Security Automation Market Report Scope & Overview:

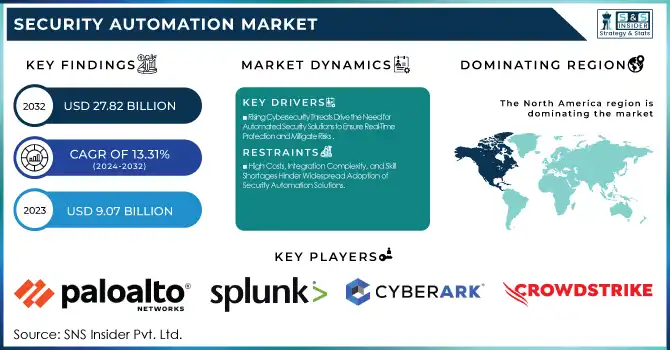

The Security Automation Market was valued at USD 9.07 billion in 2023 and is expected to reach USD 27.82 billion by 2032, growing at a CAGR of 13.31% from 2024-2032. This report includes key insights into the adoption rates of emerging technologies, highlighting the increasing integration of AI and machine learning in security systems. It also examines user satisfaction and ROI, showing a positive impact on operational efficiency. Additionally, the report covers advancements in threat detection accuracy and a notable growth in investment, driven by the rising need for advanced, automated security solutions in various sectors.

To Get more information on Security Automation Market - Request Free Sample Report

Security Automation Market Dynamics

Drivers

-

Rising Cybersecurity Threats Drive the Need for Automated Security Solutions to Ensure Real-Time Protection and Mitigate Risks

The increasing prevalence and sophistication of cyberattacks like ransomware, data breaches, and advanced persistent threats have rendered an urgent demand for automated security systems. As the nature of cyber threats increases in sophistication, organizations need timely detection and response to cyber threats in order to minimize risks effectively. Automated security systems are the key to promptly identifying vulnerabilities and taking care of security incidents prior to their progression. In addition, the ever-changing nature of cybercrime strategies requires an active, technology-oriented approach to cybersecurity. Security automation offers the velocity and precision required to address these issues, presenting organizations with a streamlined way to safeguard their infrastructure and confidential information from increasingly sophisticated threats.

Restraints

-

High Costs, Integration Complexity, and Skill Shortages Hinder Widespread Adoption of Security Automation Solutions

The high initial costs of initial deployment of security automation products such as setting up infrastructure and software is a major challenge, especially for small and medium enterprises with tight budgets. Also, the complexity involved in integrating these products with the legacy systems in place can result in longer deployment periods and higher operational expenses. In addition, privacy concerns regarding data, particularly in heavily regulated sectors, can keep organizations from leveraging automation in security functions to their full potential. Though automation lessens the demand for human intervention, a lack of qualified cybersecurity experts who can handle these systems can also become a hindrance. Finally, companies can have vendor dependency risks, which constrain flexibility and customizability of the automation technology.

Opportunities

-

AI Integration, Cloud Security, and SME Adoption Fuel Growth in the Security Automation Market

The integration of AI and machine learning in security automation solutions holds great promise in terms of enhanced threat detection, predictive analytics, and swift response to new cyber threats. Such technologies help systems to dynamically change to new patterns of attack without human intervention, strengthening security overall. Besides this, the increased adoption of cloud infrastructure in every sector is the largest opportunity that the market presents, as enterprises are looking for automated solutions that will protect their cloud infrastructure. Heightened consciousness regarding cybersecurity threats and regulatory compliances also create drivers for market growth, forcing enterprises to deploy automated security technologies. As security automation gets more economical and widespread, small and medium businesses are embracing these solutions too to safeguard their digital properties, further fueling the market.

Challenges

-

Complex Implementation, Over-reliance on Automation, and Skill Gaps Pose Challenges for Security Automation Adoption

Implementing security automation solutions requires considerable time, effort, and skills, especially when mapping them into existing legacy systems. This complexity may lead to late deployments and increased expense, causing difficulties for organizations, particularly smaller entities, to integrate these solutions to their full extent. Also, the inability of some tools to be customized might restrict their efficacy in managing distinctive security requirements. Another issue is the dependency on automated systems, which might lower human monitoring and create holes in threat identification, particularly against sophisticated attacks. Regular monitoring and timely updates must also be carried out to keep the systems in place since new threats constantly arise. Furthermore, there is a continued need for qualified professionals to control and streamline these automated solutions, making the operations more expensive.

