Super App Market Report Scope & Overview:

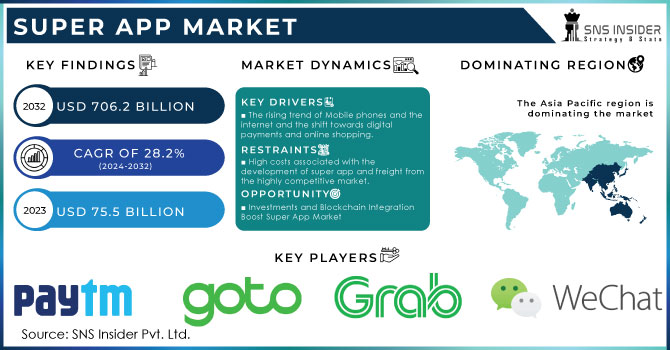

The Super app Market size was recorded at USD 96.79 Bn in 2024 and is expected to reach USD 706.2 Bn by 2032, growing at a CAGR of 28.2 % over the forecast period 2025-2032.

The affordable rate of the Internet and the variety in choices of smartphones, as well as the increasing popularity of integration of advanced features such as AI in mobiles, and increasing use of e-commerce and digital payments, are some of the factors driving the growth of Super app market. According to the study on the sales of the smartphone market, the no. of smartphones shipped is around 1.2 Billion in 2024. The market growth is also supported by growing demand for seamless, efficient experiences with payments, online shopping, Entertainment, and study purposes across the globe. Therefore, the growing demand for cashless commerce and financial inclusion has a positive impact on the market. Additionally, an increase in technological advancements such as the integration of AI in mobile functionality and improvement in the app features to signify the user’s experience offer drastic growth opportunities for investors in this industry.

Get More Information on Super app Market - Request Sample Report

Super App Market Size and Forecast:

-

Market Size in 2024: USD 96.79 Billion

-

Market Size by 2032: USD 706.2 Billion

-

CAGR: 28.2% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Super App Market Key Trends:

-

AI-powered personalization – Advanced AI algorithms are enabling tailored recommendations, targeted advertising, and optimized service delivery, enhancing user engagement.

-

Integration of Web3 and blockchain – Decentralized features are improving security, transparency, and user control over data, attracting privacy-conscious consumers.

-

Expansion into health and wellness – Super apps are adding health services, including AI-driven health platforms, telemedicine, and wearable integration for personalized health insights.

-

Rapid growth in quick commerce – Integration of e-commerce and logistics services allows ultra-fast delivery of groceries and essentials, boosting user retention.

-

Global expansion and localization – Services are being adapted to local payment systems, cultural preferences, and regulatory requirements to penetrate new markets effectively.

-

Challenges in Western markets – Adoption in Western countries is slower due to established consumer habits, privacy concerns, and regulatory barriers.

The increasing rate of downloading multifunctional apps and efficient browsing has increased the screen timing of people. According to the market study on the rate of use of mobile apps, the largest number of installed apps on phones are recorded in the age categories of the Generation Millennials (defined as those born between 1981 and 1996). In Line With that, the younger ones, are seen having more screen time using mobile apps, as Compared to the elder generation. The people of the age group between 18 to 24 years old spent around 114-115 hours on the phone, playing games, scrolling shopping apps, or on entertainment sites each month.

Additionally, there is a growth in the use of mobile wallets and QR code payments, which are examples of cashless payment methods that are becoming more popular. For Instance, the popular apps that are mostly used by the young generation globally are, WeChat, Whatsapp, Paytm, GooglePay, Alipay (fintech app), Grab (used to order foods), PhonePay, Uber, etc. In March 2024, according to the Chinese Multi-functional social media platform, the active WeChat monthly active users are around 1.35 Billion. In Addition to that, WhatsApp is also becoming more popular among various age groups, and the revenue generated by the WhatsApp Business is more than $ 380 Million, in 2023.

Some top companies that influence the super app market are GoTo, Alibaba Cloud, LINE Corporation, Tata Group, AgileTech Vietnam, GeneXus, Cisco Systems Inc., IBM Corporation, Elluminati Inc., and Huawei Technologies Co., Ltd.

Moreover, the Government also provides grants to the companies for the development of super apps. And also promotes the collaboration of super app with service providers to ease the user’s experience. For Instance, An Indian government-supported app, India's Unified Mobile Application for New-age Governance (UMANG) is a mobile-based platform providing over 20,000 public services with the help of different applications here. Another, LifeSG in Singapore is a government super app offering various citizen services. Indonesia will cut down multiple government apps to eight super-apps for private & public services integrations.

Super App Market Drivers:

-

The rising trend of Mobile phones and the internet and the shift towards digital payments and online shopping.

