technology platform developed to improve situational awareness and safety/security at sports and entertainment events.

-

As one of the largest sporting events in all of the U.S. Super Bowl LVIII approaches the Cybersecurity and Infrastructure Security Agency (CISA), NFL, Allegiant Stadium and federal/state partners conducted a cybersecurity tabletop exercise. In a series of controlled, harnessed, and simulated environments, over 100 stakeholders worked together to fortify event resilience against cyber threats.

Stadium Security Market Restraints

-

High Implementation and Maintenance Costs of Advanced Security Systems Limiting Adoption in Smaller Stadiums and Budget-Constrained Event Venues

These systems require substantial investment in surveillance, biometric access control and crowd management technology though. More modest venues, or those in emerging economies, may struggle to implement such cutting-edge solutions due to budget reasons. This adds to the financial burden on top of other ongoing costs such as software updates, maintenance of equipment and having a team with expertise. Such high costs have discouraged many, leaving most at the mercy of basic security measures. This financial obstacle results in a sluggish market expansion, particularly in areas with insufficient sports facilities and also places with unstable or undeveloped public-private security funding partnerships.

Stadium Security Market Opportunities

-

Growing Adoption Of AI, Iot, And Predictive Analytics in Stadium Security for Real-Time Threat Detection and Crowd Management Optimization

AI, IoT and predictive analytics have improved the safety of stadiums by practicing real-time detection of threats and crowd monitoring capacities. AI-video analytics identifies suspicious activities and crowd anomalies, IoT-sensors deliver environmental monitoring, and unauthorized access detection. Using past and current data, crowd prediction models can forecast crowd behaviour and aid in the efficient management of personnel and evacuation plans. While these technologies improve the efficiency of security operations and provide a more seamless fan experience with less intrusive screening, these have shown to be capital investments for stadium operators that look to improve the quality of their security system.

-

A recent study introduced EvacuNet, an AI-powered model using data on temperature, humidity, and CO₂ and VOC levels from over 62,000 sensors, was developed to detect fire hazards with 99.99% accuracy. It optimizes evacuation plans and then addresses crowding issues in emergencies.

Stadium Security Market Challenges

-

Balancing Robust Security Measures with Fan Convenience to Avoid Negative Impacts on Overall Stadium Experience and Event Attendance

Robust security measures, including extensive baggage inspections, biometric authorization, and multiple levels of access control, frequently result in slow entry queues and disruption for visitors. Although protecting the venue has to be of critical concern, too stringent an approach might simply drive fans away and cause attendance to become lacking in enthusiasm. It's a constant battle for stadium operators to strike the right balance between safety and keeping the flow of people moving freely. Clearly, contactless access, mobile ticket scanning and AI-powered enforcement can address a number of these challenges but only if properly managed in context without compromising security. This dilemma requires stakeholders to come up with new security protocols that ensure the freedom of movement for fans in an open environment.

Stadium Security Market Segmentation Analysis

By Technology

Surveillance systems held the largest share of about 44% in 2025 owing to their vital role in real-time monitoring, threat detection, and incident documentation in stadiums. High-resolution cameras, AI-based analytics to identify crowded, chaotic, and individual inappropriate activity, and advanced video management systems to provide wide surveillance coverage while deterring malicious activity, make them a first choice for venue operators willing to boost safety, comply with regulations, and keep venues on-site operational at scale during events.

Access control systems are projected to grow at the fastest CAGR of 9.90% over 2026–2035, due to the increasing adoption of biometric authentication, RFID based ticketing and mobile entry solutions. By simplifying entry procedures, lowering unwarranted access, and promoting crowd movement, these technologies have the potential to radically change visitor experience without compromising security. A shift toward contactless, speedy, and data-driven approach toward entry management for safety and convenience is even further propelling their adoption across the stadiums.

By Application

Event security dominated with a 40% share in 2025 driven by the growing need for complete security at live sports, concerts, and tournaments. Trained personnel, a screening system, and incident response teams enable things to run smoothly during events. Event-centric security services driven by high profile gatherings creating the need to safeguard athletes, performers, and audiences make this segment among core operational to stadium operators globally.

Crowd management is expected to register the fastest CAGR of 9.02% over 2026–2035 primarily driven by increasing organization of large-scale events along with enhancing safety compliance standards. With the help of advanced crowd analytics, AI-based prediction models, and real-time monitoring, stampede prevention, seating flow optimization, and emergency evacuations can be best managed. This ensures securing safe and efficient operations while also improving the visitor experience; a significant interest and investment in crowd management solutions.