Security Automation Market Segment Analysis

By Component

The Solution segment dominated the Security Automation Market in 2023, with a revenue share of nearly 65%. The reason behind this is the growing demand for automated security solutions, which enable real-time threat identification, response, and better protection for organizations. With increased cyber threats and the requirement for compliancy, companies are investing heavily in strong security automation solutions. Such systems provide scalability, integration with current infrastructures, and improved efficiency in the administration of complex security environments, hence their popularity.

The Services segment is anticipated to grow at the fastest CAGR of approximately 14.33% during 2024-2032 owing to the increasing demand for specialized support in deploying, managing, and optimizing security automation solutions. With more organizations embracing automation tools, there is a greater need for consulting, integration, training, and managed services. These services enable companies to successfully deploy and maintain their automated security systems and continuously adapt to changing threats and compliance needs.

By Deployment Mode

The Cloud segment led the Security Automation Market in 2023 with approximately 63% of the revenue share. This is because cloud-based solutions are increasingly being adopted, owing to their flexibility, scalability, and affordability. Cloud environments are being used more by organizations, and hence automated security solutions are needed to secure sensitive data and applications. Ease in deploying security automation quickly at scale, along with easy integration into other cloud products, is its biggest attraction to businesses.

The On-Premise segment shall grow at the fastest CAGR of approximately 14.46% during the forecast period from 2024-2032 because of mounting demand for controlling security infrastructure. Most organizations, particularly in sectors with stringent regulatory requirements, tend to use on-premise models for better data privacy, security, and specific regulation compliance. Furthermore, enterprises looking to extend automation to old systems find it more convenient using on-premise deployments, hence driving market expansion in this category.

By Industry Vertical

The BFSI segment controlled the Security Automation Market in 2023, having the maximum revenue share of nearly 28%. This is motivated by the mounting requirement of the financial sector to secure the personal information of clients, follow the regulations and controls, and ensure they avoid attacks from cyberspace in the form of fraud and data breach. The BFSI industry is exposed to regular and advanced cyberattacks, which has led organizations to invest heavily in automated security solutions to provide real-time threat detection and compliance management.

The Healthcare segment is anticipated to expand at the highest CAGR of approximately 15.11% during 2024-2032, mainly because of the increasing need for protecting patient information and healthcare systems. With the growing digitization of healthcare, such as the use of electronic health records and IoT devices, the demand for automated security to safeguard sensitive health information from cyberattacks is also expanding at a fast pace. Moreover, demanding healthcare regulations, like HIPAA, are compelling organizations to spend money on cutting-edge security automation tools.

By Technology

AI and ML segment dominated the Security Automation Market in 2023 with the highest revenue share of around 39%. This dominance is fueled by the growing use of AI and machine learning technologies to improve threat detection and response functions. AI and ML allow automated systems to process large volumes of data, recognize patterns, and forecast possible threats, enabling quicker and more precise responses. Their capacity to evolve with changing cyber threats makes them indispensable in contemporary security automation solutions.

The User & Entity Behavior Analytics segment will register the highest CAGR of approximately 15.74% from 2024-2032, driven by its increasing role in identifying insider threats and abnormal user behavior. UEBA products use advanced analytics to create baselines for normal user activity and detect deviations that could indicate malicious intent. As businesses demand more advanced security solutions, UEBA products are gaining traction to improve threat detection and avert security breaches.

By Application

The Endpoint Security segment led the Security Automation Market in 2023 with the largest revenue share of approximately 31%. This is due to the growing number of endpoint devices like laptops, smartphones, and IoT devices that are susceptible to cyberattacks. Organizations are spending a lot on endpoint security solutions to make sure that all devices connected to their network are adequately secured. Automatic endpoint security solutions provide real-time detection of threats and rapid response to possible security threats, making them a vital part of contemporary cybersecurity measures.

The Incident Response Management segment is anticipated to grow at the fastest CAGR of approximately 15.51% during 2024-2032 owing to the increasing requirement for organizations to rapidly identify and respond to security incidents. As cyberattacks become increasingly sophisticated, companies are investing in automated incident response systems to minimize response time and loss. Automated tools facilitate streamlined investigation, containment, and recovery processes, allowing quicker and more efficient handling of security incidents.