With smartphones, connectivity, and all that online shuffle of money & shopping - the super App market is in demand. Smartphones are cheaper, and the Internet is more common, which means there is a huge number of people who bypassed desktop computers entirely in favor of using mobile apps for their day-to-day tasks. Super apps can conduct frictionless transactions directly with their customers, due to digital payments and online shopping further promote this activity. Furthermore, end-to-end commerce technology has been adopted by marketplaces and merchants to facilitate seamless online shopping and payment through e-commerce platforms, allowing customers to shop from anywhere.

MobiCash's white paper highlights that excellent applications can provide merchants with an easy and cost-effective way to engage in m-commerce and enable seamless personal e-commerce that helps increase conversion rates. This shows how the integration of e-commerce and digital payments with super-apps is a key factor in their growth.

According to an ECS Payments article, the rise of super wallets or super apps in emerging markets is fueled by the demand for digital payment solutions that can function beyond banks and other payment processing companies. This further strengthens the link between the adoption of digital payments and the growth of the premium software market.

Super App Market Restraints:

-

High costs associated with the development of super app and freight from the highly competitive market.

The development of a super app requires significant financial investment due to the need to integrate multiple services, such as payments, e-commerce, messaging, ride-hailing, and more, into a single seamless platform. Building a robust, secure, and scalable infrastructure demands advanced technology, skilled developers, and ongoing maintenance, which can be prohibitively expensive for new entrants. Additionally, the super app market is highly competitive, dominated by established players with strong brand loyalty and extensive user bases. New entrants face challenges in acquiring users, differentiating their offerings, and achieving profitability. This combination of high development costs and intense market competition acts as a major restraint, limiting rapid expansion and slowing adoption in certain regions.

Super App Market Opportunities:

-

Growing public and private investments in the super app market and integration of Blockchain technology to provide secure and efficient services.

Greater amounts of capital are being invested into super apps, from both companies and governments. This investment is how super apps can introduce new functionality, bring themselves to new customers, and provide more services. The investment brings new features or new tools in banking, shopping, or various fields. For Instance, Fierce (in 2023), has raised funds of around $10 Million, to provide customers with an efficient banking service platform through super app development. Some amount of government support can come into play too, in enabling super apps to reach the unbanked.

Moreover, by facilitating seamless DeFi integration, safe and instantaneous transactions, lower costs, quicker settlements, greater confidence and transparency, and wider financial inclusion, the incorporation of blockchain technology into super applications can improve transaction management. These advantages create fresh chances for the market for super apps to expand.

Super App Market Segmentation Analysis:

By Platform, Android Leads Global Super App Market, iOS Maintains Stronghold in Developed Regions

The Android segment dominated the super apps market with a 61.0% revenue share in 2024 and is projected to grow at the fastest CAGR of over 28.0% during the forecast period. Android’s dominance is particularly strong in regions such as Asia Pacific and Latin America due to the affordability of Android devices, offering multiple options for users with lower disposable incomes compared to Apple’s iPhones. The iOS segment is expected to grow at a notable CAGR of 26.6% during the same period. iOS remains popular in developed countries including the U.S., Japan, the U.K., and Canada, offering regular software updates and stronger security. However, iOS devices have a narrower range and comparatively more cumbersome file transfer compared to Android.

By Device, Smartphones Dominate Super App Usage; Wearables Gain Traction Among Youth

Smartphones accounted for 75.6% of the super app market in 2024 and are expected to expand at the fastest CAGR of over 28.0% during the forecast period. Their portability, ease of one-handed use, and convenience for communication make them ideal for super app services, such as QR code payments. The “others” segment, including laptops, desktops, MacBooks, and wearable devices, is projected to grow at a CAGR of 26.5%. Wearables, in particular, are gaining popularity among younger users due to rising health awareness. Lightweight and easily connected to smartphones, smartwatches are increasingly supporting super app functionalities.

By Application, Social Media & Messaging Drive Revenue, Financial Services Show Fastest Growth

The social media and messaging segment held the largest market share at 27.3% in 2024, with a projected CAGR of over 27.0%. Entertainment apps, including social media, gaming, and communication, remain among the most frequently used categories. According to U.S.-based Simform, 58% of respondents ranked gaming, social media, and communication as their top three app categories. Users spend an average of 131 minutes weekly on social media apps, making this segment a key revenue driver for super apps. The financial services segment, including digital wallets, payments, insurance, and investment services, is expected to grow at the fastest CAGR of 29.6%. Providers like China’s WeChat (Tencent) and India’s Paytm offer digital banking services, catering especially to unbanked and underbanked populations.

