Subsea Pumps Market Key Insights:

To Get More Information on Subsea Pumps Market - Request Sample Report

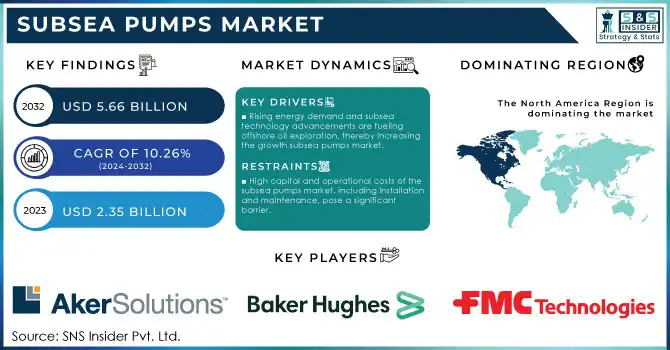

The Subsea Pumps Market size was valued at USD 2.35 Billion in 2023 and is now anticipated to grow to USD 5.66 Billion by 2032, displaying a compound annual growth rate (CAGR) of 10.26% during the forecast Period 2024-2032.

The subsea pumps market is experiencing significant growth, driven by a variety of factors. The primary driver is the rising global energy demand, which supports offshore oil and gas exploration at subsea levels, creating opportunities for subsea pumps to efficiently extract oil and gas in challenging conditions. Technological advancements have enhanced the reliability of subsea pumps, enabling them to operate in high-pressure, low-temperature environments, while variable speed drives optimize pump performance and reduce energy consumption. Despite the high initial investment, long-term benefits include increased production volume, optimized pump performance, and the elimination of costly topside processing facilities, which help reduce operating costs. Additionally, environmental concerns have led to a focus on subsea pumps designed for clean production methods, such as water injection systems that maintain pressure, improve oil recovery, and minimize the surface footprint.

Aker Solutions ASA, Schlumberger, and Subsea 7 have formed a joint venture to revolutionize subsea production economics, helping customers unlock reserves, shorten time to first oil, and reduce development costs while also meeting decarbonization goals.

Leistritz Pumpen GmbH and KSB have teamed up to enhance efficiency and connectivity, offering an expanded range of screw pump services. Their collaboration aims to elevate customer service globally, providing faster and more networked solutions.

MARKET DYNAMICS

DRIVERS

- Rising energy demand and subsea technology advancements are fueling offshore oil exploration, thereby increasing the growth subsea pumps market.

The increasing demand for energy, driven by global industrialization and population growth, has spurred the need for offshore oil and gas exploration. As conventional onshore oil reserves deplete, energy companies are turning to offshore fields, particularly deepwater and ultra-deepwater areas, to meet the rising demand. Subsea pumps play a critical role in these operations, enabling the extraction of oil and gas from these challenging environments. Technological advancements in subsea pumps, such as electric submersible pumps (ESPs) and enhanced sealing mechanisms, have made it possible to operate in deeper, more complex offshore conditions, further fueling market growth.

Additionally, as exploration moves into harsher environments, the need for reliable, high-performance subsea equipment has increased. Subsea pumps are designed to withstand the high pressures and extreme temperatures found deep beneath the sea, making them essential for efficient production. The ongoing development of new subsea technologies, including automated and remotely operated systems, has further boosted their adoption, enhancing operational efficiency and safety. These factors combined have resulted in a steady rise in demand for subsea pumps, contributing to the market’s growth as the oil and gas industry continues to explore untapped deepwater reserves to secure future energy supplies.

RESTRAIN

- High capital and operational costs of the subsea pumps market, including installation and maintenance, pose a significant barrier.

The high capital and operational costs of subsea pumps have traditionally been a major barrier to market growth, particularly for smaller companies with limited budgets. However, as technological advancements continue to reduce costs and improve efficiency, the subsea pumps market is experiencing growth. The development of more affordable subsea pump technologies, including energy-efficient systems and modular designs, has allowed operators to manage the high initial investments and operational expenses more effectively. Furthermore, innovations in predictive maintenance and real-time monitoring systems are helping reduce the frequency of repairs and downtime, lowering long-term operational costs.