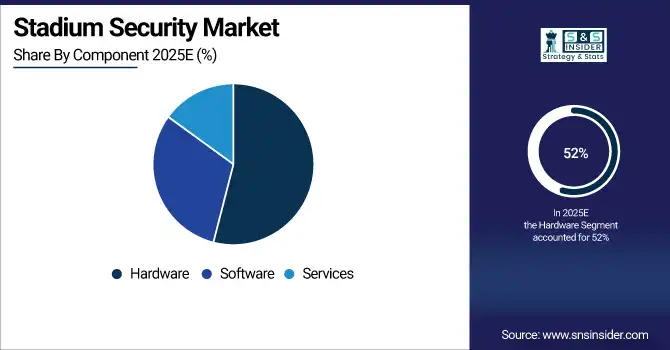

By Component

Hardware dominated the stadium security market share in 2025 of a 52%, as surveillance cameras, metal detectors, scanners, biometric devices, and other hardware elements are the first line of defense against a myriad of threats. This physical hardware, in turn, is the foundation of security infrastructure, providing tangible deterrents and monitoring. Hardware is expected to remain the highest revenue generating segment within the market due to continuous technology upgrades and the need for safety installations.

Software is set to grow at the fastest CAGR of 9.51% over 2026–2035, due to AI-based analytics, facial recognition, & incident management platforms. They facilitate the centralized nature of control, enable automated detection of threat, provide actionable insights which enables fast response. However, with the increasing frameworks being implemented at the smart stadium with integrated smart and integrated security, the software-based world between assisting decision, compliance, and operational efficiency has now become necessity rather than luxury, fueling a strong growth.

By End-User

Sports stadiums accounted for 59% of revenue in 2025 due to hosting frequent high-capacity events such as football, cricket, and rugby games which require substantial security. Due to the requirement to provide security for large crowds, high-profile athletes, and abide by international security protocols, sports stadiums have continued to invest in advanced surveillance, access control, and emergency security in which sports stadiums are still the highest demand for sophisticated security globally.

Concert venues are expected to grow at the fastest CAGR of 9.32% over 2026–2035, owing to the surge in demand for large-scale live performances and music festivals. Such events need flexible security systems that can respond to a different crowd behaviour and hung in the various layout. Support efforts with advanced monitoring, mobile access systems and real-time crowd analytics ensure safety, keeping the attendee experience compromise-free, thus making concert venue security investments all the more necessary from operators and organizers standpoint.

By Sales Channel

Direct sales captured 53% of the market in 2025 as stadium operators prefer to deal directly finding value through tailored installations and service agreements from security solution providers. This allows for tailored systems, improved post-sales service, and seamless communication in case of upgrades or a crisis. Direct sales further enable the integration of niche technologies, providing stadiums some assurance of system robustness and long-term operational viability, thereby keeping direct sales firmly atop the stadium purchase ecosystem.

Channel partners are projected to grow at the fastest CAGR of 8.63% over 2026–2035 as they provide extensive Distribution networks, localized service support, and competitive pricing. They help bring security solutions to mid-tier and smaller stadiums in emerging markets. Collaboration with system integrators, resellers, and consultants further enriches the customization and scalability of the solution, which continues to trigger venues to adopt these systems on an economical yet uncompromising security system.

Stadium Security Market Regional Outlook

North America Stadium Security Market Insights

North America held the largest share of about 39% in 2025, owing to its existing sports infrastructure, regular large-scale events, and stringent security regulations. Market dominance is largely due to high adoption of advanced technologies such as AI surveillance and biometric access control along with integrated surveillance systems. The strong presence of large investments by stadium operators, and the high level of collaboration among defense forces and public-private agencies boosts stadium security market dominance in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. is dominating the stadium security market in North America, driven by active participation at the state level in sports, the presence of sport infrastructure on a grand scale, and a lot of money being invested into new and advanced safety technologies.

Asia Pacific Stadium Security Market Insights

Asia Pacific is projected to grow at the fastest CAGR of 9.53% over 2026–2035, owing to rapid urbanization, growing popularity of sporting events, and an expanding entertainment industry. There is a major investment by both governments and the private sector in stadium infrastructure; the new stadiums come with advanced security technology. The growing consciousness toward safety compliance along with adoption of AI-powered surveillance systems and access management systems render the region as a prominent growth engine for stadium security solutions.

China is dominating the stadium security market in Asia Pacific, driven by massive sports infrastructure investments and rapid adoption of advanced surveillance and access control technologies.

