Thin Wall Plastic Container Market Report Scope & Overview:

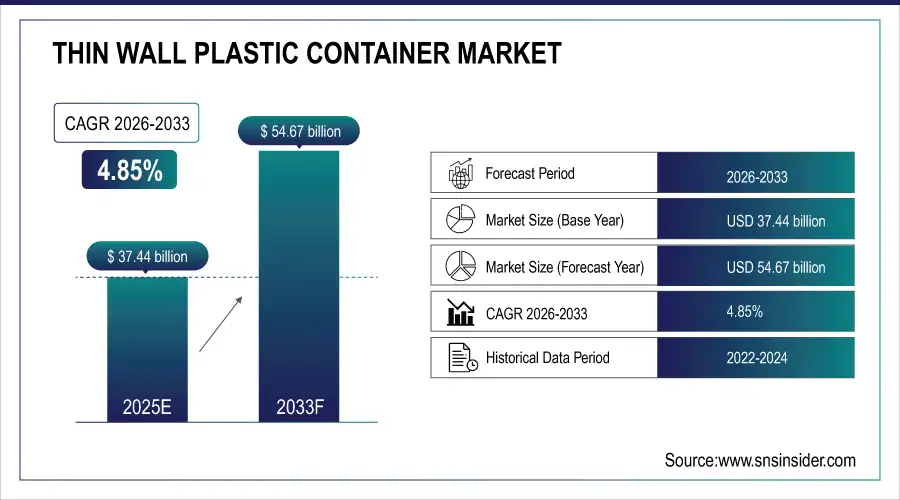

The Thin Wall Plastic Container Market size was valued at USD 37.44 Billion in 2025 and is expected to reach USD 54.67 Billion by 2033, growing at a CAGR of 4.85% over the forecast period 2026–2033.

The market is witnessing accelerating adoption across food, beverage, and household goods industries, driven by growing demand for lightweight, recyclable, and cost-efficient packaging. Superior strength-to-weight ratio, barrier properties, and compatibility with automated filling lines make thin wall containers increasingly vital. Rising sustainability targets, evolving consumer lifestyles, and supply chain efficiencies are fueling ongoing product innovation among key players worldwide.

The Thin Wall Plastic Container Market is expanding rapidly, underpinned by surging demand for high-convenience and sustainable packaging solutions. Improvements in material technology, lightweight design, and recyclability are enabling widespread use in dairy, ready meals, bakery, and personal care. Thin wall containers support shelf-life extension, reduced logistics cost, and environmental compliance, positioning them as a top choice for brands targeting cost and eco-efficiency. Robust growth is driven by online delivery, regulatory mandates, and preference for single-use hygienic formats.

Thin Wall Plastic Container Market Size and Forecast

-

Market Size in 2025: USD 37.44 Billion

-

Market Size by 2033: USD 54.67 Billion

-

CAGR: 4.85% (2026–2033)

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Thin Wall Plastic Container Market - Request Free Sample Report

Key Thin Wall Plastic Container Market Trends

-

Rising consumer preference for lightweight, eco-friendly packaging is boosting demand for thin wall containers.

-

Strong expansion of ready-to-eat meal and quick-service food segments fuels high-convenience packaging innovation.

-

Increased use of polypropylene and polyethylene, driven by recyclability and cost advantage, boosts application scope.

-

Regulatory pressure and corporate ESG targets drive adoption of recyclable and biodegradable container formats.

-

Advances in high-speed injection molding and thermoforming technologies improve precision and cost structure.

-

The surge in online food delivery and e-grocery accelerates need for tamper-proof, leak-proof thin wall packaging.

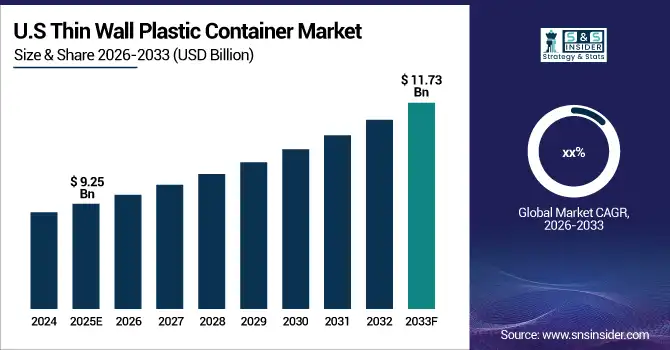

U.S. Thin Wall Plastic Container Market Insights

The U.S. Thin Wall Plastic Container Market size was USD 9.25 Billion in 2025E and is expected to reach USD 11.73 Billion by 2033. According to a study, rising prevalence of single-person households and on-the-go meal preferences have led to an approximate 35% increase in demand for thin wall food containers. This cause, growing consumer demand for portability and hygiene, effects widespread use in dairy, snacks, and ready meals. Thin wall containers are helping brands address fresh-food preservation, cost controls, and sustainability goals in the U.S., driving strong market acceleration.

