Cloud Monitoring Market Report Scope & Overview:

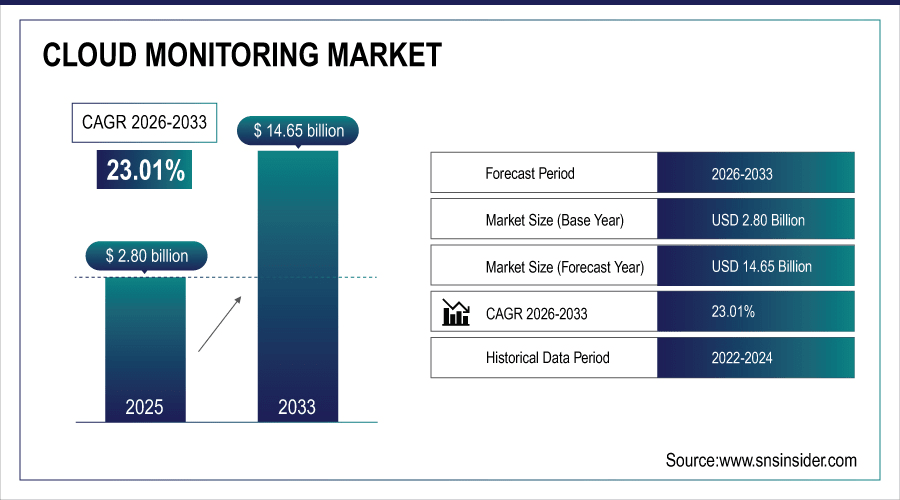

The Cloud Monitoring Market Size was valued at USD 2.80 Billion in 2025E and is expected to reach USD 14.65 Billion by 2033 and grow at a CAGR of 23.01% over the forecast period 2026-2033.

The growth of the Cloud Monitoring Market is primarily driven by rapid adoption of cloud services across industries. With more critical workloads moving to public, private, and hybrid clouds, there is a great need for monitoring solutions to provide high availability performance and reliability assurance. As IT infrastructures become ever more multi-cloud and complicated, multi-cloud deployments and distributed applications are prompting a need for real-time monitoring and observability, allowing enterprises to proactively find and remedy performance bottlenecks. Moreover, the increased emphasis on digital transformation and adoption of DevOps practices has led to a rise in the usage of cloud monitoring tools, with more tools also being integrated into automated workflows to improve operational efficiency. According to study, Organizations integrating cloud monitoring with CI/CD pipelines experience 25% faster incident resolution and 20% improvement in deployment success rates.

To Get More Information On Cloud Monitoring Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 2.80 Billion

-

Market Size by 2033: USD 14.65 Billion

-

CAGR: 23.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cloud Monitoring Market Trends

-

Enterprises increasingly migrate workloads to multi-cloud environments demanding robust monitoring.

-

Real-time cloud monitoring adoption rises to ensure performance and reliability.

-

Integration of monitoring tools with DevOps pipelines enhances operational efficiency.

-

Distributed applications drive higher need for multi-cloud observability solutions globally.

-

High implementation costs limit adoption of advanced cloud monitoring platforms.

-

SMEs face budget constraints impacting deployment of sophisticated monitoring solutions.

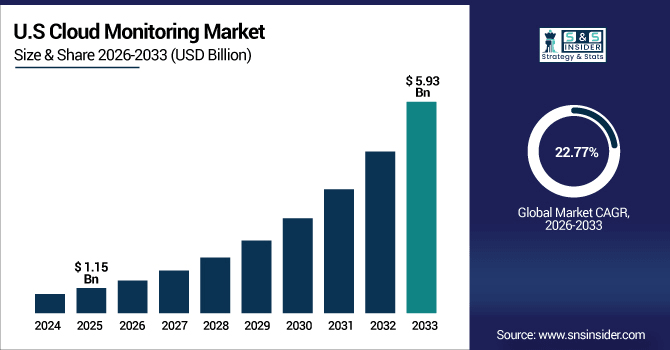

The U.S. Cloud Monitoring Market size was USD 1.15 Billion in 2025E and is expected to reach USD 5.93 Billion by 2033, growing at a CAGR of 22.77% over the forecast period of 2026-2033, driven by rapid cloud adoption, multi-cloud deployments, AI/ML-enabled monitoring, regulatory compliance requirements, digital transformation initiatives, and the need for real-time performance, reliability, and proactive incident management.

Cloud Monitoring Market Growth Drivers:

-

Rapid Cloud Adoption Fuels Demand for Real-Time Monitoring Solutions

The primary driver of the Cloud Monitoring Market is the accelerated adoption of cloud services by enterprises globally. To achieve improved scalability, agility, and cost-efficiency, organizations are increasingly moving their critical workloads out to Public, Private, and Hybrid cloud environments. The migration generates substantial need for monitoring solutions to provide high availability, performance and reliability of cloud-hosted applications. Also, the complexity of multi-cloud and distributed architectures mean real-time monitoring is necessary to identify performance bottlenecks, minimize downtime, and improve operational efficiency. The adoption of cloud monitoring tools is also driven by usage with DevOps practices and automated workflows.