The trend toward digitalization and automation in subsea pump operations is also contributing to cost reduction. Remote monitoring and control technologies enable operators to oversee equipment performance, identify issues early, and optimize maintenance schedules, thus minimizing the risk of expensive repairs. Additionally, larger oil and gas companies are increasingly opting for integrated solutions that bundle subsea pumps with other equipment, spreading the capital costs across a wider range of assets.

KEY SEGMENTATION ANALYSIS

By Type

The Helico-Axial Pumps (HAP) segment dominated with the market share of over 36% in 2023, due to their high efficiency in handling large volumes of fluids at elevated pressures, making them ideal for subsea oil and gas applications. These pumps are particularly well-suited for deep-water and offshore environments, where they support operations like boosting production from subsea reservoirs to surface facilities. Their design allows for consistent flow, even in challenging conditions, and they excel in applications requiring high flow rates and pressures, such as oil recovery and water injection. HAPs are commonly used for tasks like subsea boosting, where maintaining high production levels from deep-sea wells is critical. The robustness of HAPs, along with their ability to perform in extreme conditions, contributes significantly to their dominance in the subsea pump market, making them the preferred choice for offshore and subsea oil and gas operations.

By Application

The Subsea Boosting segment dominated with the market share over 42% in 2023, due to its crucial role in enhancing oil and gas production from deep-sea reservoirs. This process involves the use of subsea pumps to increase pressure within the subsea pipeline, helping to move hydrocarbons from deep offshore wells to surface facilities. As offshore reservoirs mature, the pressure naturally declines, leading to reduced production rates. Subsea boosting helps counter this decline by maintaining optimal pressure levels, ensuring a steady flow of oil and gas to the surface. This technology is vital for maximizing production from existing fields, improving the economics of offshore projects, and extending the life of oil and gas reservoirs. With the increasing shift towards deep-water and ultra-deep-water exploration, subsea boosting is gaining significant attention, as it enables efficient resource extraction from challenging and high-pressure environments.

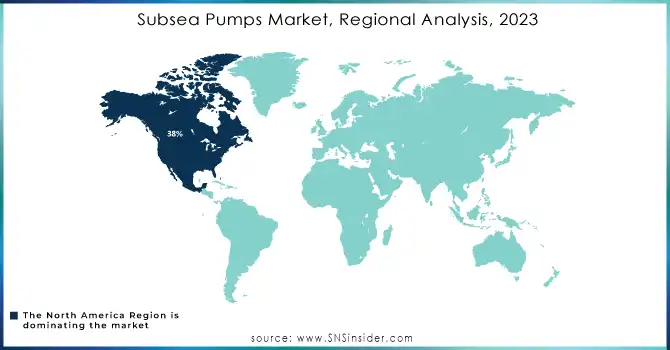

KEY REGIONAL ANALYSIS

North America region dominated with the market share of over 38% in 2023, due to substantial investments in offshore oil and gas exploration, particularly in the Gulf of Mexico, one of the world's largest and most established offshore regions. The region benefits from a well-developed infrastructure, including advanced subsea pumping systems, which support efficient and cost-effective extraction of offshore resources. Major oil and gas companies, such as ExxonMobil, Chevron, and BP, have a strong presence in the area, further driving the demand for subsea pumps. Additionally, technological advancements, including the development of more reliable and efficient pumps for deepwater and ultra-deepwater applications, have bolstered the region’s market leadership. North America's expertise in offshore drilling, well-established supply chains, and favorable regulatory environment create a stable foundation for continued growth, making it a key player in the subsea pumps market.