Europe Stadium Security Market Insights

Europe holds a significant position in the stadium security market, Due to large number of international sporting events, strict safety codes & regulations and rapid technology penetration in the region. The UK, Germany and France are big investors in surveillance, access control and crowd management solutions

The U.K. is dominating the stadium security market in Europe, due to advanced infrastructure, regular occurrence of major events and a high adoption of modern safety technologies.

Middle East & Africa and Latin America Stadium Security Market Insights

The stadium security market trends in Middle East & Africa are on the rise owing to investments for modern sports venues, especially for mega-events. Latin America, on the other hand, is playing catch-up with upgrades to football stadiums as safety concerns rise and advanced surveillance and crowd control systems become more commonplace.

Stadium Security Market Competitive Landscape:

Avigilon Corporation

Avigilon, a Motorola Solutions company, specializes in AI-driven video surveillance, security analytics, and access control systems. Its solutions integrate advanced AI and computer vision to provide intelligent monitoring, automated alerts, and improved situational awareness. Avigilon serves enterprise, government, and public venues, delivering scalable security solutions for stadiums, campuses, and critical infrastructure. The company emphasizes operational efficiency, crowd safety, and loss prevention while enabling real-time threat detection, centralized management, and enhanced decision-making across video and access control systems.

-

2025: Avigilon’s AI-driven cameras and analytics at Vodafone Park enhanced coverage, minimized illegal entries, and improved spectator and staff safety through intelligent monitoring and real-time video alerts.

-

2024: Ullevaal Stadion deployed Avigilon Unity video and AI analytics, boosting real-time threat detection, crowd safety management, and integration within the stadium’s security ecosystem.

Genetec Inc.

Genetec develops unified security platforms integrating video surveillance, access control, license plate recognition, and analytics. Its Security Center platform centralizes security operations, offering hybrid-cloud deployment, AI-driven insights, and streamlined incident response. Serving stadiums, transportation, and enterprise facilities, Genetec improves safety, operational efficiency, and situational awareness. Its solutions enable real-time monitoring, predictive threat detection, and efficient collaboration across teams. Genetec emphasizes innovation in physical security, digital surveillance, and hybrid-cloud integration to meet modern venue security requirements.

-

2024: Eden Park deployed Genetec Security Center platform to improve crowd monitoring, vehicle tracking, and centralized incident response, strengthening stadium security management and operational efficiency.

Honeywell International Inc.

Honeywell is a global technology and manufacturing leader offering building automation, industrial safety, and security solutions. Its intelligent automation and AI-driven technologies enhance operational efficiency, safety, and security for enterprises, stadiums, and public venues. Honeywell provides scalable solutions including building management, access control, video surveillance, and smart facility integration. Its innovations emphasize predictive analytics, safety compliance, and automation, supporting seamless operations for high-traffic facilities while improving crowd safety, energy management, and real-time threat detection in complex environments.

-

2025: Honeywell partnered with Charlotte Hornets to integrate AI-driven automation and security enhancements at Spectrum Center and new training facilities, improving operational efficiency and safety.

-

2024: As Official Sustainable Building Technology Partner for State Farm Arena, Honeywell hosted an innovation challenge, featuring safety and security concepts developed for stadium operations.

Key Players

Some of the Stadium Security Market Companies

-

AxxonSoft

-

BOSCH Security Systems

-

Genetec Inc.

-

Dallmeier

-

Honeywell International Inc.

-

NEC Corporation

-

Rapiscan Systems

-

Cisco Systems Inc.

-

Intel Corporation

-

IBM

-

Johnson Controls International plc

-

Axis Communications AB

-

Siemens AG

-

GP Smart Stadium

-

L3Harris Technologies Inc.

-

FLIR Systems Inc.

-

Verint Systems Inc.

-

Pelco

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 12.57 Billion |

| Market Size by 2035 | USD 26.45 Billion |

| CAGR | CAGR of 7.72% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Technology (Surveillance Systems, Access Control Systems, Emergency and Disaster Management, Cybersecurity, Others) • By Application (Event Security, Parking Security, Crowd Management, Others) • By End-User (Sports Stadiums, Concert Venues, Others) • By Sales Channel (Channel Partners, Direct Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Avigilon Corporation, AxxonSoft, BOSCH Security Systems, Genetec Inc., Dallmeier, Honeywell International Inc., NEC Corporation, Rapiscan Systems, Cisco Systems Inc., Intel Corporation, IBM, Johnson Controls International plc, Axis Communications AB, Siemens AG, GP Smart Stadium, L3Harris Technologies Inc., FLIR Systems Inc., Verint Systems Inc., Smiths Detection Inc., Pelco |