Enterprises integrating cloud monitoring with DevOps workflows report 20–25% faster incident detection and resolution.

Cloud Monitoring Market Restraints:

-

High Implementation Costs Challenge Widespread Cloud Monitoring Adoption

The high cost associated with deployment and integration of cloud monitoring solutions restraining the market growth, especially for SMEs. A lot of monitoring platforms are subscription-based and they need special infrastructure, and skilled personnel to configure & maintain them. In a multi-cloud or hybrid environment, the enterprise will also incur more costs by establishing monitoring tools across multiple cloud providers. Such costs can slow down adoption for smaller organizations with limited IT budgets, which restricts the growth of the market even in the face of increasing demand. In addition to this, the operational costs can increase pain with constant maintenance and upgrades.

Cloud Monitoring Market Opportunities:

-

AI-Powered Monitoring Solutions Present Significant Growth Opportunities Globally

One of the key opportunities with the trend on the uptake in AI and ML-powered cloud monitoring solutions. Today, smart monitoring solutions use AI to deliver predictive analytics, anomaly detection and automated remediation to empower enterprises to effectively manage IT proactively. By minimizing his downtime and optimizing the use of their resources and maximize the performance of the entire system. As more enterprises transition to post-modern enterprise with cloud-native applications and multi-cloud architectures, we expect AI-driven monitoring solutions to have a high adoption rate, offering vendors an opportunity to capture additional market share and positions to deliver value-add services such as automated incident response and intelligent alerting.

AI-driven monitoring solutions improve IT resource utilization by 25–30%, enhancing cost efficiency.

Cloud Monitoring Market Segmentation Analysis:

-

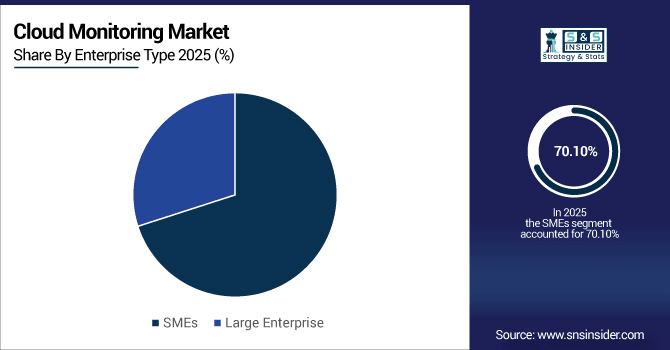

By Enterprise Type: In 2025, SMEs led the market with share 70.10%, while Large Enterprise is the fastest-growing segment with a CAGR 18.60%.

-

By Type: In 2025, Cloud Storage Monitoring led the market with share 27.80%, while Website Monitoring are the fastest-growing segment with a CAGR 22.06%.

-

By Cloud Architecture: In 2025, Public Cloud the market 57.20%, while Hybrid Cloud fastest-growing segment with a CAGR 24.80%.

-

By Service Model: In 2025, SaaS led the market with share 48.06%, while PaaS the fastest-growing segment with a CAGR 29.90%.

-

By Industry: In 2025, IT & Telecom led the market with share 45.40%, while BFSI is the fastest-growing segment with a CAGR 21.60%.

By Enterprise Type, SMEs Led Market While Large Enterprise Fastest Growth

The SMEs segment accounts for the highest share of the cloud monitoring market because they have to adopt scalable and affordable monitoring solutions which require negligible infrastructure as well as provide organizations with real-time visibility into application and network performance. Cloud monitoring tools help SMEs maintain uptime, optimize resource use, and improve operational efficiency without large IT expenditures. Concurrently, Large Enterprises are the fastest growing segment as they are requiring enhanced monitoring capabilities for performance management, security compliance, and proactive incident resolution in their increasingly complex multi-cloud and hybrid environments. The expansion of these two segments highlights the increasing need for flexibility and intelligent monitoring infrastructure solutions for enterprises of all scales.

By Type, Cloud Storage Monitoring Leads Market While Website Monitoring Fastest Growth

Cloud Storage Monitoring still leads in the Cloud Monitoring Market, as enterprises adopted cloud storage solutions for a scalable, reliable, and secure data management solution at the same time, Website Monitoring is the fastest-growing segment, driven by the growing demand for real-time performance monitoring, user experience optimization, and uptime guarantee of digital applications. The increased adoption of both segments indicates the emphasis organizations place on achieving high availability and business continuity while minimizing downtime and proactively managing distributed cloud performance, Moore added. With enterprises increasingly looking at cloud infrastructure, the need for powerful monitoring tools spanning storage and web applications will continue to grow in the coming years.