Thin Wall Plastic Container Market Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Thin Wall Plastic Container Market Growth

Increasing environmental awareness among consumers has prompted brands to seek lightweight, recyclable packaging with a lower environmental footprint. This cause, heightened regulatory pressure and ESG targets in the food and household goods industries, effects rapid development and market acceptance of thin wall plastic containers. These solutions offer material savings, lower greenhouse gas emissions, and better recyclability, supporting both corporate sustainability and consumer preferences. Companies are redesigning their packaging architectures, introducing thinner walls and recycled-content polymers, to align with global “reduce and reuse” trends.

For example, a major U.S. yogurt manufacturer adopted thin wall containers in March 2025, cutting virgin plastic use by 32% per product while maintaining strength and shelf-life.

Thin Wall Plastic Container Market Restraints:

-

Recycling Infrastructure Gaps and Single-Use Plastic Perception Limit Full Market Potential

Despite efficiency benefits, thin wall plastic containers face headwinds from gaps in local recycling systems and consumer concerns about single-use plastics. This cause, widespread inability to process lightweight packaging in municipal recycling programs, effects limited end-of-life recovery rates for thin wall containers. Additionally, public campaigns against plastic waste have increased scrutiny on single-use formats, prompting regulatory pushes for alternative materials. As a result, brands may hesitate to fully transition portfolios to plastic, instead piloting biodegradable or refillable formats until systems improve.

For instance, in 2024, certain U.S. cities temporarily restricted collection of thin wall plastic containers due to contamination and processing cost concerns, slowing adoption among regional food processors.

Thin Wall Plastic Container Market Opportunities:

-

Emergence of Bio-Based and Compostable Thin Wall Packaging Expands Growth Prospects

The industry is witnessing a shift toward biodegradable, compostable, and plant-based polymer solutions for thin wall containers. This cause, intensified consumer and government demand for products with lower environmental impact, effects accelerated R&D in renewable plastics like PLA and PHA. These next-generation containers support “zero-waste” goals by enabling commercial composting or easier recycling, unlocking new opportunities in premium food and personal care segments. Partnerships between packaging innovators and food brands are expanding, with quick market adoption projected in regions with active circular economy regulations.

In June 2025, a global food brand launched a range of ready-meal products in compostable thin wall containers, reducing landfill waste by up to 40% during its pilot phase.

Thin Wall Plastic Container Market Segmentation Analysis:

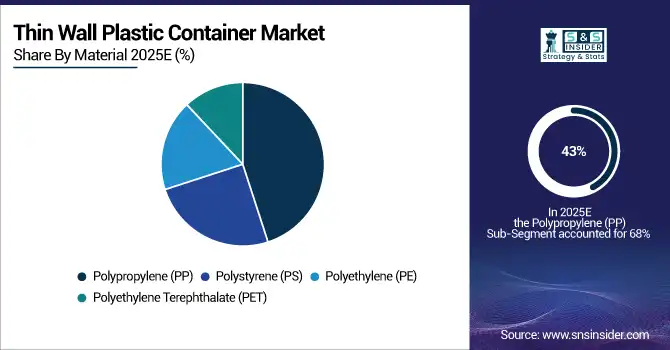

By Material, Polypropylene (PP) Leads While Polyethylene (PE) Registers Fastest Growth

The Polypropylene segment leads with 43% of revenue, thanks to its superior balance of strength, flexibility, and recyclability. This cause, cost-effective performance and microwave-safe properties, effects strong preference for PP among food, dairy, and prepared meal brands. Ongoing R&D into high-clarity, multilayer PP containers further solidifies its role in thin wall packaging.

Polyethylene (PE) is growing at the highest CAGR of 8.56%, pushed by increasing use in frozen foods and personal care products. This cause, demand for flexible, lightweight, and chemical-resistant containers, effects a shift towards innovative PE-based formats with improved barrier performance and recycling compatibility.

By Product, Cups Dominate While Bowls Register Fastest Growth

The Cups segment holds the largest revenue share at 34% in 2025E, led by broad deployment in dairy, beverage, and grab-and-go snack markets. This cause, evolving eating habits and rising demand for portion-controlled packaging, effects consistent innovation in stackability, barrier coating, and recyclability. Manufacturers continuously enhance cup durability and functionality to meet food safety and branding requirements, securing dominance across retail and food service channels.