By End-user, Businesses Lead Revenue Generation; Consumer Segment Growing Rapidly

The business segment led the market with a 61.6% revenue share in 2024 and is anticipated to grow at a CAGR of over 27.0%. Super apps generate revenue from B2B models, including advertising fees, commissions, and other services. Advertising remains a major revenue source. The consumer segment is projected to grow at the fastest CAGR of 28.5%, driven by value-added services and transaction fees from digital payments. For example, WeChat Wallet charges a 0.01% fee for withdrawals exceeding a certain amount. Increasing smartphone adoption and internet penetration are expected to create significant opportunities for revenue growth from individual users.

Need any customization research on Super app Market - Enquiry Now

Super App Market Regional Analysis:

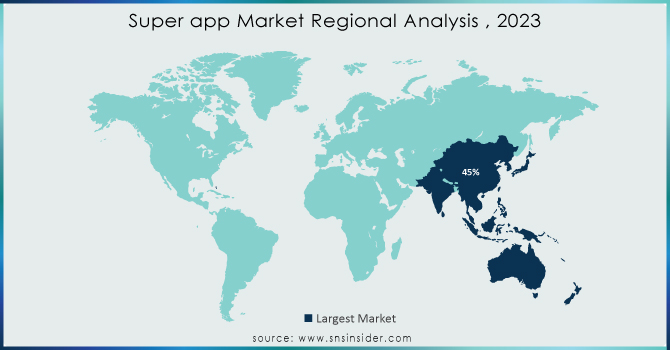

North America dominates the Super App Market in 2024

In 2024, North America holds an estimated 16.1% share of the Super App Market, driven by high smartphone penetration, advanced digital infrastructure, and widespread adoption of integrated mobile services. The region benefits from tech-savvy consumers, strong investment in app development, and the presence of major super app developers offering multi-service platforms. Increasing reliance on digital wallets, in-app payments, and seamless communication tools further supports market growth. These factors collectively reinforce North America’s leadership position and its role as a hub for innovation in the super app ecosystem.

-

United States leads North America’s Super App Market

The United States dominates due to its mature digital economy, high disposable income, and large smartphone user base. Consumers increasingly rely on mobile-first platforms for payments, messaging, shopping, and entertainment. Integration with secure payment systems, QR-code transactions, and advanced privacy features strengthens adoption. Leading companies like WeChat (U.S. partnerships), PayPal, and Paytm (U.S. operations) enhance platform usability through multi-service offerings and loyalty programs. Combined with strong technological infrastructure and regulatory support for innovation, the U.S. remains the largest contributor to North America’s super app revenue.

Asia Pacific is the fastest-growing region in the Super App Market in 2024

The Asia Pacific market is projected to grow at an estimated CAGR of 29.4% from 2024 to 2030, driven by a young, mobile-first population, affordable smartphones, and increasing internet penetration. Rising demand for integrated services such as payments, messaging, e-commerce, and entertainment fuels adoption. Localized platforms, multi-language support, and partnerships with fintech and logistics providers enhance accessibility and convenience. Rapid digitalization, growing urban centers, and expanding middle-class consumers accelerate market expansion, positioning Asia Pacific as the fastest-growing region during the forecast period.

-

India leads Asia Pacific’s Super App Market

India dominates the region due to its massive population of tech-savvy users and high mobile internet adoption. Platforms like Paytm, Gojek, and others integrate payments, ride-hailing, messaging, and financial services in one ecosystem. Government initiatives promoting digital payments, widespread smartphone usage, and affordable 4G/5G connectivity drive rapid adoption. Popularity of e-commerce, mobile banking, and in-app entertainment ensures continuous engagement. Combined with a growing middle class and increasing digital literacy, India emerges as the leading contributor to Asia Pacific’s super app revenue growth.

Europe Super App Market Insights, 2024

Europe exhibits steady growth in 2024, supported by high smartphone penetration, expanding digital banking adoption, and growing demand for multi-service apps. Consumers increasingly rely on super apps for payments, social media, communication, and shopping. Regulatory frameworks promoting consumer protection and data privacy drive adoption of secure platforms. Cross-border services, integration with fintech solutions, and localized offerings enhance user engagement. Strong digital infrastructure and high disposable income in key European countries support sustainable growth across the region.

-

United Kingdom leads Europe’s Super App Market

The United Kingdom dominates Europe due to high smartphone penetration, widespread digital payments, and consumer preference for secure multi-service platforms. The country benefits from tech-savvy users, supportive fintech policies, and mature e-commerce infrastructure. Integration of social media, banking, and entertainment services in single apps drives engagement. Leading providers ensure seamless in-app experiences, loyalty rewards, and secure payment options. Combined with strong internet connectivity and consumer trust, the UK remains the largest contributor to Europe’s super app revenue in 2024.