By Cloud Architecture, Public Cloud Leads Market While Hybrid Cloud Fastest Growth

Public Cloud remains the largest segment of the Cloud Monitoring Market as enterprises increasingly prefer cloud infrastructure that supports their most critical workloads to be scalable, flexible, and cost-effective. Public cloud platforms inherently offer strong monitoring capabilities to maintain the high performance, availability, and reliability of the applications. Simultaneously, Hybrid Cloud is a structure that continues to experience the highest growth segment, driven by organizations opting for combinatory deployment models to address security, compliance and operations agility challenges. Both the APM and the log management segments are growing in importance as IT environments become more complex and the need for observability across multiple cloud platforms grows, along with the demand for tools that will make it easier to monitor them, and proactively address and resolve issues.

By Service Model, SaaS Leads Market While PaaS Fastest Growth

SaaS segment for Cloud Monitoring Market leads the market, mainly due to the trend for enterprises of using subscription-based, scalable, and easy to deployment monitoring solutions that reduces complexities in infrastructure management. With SaaS platforms, the real-time visibility, automatic alerting, and integration capabilities with present IT and DevOps workflows, allows for the high performance and reliability of applications hosted within the cloud. At the same time, PaaS continues to grow the fastest as dev teams increasingly use platform-based development environments to support continuous monitoring of application performance, resource use and deployment pipelines.

By Industry, IT & Telecom Lead Market While BFSI Fastest Growth

IT & Telecom dominates the Cloud Monitoring Market due to fast-growing digital services market, high performance networks, and cloud native applications. These entities depend on cloud monitoring tools to maintain uptime, maximize resource use, and provide users with uninterrupted experiences across distributed infrastructures. At the same time, BFSI is the fastest-growing segment, driven by the growing demand for secure, compliant, and resilient cloud environments to power mission-critical financial operations and a growing digital banking footprint. The expansion of both sectors underlines the increasingly critical role real-time observability, predictive analytics, and proactive performance management in high operational and regulatory demand industries.

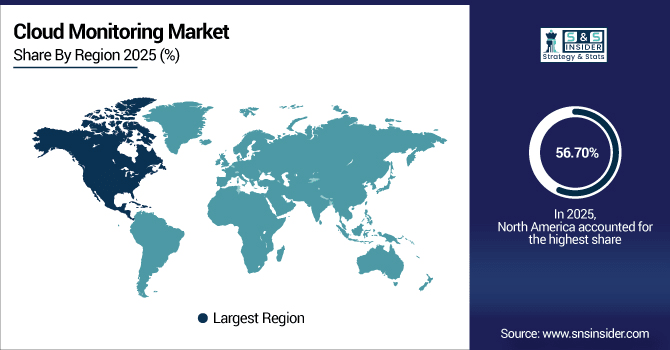

Cloud Monitoring Market Regional Analysis:

North America Cloud Monitoring Market Insights

North America accounted for the largest share 56.70%of the Cloud Monitoring Market in 2025, due to the presence of major cloud service providers, developed IT infrastructure and the early adoption of cloud technologies. Enterprise organizations in the U.S. and Canada are increasingly using public, private and hybrid clouds, amplifying demand for monitoring solutions to ensure availability, performance and security. Real time monitoring and observability tools driven by digital transformation, adoption of DevOps, and regulatory compliance, are gaining traction in the region. Furthermore, rising investments in AI/ML-enabled cloud monitoring solutions augment Predictive Analysis, Automated Incident Response, and proactive Performance Management in different industries, supporting market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Canada and U.S. Drive Cloud Monitoring Market Through Digital Transformation.

Enterprises across the U.S. and Canada are increasingly adopting cloud monitoring solutions to ensure high availability, optimize performance, and maintain compliance, leveraging advanced AI-driven tools for real-time observability and proactive incident management.

Asia-Pacific Cloud Monitoring Market Insights

In 2025, Asia-Pacific is the fastest-growing Cloud Monitoring Market with a CAGR 24.25%, due to cloud technologies are being adapted at a very fast pace by enterprises, SMEs and government organizations. Select countries like China, India, Japan and Australia are investing massively in their digital transformation programs, cloud-native apps, and multi-cloud deployments. Market growth is driven by the growing need for real-time performance monitoring, proactive incident management, and AI/ML analytics. Besides, rising IT infrastructure spending, increasing telecom networks, and regulatory compliance needs are driving the demand for cloud monitoring software. The rapidly evolving commercial ecosystem makes Asia-Pacific the fastest-growing market for serviced offices in the world.

China and India Propel Rapid Growth in Cloud Monitoring Market

China and India are rapidly adopting cloud monitoring solutions to enhance application performance, ensure uptime, optimize resources, and implement AI-driven real-time analytics, driving significant growth across the Asia-Pacific region.