Regional Analysis

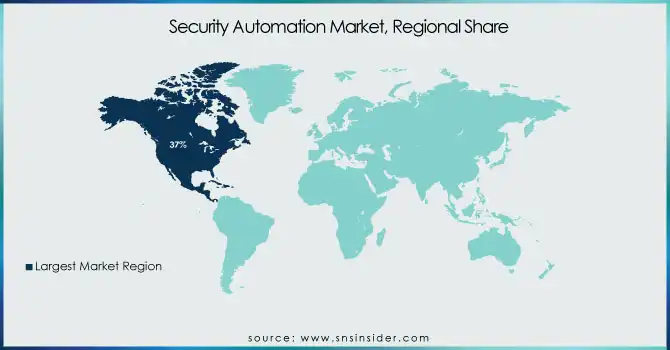

North America led the Security Automation Market in 2023 with the largest revenue share of approximately 37%. This is mainly attributed to the developed technological infrastructure, strong adoption of digital transformation, and well-established cybersecurity ecosystem within the region. Increasing frequency and sophistication of cyberattacks, coupled with stringent regulatory frameworks, have made businesses and government agencies in North America invest significantly in automated security solutions. Moreover, the availability of major players and robust R&D investments are responsible for the market dominance.

Asia Pacific is expected grow at the fastest CAGR of approximately 15.96% during 2024-2032, fueled by fast digitalization, rising internet penetration, and expanding awareness of cybersecurity threats in the region. The increasing usage of cloud computing, IoT, and intelligent technologies across industries such as manufacturing, healthcare, and finance is fueling the demand for security automation solutions. In addition, growing cyberattacks and regulatory compliances in emerging economies are driving the demand for advanced security automation technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Palo Alto Networks (Cortex XSOAR, Prisma Cloud)

-

Splunk (Splunk Phantom, Splunk Enterprise Security)

-

CyberArk (CyberArk Privileged Access Security, CyberArk Endpoint Privilege Manager)

-

Check Point (Check Point Security Management, Check Point Threat Prevention)

-

CrowdStrike (Falcon Platform, Falcon X)

-

Red Hat (Ansible Automation Platform, OpenShift)

-

Cisco (Cisco SecureX, Cisco Umbrella)

-

Carbon Black (VMware Carbon Black Cloud, Carbon Black Response)

-

Trellix (Trellix XDR, Trellix Endpoint Security)

-

IBM (IBM Security QRadar, IBM Resilient)

-

Secureworks (Secureworks Taegis XDR, Secureworks Managed Security Services)

-

Tenable (Tenable.io, Tenable.sc)

-

Microsoft (Microsoft Sentinel, Microsoft Defender)

-

Swimlane (Swimlane Orchestration, Swimlane Incident Response)

-

Tufin (Tufin Orchestration Suite, Tufin SecureTrack)

-

Sumo Logic (Sumo Logic Cloud SIEM, Sumo Logic Cloud SOAR)

-

Google (Chronicle Security, Google Cloud Security Command Center)

-

LogRhythm (LogRhythm SIEM, LogRhythm NDR)

-

Exabeam (Exabeam Fusion, Exabeam Advanced Analytics)

-

ManageEngine (Log360, OpManager)

-

Fortinet (FortiSIEM, FortiAnalyzer)

-

Devo Technology (Devo Security Operations, Devo Data Analytics)

-

D3 Security (D3 SOAR, D3 Incident Management)

-

Logsign (Logsign SIEM, Logsign SOC Platform)

-

Vulcan Cyber (Vulcan Risk, Vulcan Vulnerability Management)

Recent Developments:

-

In August 2024, IBM introduced a generative AI-powered Cybersecurity Assistant to enhance its Threat Detection and Response Services, aiming to accelerate threat investigations and provide actionable insights for security analysts.

-

In June 2024, Cisco unveiled its Security Cloud vision, introducing AI-driven solutions to transform enterprise defenses with unified management and security, including the launch of Security Cloud Control for optimized configurations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.07 Billion |

| Market Size by 2032 | USD 27.82 Billion |

| CAGR | CAGR of 13.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment Mode (Cloud, On-Premise) • By Technology (AI and ML, Predictive Analytics, Robotic Process Automation (RPA), User & Entity Behavior Analytics (UEBA)) • By Application (Network Security, Endpoint Security, Incident Response Management, Vulnerability Management, Other) • By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Palo Alto Networks, Splunk, CyberArk, Check Point, CrowdStrike, Red Hat, Cisco, Carbon Black, Trellix, IBM, Secureworks, Tenable, Microsoft, Swimlane, Tufin, Sumo Logic, Google, LogRhythm, Exabeam, ManageEngine, Fortinet, Devo Technology, D3 Security, Logsign, Vulcan Cyber |