Middle East & Africa and Latin America Super App Market Insights, 2024

The Super App Market in the Middle East & Africa and Latin America is experiencing moderate growth in 2024. In the Middle East, the UAE and Saudi Arabia lead adoption due to advanced digital infrastructure, high smartphone penetration, and government initiatives promoting smart cities and fintech. Africa shows gradual uptake as urban centers expand and mobile connectivity improves. In Latin America, Brazil and Mexico dominate owing to strong mobile-first adoption, widespread e-commerce, and integrated financial services. Affordable smartphones, mobile wallets, and growing demand for multi-service platforms drive steady market expansion across both regions.

Paytm-Company Financial Analysis

Competitive Landscape for the Super App Market:

Paytm

Paytm is an India-based leader in digital payments and multi-service super apps, offering mobile wallets, banking, e-commerce, insurance, and ticketing services. With extensive experience in digital financial solutions, the company provides a seamless, secure ecosystem for consumers and businesses. Paytm operates directly through its app and web platforms, managing transactions, loyalty programs, and payment gateways across India. Its role in the super app market is vital, as it integrates diverse services in one platform, enabling users to pay bills, shop, invest, and access financial products conveniently.

-

In 2024, Paytm expanded its super app offerings, introducing AI-powered personalized financial recommendations, QR-code-enabled offline payments, and enhanced digital banking services for unbanked users.

Gojek Tech (GoTo)

Gojek Tech, operating under the GoTo ecosystem in Indonesia, is a leading multi-service super app integrating ride-hailing, logistics, payments, food delivery, and digital commerce. The company specializes in providing seamless connectivity between users, merchants, and service providers through its mobile platform. GoTo operates both consumer and merchant-facing services, enabling efficient digital transactions and convenient access to essential services. Its role in the super app market is critical, as it combines mobility, e-commerce, and fintech solutions to drive digital adoption across Southeast Asia.

-

In 2024, GoTo introduced integrated payment solutions and expanded on-demand services, including grocery delivery, telemedicine, and in-app entertainment features for urban users.

WeChat (Tencent)

WeChat, developed by Tencent in China, is a pioneering super app offering messaging, social networking, payments, digital banking, e-commerce, and lifestyle services within a single ecosystem. With a mature platform supporting billions of users, WeChat provides secure, multi-functional digital experiences for consumers and businesses. It operates through its mobile and desktop applications, integrating social interaction, commerce, and financial services seamlessly. Its role in the super app market is central, as it sets the benchmark for multi-service integration and user engagement globally.

-

In 2024, WeChat launched AI-driven personalization and expanded mini-programs, enabling in-app gaming, online shopping, and financial service management for millions of users.

Grab

Grab, based in Singapore, is a leading Southeast Asian super app providing ride-hailing, food delivery, digital payments, logistics, and financial services. The company focuses on integrating mobility, commerce, and fintech solutions to enhance daily life for consumers and businesses. Grab operates through its mobile app, offering seamless booking, in-app payments, and loyalty rewards across multiple countries. Its role in the super app market is crucial, as it bridges urban mobility and digital financial services, creating a holistic ecosystem for Southeast Asian users.

-

In 2024, Grab expanded its financial services suite, introducing micro-loans, digital wallet enhancements, and AI-powered recommendation features for personalized shopping and travel experiences.

Super App Market Key Players:

-

Paytm

-

Gojek Tech (GoTo)

-

WeChat (Tencent)

-

Grab

-

Rappi Inc.

-

Revolut Ltd.

-

LINE Corporation

-

Alipay (Ant Group Co., Ltd.)

-

PhonePe (Flipkart.com)

-

Kakao Corp.

-

Tata Neu

-

GeneXus

-

Alibaba Cloud

-

Cisco Systems Inc.

-

AgileTech Vietnam

-

Huawei Technologies Co., Ltd.

-

GoTo

-

Elluminati Inc.

-

Tata Group

-

IBM Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 96.79 billion |

| Market Size by 2032 | US$ 706.2 Billion |

| CAGR | CAGR of 28.2 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025--2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device (smartphone, Tablet, others) • By Platform (Android,iOS, other) • By Application (E-commerce,Financial Services,Transportation & Logistics Services, Social Media & Messaging,Others) • By End-User (Business, Consumers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Paytm, Gojek tech (goto), WeChat (Tencent), Grab, Rappi Inc., Revolut Ltd, LINE Corporation, Alipay (Ant Group CO., Ltd.); PhonePe (Flipkart.com), Kakao Corp.,Tata Neu (Tata Sons Private Limited); GeneXus, Alibaba Cloud, Cisco Systems Inc., AgileTech Vietnam, Huawei Technologies Co., Ltd., GoTo, Elluminati Inc., Tata Group, LINE Corporation, IBM Corporation |