Europe Cloud Monitoring Market Insights

The Cloud Monitoring Market in Europe is poised to earn the largest share owing to the adoption of cloud by enterprises, need for high IT environment, and regulatory environment such as GDPR. As organizations up and down the U.K., Germany, France, and wider European markets leverage public, private, and hybrid clouds, the need for monitoring solutions that guarantee performance, availability, compliance continues to surge. Meanwhile, increased emphasis on digital transformation, AI/ML-enabled monitoring, and DevOps integration are driving up adoption even further. Moreover, growing demand for cloud monitoring from enterprises to optimize their operational efficiencies, reduce the occurrence of downtimes, and manage distributed applications in a proactive manner is boosting the growth of Europe regional market at a steady pace.

Germany, U.K. Lead European Market in Fake Image Detection Solutions

Germany and the U.K. are rapidly adopting fake image detection solutions to combat misinformation, enhance digital security, and ensure content authenticity across social media, media platforms, and enterprise communication systems.

Latin America (LATAM) and Middle East & Africa (MEA) Cloud Monitoring Market Insights

Cloud monitoring solutions market in Latin America (LATAM) and Middle East & Africa (MEA) is at a nascent stage and a relatively vast number of businesses, and government and private organizations are adopting cloud, which is also likely to propel the cloud monitoring solutions market growth in this region in the coming years. Brazil, Mexico and other nations in LATAM are focused on digital transformation, operating in multi-cloud deployments and investing in real-time performance monitoring tools to provide reliability and scale. Demand is being accelerated in MEA due to growing IT infrastructure and telecom networks, as well as increased adoption of public and hybrid clouds in countries such as the UAE, Saudi Arabia, and South Africa. These regions are high-growth markets for AI/ML-enabled monitoring solutions and are seeing increasing interest as well.

Cloud Monitoring Market Competitive Landscape

Huawei Cloud offers advanced cloud monitoring solutions, leveraging AI-driven analytics and real-time observability. Its platform enables enterprises to optimize performance, ensure high availability, and proactively manage multi-cloud and hybrid environments across industries, supporting digital transformation and operational efficiency.

-

In June 20, 2025, Huawei Cloud announced Pangu Models 5.5 and an all-new AI Cloud Service, positioning itself as the AI pioneer in industries.

Tencent Cloud provides comprehensive cloud monitoring tools that deliver real-time performance tracking, automated alerts, and predictive analytics. Its solutions help enterprises maintain uptime, enhance resource utilization, and manage multi-cloud infrastructures efficiently, driving adoption across IT, telecom, and growing enterprise sectors.

-

In August 10, 2025, Tencent Cloud announced a full upgrade of its AIoT 2.0 product solutions, setting a new all-in-one standard for intelligent device development.

Alibaba Cloud’s monitoring platform offers scalable, real-time observability for public, private, and hybrid cloud environments. It ensures application reliability, proactive issue resolution, and performance optimization, catering to diverse enterprises across Asia-Pacific and globally, supporting cloud adoption and operational excellence.

-

In June 22, 2025, Alibaba Cloud's Hybrid Cloud Monitoring Service underwent an upgrade to provide better services. During the upgrade, there was a low probability of false alarms for the 'Agent_Status_Stopped' event on user hosts.

Cloud Monitoring Market Key Players:

Some of the Cloud Monitoring Market Companies are:

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

Alibaba Cloud

-

Tencent Cloud

-

IBM Cloud

-

Oracle Cloud

-

Huawei Cloud

-

DigitalOcean

-

Linode (Akamai)

-

Datadog

-

LogicMonitor

-

Dynatrace

-

New Relic

-

Splunk

-

PagerDuty

-

Sumo Logic

-

Grafana Labs

-

Elastic N.V.

-

AppDynamics (Cisco)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.80 Billion |

| Market Size by 2033 | USD 14.65 Billion |

| CAGR | CAGR of 23.01% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Database Monitoring, Website Monitoring, Virtual Network Monitoring, Cloud Storage Monitoring, Virtual Machine Monitoring) •By Cloud Architecture (Public Cloud, Private Cloud, Hybrid Cloud) •By Service Model (SaaS, PaaS, IaaS, Others (FaaS)) •By Enterprise Type (SMEs, Large Enterprise) •By Industry (BFSI, Healthcare, IT & Telecom, Government, Manufacturing, Others (Retail)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Alibaba Cloud, Tencent Cloud, IBM Cloud, Oracle Cloud, Huawei Cloud, DigitalOcean, Linode (Akamai), Datadog, LogicMonitor, Dynatrace, New Relic, Splunk, PagerDuty, Sumo Logic, Grafana Labs, Elastic N.V., AppDynamics (Cisco), and Others. |