The Asia-Pacific region is currently the fastest-growing for subsea pump market, largely driven by the rising demand for offshore oil and gas exploration. Key countries such as China, India, and various Southeast Asian nations are at the forefront of this growth, with a marked increase in energy consumption and a surge in investments aimed at developing offshore oil fields. The ongoing shift toward deepwater and ultra-deepwater exploration is further propelling the need for advanced subsea pump solutions, which are crucial for efficiently extracting resources from challenging depths. Technological advancements in subsea production, alongside a heightened focus on energy security, are additional factors driving the market expansion.

Do You Need any Customization Research on Subsea Pumps Market - Inquire Now

Some of the major key players of Subsea Pumps Market

-

Aker Solutions (Subsea pumps, subsea production systems)

-

Baker Hughes Incorporated (Subsea pumps, subsea systems)

-

FMC Technologies, Inc. (Subsea pumps, subsea equipment)

-

General Electric Company (Electric subsea pumps, subsea systems)

-

OneSubsea (Subsea pumps, subsea processing equipment)

-

Sulzer AG (Subsea pumps, centrifugal pumps)

-

SPX Corporation (Subsea pumps, pumping solutions)

-

ITT Bornemann GmbH (Subsea pumps, screw pumps)

-

Flowserve Corporation (Subsea pumps, industrial pumps)

-

Schlumberger (Subsea pumping systems, flow assurance solutions)

-

National Oilwell Varco (NOV) (Subsea pumps, oilfield services)

-

TechnipFMC (Subsea pumps, subsea systems, pipeline technologies)

-

Parker Hannifin Corporation (Subsea pumps, fluid handling solutions)

-

Wartsila Corporation (Subsea pumps, marine solutions)

-

Hydra-Stop Valve Company (Subsea pumps, valve automation)

-

Cameron International Corporation (Subsea pumps, valve solutions)

-

Proserv (Subsea pumps, subsea control systems)

-

Aker BP (Subsea pumps, oil and gas exploration systems)

-

Trelleborg Group (Subsea pumps, sealing systems)

-

Parker Kittiwake (Subsea pumps, monitoring systems)

Suppliers providing advanced subsea pump solutions, focusing on efficiency, reliability, and innovation for offshore oil and gas production in Subsea Pumps Market

-

Schlumberger

-

GE Oil & Gas

-

Aker Solutions

-

OneSubsea

-

TechnipFMC

-

Cameron

-

Sulzer

-

Wärtsilä

-

Sperry Drilling

-

Flowserve

Recent Developments

-

In April, 2024: Baker Hughes will supply Snam, with three turbocompressors driven by NovaLT 12 gas turbine technology, offering fuel flexibility of up to 10% hydrogen blend with natural gas.

-

In March 2024: NOV’s Subsea Production Systems (SPS) business unit signed a contract with an undisclosed customer to deliver an actively heated flexible pipe system for a gas project in the Black Sea. NOV will supply its first active heated pipe system in 2025, introducing a proprietary technology solution of electrically heating the bore of the pipe through the resistance of the pipe’s inner carcass layer.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.35 Billion |

| Market Size by 2032 | USD 5.66 Billion |

| CAGR | CAGR of 10.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Helico-Axial Pumps (HAP), Twin Screw Pumps (TSP), Hybrid Pumps, Electrical Submersible Pumps (ESP), Centrifugal Pumps, Others) • By Application (Subsea Boosting, Subsea Injection, Subsea Separation, Subsea Compression) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aker Solutions, Baker Hughes Incorporated, FMC Technologies, Inc., General Electric Company, OneSubsea, Sulzer AG, SPX Corporation, ITT Bornemann GmbH, Flowserve Corporation, Schlumberger, National Oilwell Varco (NOV), TechnipFMC, Parker Hannifin Corporation, Wartsila Corporation, Hydra-Stop Valve Company, Cameron International Corporation, Proserv, Aker BP, Trelleborg Group, Parker Kittiwake. |

| Key Drivers | • Rising energy demand and subsea technology advancements are fueling offshore oil exploration, thereby increasing the demand for subsea pumps market. |

| RESTRAINTS | • High capital and operational costs of subsea pumps market, including installation and maintenance, pose a significant barrier to adoption, particularly for smaller companies with limited budgets |