The Bowls segment is growing at the fastest CAGR of 10.25%, benefiting from a surge in demand for ready-to-eat meal and salad packaging. This cause, urban lifestyles and meal delivery trends, effects rapid innovation in leak-proof, microwave-ready, and transparent bowl designs. Enhanced printability and custom shapes are driving adoption in premium and health-focused food sectors.

By Manufacturing Technology, Injection Molded Technology Dominates While Thermoformed Segment Grows Fastest

Injection Molded Technology dominates with a 42% share in 2025E due to its unmatched precision and production speed. This cause, the need for thin, uniform, and robust containers at scale, effects widespread use in mass-market food packaging. Enhanced automation and efficient tooling reduce per-unit cost and time-to-market for container manufacturers.

The Thermoformed segment is growing fastest, leveraging lower tooling costs and strong design flexibility to serve small-to-medium production runs. This cause, increasing customization and rapid prototyping needs among specialty food brands, effects higher adoption of thermoforming for limited-edition or seasonal packaging formats.

By Application, Dairy Products Dominate While Ready-to-Eat Meals Register Fastest Growth

Dairy Products account for 22% of market share in 2025E, reflecting persistent demand for multi-serve and single-portion yogurt, cheese, and cream containers. This cause, health and convenience-driven dairy consumption, effects consistent innovation in barrier technologies and resealable designs, securing thin wall containers’ leading role in the sector.

Ready-to-eat Meals are growing at the fastest CAGR, driven by busy lifestyles and urbanization. This cause, consumer appetite for microwaveable, hygienic, and shelf-stable prepared meals, effects robust growth in thin wall packaging featuring advanced sealing and tamper-evidence properties for the fast-moving food market.

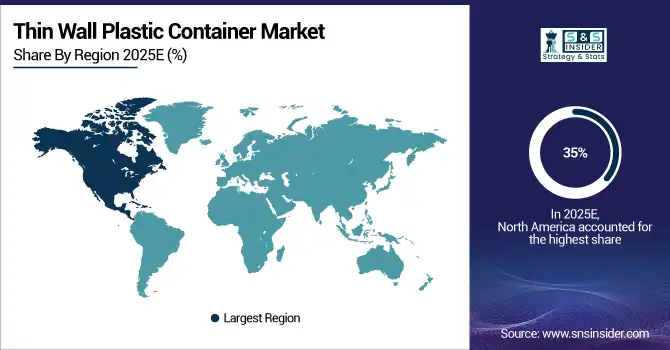

Thin Wall Plastic Container Market Regional Analysis:

North America Dominates Thin Wall Plastic Container Market in 2025E

North America holds an estimated 35% market share in 2025E, driven by broad consumption of packaged groceries, quick-service restaurant (QSR) meals, and advanced logistics infrastructure. This causes sustained demand for thin wall containers, with recyclability and lightweighting serving as key priorities for both brands and regulators. Robust recycling initiatives, technological innovation, and sustainability-driven investments underpin the region’s leadership in thin wall container adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

United States Leads North America’s Thin Wall Plastic Container Market

The U.S. dominates North America due to its advanced packaging sector, strong regulatory emphasis on recycling, and extensive food processing industry. Continuous investment in sustainable materials, automation, and efficiency-enhancing logistics further strengthen its role. The U.S. is also a hub for innovation, where manufacturers leverage both bio-based resins and next-generation lightweighting to meet consumer and regulatory demands.

Asia Pacific is the Fastest-Growing Region in Thin Wall Plastic Container Market in 2025E

Asia Pacific is projected to grow at a CAGR of 8.58% in 2025, driven by rapid urbanization, expanding middle-class consumption, and booming demand for packaged food products. This causes thin wall container adoption to accelerate, particularly in ready-to-eat meals, dairy, and beverages, supported by rising investments in recycling and material technology.

-

China Leads Asia Pacific’s Thin Wall Plastic Container Market

China dominates the regional market due to its vast food processing base, stringent government packaging regulations, and strong demand for convenience-driven food options. Aggressive innovation in plastics recycling, automation, and bio-based material development positions China as a bellwether for thin wall packaging in Asia Pacific.

Europe Thin Wall Plastic Container Market Insights, 2024

Europe maintains a strong position, driven by strict EU directives on single-use plastics and recycling compliance. This causes accelerated adoption of recyclable thin wall packaging across food and beverage applications. Investments in eco-friendly material transitions and sustainable labeling further enhance market growth.

-

Germany Leads Europe’s Thin Wall Plastic Container Market

Germany leads due to its advanced recycling infrastructure, rigorous regulatory frameworks, and strong innovation ecosystem in sustainable packaging. High demand for premium eco-labeled products makes Germany a leader in adopting thin wall containers that balance performance with sustainability.

Middle East & Africa and Latin America Thin Wall Plastic Container Market Insights, 2024

The Thin Wall Plastic Container Market in these regions is expanding steadily, supported by demand for heat- and humidity-resistant packaging in dairy, prepared meals, and beverages. This causes increased reliance on thin wall containers for both affordability and durability.

-

Brazil and UAE Drive Regional Growth

Brazil anchors Latin America’s market with its large-scale food processing and packaging industries, while the UAE leads in the Middle East with strong green policies and rapid adoption of sustainable packaging in hospitality and foodservice. Both regions demonstrate rising demand for recyclable and climate-adaptive thin wall packaging solutions.

Competitive Landscape for the Thin Wall Plastic Container Market:

Amcor

Amcor is a global leader in packaging solutions, specializing in rigid and flexible packaging for food, beverage, healthcare, and personal care industries. In the thin wall plastic container market, Amcor plays a key role by offering lightweight, recyclable, and sustainable container solutions that meet evolving consumer and regulatory demands. The company integrates advanced manufacturing technologies to deliver innovative designs, reduced material usage, and enhanced shelf appeal.

-

In 2025, Amcor expanded its thin wall portfolio with recyclable polypropylene containers tailored for ready-to-eat meals and dairy products, addressing sustainability and convenience trends.

Berry Global Inc.

Berry Global Inc. is a U.S.-based manufacturer of plastic packaging and engineered materials with a strong presence in thin wall plastic containers. The company serves foodservice, personal care, and household sectors with durable, lightweight, and customizable container solutions. Berry leverages innovation in barrier technologies and sustainable materials, enabling clients to extend product shelf life while reducing environmental impact.

-

In 2025, Berry introduced a new series of thin wall containers made with 50% post-consumer recycled content, aligning with global sustainability commitments and consumer eco-preferences.

RPC Group Plc

RPC Group Plc, now part of Berry Global, is renowned for its expertise in plastic packaging, particularly in injection-molded thin wall containers. The company serves food, healthcare, and industrial clients with solutions that emphasize functionality, cost efficiency, and brand differentiation. RPC’s innovative use of lightweight plastics and sustainable designs strengthens its competitive position in the global thin wall market.

-

In 2025, RPC launched a range of microwave-safe thin wall containers with improved sealing technology, targeting the growing convenience food and ready-meal segment.

Greiner Packaging International

Greiner Packaging International, headquartered in Austria, is a leading supplier of thin wall plastic containers for the food and dairy industry. The company emphasizes sustainable packaging, investing heavily in circular economy practices and eco-friendly material innovations. Its thin wall products are widely adopted across Europe due to their high performance, lightweight structure, and recyclability.

-

In 2025, Greiner expanded its product line with bio-based thin wall containers, catering to increasing demand for renewable packaging solutions and regulatory compliance in the EU market.

Thin Wall Plastic Container Market Key Players:

-

Amcor

-

Berry Global Inc.

-

RPC Group Plc

-

Greiner Packaging International

-

Silgan Holdings Inc.

-

Huhtamaki Oyj

-

Plastipak Holdings Inc.

-

Sonoco Products Company

-

Sem Plastik

-

Double H Plastics Inc.

-

Tek Pak Inc.

-

Reynolds Group Holdings Limited

-

Sanpac

-

Mold-Tek Packaging

-

Graham Packaging Company L.P.

-

Faerch Group

-

Novio Packaging B.V.

-

Groupe Guillin SA

-

Takween Advanced Industries

-

Saudi Basic Industries Corporation (SABIC)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 37.44 Billion |

| Market Size by 2032 | US$ 54.67 Billion |

| CAGR | CAGR of 4.85 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Boxes and Bins, Trays, Cups, Lids, Thin Wall Pails, Bowls) • By Material (Polypropylene (PP), Polystyrene (PS), Polyethylene (PE) [High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE)], Polyethylene Terephthalate (PET)) • By Manufacturing Technology (Thermoformed, Vacuum Formed Technology, Injection Molded Technology, Others) • By Application (Dairy Products, Frozen Food, Fruits and Vegetables, Bakery and Confectionery, Juices and Soups, Meat, Seafood and Poultry, Ready-to-eat Meals, Pharmaceuticals, Personal Care and Cosmetics, Paints, Lubricants and Adhesives) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amcor, Berry Global Inc., RPC Group Plc, Greiner Packaging International, Silgan Holdings Inc., Huhtamaki Oyj, Plastipak Holdings Inc., Sonoco Products Company, Sem Plastik, Double H Plastics Inc., Tek Pak Inc., Reynolds Group Holdings Limited, Sanpac, Mold-Tek Packaging, Graham Packaging Company L.P., Faerch Group, Novio Packaging B.V., Groupe Guillin SA, Takween Advanced Industries, and Saudi Basic Industries Corporation (SABIC), and Others. |